The bond market continues to be even crazier than the stock market.

We’ve witnessed a massive move in long-term bond yields these past couple of weeks and months.

Yields on the 10, 20 and 30 year Treasury were all up in the neighborhood of 60 basis points over the past 16 trading sessions. Yields are up 1% or more on each of these bond maturities since the end of June.

Yields have increased more in the past month than the absolute levels of these bonds at the generational lows in 2020.

What’s going on here? Why are longer maturity bond yields finally moving higher after months and months of being well below the short-term rates set by the Fed?

I’m not a bond whisperer but there are a handful of theories floating around.

Let’s take a look at those theories from doomer to Goldilocks:

Government debt is spiraling out of control. I understand this one but people have been making this claim for well over 100 years.

The Fed wants rates higher to slow the economy.

I will believe this theory once the Fed is trying to bring rates down but they don’t cooperate.

I’m guessing it would take one sentence from Jerome Powell about buying bonds for rates to fall in a hurry.

Global markets are losing faith in our political system. I’m sympathetic to this argument since our politicians seem to be hellbent on holding the government hostage every 45 days with another shutdown threat.

But how many other countries have a more stable system than us right now?

Nice theory but I’m not quite there (yet).

The supply of bonds is too high and there’s not enough demand. This one sounds good in theory too.

But why did it happen all of the sudden over the past couple of months?

The government has been spending money like crazy since the onset of the pandemic. It’s not like bond investors were unaware of the spending binge we’ve been on.

And shouldn’t demand increase as rates rise?

I do think the Fed’s purchases of Treasuries during the pandemic screwed up the supply and demand equation more than they would have liked.

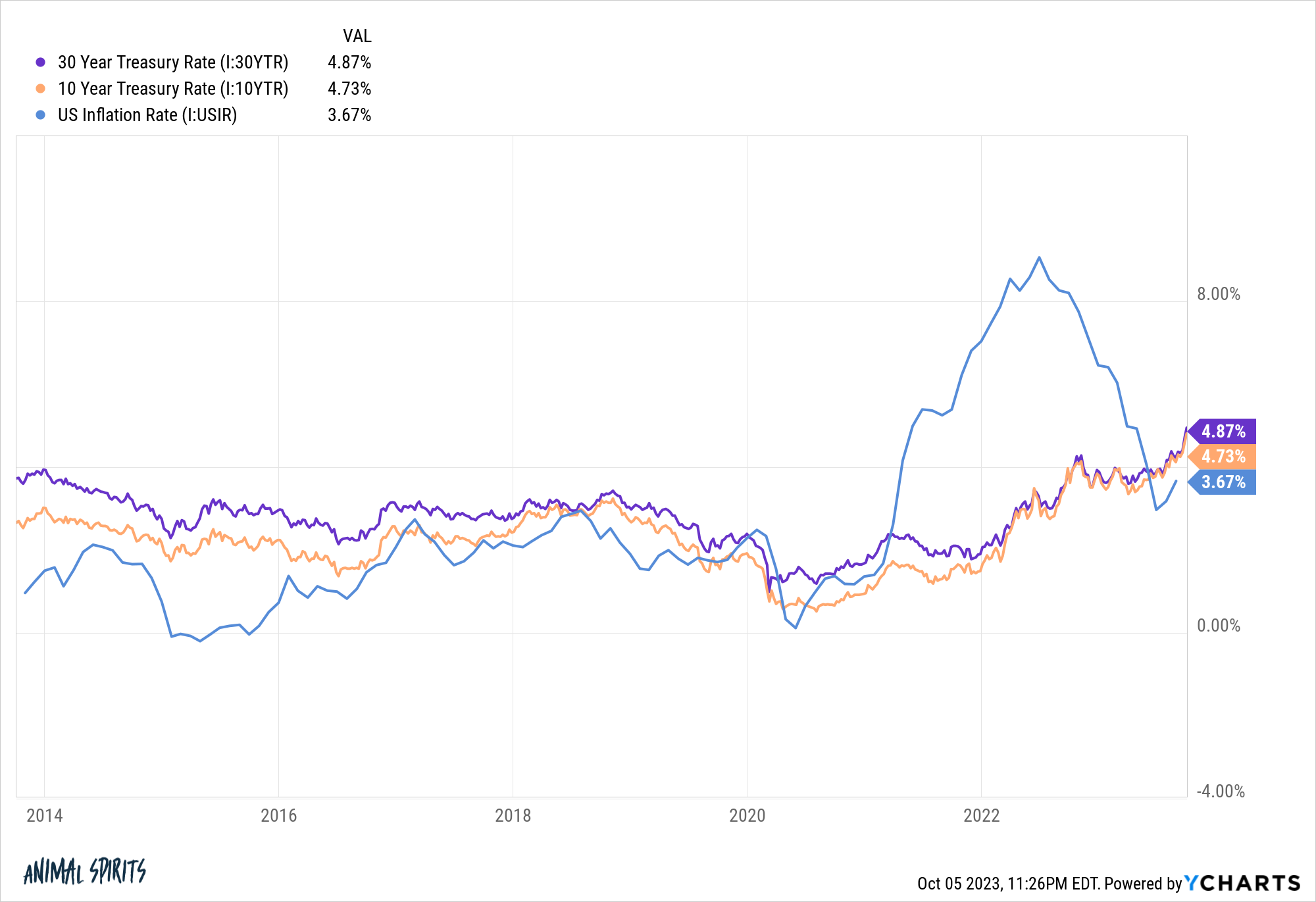

Inflation is going to be higher for longer. It’s possible we’re entering a new inflation regime but why did it take so long for bond yields to react to inflation?

Inflation levels have improved substantially from the peak in the summer of 2022.

It’s strange how bond yields are rising more with inflation under 4% than when it was above 9%.

You could make the argument the bond market assumed inflation was transitory but it’s bizarre how quickly rates have adjusted these past few months.

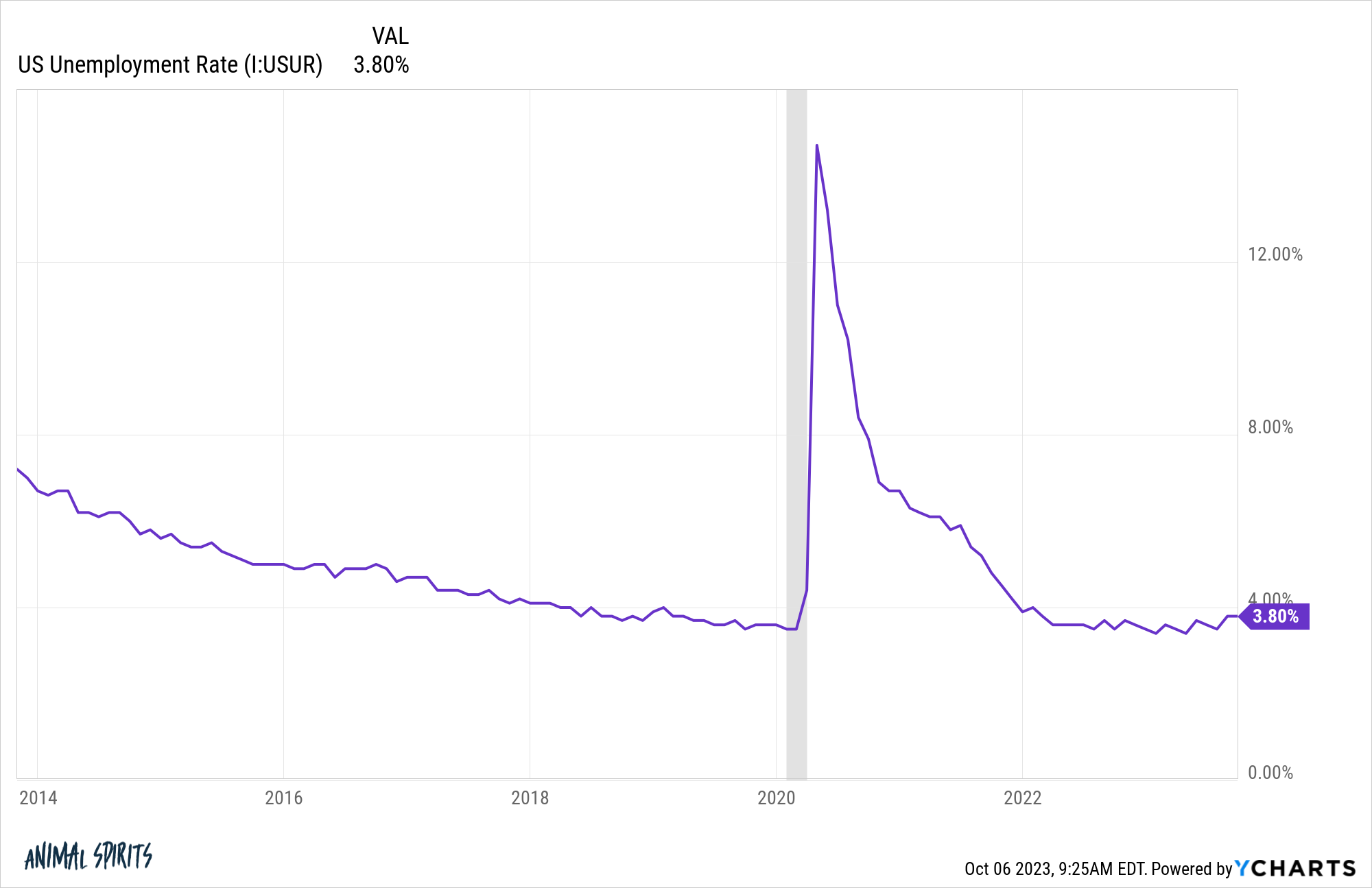

It’s the economy, stupid. I know the doomer theories of China selling Treasuries and U.S. debt spiraling out of control make for a better narrative but what if rates are rising because the economy remains strong?

The labor market continues to brush off higher rates:

The Atlanta Fed’s model is predicting real GDP growth for Q3 of 4.9%. That’s economic growth over and above inflation.

If we are in a new economic regime of higher inflation and growth, that would be consistent with higher long-term interest rates.

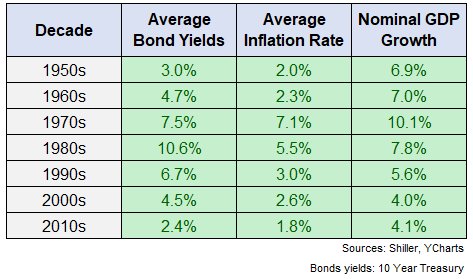

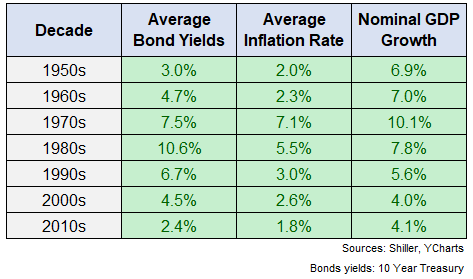

Here’s a look at average bond yields, inflation and nominal GDP growth by decade back to the 1950s:

Throw out the 1950s because the government capped rates to inflate away our war debts.

There’s not a perfect relationship between these factors, but higher growth and inflation are typically consistent with higher bond yields.

Through June of this year, nominal GDP growth in the 2020s has averaged 6.2% annualized. Of course, inflation has been higher too so maybe the bond market simply got caught offside here.

The bond market is dumber than we give it credit for. There is this old wive’s tale in the financial markets that bonds are the smart money.

What if that’s just not true?

Robert Shiller has some excellent research on the bond market’s ability to predict the economy:

One might think that long-term interest rates tend to be high when there is evidence that there will be higher inflation over the life of the bond, to compensate investors for the expected decline in the dollar’s purchasing power. Using data since 1913, when the consumer price index computed by the US Bureau of Labor Statistics starts, we find that the there is almost no correlation between long-term interest rates and ten-year inflation rates over succeeding decades. While positive, the correlation between one decade’s total inflation and the next decade’s total inflation is only 2%.

But bond markets act as if they think inflation can be extrapolated. Long-term interest rates tend to be high when the last decade’s inflation was high. US long-term bond yields, such as the ten-year Treasury yield, are highly positively correlated (70% since 1913) with the previous ten years’ inflation. But the correlation between the Treasury yield and the inflation rate over the next ten years is only 28%.

The bond market exhibits recency bias just like the rest of us!

The least satisfying explanation for the sharp rise in yields is the bond market is confused. We’ve never seen an environment quite like this with pandemic-induced government spending, supply chain shocks and aggressive monetary tightening.

Maybe the bond market is just telling us we live in confusing economic times.

There are so many cross-currents right now that I’m ok admitting I don’t know what comes next from this grand economic experiment.

As Charlie Munger once observed, “If you’re not confused, you’re not paying attention.”

Michael and I talked crazy bond yield moves and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why I’m More Worried About the Bond Market Than the Stock Market

Now here’s what I’ve been reading lately:

Books: