There are always going to be winners and losers in the system under which we operate.

Some people will always be doing better than you while some people will always be people doing worse than you.

Right or wrong, that’s a feature, not a bug.

Most of the time it could take years, decades or even generations to separate the winners from the losers in the economy.

In the housing market, it happened in the blink of an eye, first with housing price gains, then with the swift increase in mortgage rates.

If you owned a home before 2020 or so you should be sitting on a nice pile of equity. And if you took out a mortgage or were able to refinance when mortgage rates were at generational lows, you locked in one of the best inflation hedges imaginable.

If you missed out on both of these moves, you’re rightfully feeling left out.

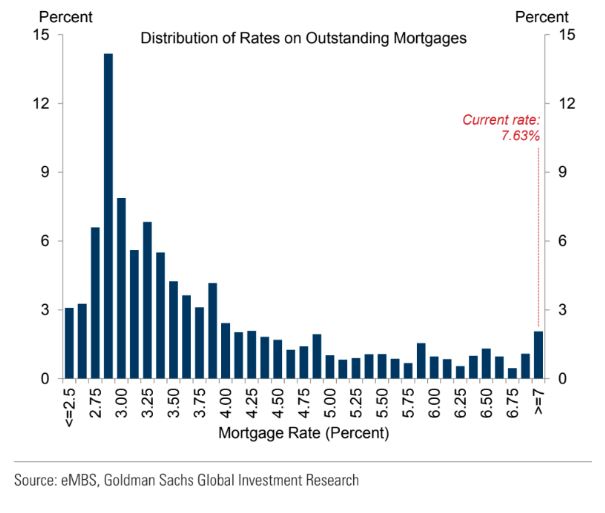

This is the current distribution of mortgage rates courtesy of Goldman Sachs:

If rates remain higher for longer this distribution will slowly change but that will be a gradual process. Plenty of homeowners have low rates locked in for the foreseeable future.

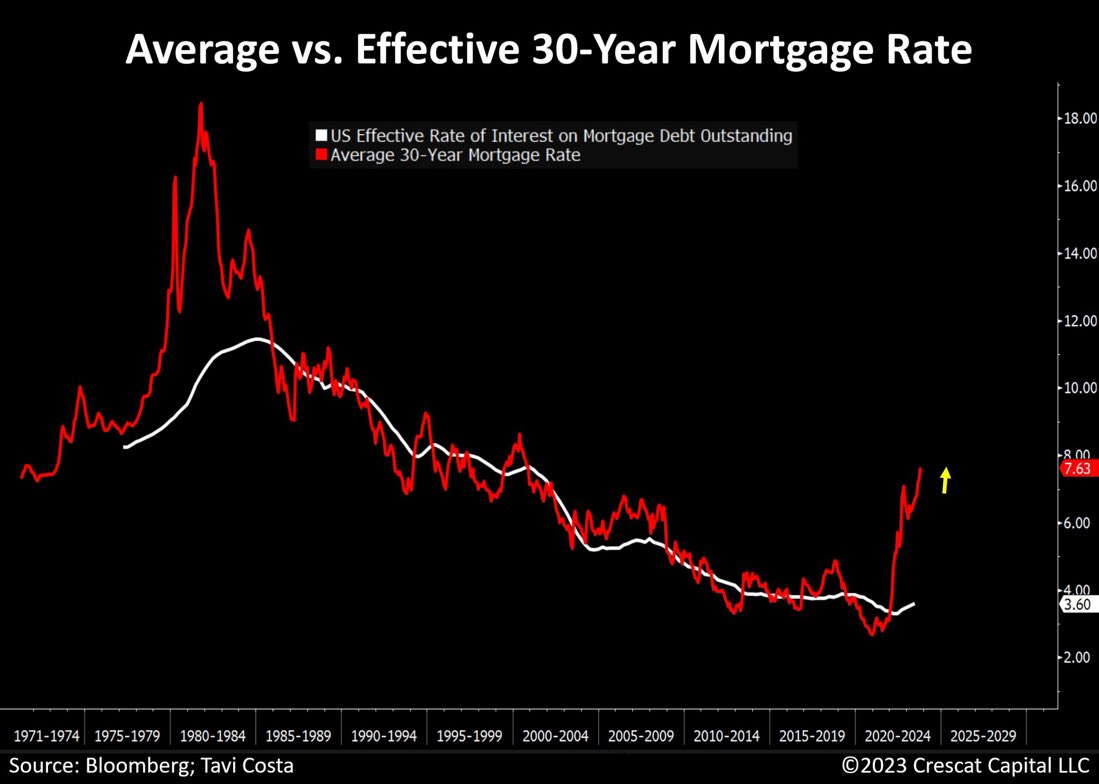

Here’s another way to look at this by comparing the current mortgage rate to the effective mortgage rate based on the rates current homeowners are actually paying:

The last time we saw a divergence this wide was in the early 1980s.

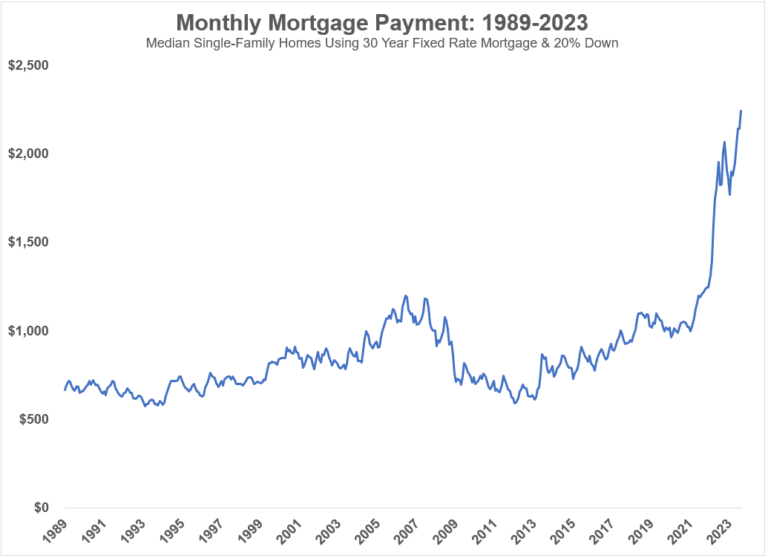

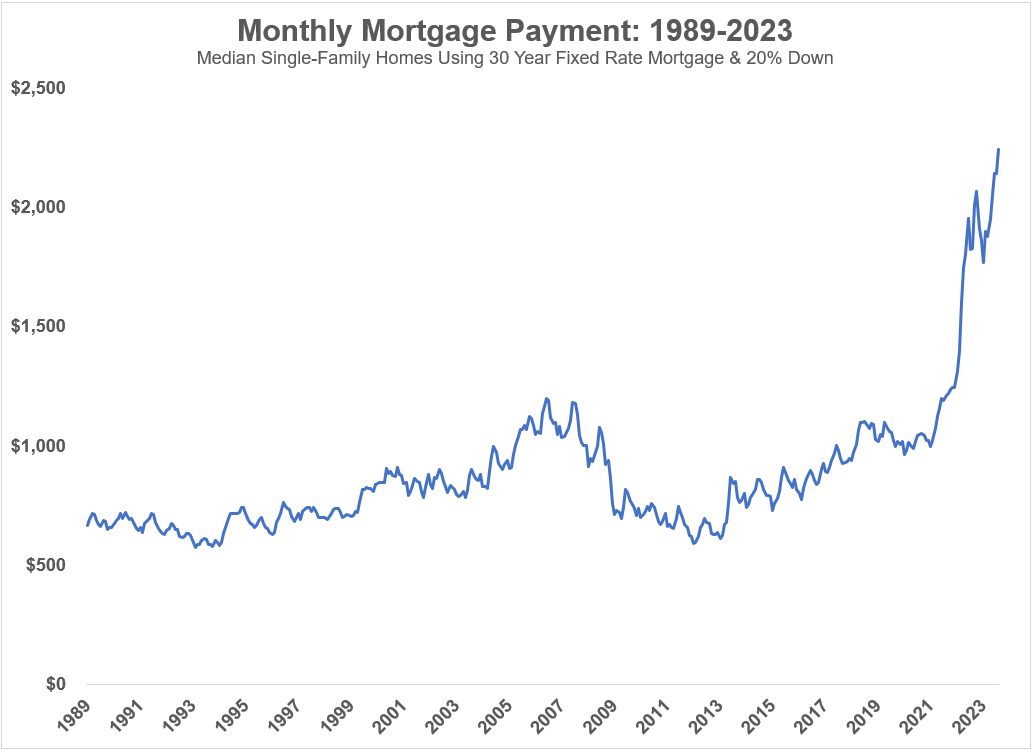

I’ve been keeping track of monthly payments on U.S. existing home prices over time assuming a 20% down payment and the prevailing month-end 30 year mortgage rates:

Both the increase and the pace of change since 2021 are breathtaking.

The hope for people taking out nosebleed mortgage rates right now is eventually they’ll come back down. Maybe not to 3% but even 5% would sound appealing at the moment.

That’s possible if inflation falls or the Fed lowers rates or growth slows or we go into a recession or all of the above.

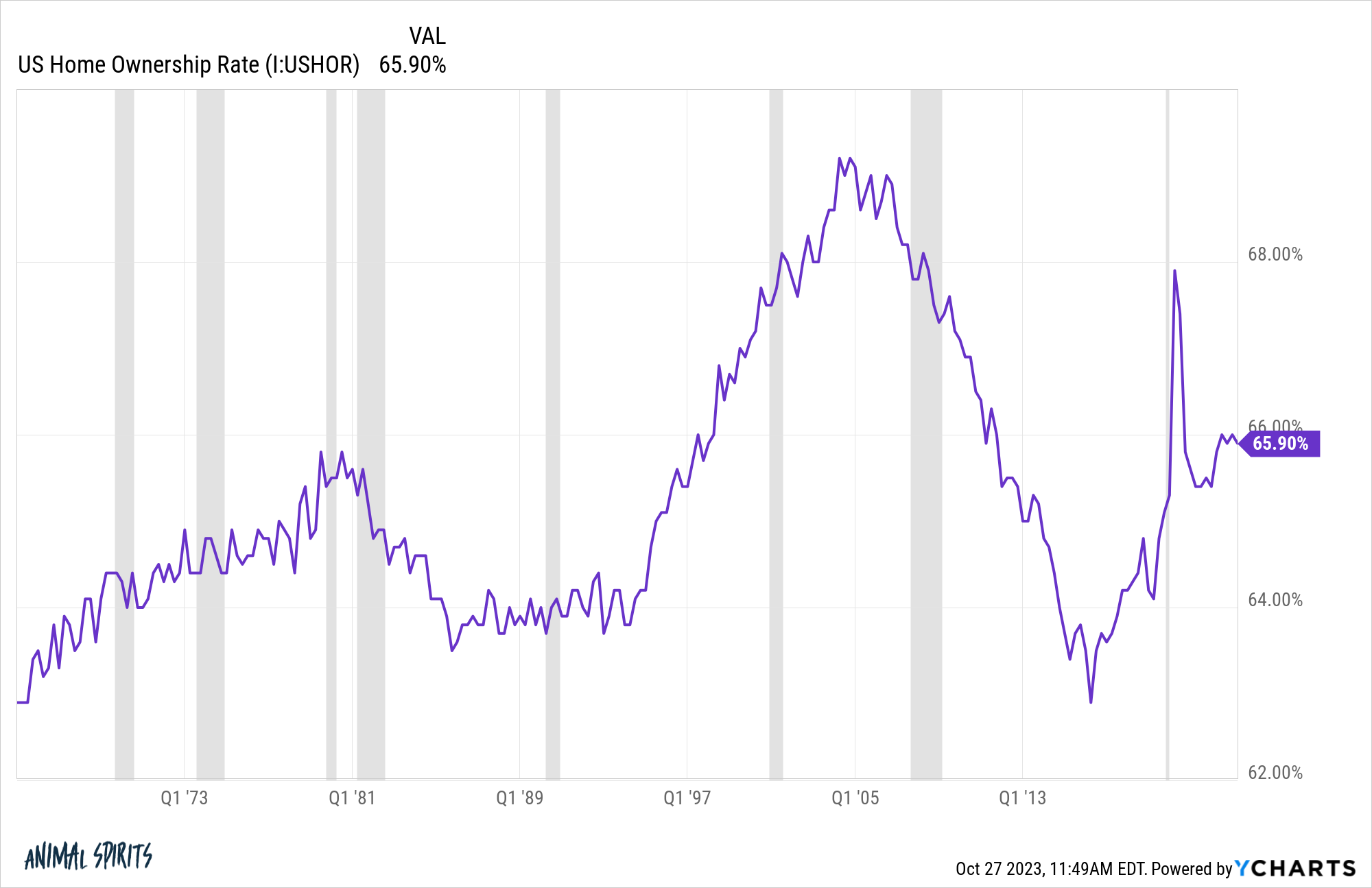

While things feel extremely unfair for young people and other first-time homebuyers, there are plenty of people who already own their homes:

The question is — how much is a low rate mortgage rate worth right now in a world of much higher rates?

For most homeowners, we’re probably talking hundreds of thousands of dollars.

Mortgage rates were 3% just two years ago at the tail-end of 2022. At that time the median existing home price was around $362k.

Here are the loan details for the median existing home price in October 2021 with a 3% mortgage rate:

- 20% down payment: $72,400

- Remaining principal: $289,600

- Interest over the life of the loan: $149,950

- Monthly payment: $1,220

It’s hard to believe how reasonable things seemed not that long ago.

Now here are the numbers using the most recent data with the same assumptions:

- 20% down payment: $82,700

- Remaining principal: $330,800

- Interest over the life of the loan: $477,555

- Monthly payment: $2,245

The biggest difference is obviously the interest expense, which flows through to a much higher monthly payment. Two years ago you would have been paying around 40% of the purchase price in interest costs over the 30 year life of the loan.

Now the interest costs are more than the cost of the house!

It’s now a little more than $1,000 more for the monthly payment. The all-in cost with higher rates adds close to $380k over the life of a 30 year loan.

That’s more than the median existing-home price was back in late-2021!

And we didn’t even add home equity to the equation.

Obviously, the hope is you eventually get to refinance to take down that debt burden but the higher monthly payments in the meantime aren’t very much fun.

Maybe mortgage rates or housing prices will come back down in the coming years to even things out a little. That’s the hope for those who are looking to buy.

Unfortunately, there are no guarantees for where mortgage rates go from here.

If you were able to lock in lower housing prices and lower mortgage rates consider yourself lucky.

I’m guessing many homeowners could not afford their own homes at prevailing prices and mortgage rates.

Sometimes it doesn’t seem fair how the winners and losers are determined in this crazy world of ours.

However, I’m not sure we’ve ever experienced a wider gap between the winners and losers in something as big and important as the housing market.

This is going to have a lasting impact for years to come and I don’t think we’ve thought through the potential ramifications yet.

Further Reading:

The Worst Case Scenario for the Housing Market