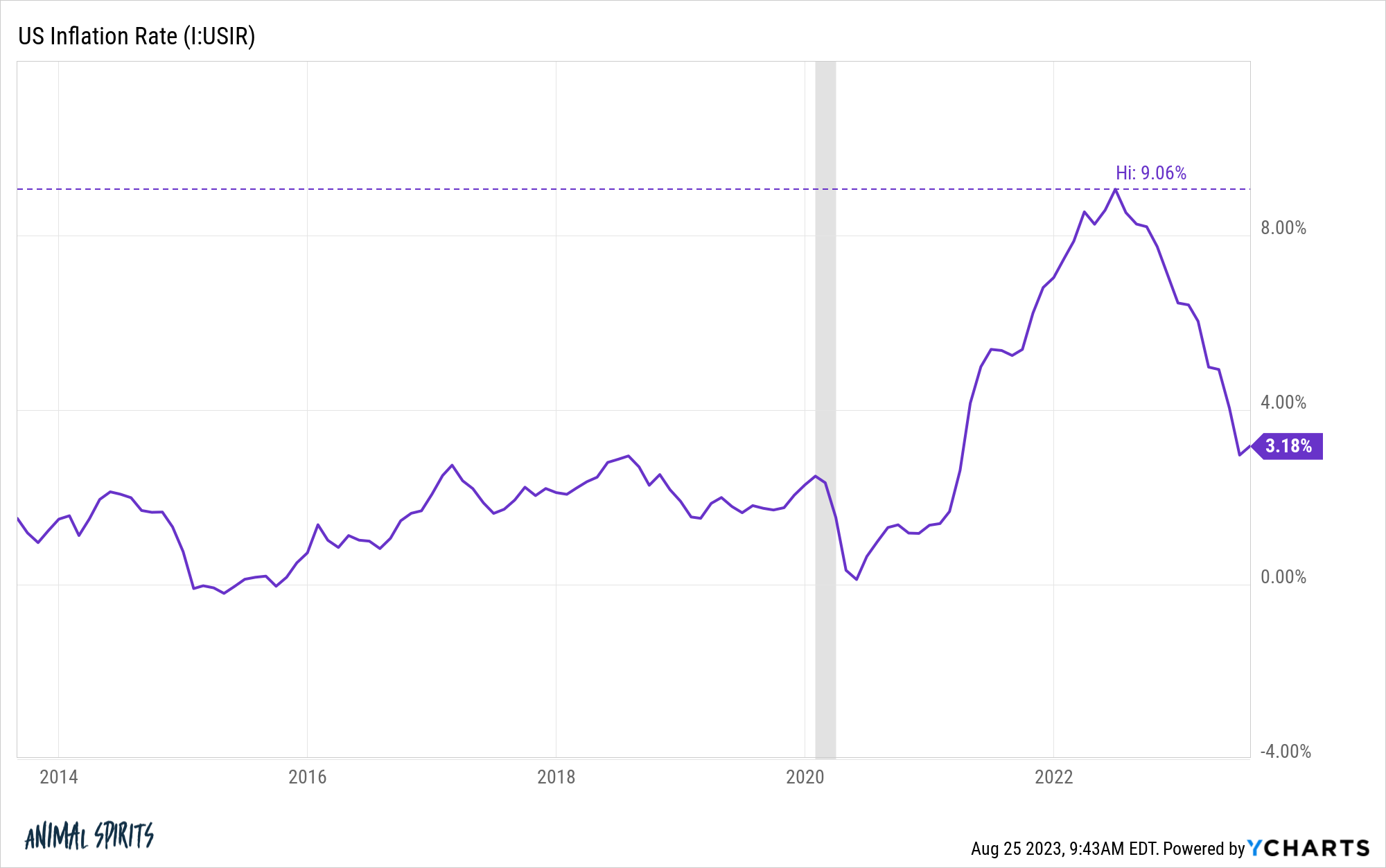

Inflation has come down from more than 9% to a more reasonable 3.2%:

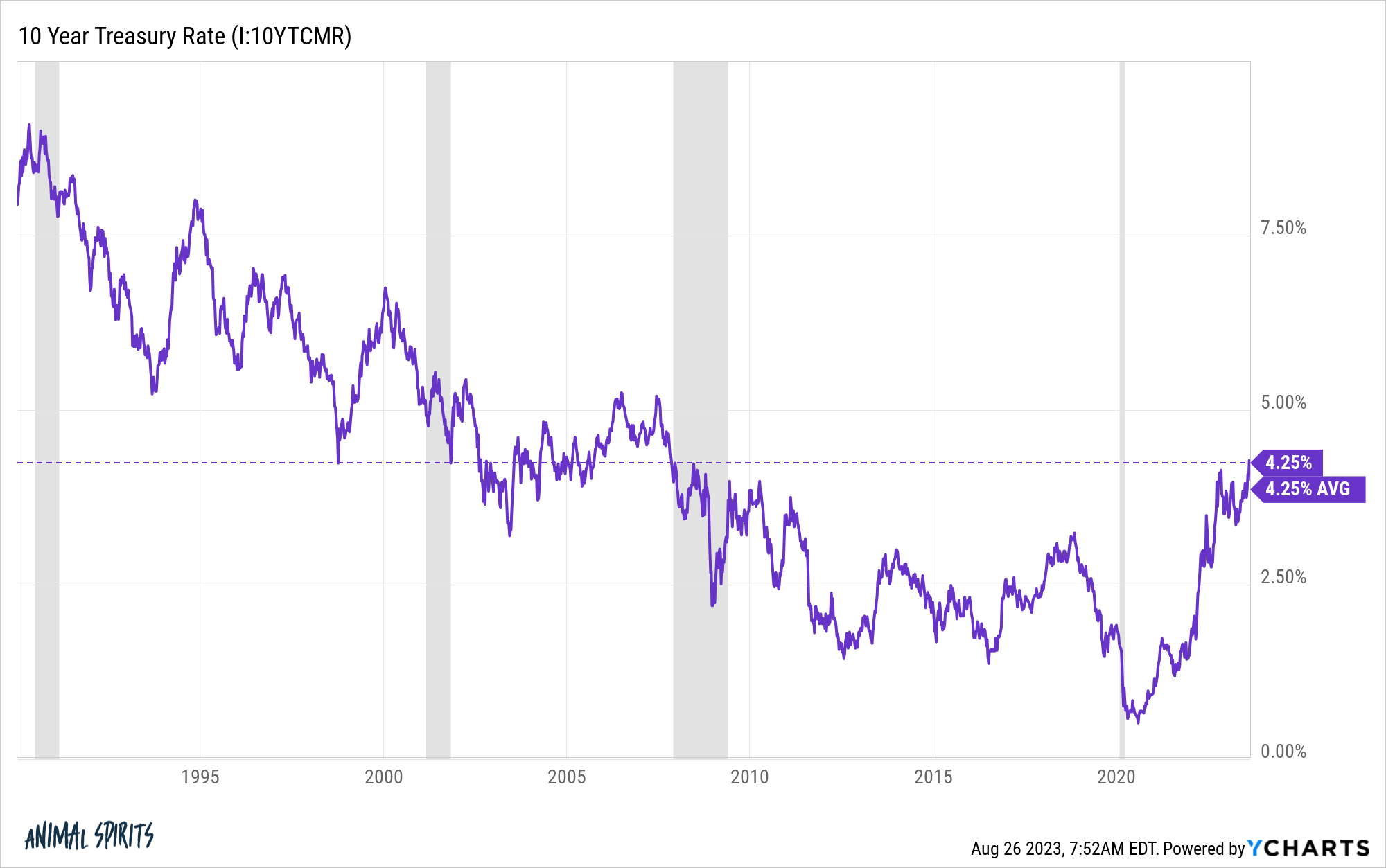

Bond yields are now much higher than they were in the 2010s but 4.25% on the benchmark 10 year Treasury is still not high from a historical perspective:

It’s actually right at the average since 1990.

If you had armed me with this information 12 months ago I would have assumed mortgage rates would be lower, probably somewhere around 6%.

I would have been wrong.

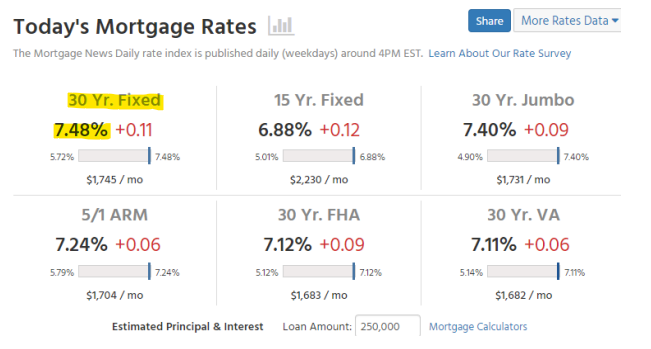

According to Mortgage New Daily, the 30 year fixed rate mortgage hit 7.5% this week:

With the 10 year at 4.2% and inflation at 3.2%, mortgage rates should be lower…right?

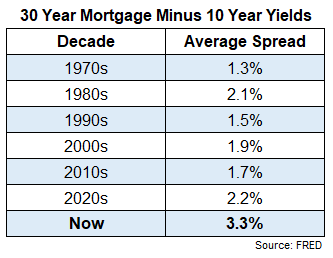

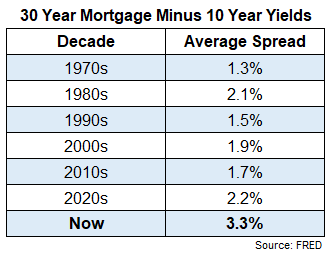

Mortgage rates typically trade a spread to the 10 year Treasury yield. Here are the average spreads by decade going back to the 1970s:

If we were at 1990s spread levels we would be looking at mortgage rates of 5.7%. Even if we were at the average for the 2020s so far they would be at a more reasonable 6.4%.

So why are spreads so high right now?

It’s a little wonky but there are reasons for this.

When you take out a mortgage most banks don’t want to keep that loan on their books so they package a bunch of mortgages into mortgage-backed securities. These bonds are a collection of mortgages that come with a periodic yield payment just like any other bond.

Mortgage bonds have a different risk than most other types of bonds called prepayment risk. Most people who take out a 15 or 30 year mortgage don’t actually make every payment on that loan from day one.

Instead, most people refinance, which repays that original loan. Or they move before the loan is paid off. So the duration of these bonds is not 15 or 30 years. For most of them it’s probably more like 6-8 years.

The professional fixed income buyers who invest in these securities have parameters around the types of bonds they will buy.

Prepayments on these bonds have fallen off a cliff because refinancing has come to a standstill. According to Fannie Mae, refinancing volume is down 90% from the peak in 2020.

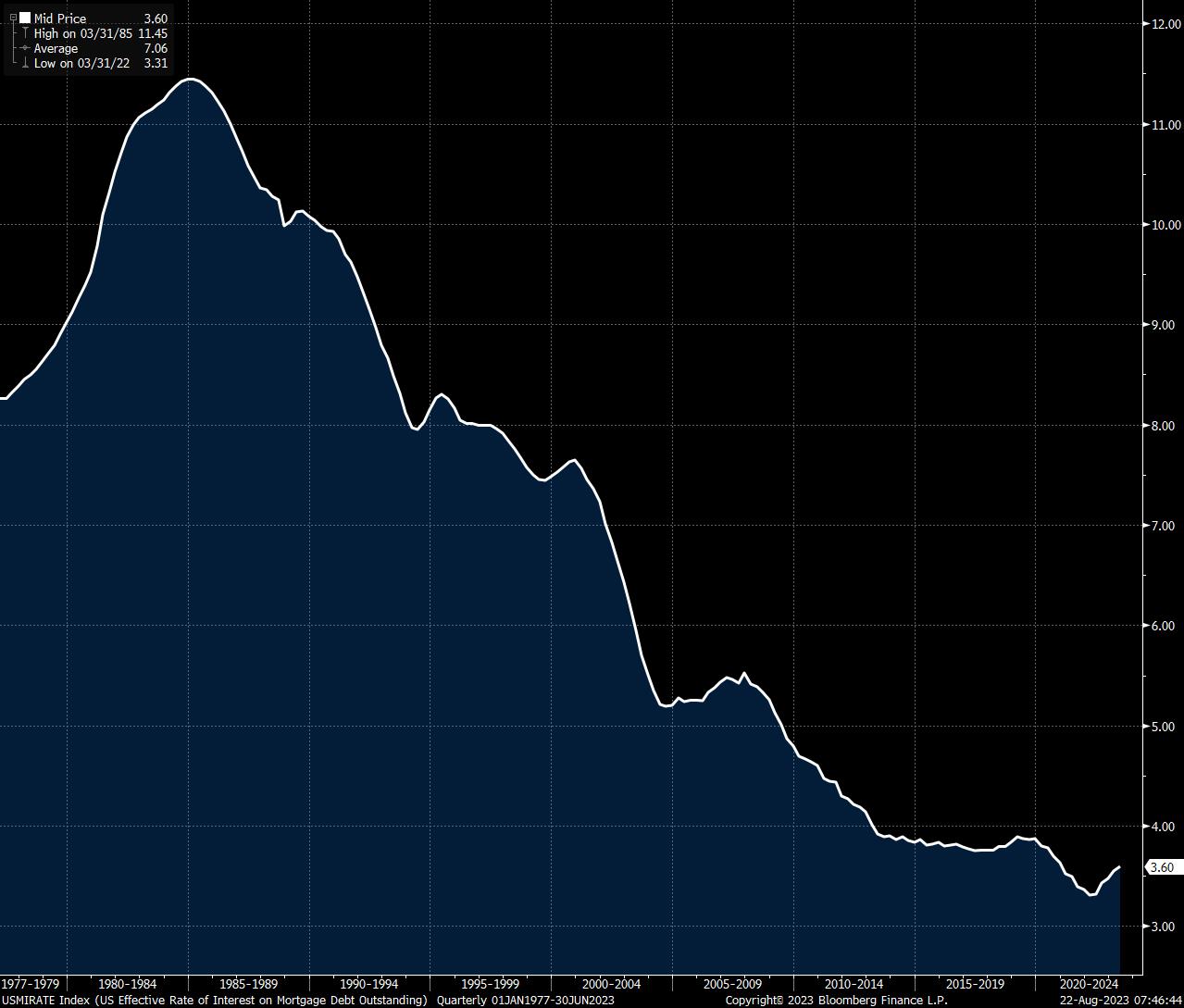

I’m guessing most of the activity remaining is cashout refis considering the average mortgage rate for all borrowers right now is 3.6% (via Robert Burgess):

No one has to refinance right now.

When you combine the lack of refinancing activity with the lack of supply of homes for sale, there isn’t much happening in the housing market at the moment. That means there isn’t much happening in terms of prepayments in mortgage-backed securities.

The increase in the duration of these bonds has led to a blowout in spreads between mortgage rates and government bonds, making an unhealthy housing market even worse.

Another extenuating circumstance here is the Fed probably jacked up the mortgage market when they bought a bunch of these mortgage-backed securities during the pandemic.

They already owned $1.4 trillion worth of mortgage bonds heading into the pandemic in early-2020 but that number ballooned to nearly $3 trillion following all of the quantitative easing to combat the economic slowdown and keep credit markets functioning.1

Add to all of this the speed of the rate rise going from 3% to 7%, and the mortgage financing market isn’t functioning like a well-oiled machine at the moment.

So consumers are suffering through likely the worst housing affordability we have ever seen.

The Fed is punishing borrowers in a big way right now.

The problem is so many people have such low rates locked in that we’re not going to see a huge flood of refinancing activity even if mortgage rates decline from here.

Surprisingly, mortgage rates are actually below average going back to 1970 (the earliest I have data):

That average is being skewed higher by the ridiculous mortgage rates in the early-1980s but it’s at least worth considering the possibility of rates remaining uncomfortably high.

Beyond the extenuating circumstances in the mortgage market right now the path of rates going forward has a lot to do with the Fed’s actions and the state of the economy.

If we get a recession and/or inflation continues to fall you would assume the Fed will cut rates. But good luck predicting economic activity from here.

We were supposed to be in a recession by now yet here we are, staring at the possibility of one of the fastest quarters of GDP growth in 20 years.

Mortgage rates should fall once the economy cools off a bit, something that should happen eventually with rates this high.

I just don’t know how high they’ll get in the meantime or how far they’ll fall when the economy does slow.

The challenge for those looking for better levels of affordability could be that we’ll likely see a spike in demand for homes when mortgage rates do finally fall.

Further Reading:

The Worst Housing Affordability Ever?

1The Fed obviously overstayed its welcome in this market.