Today’s Animal Spirits is brought to you by Teucrium and YCharts:

This episode is sponsored by YCharts. Explore Hamilton Lane benchmarks on YCharts, and get 20% off your initial YCharts Professional subscription (new customers only).

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky:

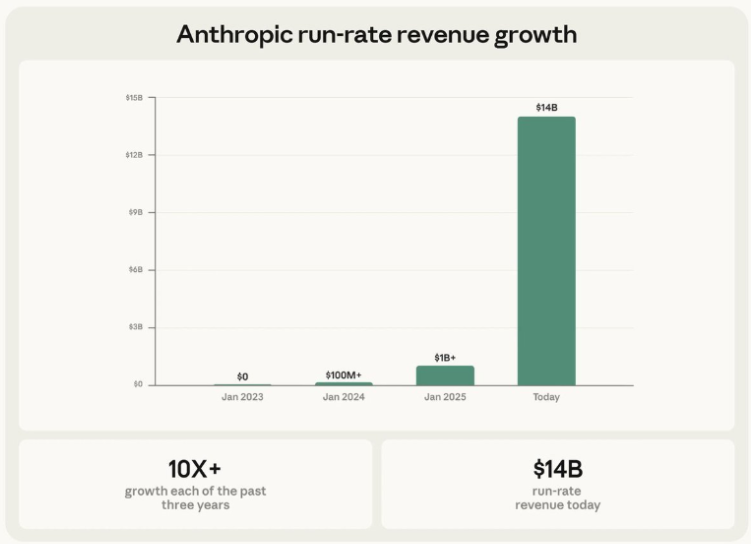

1 in 5 businesses on Ramp now pay for Anthropic. A year ago, it was 1 in 25.

Latest Ramp AI Index shows Anthropic surged from 16.7% to 19.5% of businesses while OpenAI slipped to 35.9%. The natural question: is Anthropic winning at OpenAI’s expense?

I think popular analyses… pic.twitter.com/Vzy9Z4fYsB

— Ara Kharazian (@arakharazian) February 11, 2026

Wild market. We haven’t seen anything like this since the dotcom bubble burst.

Over the last 8 sessions, 115 stocks in the S&P 500 have decline 7% or more in a single day.

The average drawdown when that happens is 34%. Right now we’re 1.5% below the all-time high. pic.twitter.com/SDy5kAXzGp

— Michael Batnick (@michaelbatnick) February 12, 2026

Here’s a look at the Nasdaq 100’s action in the year leading up to and the year after its March 2000 peak versus its actin in the year leading up to its 10/29/25 peak. $QQQ pic.twitter.com/qKZPbHqAES

— Bespoke (@bespokeinvest) February 12, 2026

US vs World ex-US … worst start to a year in decades @augurinfinity pic.twitter.com/eXlBiJJYN0

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) February 14, 2026

The average stock reporting so far this earnings season has moved 5.2% up or down, the biggest post-earnings move since at least 2012–Citi pic.twitter.com/Avh8yKzn1V

— Gunjan Banerji (@GunjanJS) February 11, 2026

This chart is for all the folks who couldn’t understand my post (below) a couple of days ago because, you know, words… https://t.co/tzFJFYFGZr pic.twitter.com/UMxX8ckOGS

— Kalani o Māui (@MauiBoyMacro) February 10, 2026

BREAKING: Japan’s 30Y Government Bond Yield surges to a new record high of 3.52%.

At what point does something break? pic.twitter.com/tfVsGsPTcN

— The Kobeissi Letter (@KobeissiLetter) January 7, 2026

OOPS! The slump in Japanese bonds deepened, sending yields soaring to records as investors gave a thumbs down to PM Sanae Takaichi’s election pitch to cut taxes on food. Japan’s 30y yields rocketed 26bps towards 4%. pic.twitter.com/NzsbWQhnXV

— Holger Zschaepitz (@Schuldensuehner) January 20, 2026

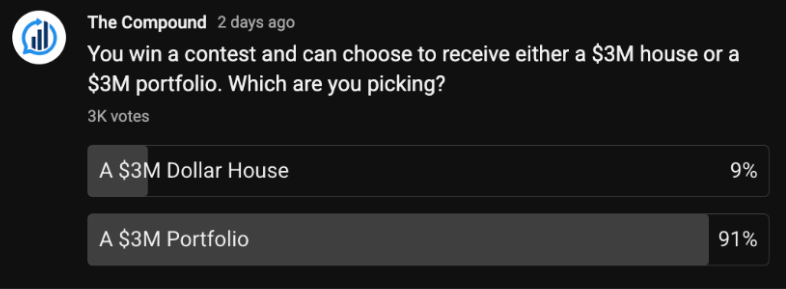

The truth about millionaires in America:

-Half have less than $2M in net worth (and less than $340k in liquid assets).

-Most are NOT business owners.

-Almost all are house/401k rich but cash poor.Is this what you expected? pic.twitter.com/mBwNgOOZp0

— Nick Maggiulli (@dollarsanddata) February 12, 2026

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.