I’ve been writing about how demographics are destiny in the housing market for nearly a decade (see here, here and here).

This has mainly been from the perspective of millennials because that’s my demographic.

Following the Great Financial Crisis, many pundits assumed millennials would never settle down, own a home or buy a car. They would simply live in a big city and eschew the typical path to the suburbs.

This never made sense to me.

I saw so many of my peers move to a big city after college and then buy a home in the burbs once they got married or started a family. Millennials just put this off for longer than other generations because of the GFC and the fact that a lot of this group went to school longer.

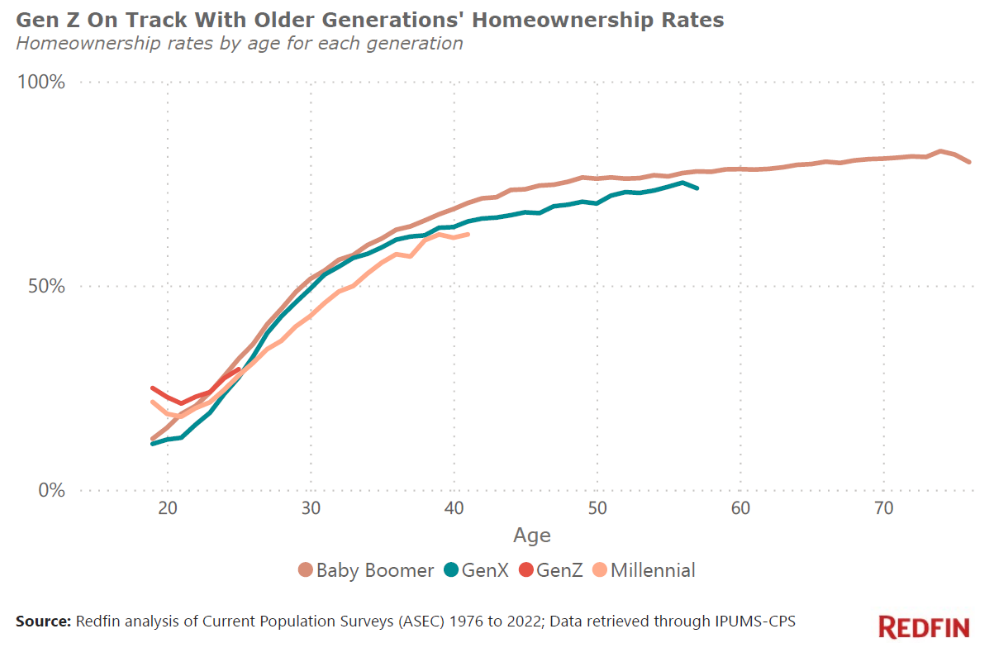

Millennials (and Gen Z and Gen X) are basically right on track with the baby boomers when it comes to homeownership at the same stage in life (via Redfin):

This is just what happens when you reach a certain age.

I know housing affordability is not great right now but I have a feeling many young people will figure it out in the years ahead. I would be surprised if the millennial and Gen Z lines don’t closely track the boomer and Gen X lines that came before them. That’s just what we do in this country.

But enough about the young people.

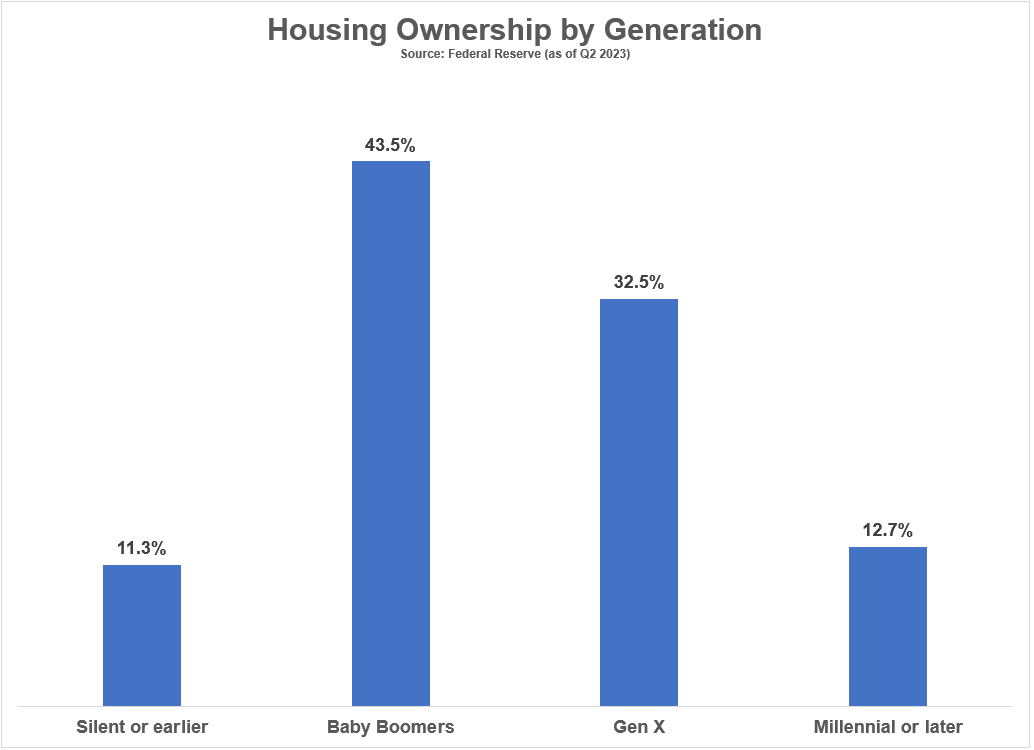

The older generations still control almost 90% of the housing stock in this country:

Yes, Gen X, you’re considered old now too. Interestingly, Gen X owns around one-third of the housing in this country, which is where the baby boomers were in 1989.

The difference between now and previous iterations is we’ve never had a demographic of 70+ million people live as long as baby boomers are going to live with this much wealth in play.

Baby boomers were born between 1946 and 1964. That means the oldest cohort of boomers is approaching age 78. If they’ve lived that long the average life expectancy is 88 for males and 90 for females. The youngest boomers are approaching age 60. Average life expectancy from age 60 is 83 and 86, respectively.1

So we’re probably talking at least another 20 years or so of baby boomer dominance until Gen X takes the throne. There are going to be some fascinating changes to the housing market in that time.

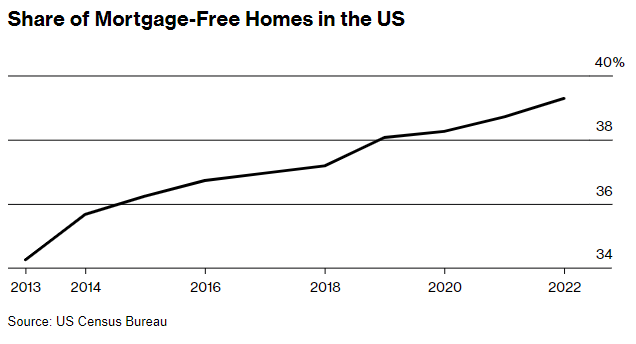

Just look at the share of houses that are free and clear of a mortgage (via Bloomberg):

Bloomberg notes:

The number of mortgage-free, single-family homes and condos increased by 7.9 million from 2012 to 2022, to 33.3 million, according to Census Bureau data analyzed by Bloomberg.

As baby boomers age, they’re snapping up–or holding on to–a larger share of homes overall. Of the 84.6 million owner-occupied homes that existed in 2022, almost 33% were owned by people age 65 or older, a 4.6-percentage-point increase from 10 years earlier.

Almost two-thirds of all mortgage-free homes in the US are paid off over a period of more than 21 years, according to data compiled by Attom, a real estate property data provider.

Owning a home with no mortgage gives this group tons of flexibility.

No monthly mortgage payment is nice but they can also use their equity for negotiating purposes. The affordability equation changes considerably when you can downsize to a new place and pay with cash from the sale of your paid-off home.

In the current unhealthy housing market, older people are in a much better place than most young people and they’re taking advantage.

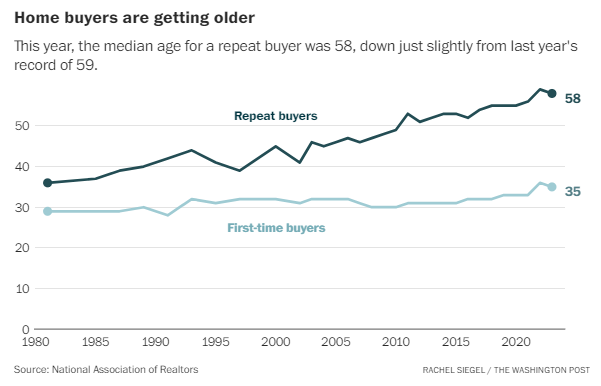

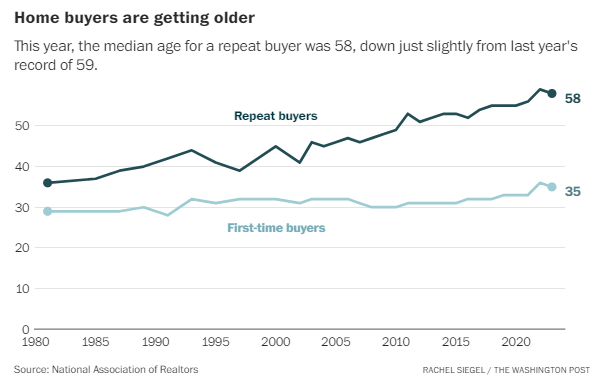

The Washington Post showed the median age of a repeat homebuyer is now close to 60, up from 36 in 1981.

Meanwhile, the average age of first-time homebuyers has increased from 29 in 1981 to 35 now. And while there are still first-time homebuyers in the market, that group is declining.

According to the National Association of Realtors, the average share of purchases from first-time homebuyers since the early-1980s is 38%. First-time buyers only make up 32% today.

The NAR says the typical home seller last year was 60 years old.

Seventy percent of buyers have no children under the age of 18 living with them. That’s an all-time record high. The number was 42% in 1985.

Household income for the average buyer was $107,000, up from $88,000 in the previous year.

This is obviously a terrible environment for first-time homebuyers. They’re competing with a group of people who have built-in equity, higher incomes and more flexibility. Plus the mortgage lock-in effect has depleted the supply of houses for sale on the market.

The supply situation will improve eventually. People will get married, divorced, have kids, die off, change jobs, move to new cities, etc. Life goes on.

The passage of time is undefeated so eventually this dynamic will flip. The hope with the baby boomer housing stock is eventually they will downsize, pass their home down to the next generation or sell to finance their lifestyle in retirement.

I do not believe that millions of retiring baby boomers will crash the stock market in retirement. That argument never made sense to me since the top 10% owns nearly 90% of the stocks in this country.

But the housing market is different than the stock market. Housing is by far the biggest financial asset for the middle class. Most people have more money in their house than their 401k.

This is probably a 2030s story but I don’t know how this is going to play out.

Maybe there will be a wave of retirees selling their homes. Or maybe they’ll take out HELOCs and reverse mortgages to spend down those accumulated forced savings. Or maybe their children will inherit their homes and live in them if they can’t afford one on their own.

There is no historical precedent here.

However, millennials will rule the housing market at some point. It’s just a numbers game.

But for now the older generations are in the driver’s seat when it comes to the housing market.

Further Reading:

Did the Baby Boomers Ruin the Housing Market?

1You can play around with the Social Security life expectancy calculator here.