A reader asks:

There are lots of financial rules of thumb out there. Do you have a rule of thumb for when to prioritize paying down a mortgage instead of investing? I have a rate at 6.375% for $470,000 and I am 30 years old. How should I be thinking about this?

I love questions like this because there are black, white and shades of gray answers.

Here’s my general rule of thumb:

If your mortgage rate is under 4% to 4.5% it doesn’t make any sense to pay it off.

Finance is personal and some people despise debt. But I can’t accept paying off debt at such a low borrowing rate when inflation is 3%. It makes zero sense, feelings be damned.

Anything 7% or higher and you should seriously consider making an extra payment here or there. That’s a decently high hurdle rate.

That means the 4% to 7% range is no man’s land. Dealer’s choice.

Some people like making one extra mortgage payment a year. Others perfer to do an extra principal payment each month.

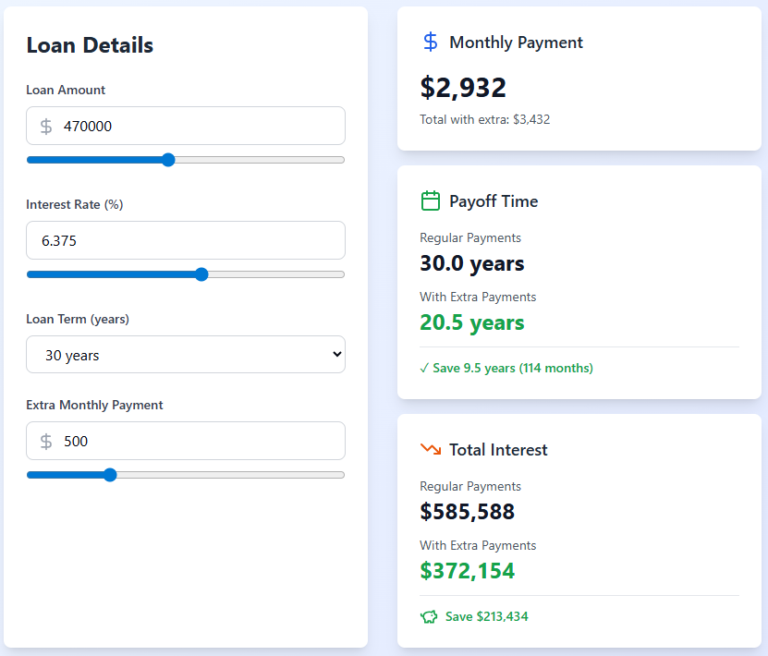

My had my new friend Claude created a simple mortgage calculator1 so let’s look at how extra monthly payments would impact the numbers. Here’s what an extra $100/month would look like:

You shave a few years off the loan and show a healthy savings in interest expense.

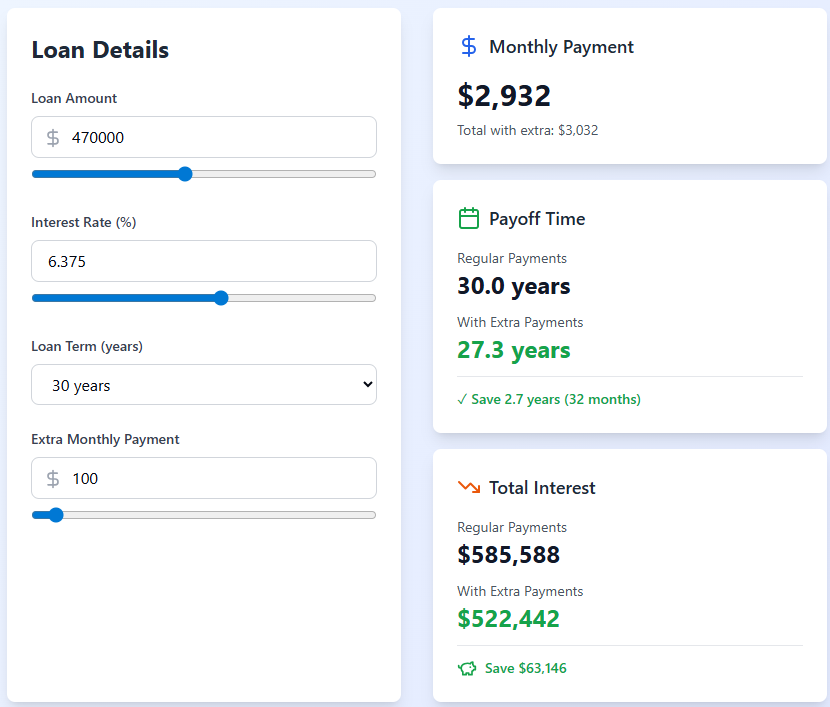

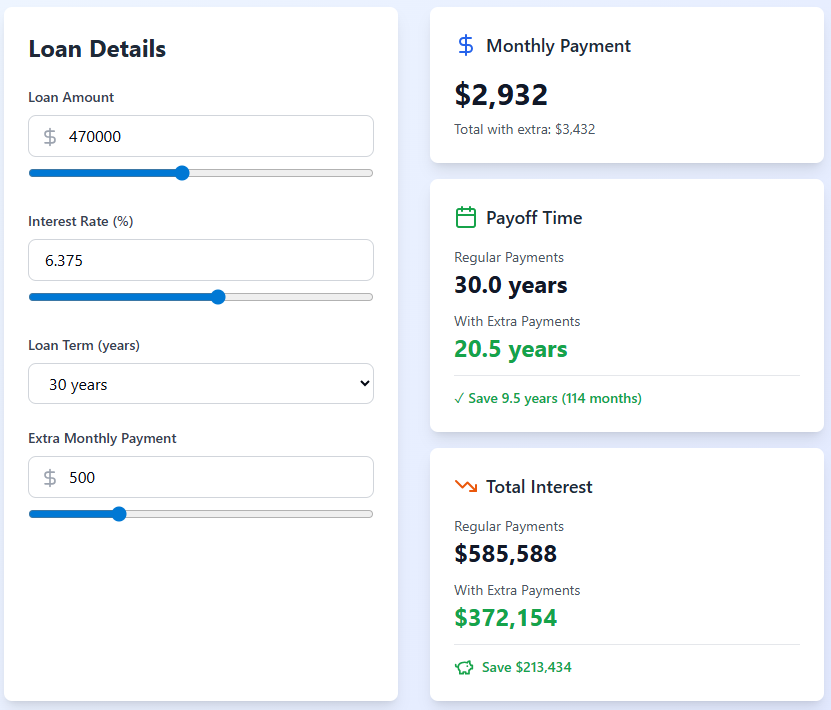

Now here’s $500/month in extra payments:

That’s not bad.

It would take an extra $1,100 or so every month to turn a 30 year mortgage into a 15 year loan.

The problem is very few homeowners live in the same house for the life of a loan and never refinance. The hope would be that you can refinance your 6.375% into a lower rate in the years ahead.

You also need to weigh your preference for debt repayment versus your desire for flexibility and liquidity. Once that money is in the house it’s not coming out unless you sell it or borrow against it. If you invest in the stock market, you can always get your money back by selling.

Of course, the mortgage rate is a guaranteed return. Stock market returns aren’t guaranteed to be as high in the future as they were in the past.

The biggest factor beyond the interest rate is your age. You’re only 30 years old. You have many years of compounding ahead of you. You might move in the years ahead. You will probably refinance into a lower rate. You might decide to cash out some of your home equity to pay for a renovation.

These decisions are always personal.

I’m never paying off my 3% mortage early but 6% and change might change the calculus.

Some people have very strong opinions about decisions like this. You always pay off the debt early no matter what! No you never pay off the debt early!

I don’t like going to extremes. It doesn’t have to be all or nothing.

I like diversification in all things. Diversification of income streams. Diversification of timing contributions into the market. Diversification by asset class, geography, strategy and security.

If you do decide to make extra mortgage payments, don’t completely shut off your investments in the stock market.

They say no one ever regrets paying off their mortgage early.

No one regrets putting money into the stock market and letting it compound for multiple decades either.

I talked about this question on the latest episode of Ask the Compound:

I also answered questions about when to turn off your dollar cost averaging into stocks, how UCITs work, home equity as a false kind of wealth, owning your home for a short period of time and how to invest in your 401k.

Further Reading:

The Economics of a 50 Year Mortgage

1Why didn’t I just use mortgage calculators that were already available? The Claude AI version looks nicer. And it’s simpler.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.