Jesse Livermore once said, “Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

Fair point.

Human nature is the one constant across all market environments.

On the other hand, Warren Buffett once said, “If past history was all that is needed to play the game of money, the richest people would be librarians.”

Also a fair point.

Everyone has access to historical information about the markets these days, but it doesn’t necessarily make it any easier to outperform.

So which one is it?

Are the cycles always the same or are they always different?

Well it’s a little of both.

Human nature never changes — fear, greed, envy, etc. — but markets and our reactions to them do change depending on the environment. Markets are hard to predict because people are hard to predict.

Take recency bias as an example.

Sometimes investors become complacent by assuming the current market or economic environment will last forever, failing to recognize the inherent cyclicality in our system.

Other times investors fight the last war by assuming the next risk will look exactly like the last risk.

The Great Financial Crisis and its aftermath are a perfect example these competing mindsets.

The 2010s lulled investors to sleep in a world of low, growth, low inflation and low rates which felt like it was the new normal. It was until it wasn’t.

The 2008 crash also led many investors to believe every downturn was going to lead to a systemwide meltdown, causing people to look for the next big short at every turn.

If your only baseline for an economic contraction is the GFC, you mistakenly assume the housing market crashes and the stock market gets obliterated every time there is a recession.

The stock market does tend to get hurt when the economy slows but it’s not always in complete meltdown. There’s a difference between a bear market and a crash.

As far as housing prices are concerned, they can fall during a recession but it happens far less often than you think.

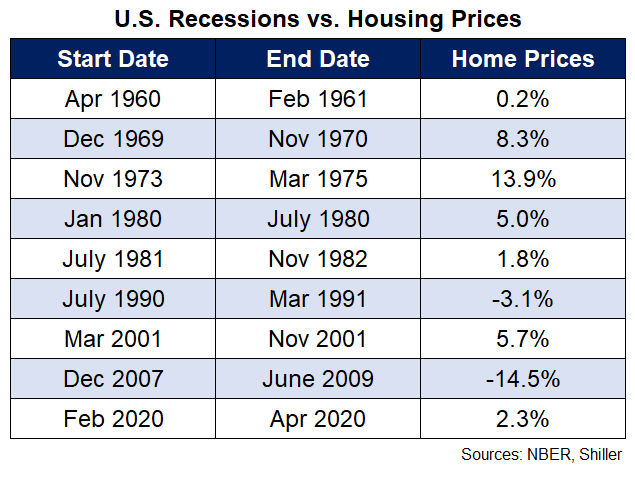

I looked at every recession going back to 1960 to see how housing prices1 in the U.S. held up during an economic contraction:

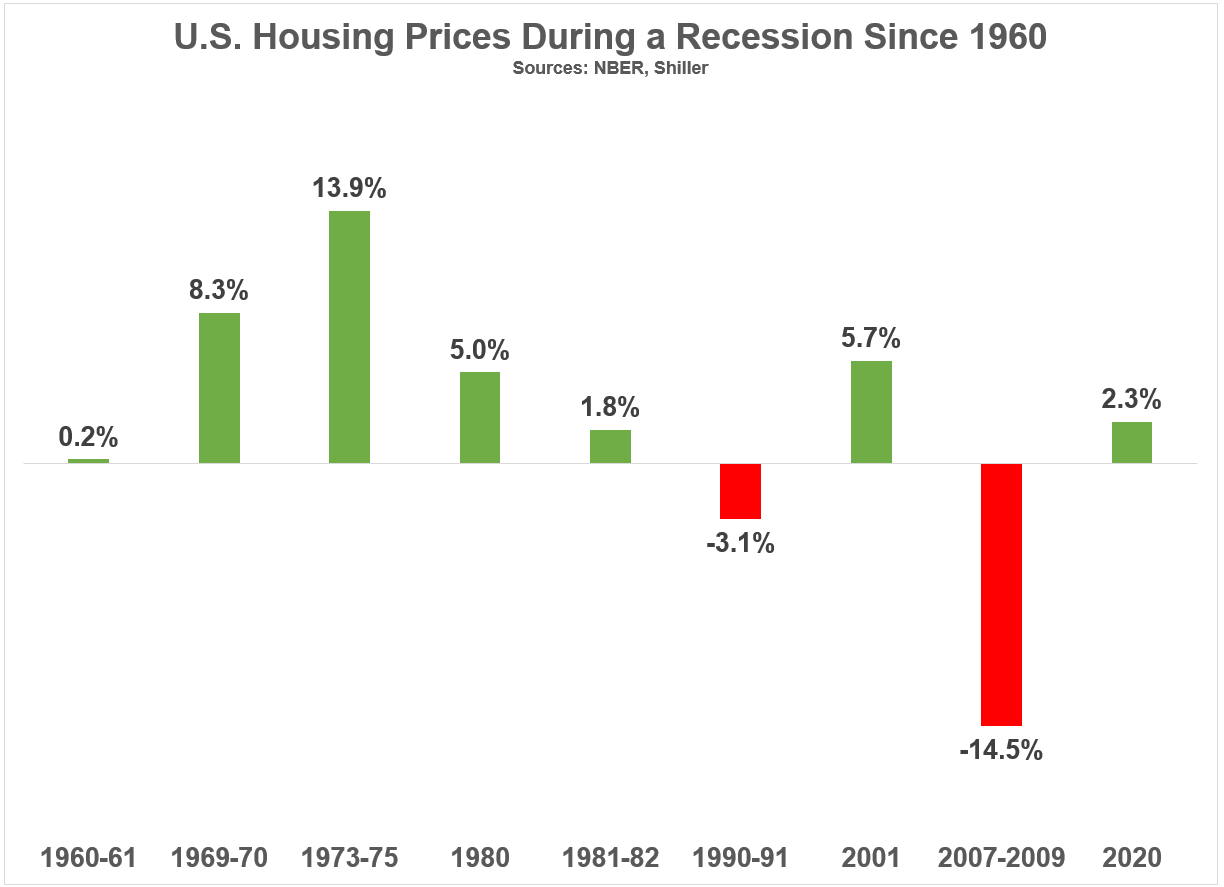

Here’s the data in bar chart form for the visual learners:

Kind of surprising, right?

The Great Financial Crisis was a gut-punch but that was a chicken and the egg problem. A bad housing market helped cause the recession, not the other way around.

The early 1990s recession also wasn’t great for housing prices.

But housing prices actually rose in 7 out of the past 9 recessions.

Pretty remarkable.

OK, so that’s historical data. What about the present?

It feels like housing prices should fall given the insane run-up in prices and mortgage rates we’ve experienced.

The difficulty with the current environment is we’re in a weird place in the housing market because of the move in mortgage rates from 3% to 8% in such a hurry.

Employment has been growing, GDP has been booming, yet home sales have been crashing. It’s an admittedly odd set of market dynamics.

If we get a recession and mortgage rates fall, it’s likely we’ll get a boom from pent-up demand for housing given the unaffordability levels have kept many buyers and sellers on the sidelines.

The argument from the eternally bearish crowd will be once we go into a recession the unemployment rate will rise and that will cause strain on homebuyers and homeowners alike.

That’s certainly possible.

But let’s say the unemployment rate goes from 4% to 6% or 7% in the next recession. That’s not good but it means 93-94% employment. People hunker down in a recession but life goes on.

Things will get worse if we go into a recession but consumers are in a much better place than they were heading into the 2008 crisis.

The latest report from the New York Fed tells the story here.

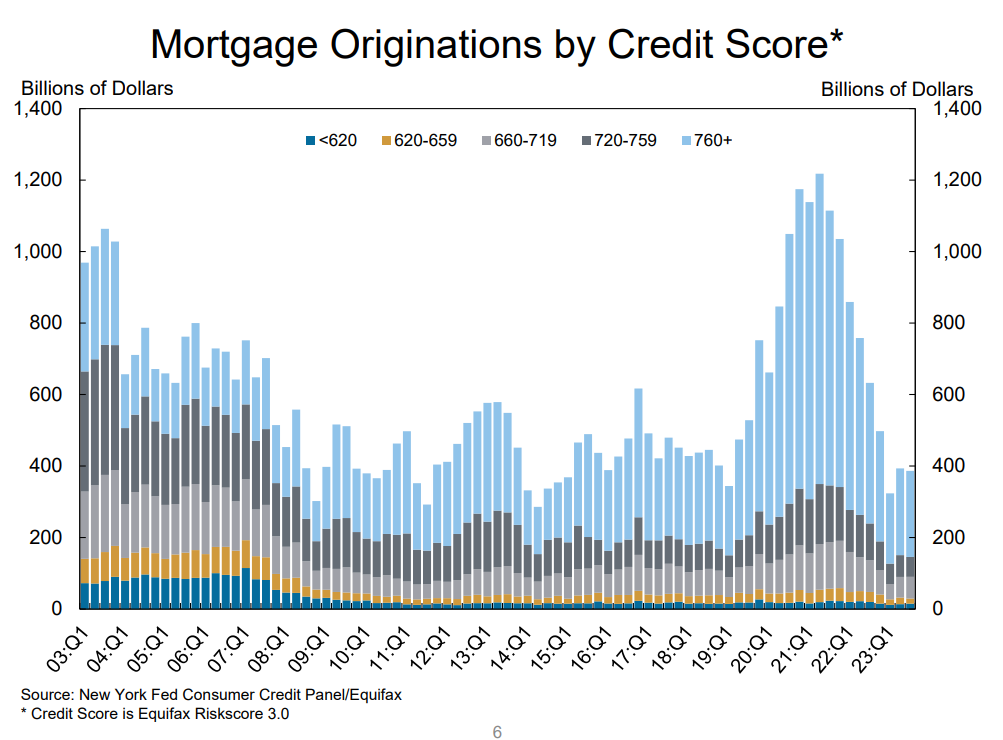

This is one of my favorite charts of the 2000s, which shows mortgage originations by credit score:

The people buying houses in the early-2000s housing bubble had pretty terrible credit scores. This cycle, credit scores for homebuyers have been much better.

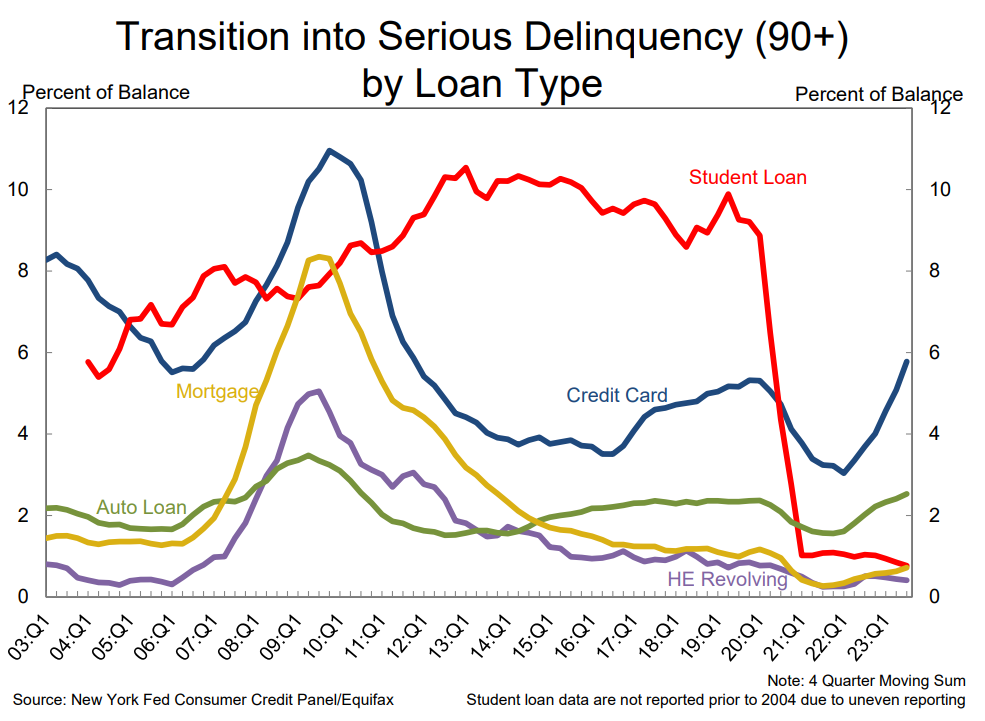

Mortgage delinquencies remain low:

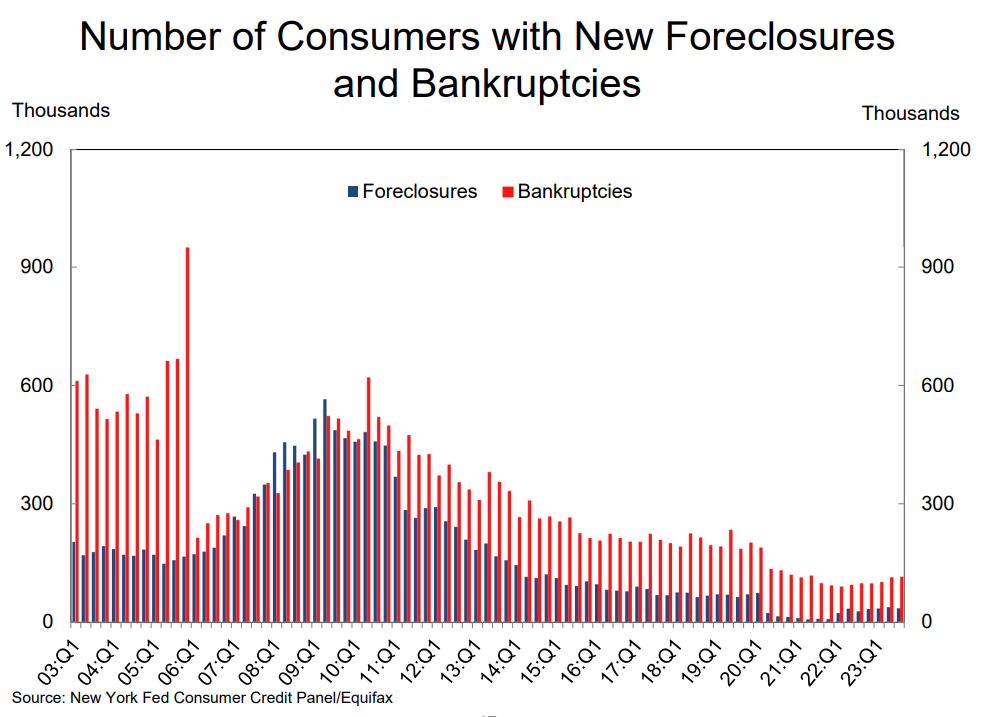

The same is true of foreclosures and bankruptcies:

These readings would likely worsen in a recession, but we’re starting from such a low baseline that we would have to go to a very bad place to seriously impact the housing market.

The housing market may slow during a recession, but it’s not a guarantee.

History says it’s actually more probable housing prices won’t fall during the next recession.

We shall see…

Further Reading:

The Worst Case Scenario for Housing

1These housing numbers are just during the recession window. For example, housing prices fell more like 26%.