Jeremy Grantham was on The Compound and Friends with Michael and Josh last week talking bubbles.

I partially agree and partially disagree with Grantham here.

I continue to believe the U.S. housing market is not in a bubble.

Is the housing market broken in many ways? Yes.

Is affordability as bad as it’s ever been? Also yes.

Does that mean we are in for another housing market crash like we experienced during the Great Financial Crisis? I don’t think so.

Here’s why:

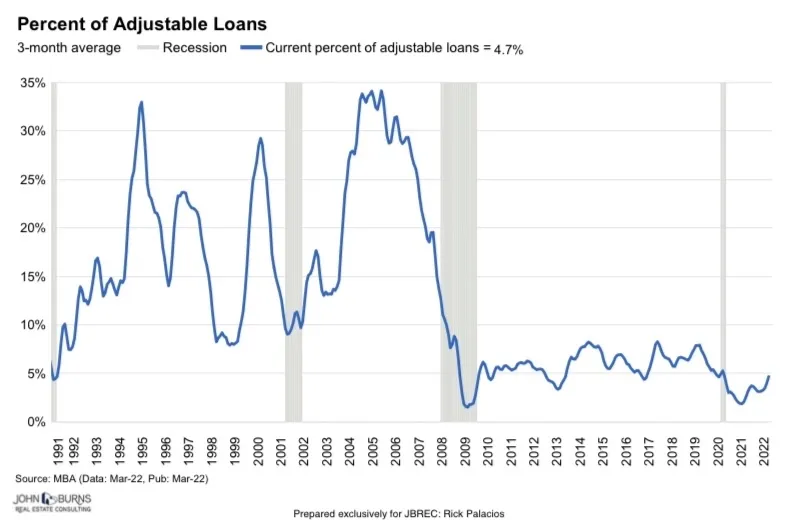

We didn’t binge on adjustable-rate mortgages. One of the biggest reasons the housing market crashed last time is that so many people took out loans with low teaser rates that adjusted higher a few years later.

The use of ARMs is so much lower today:

Most borrowers spent the pandemic years locking in low fixed-rate loans.

Roughly two-thirds of all mortgage borrowers have a rate under 4%. Nearly 40% of homeowners own their home outright with no mortgage.

It’s hard to see forced selling when so many people have affordable housing payments locked down.

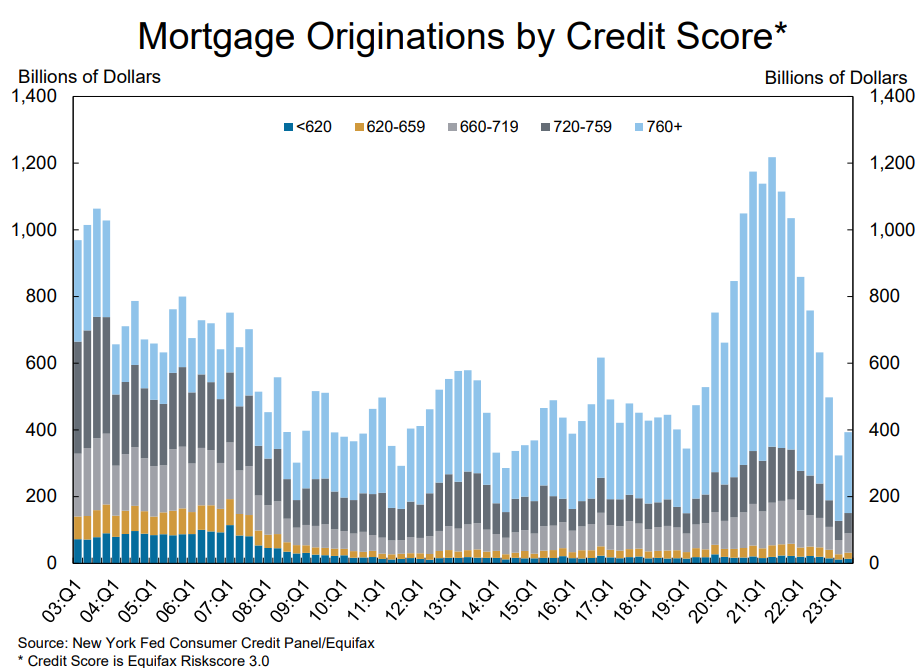

Borrowers have far better credit profiles. We’re not reliving The Big Short where strippers could get loans to buy 5 houses and lenders were incentivized to make subprime loans:

There aren’t many loans being made right now but most of them are going to people with excellent credit scores:

In fact, two-thirds of all mortgage loans since 2017 have gone to borrowers with sterling credit scores (760 and up) while just 2.6% have gone to subprime borrowers (620 and below).

From 2003-2007 more than 11% of loans went to subprime borrowers and just 26% to borrowers with the best credit scores.

No more NINJA loans this time around.

We didn’t build enough houses. From 2000-2007 nearly 14 million new homes were built in the United States. Not only were the loans bad but supply began to outstrip demand.

Then the housing bust happened and we only built 9.1 million new homes in the 2010s.

When you combine a lack of housing supply with millennials reaching their prime household formation years, prices were bound to go up.

The pandemic just supercharged this dynamic.

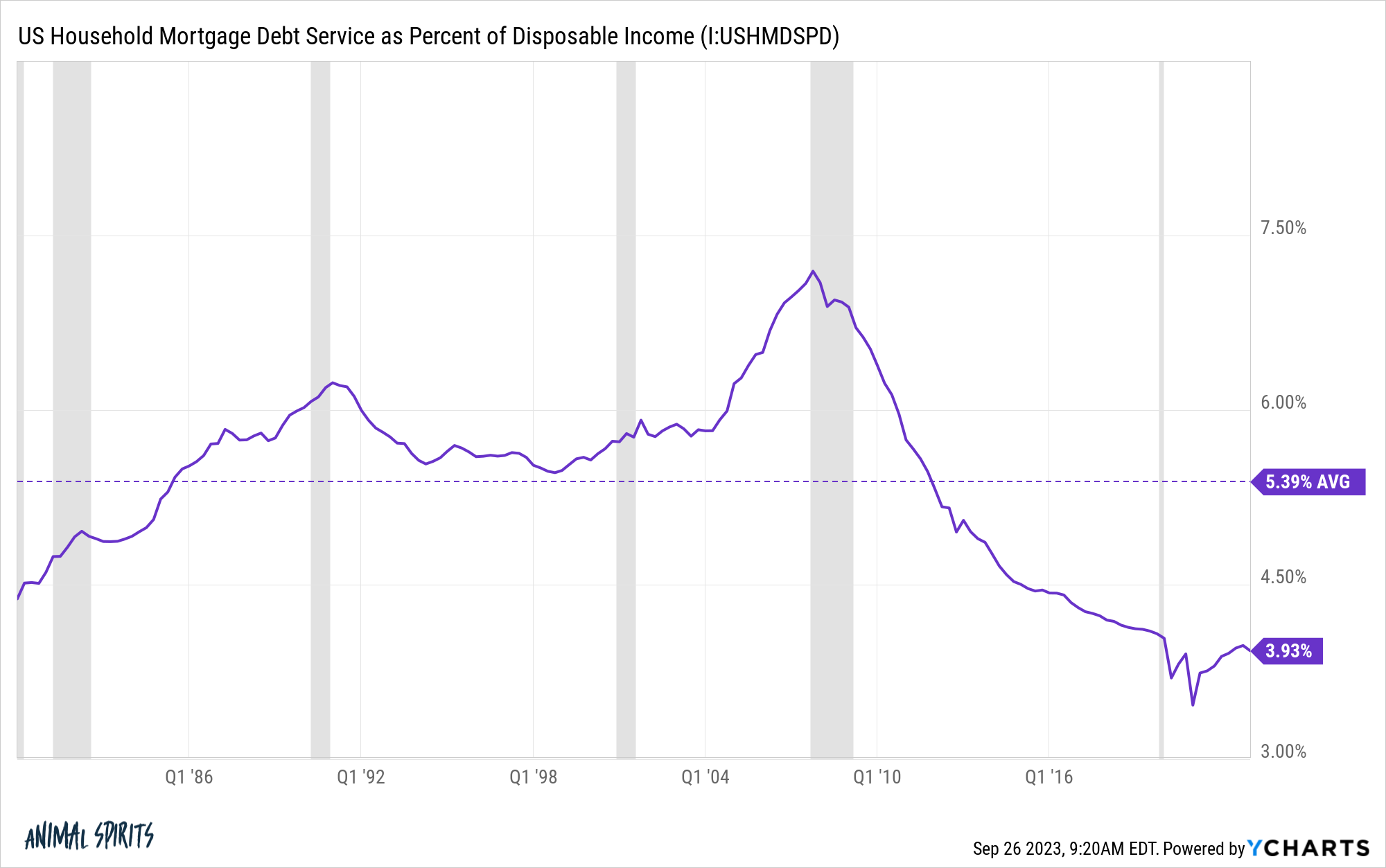

Consumers are in pretty good shape. Households still have the ability to pay their mortgage debt:

It would take severe job losses to bring about a fire sale of houses on the market.

I’m not saying U.S. housing prices can’t or won’t fall but it’s hard to call the current situation a bubble, even with the insane run-up we’ve seen in prices.

So where are the housing bubbles today?

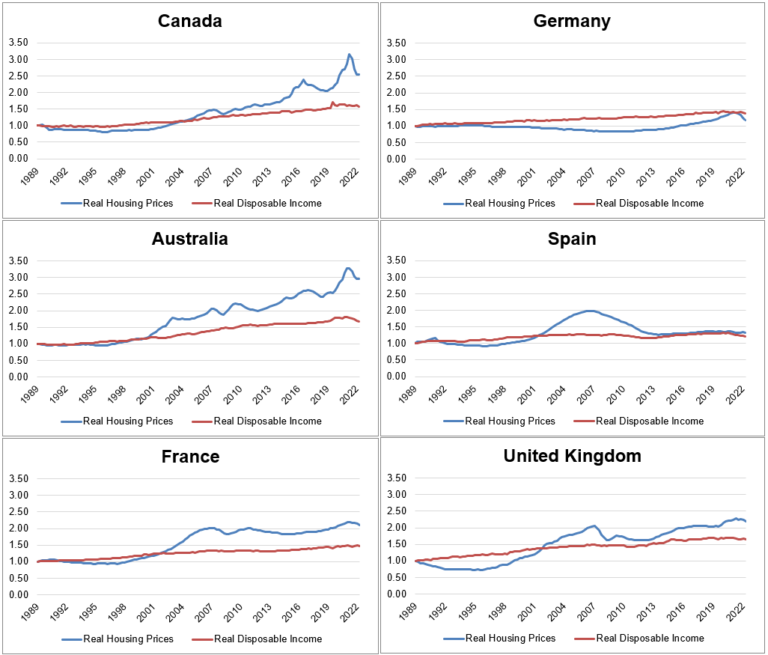

A few weeks ago I compared Canada to the United States to show what an actual insane housing market looks like.

Since I already had the data it made sense to look at some other foreign markets to see how out of whack price gains have been relative to incomes over the past 3+ decades.

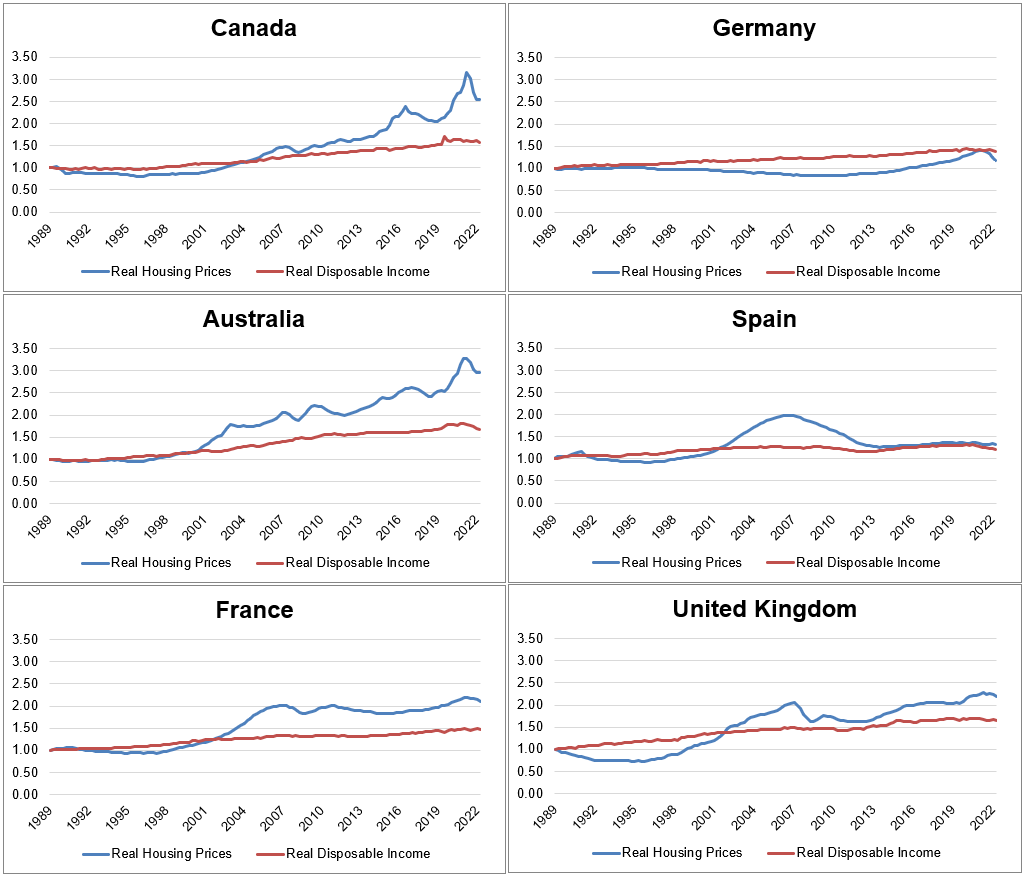

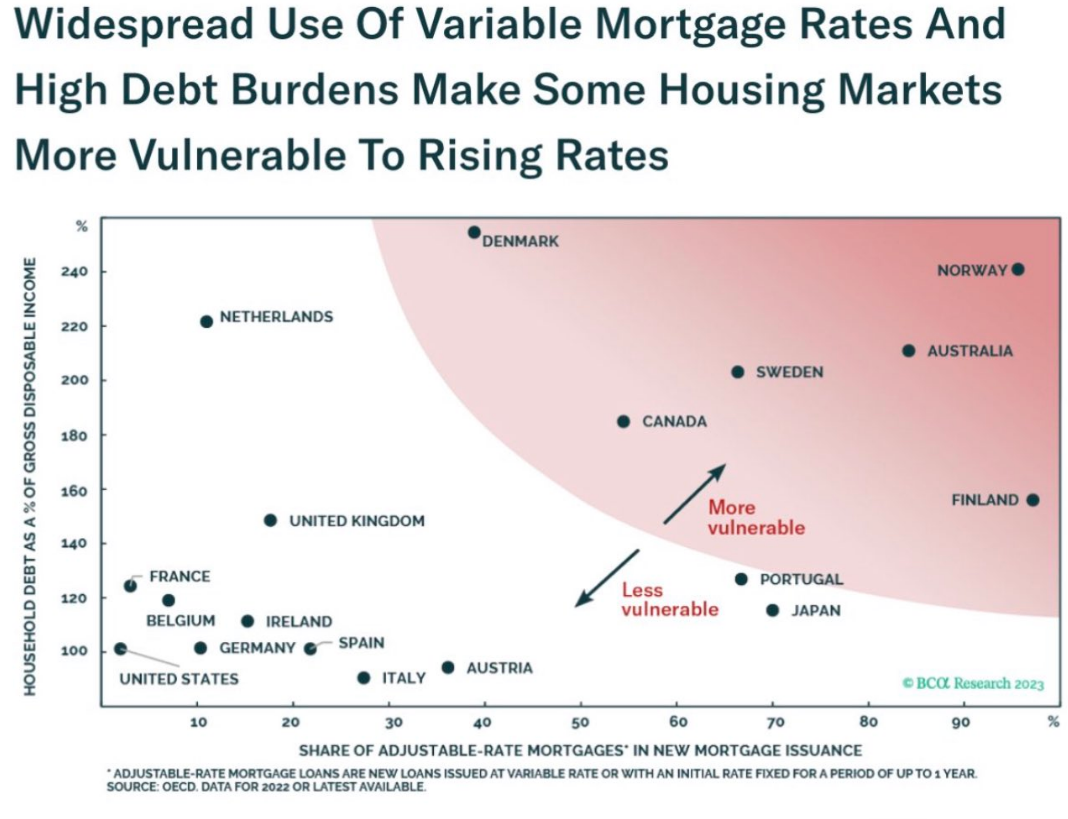

These charts show the real (inflation-adjusted) growth in both housing prices and disposable incomes since 1990:

Canada and Australia stand out as the outliers in terms of housing prices growing much faster than incomes. France and the UK are up there too.

The United States, Spain and Germany look relatively tame with prices and incomes growing in tandem for most of this period.

Then you have prices going in the opposite direction in Japan and South Korea but that’s more of a function of the Japanese housing bubble of the 1980s.

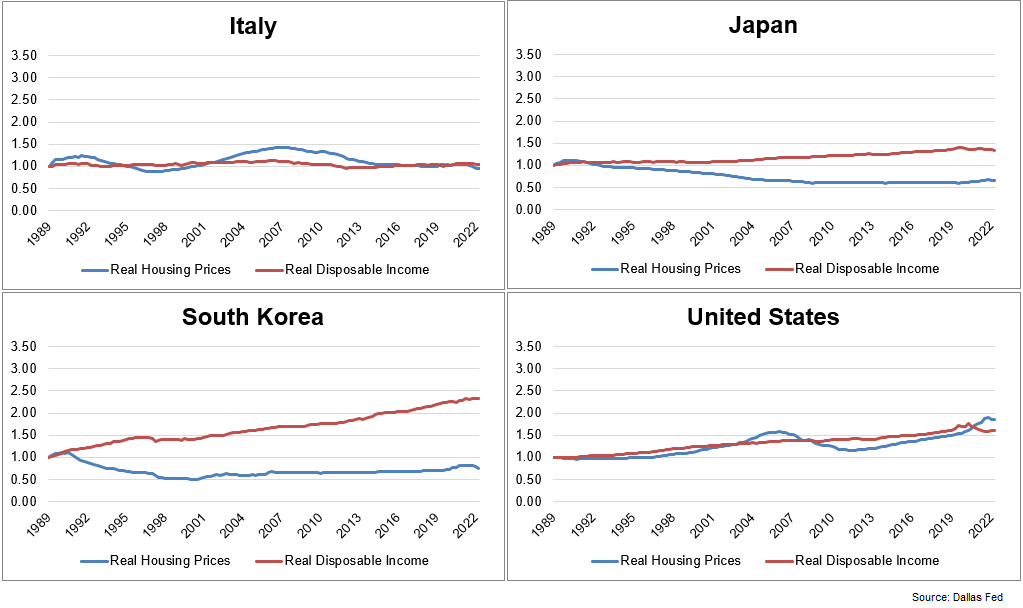

Many of these foreign markets are more susceptible to falling prices because higher interest rates will have a much bigger impact on borrowers. In the U.S. we’re used to fixed rate mortgages but lots of developed nations rely heavily on variable mortgage products:

In countries like Canada and Australia, many loans automatically reset rates every 5 years or so. This was a wonderful thing for borrowers when rates were falling. But now that mortgage rates have more than doubled, homeowners are looking at much higher borrowing rates.

The markets are starting to price this in (although we have a long way to go in terms of getting back to more affordable levels).

Since the second quarter of last year, housing prices in Canada are down 20% on a real basis. In Australia, prices are down 10% after accounting for inflation. Prices in France and the UK are down marginally, -5% and -4%, respectively.

I don’t have the ability to predict housing prices. But if you’re looking for a potential bear market in housing, the United States is in much better shape than other nations around the globe.

Prices have grown much faster in Canada, Australia and the UK. And borrowers in those countries are now looking down the barrel of much higher mortgage rates.

If there is a housing bubble it doesn’t appear to be in the United States.

In The Big Short 2, Steve Carell and Ryan Gosling wouldn’t be making trips to Las Vegas and Florida.

They would be paying visits to Toronto, Sydney, Vancouver and ghost towns in China.

Further Reading:

The U.S. Housing Market vs. the Canadian Housing Market