Rob Isbitts at ETF.com says Jerome Powell’s speech at Jackson Hole is bad news for 60/40 investors:

For nearly two decades, investment advisors and self-directed investors came to understand and appreciate “asset allocation” as a complementary combination of stocks and bonds. When rates were falling, bond prices were rising and the stock market was driving higher in those easier credit conditions, that combination worked very well.

Powell’s latest message prompts advisors and investors to focus their attention on what to do about their portfolios, with the possibility of a quick Fed rate cut likely off the table, unless it’s in response to a financial crisis.

With so much money and sentiment having rallied around the 60/40 concept until both stocks and bonds fell in tandem in 2022, the potential for a profitable restart just took a hit. It is up to advisors to adjust to that.

It’s fair to question a stock-bond mix right now.

Last year was one of the worst ever for a diversified portfolio of stocks and bonds. Bonds got massacred and caused the stock market to sell-off as well.

No one know where we go from here but there are people smarter than me who are worried about a continuation of higher rates and higher inflation for long enough to make investors uncomfortable.

Rising inflation and rates are typically not great for stocks or bonds but a lot of this really depends on whether you want to zoom in or zoom out when it comes to historical performance.

If we zoom in things don’t look so great for a diversified portfolio of stocks and bonds.

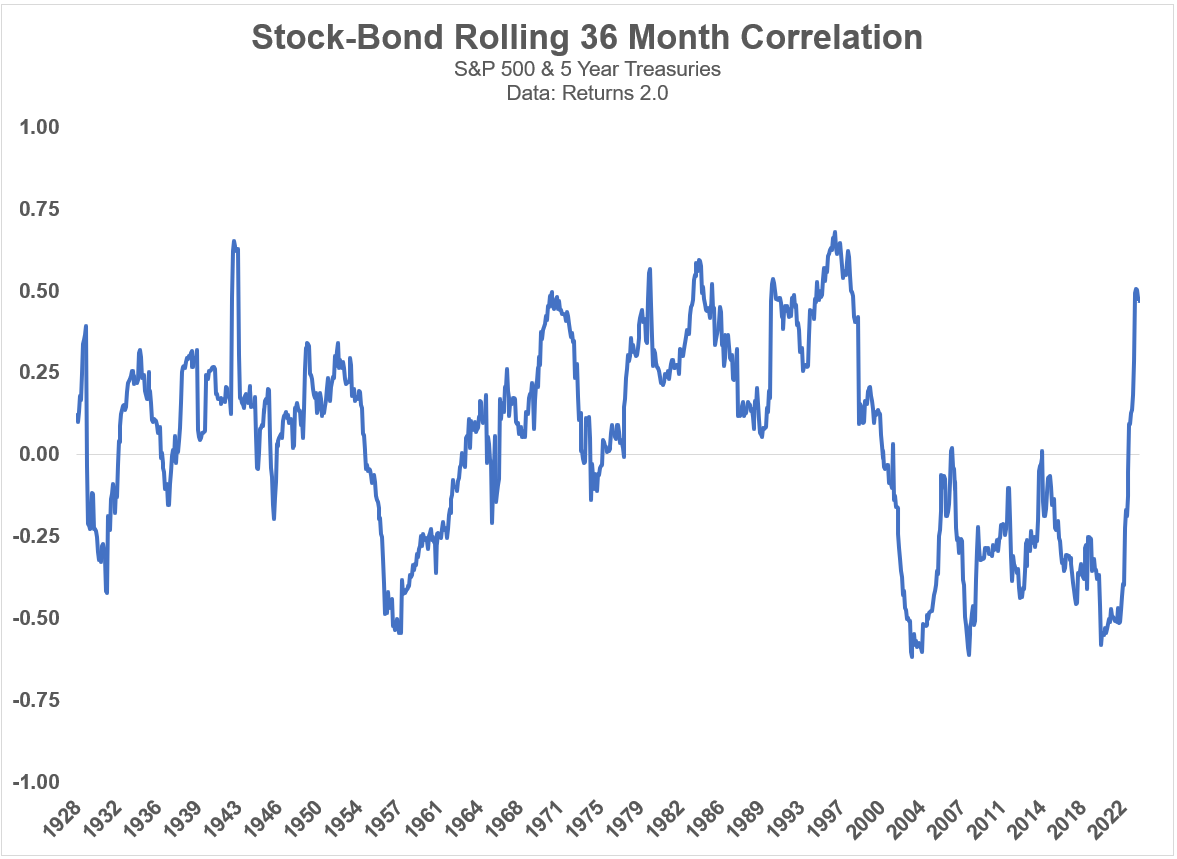

Here’s a chart of the rolling 36 month correlation or returns between the S&P 500 and 5 year Treasuries going back to 1926:

You can see spikes in the correlation numbers in the 1940s, 1970s and last year. What this tells us is stocks and bonds were moving in tandem during periods of higher-than-average inflation and interest rates.

That’s not a good thing when rates are rising because it means stocks and bonds tend to fall at the same time, which is exactly what happened in 2022.

You want bonds to diversify stocks and vice versa, especially during periods of market unrest. Diversification works most of the time but not always.

Such is the nature of risk.

But it’s also important to point out that short-term performance correlations don’t always tell the entire story.

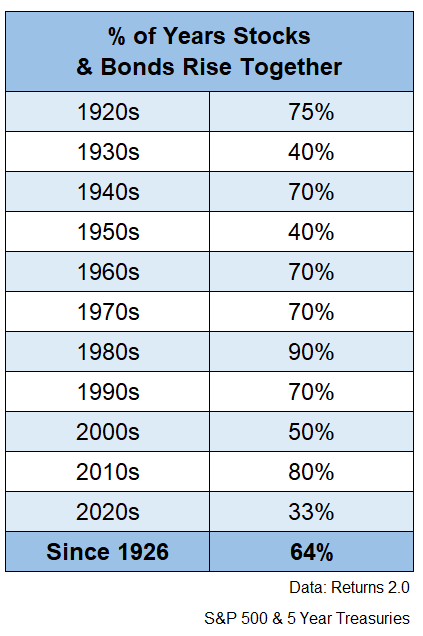

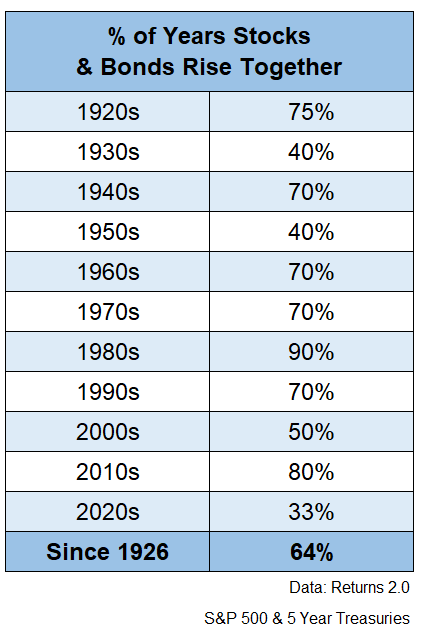

If we zoom out a little, you can see that stocks and bonds tend to go up at the same time more often than not:

This makes sense when you consider the fact that stocks and bonds are both up far more often than they are down in a given year.

Since 1926, the S&P 500 has been up roughly 3 out of every 4 years. That’s a pretty good win rate but bonds have been even more impressive.

Five year Treasuries have experienced positive returns in nearly 88% of all calendar years since 1926. Bonds are far more boring than stocks

And if we put it all together, roughly two-thirds of the time since 1926, stocks and bonds have finished the year in positive territory simultaneously.

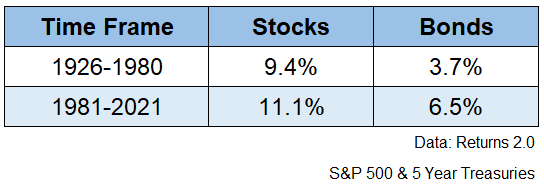

While both stocks and bonds have benefitted mightily over the past four decades or so from declining interest rates, falling rates are not a prerequisite for returns in the financial markets.

It’s fair to say investors have been spoiled since the 1980s, but markets threw off decent returns even in the face of depressions, wars, rising interest rates and sky-high inflation in the past:

Yes returns were higher in a falling rate environment but it’s also important to recognize starting yields matter more to bonds than the direction of rates.

Corey Hoffstein from Newfound Research wrote a note a number of years ago that has always stuck with me where he asked: Did decline rates actually matter?

He looked back at the period from 1981-2017 when U.S. Treasury yields went from 15% all the way down to 2%.

Most people assume those falling rates were the biggest reason for the extended bond bull market.

Hoffstein looked at the annual sources of returns for 10 year Treasuries over that time. Here’s what he found:

What we can see is that coupon return dominates roll and shift. On an annualized basis, coupon was 6.24%, while roll only contributed 0.24% and shift contributed 2.22%.

Which leaves us with a final decomposition: coupon yield accounted for 71% of return, roll accounted for 3%, and shift accounted for 26%.

So three-quarters of the returns in Treasuries during the bond bull market came from the higher-than-average starting yield plus a little from the roll return1 while falling rates accounted for roughly one-quarter of the return.

Not what you would assume, right?

To be fair, falling yields accounted for 2.2% of the annualized 8.7% gain. It was a nice boost for sure. But the main reason bonds did so well is because the average starting yield in the 1980s, 1990s and 2000s was so high.

Yields right now are not as high as they were back then but they are far more respectable.

Unless you are trying to put on a trade and catch bonds before rates fall, you should want interest rates to stay higher for longer as a fixed income investor. Clip those coupons.

Nothing is guaranteed in the financial markets but a diversified portfolio of stocks and bonds is in a much better place right now that it was just a few short years ago, mainly because bond yields have risen so much.

If your target annual return for a 60/40 portfolio is 6% but bond yields are 1%, you need almost 10% per year from the stock market.

But if bond yields are 5%, now you only need less than 7% from the stock market to hit that goal.

Investing would be much easier if correlations were static, rates were always starting from a high level, only to drop and stock market valuations were below average.

It’s likely never going to be that easy again.

But a diversified portfolio of stocks and bonds is now in a much better place for the long-run even if things get a little bumpy over the short-run.

Michael and I talked about 60/40 portfolios, bond yields and much more on the latest Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Is the 60/40 Really Dead This Time?

Now here’s what I’ve been reading lately:

1The roll return is essentially taking advantage of the yield curve as bonds tend to converge to par value as they approach maturity.