One of the biggest problems with money is our feelings about it are always relative.

So many people assume once they hit a certain level of income or net worth that all of their problems will magically vanish.

Unfortunately, what typically happens when you make and save more money is you begin comparing yourself to people who have more than you, instead of your previous levels of wealth.

Lifestyle creep causes you to spend more and more to keep up and since there are always going to be people richer than you, it’s difficult to feel wealthy even when you are.

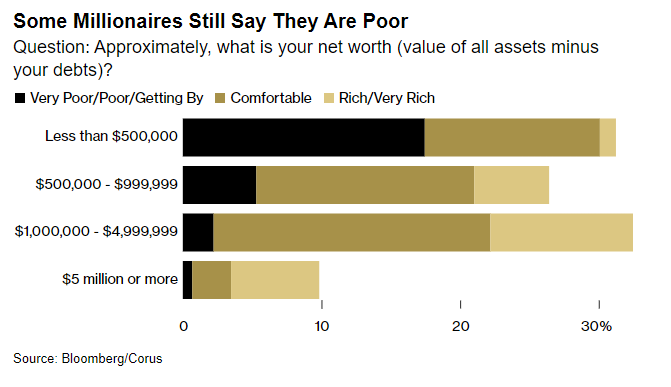

Bloomberg has a new survey that asks people how rich they feel:

Even people with millions of dollars don’t always feel rich.

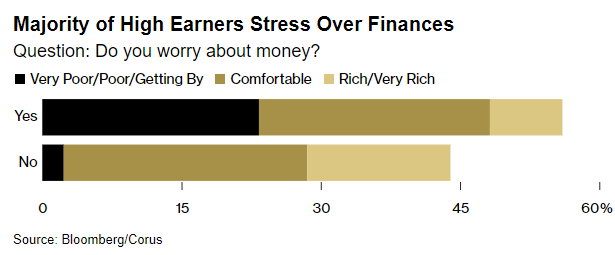

Plenty of people who are well-off still worry about money:

My contention is it’s hard to consider yourself wealthy if you still worry about money all the time.

The quotes from some of the survey respondents are telling in this regard:

“Ten years ago if I had told myself I was making the money I am now, I’d be flabbergasted. I would’ve said I was living it up,” he said. “Now, while I’m financially secure, it doesn’t feel like I’m making the dollar amount I’m making.”

“Honestly the more money you make, the more your lifestyle kind of changes a lot,” he said. “Your vacations and the restaurants you go to are more expensive.”

This is the perfect encapsulation of lifestyle creep and why some mythical number in the future probably won’t solve all of your problems. Younger you would probably be blown away by how much you make but older you is a completely different person with different preferences and responsibilities.

Here’s another one:

Despite owning a home worth almost $400,000 in Dallas and a condo in Hawaii, Tom Thompson and his wife don’t feel rich. In fact, having more money has just resulted in more bills. The 54-year-old is feeling the pressure of inflation, especially as he prepares to pay for his 18-year-old son’s college tuition.

Despite an annual household income of about $450,000, Thompson worries about his job stability at an ad agency where losing a big client could mean a layoff.

“We’re not living paycheck to paycheck, but I feel like we have looming expenses,” he said. “My personal definition of rich is the ability to buy or participate without concern, and I do not have that.”

Six-figure income. Owns a home. Owns a condo in Hawaii. Still doesn’t feel rich. Probably never will.

This is one of the reasons financial advisors act more like therapists than number-crunchers with many of their clients. We all have a weird relationship with money in some form or another.

The Wall Street Journal ran a story this week that felt like it was written exclusively for me. I love these ones:

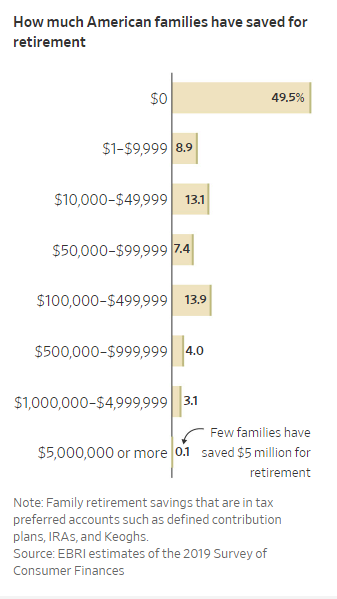

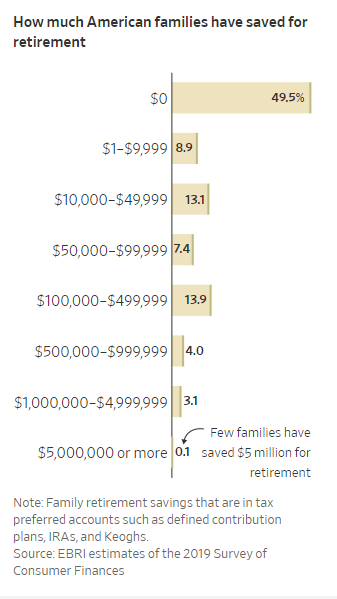

They broke out retirement savings by different levels to show how rare it is to have millions of dollars saved for retirement:

To be fair, this is only money in retirement accounts like 401k and IRAs and doesn’t include taxable money. Still, the point remains that people with seven-figure portfolios are in the minority.

After reading the headline I probably could have told you what the profiles would say. While there are wealthy individuals who spend like crazy, most millionaire next-door types have a difficult time going from being a saver to a spender once they retire.

One guy they profiled has more than $6 million saved. Yet he only spends $144,000 a year and still expects to receive $40,000 annually once he claims Social Security.

“My plan is to continue living within or below my means, stay invested and have something to leave to my kids,” he said.

You can tell he still has a saver’s mindset even with such a large nest egg.

Another couple stocked away more than $4 million by maxing out their 401k accounts from an early age. They too still seem worried about their money in retirement:

Losing a steady paycheck was scary at first. When the market tumbled in 2020, he scrutinized the couple’s every purchase, down to the napkins, but quickly realized that doing so was unnecessary, given their healthy nest egg.

The couple now has $4.2 million, half in retirement accounts and half in taxable accounts.

They spend just $130,000 a year.

Look, I’m not saying everyone has to die with zero. Having a low burn rate is certainly the best hedge against longevity risk in retirement.

But what’s the point of saving in the first place if you’re not going to spend some of it?

It’s counterintuitive, but many people overestimate how much they will need based on their spending habits because it can be so psychologically challenging to spend money in retirement.

My favorite research on this topic comes from an Employee Benefit Research Institute study in 2018 that analyzed the spending habits of retirees during their first two decades of retirement:

- People with less than $200k in assets (not including their house) spent down around 25% of their savings in the first 18 years of retirement.

- Individuals with between $200k and $500k heading into retirement spent a little more than 27% of their money.

- Retirees with $500k or more at retirement spent less than 12% of their nest egg within the first 20 years of retirement (on a median basis).

- People with a pension spent the least from their portfolio with assets down an average of just 4% (versus a 34% decline for non-pensioners).

- The median household in this study simply spent the income from their portfolio and avoided taking from the principal portfolio balance.

The crazy thing about these results is the more secure people were in retirement, the less they spent relative to the size of their wealth.

The dichotomy here is there are millions of people who are woefully underprepared for retirement from some combination of a low income or a lack of planning.

Then there are those people who are prepared but cannot stop worrying about money enough to enjoy it.

Everyone worries about money in some form and few people have it all figured out.

Michael and I discussed $5 million retirements and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why It’s So Hard to Spend Money in Retirement

Now here’s what I’ve been reading lately:

Books: