This a as you heard we are recording I know lots of folks like to um perhaps listen to this later and or um want to share it with a colleague later so we are thrill to have you here I am Kathy Hastings director of Outreach and Communications and I am joined today

With my colleague Jenny Johnson who is um just getting her audio set up right now but uh we are thrilled for those of you who are maybe either new to guiding students in financial aid and FAFSA and or maybe you’ve been a counselor for a while but new to that role we’re just

Going to give you an overview today so hopefully by the end of the hour you’ll feel a little bit more comfortable with both and so with that I’m going to turn it over to Jenny Johnson hi Jenny hi thank you for the introduction Kathy I appreciate it um forgive me

Y’all for my tardiness I was having all of the computer trouble just a minute ago had to restart but it doesn’t matter I’m here let’s roll okay so I’m going to switch over to sharing my screen it’s the same presentation um so as Kathy mentioned today this is a financial aid

Overview Fasto 101 it’s meant to be um an introductory um lesson about financial aid and FAA it’s not in depth but hoping that or our hope is that it’ll get you started if you’re new to this financial aid in this FAA world so here’s the plan

For today we are going to um start by discussing the different types of financial aid that are available we’ll talk about what the Fafa is and then how you can help students and family fill out the FAFSA and then lastly we’ll talk about some best practices and some

Resources so we’d like to know who we have in the room today so if you would pull out your smartphones scan the QR code and tell us what’s your level of comfort with the financial aid um with financial aid and with the FASA let us

Know who we have here and um we’d love to hear from you during this this first session of the presentation okay nice I love the quick response and I love to watch the rates change as more people chime in all right okay interesting to see we don’t have

Anybody all the way at the Left End of the scale who’s like completely weary knows nothing about the a process seems like most of you are somewhere in the middle maybe you know a little bit um could know more okay we got some heart eye

Emojis So based on the scores of the of those who submitted responses most of you are right around somewhere in the middle so I’m hoping that this is gonna um either boost the knowledge that you already have for those of you who are in the middle or for those of you who just

Are not comfortable at all that you’re going to walk away feeling a little more comfortable a little more empowered to be able to talk about the financial aid process so when we think about the types of students and families um who are attending higher education at least from

The the pay side we have three types of students and families so first self- funders so these are the families that either make too much money uh to qualify for need-based Aid or don’t want a government handout we have those who are um in high socioeconomic need background

So they might they will qualify for the most need-based Aid um that’s out there and then we have the Forgotten middle so they make too much money for most need based aid but don’t earn enough to completely be able to fund their their education or their students education and so while you

Would never ask a family what which one of these categories they fall into it’s a good thing to keep this in the back of your mind as you’re talking to families um and as you’re talking with students of yours and how they might fall into these categories and then how you might

Need to frame your messaging um to fit these famili family needs so there are three main ways to pay for college and boy I tell you technology really is just showing herself today because that is not what the slide looks like but we’re going to go with it anyway so there are three

Main ways to pay for college um there are family funds there’s financial aid which is at the federal state and college level and then there are Gap funds so that’s money that is used to close the gap between the total cost of attending a college and and the financial aid and family

Funds um that a student may have access to oh look at that isn’t that pretty so today we’re going to talk about a few different types of Aid We’re going to talk specifically about federal aid we’re going to talk about state aid and then we’re also going to talk about

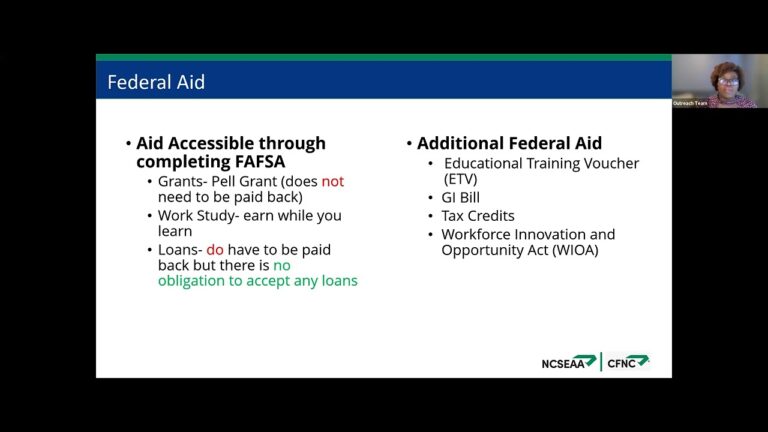

College Aid those are the types of financial aid that we’ll talk about today okay so when we move into talking about federal financial aid the main way to apply for federal financial aid is through the FASA and there are three main types of Aid that you a student can

Be eligible for based on their FAA so grants the main Grant being the pil Grant the pil Grant does not need to be repaid it is um considered Gift Aid okay work study which is allows a student to earn while they learn so when a student

Is in college and and is eligible for work study they will go through or go to the office different offices on their campus to sign up for a work study position maybe even interview for a job they’ll be able to earn a paycheck um and they’re able they decide what they

Want to do with that money while they are enrolled and they’re usually paid every two weeks or so so when I was in undergrad and I had a work study job my first two years I was an office assistant in a technology office and I

Used the money to put gas in my car I used it to um uh get my hair done and also I used it go out to eat with my friends so it was just like having a job that they may the students might have had in high school um except they’re

Being a they’re able to earn while they learn and work on campus and then lastly students are also able to access federal student loans through the FAA so as we all know loans do need to be repaid but submitting the faasa does not obligate students to accept any of the loans that

They are offered I think that’s a really important important thing to share with students there are a few other types of federal financial aid available um and they are not accessed necessarily through the FAA so that’s the educational training voucher the GI Bill tax credits and the workforce Innovation

And Opportunity Act we won’t talk about all of the details of these sources of Aid today but we will talk about two specifically the educational training voucher and the workforce Innovation and Opportunity Act so the education training voucher for foster youth was designed to help students who are currently or formerly

Experiencing foster care help pay for college or or for career school so grants are a available excuse me up to $5,000 a year up to five years or until a student um turns 26 years old students have to complete a FAA in order to be eligible but the faasa is not

Their application for an ETV instead said they would get more information at nc.org this money this $5,000 up to $5,000 per year can be combined with other grants and scholarships and um as I mentioned earlier students would need to complete a FAA in order to be eligible and they

Have to be 18 to apply funding is limited for etvs and it’s distributed on a first come first serve basis so if you have students that you know um may be eligible for this check out nc.org to educate yourself on what options could be out there for them the workforce Innovation and

Opportunity Act provides funds for education for in demand jobs excuse me this is focused on adult Learners looking to Res skill um and also for it’s open to out of out of school youth if a student wants to F find out if they qualify they can contact their

Local career center through in works.gov in addition to seeing if they qualify for Education and Training support under weoa which is what we call it they also need to consider other services that they might qualify for as well so Career Centers might offer support around creating a resume job interview skills

Or even providing help with Job searches and other career guidance and and assessment tools so the weoa is a really really interesting tool that I really only learned about recently so check out ncworks.gov to find out more information about weoa so we talked about the sources of federal financial aid and we’ll move

Into now talking about sources of state aid so there are several ways to think about state aid I’ve listed them here on the screen and we’re going to get into talking about a few of these opportunities um a lot of people don’t think about instate state tuition as a

Form of state aid but when you think about it you can qualify for instate to tuition to attend a public college or university and the average instate savings for attending an instate institution is almost $117,000 so that’s really a perspective shift um to think about instate versus

Out ofate tuition costs as a form of state aid so it’s you have to qualify for instate tuition BAS on your legal residency in the state of North Carolina so it’s a per to be able to attend an instate institution at at a at a lesser

Cost so this is a type of Aid it’s just done on the front end instead of on the back end to help reduce the cost of college upfront a recent college board report found again that on average students will receive um or save nearly $177,000 by selecting an instate University

And so those are real numbers I mean $117,000 is nothing to shake a stick at so when you’re having a conversation with students and families about ways to save money um consider staying in state going local students will need to qualify excuse me as a legal resident of North Carolina and the application

Method to do that is through the residency determination service and you can see the link to access that application there on the screen another way to save on College cost so again an upfront um method to save on College cost is for students to earn some credit while they’re in in

High school at no cost to them so advanced placement courses IB courses dual enrollment Cambridge those are all opportunities for students to be able to earn some college credit that they can take with them which could reduce the amount of time that they’re that they have to spend at the institution again

Which could save them money one thing to consider though is not all colleges accept early college credit so students will need to check with their Admissions Office to find out um whether that credit can be transferred to the institution again we’re talking about ways upfront things that students and

Families can do upfront to to manage the cost of of of obtaining a higher education and one of those methods is the North Carolina promise tuition plan so through this plan there are there are four universities or for institutions within the UNCC system where um tuition for each semester is is

At $500 and out of state tuition is at $2500 per semester so only $500 per semester at Western Carolina University faille State University Elizabeth City State University and UNCC pimbrook that’s um equates to Savings of at least $10,000 over four years of attendance which is again a that’s

Nothing to shake a stick at either one thing to note in addition to tuition there are still fees and other costs of attendance so we’re only talking about instate tuition not the fees associated with attending the institution or the cost of attendance but still $500 per semester is a huge savings for for

Students and families there are some State Grant programs that are available that students can look to tap into and families can look to tap into on the back end so after families and students have reduced the cost of college upfront by participating in one or more of the

Programs that we just talked about need-based grants are available depending on whether you’re going to a North Carolina public community college or university or one of the private colleges in North Carolina students will need to complete a facet to be considered for these programs and funding is available until it’s

Exhausted um students will need to complete the RDS process which we outlined a couple slides earlier and be deemed as Legal North Carolina residents they’ll need to be undergraduate students again at the community college or four-year college level with no prior bachelor’s bachelor’s degree and they’ll need to be able to make satisfactory

Academic progress excuse me which is really important for for state federal aid fed Financial Fe excuse me State financial aid federal financial aid and institutional Aid so is the student making satisfactory academic progress toward completing their degree and each College will outline exactly what stat looks like on their campus but it’s not

Something that students think about often before they’re in a position where they’re not making sap and their financial aid is being threatened so as you’re talking with students and families um continue or remind them that they’ll need to be able to make stat if they’re going to to keep their federal

State or institutional financial aid and then lastly these need-based grants are based on need so they’ll need to meet pel eligibility criteria in order to be eligible for those State Grant programs all right so we’ve talked a lot at length about state aid now let’s talk about college-based financial

Aid or or you might hear me call it institutional based Aid and of course as I’m talking to you all they’re coming to dump the trash and the dumpster out so I apologize if you hear a loud banging outside so according to the College Board colleges and universities

Themselves are the largest source of financial aid today so if we look at this map with all or this graph with all of the different colors and the different bars within the bar graph the dark blue section of the bar chart shows that shows what part of Financial Aid

Comes from the institutions of higher education and as the use of loans has shrunk shrunken over the past 10 years so that is the dark gray section of the bar graph you can see that the institutional grants which have come from the University have grown they’re working to meet um to to

Close the gap between what was uh Federal Loan funding and and what students need so for families who don’t think that they’ll qualify for Aid like pil grants they should still complete a FAFSA because most colleges and universities will use the FAFSA to determine if a student will qualify for

Aid at the institution itself so the FASA isn’t only for awarding federal aid but it’s also can be used as a tool to award institutional Aid so there are different types of college-based financial aid scholarships and grants can be merit-based meaning that they can be based on a students

Academics or based on a talent like Athletics or drama or music a merit based doesn’t only have to mean a academic it’s any talent-based scholarship where need isn’t considered and then scholarships and grants at the University can also be considered um need-based So based on whether a student

Needs the money to be able to attend the institution need-based scholarships as I mentioned earlier are often awarded based on a student’s FAFSA or their CSS profile which is an additional financial aid application that is required at some institutions throughout the country in North Carolina there are five institutions that require the CSS

Profile they are Duke Davidson El La Wake Forest and UNCC Chapel Hill so those five North Carolina institutions will use the CSS profile in addition to the FAA who award need-based financial aid need-based institutional financial aid again those are Duke Davidson Elon Wake Forest and UNCC Chapel Hill another type of college-based

Financial aid is alumni based scholarships so many alum and I will give money to the university and they have stipulations that students have to meet to be uh eligible for those scholarships they might be set up for students who are from the same county that the donor grew up in or studying

The major maybe that they studied or that they were interested in while they were in college when thinking about college-based financial aid and how to access it there are a few things to consider students should ask and you can ask for this or you can ask for yourself

How is a student considered for merit-based scholarships are they considered based on their admissions application or is there a separate process for applying for merit-based scholarships if the students admissions application is the method of application what’s the deadline does the student need to apply by the early action

Deadline to be considered if they apply at the regular decision deadline with application still be considered for merit-based scholarships some colleges only open their scholarship application portal to students once they’ve been submitted um excuse me once they have submitted their intent to enroll um around May 1 so the

Question there is must the student be committed to attend the University before applying to scholarships at that institution those are questions that we can ask to increase our knowledge to arm ourselves but there also questions that students should ask before the college application starts and act and also during the application

Process moving on from institutional financial aid there are Community scholarships available as well and This falls into that Gap funding that we talked about earlier so these are sources that come from other or other sources other than federal aid and college Aid and um state aid and and outside of family funding as

Well we are huge proponents of local scholarships over at seaa um and so local scholarships typically have smaller applicant pools increasing the likelihood of a student being selected to receive that scholarship and so we are huge proponents again of local scholarships so we really um heavily endorse the cfnc.org scholarships scholarship portal where

Students can find over 100 local scholarships um that can be filtered by county that can be filtered by um whether they’re attending the type of institution they’re attending twoyear or fouryear public or private It’s a Wonderful tool that students can use to access those local scholarships we also strongly endorse

The North Carolina Community Foundation scholarship portal you can just Google North Carolina Community Foundation it has nearly 150 scholarships offered um and again there are local scholarships many communities want to see their their students succeed and so they’re putting their money where their mouth is and they’re offering up

Scholarships that students can apply for to help manage the cost of attending college uh community and Civic organizations so think like your rotary clubs fraternities and sororities they often have scholarships that are available to the local students in their community and those those scholarships are typically accessed through the

School counselor’s office through your all you you all’s office local chapters of professional or associations as well so if a student knows that they’re interested in being an engineer maybe they’re an African-American student they can look for the local chapter of um The National Society of black Engineers to see what

What scholarships are available for students here in North Carolina maybe they want to go into marketing or HR and they look into the professional associations um aligned with those careers to see if they offer scholarships and then finally many local communities have an Educational Foundation that provides support for

Public schools um and for students in their area and offer some scholarship assistance so the way excuse me the Winston Salem Foundation the the green the Guilford or Greensboro Community Foundation those are all options um for students they can just simply Google it and it’ll come up on the screen and they

Can much like the North Carolina Community Foundation search through their their portal and their database of scholarships other gap funding can include employer education Assistance programs so employer education assistance has become one of the top benefits that employees look for um when considering a job change many employers

Offer education assistance programs as a way to attract and retain employees in fact 56% of employees offer some type of education assistance benefit tuition reimbursements are the most common benefit and that’s when an employe pays upfront um for their tuition and then they’re reimbursed by the employer upon complete completion of

The course some might require achieving a certain grade like an A or B in order to be reimbursed or that you commit to staying at the organization for a specific time period if you leave before then then you would need to pay the balance of the education benefit back tuition assistance which some

Employers are now starting to offer um knowing that many employees struggle to come up with the funds to pay for tuition upfront so rather than getting reimbursed the employ employer would pay the tuition when you enroll in the course they pay it directly to the institution sometimes these are limited

To a small number of Institutions that the employer has developed a relationship with such as Starbucks they have cover they’re covering the cost of um of uh tuition at Arizona State University programs student loan repayment assistance is also huge especially as we talked about you know student loans

Earlier about 8% of employees players now offer this benefit particularly to attract younger workers who favor the benefit over 401K retirement plans and then also 529 College Savings Plan off or um payroll deductions are being offered through employers now as well so they allow you to have funds transferred

Directly from your B your paycheck into the savings account plan and about 10% of employers offer this benefit all right we’ talked about um financial aid Basics we talked about the different types of Aid and the sources um so let’s talk about the FAFSA I have another Poll

For you all to complete tell me have you ever walked a student through the faster completion process again this is just a temperature gauge to to get an idea of who’s in the room with us today so scan the code and let us know o okay all right

So while you all are answering this question I love like all things financial aid a lot of people think I’m weird because I don’t get um kind of grossed out by the FAFSA I love the FAFSA all things financial aid and I’m all about helping people

With the FAFSA so you the 60% of you have never done a FAFSA before you’re in the right place so um as we move forward I just want to say we’re talking about the FAFSA but again this is a highlevel overview of the FAFSA we’re going to have some other

Workshops um coming up especially at the end of this month that’ll really help you with line by line how you get into the FAFSA so for now we’ll just talk about how you’re going to fill out the new FAFSA the first thing to know is that even before we talk about FSA IDs

Students who are high school seniors now who are looking to fill out the FAA for their first year of college are going to fill out the 2024 2025 FAA so um even though we are in school year 23 24 they are filling it out for the next year for when they actually

Need the money so it’s the 2024 2025 FAFSA the FAFSA ordinarily opens on October 1st but because there have been um some upgrades to this year FASA it has not opened yet we are told that it will open by December 31st though we don’t have a definite date to share with

You all today but when we do have that definite date we will share it with you through every medium that we have okay list serves our website ncah hub.org cfnc I’m sure it’s going to have it on social media so every way that we have to contact y’all you will know about um

The FAA date when it opens so the first thing thing to know or the second thing I guess to say to know about submitting a FAFSA is that um your key to accessing the FAFSA is creating a federal student aid ID also known as an FSA ID so everyone who is

Inputting information on the F whether it’s a student or a parent has to have an FSA ID and it each person has to have a unique email address to create an FSA ID one email address per FSA ID so no doubling up when creating the FSA ID um it’s

Important that students set up what’s called two- Factor authentication I’m GNA move ahead to that because for the 24-25 faasa everyone who attempts to sign into the FASA will need to go through a multiactor authentication process so when students are setting up their FSA ID and when parents are

Setting up their FSA ID they’ll we encourage them to verify or authenticate their email address their phone number and to also use an authenticator app so that when the time comes for them to log into the FAA they can choose any two-factor authentication method they that they want and be able to move

Through the process so again students and parents will need to have an FSA ID and that FSA ID will be um used to match a parent account to their student FAA which we’ll get into a little bit more in just a moment on the website that I just

Mentioned NC fastah hub.org there is an FSA ID worksheet available that you can use with students it walks them through the steps of creating an FSA ID and also gives them a place where they can safely house their FSA ID um username and password so because this is based on

Their social security number and their identity is tied to it they shouldn’t share their FSA ID with anyone and they also um shouldn’t leave it lying around anywhere because again it can be used to access some pretty sensitive information all right so we talked about everyone

Needs to have an FSA ID but who are the people who need to have an FSA ID the way that the FAFSA works is that a student um will input their financial information some demographic information and and also educational information on the FASA but at least one parent has to

Do so as well so parents tax information is needed to fill out the FAA who’s whose taxx information is determined um by something called a parent wizard that will help a student walk through the process and figure out whose information needs to go on the FAA so if a student’s

Legal parents are married and they file their taxes jointly only one parent has to obtain an FSA ID and both parents tax information will go on the faasa because they filed together and the students parent and and they’re married if the students legal parents are not married and they do live

Together both parents will have to get an FSA ID and both parents tax information will go on the FAA so again if their legal parents are married and filed jointly only one parent has to get an FSA ID and both of their tax information will go on the

Fafa if the legal parents are not married but they live together both parents will have to get an FSA ID and both parents tax information will go on the facet if a student’s legal parents are not married and they don’t live together then the parent wizard is going to walk

Them through the process of figuring out which one of their parents is going to need an FSA ID and whose tax information is going to go on the FASA this isn’t based on who files the student on their taxes rather the parent who um provides the most financial support for the

Student is the one whose tax information is supposed to go on the faca so again it’s not based on who files ta who files the student on their taxes it’s based on who provides the most financial support for that student so again there’s a new parent wizard within the FAA that will

Help the student know which of their parents is going to need to um contribute their tax information to the FAFSA and FSA is also updating the um who’s your parent infographic when they update that we will share it with you all I’m sure we’ll have it on NC FASA

Hub.org so that you can use that infographic to help students and families figure out who has to contribute to that student PA there’s a a new term that’s being used um with the with this new faasa and it’s called contributors so even though I’ve used the term parent and I’ve used

The term student they’re also they’re actually called contributors every person who’s provides information on the FAFSA is known as a contributor and each contributor as I mentioned will need their own FSA ID to access and to submit their portion of the faasa so the way that FSA has designed

The Fafa to work is that a student has their portion of the Fafa the the parent contributor has their portion of the faasa and those two um portions or those two contributors are not supposed to see the other contributors portion of the FASA so student Jackie um would log in the faasa using

Her FSA ID and password and that student would walk through filling out the information that is pertinent to them there’s a series of questions that they would have to ask about themselves about their demographics um about their plans for school what colleges they want to send

Their FAA to and then the student would need the parents um first and last name date of birth email address and social security number and that student would then invite their parent to contribute to their FAA so Jackie would go through and submit their portion of the FASA and

Jackie would come to a screen that looks like what you see before you and it would say your section of the faasa is complete your parent is going to need to contribute to the faasa um and then Jackie would see the name of the parent that she has invited

To contribute to the FASA the date that that request was sent to the parent and then the status whether or not the parent has um received the invitation has checked or has logged in has submitted the the their portion of the FAA so Jackie has done her part and now

Jackie is waiting on her parent to finish their part as a contributor even though that’s the way that’s the most ideal way it’s also possible for um the parent to start the process and to invite the student so if the student Begins the fasta themselves then they only see their portion they do

Not see the parents portion of the FAA however if the parent starts the process the parent can see the student portion of the pro the FASA and their own portion as well in order for a students FAA to be considered students or every contributor students and parents have to consent to having

Their federal tax information imported from the IRS in a process called the direct data exchange the way that it should work is that students and parents approve um the direct data exchange from the IRS to the FAA and they’re able to move forward with the application they don’t have to

Manually input their tax information instead it’ll be transferred directly from the IRS the thing to know that is if a student or their contributor does not approve or consent having their federal tax information transferred from the IRS or imported from the IRS the student staff so will not be considered for

Financial aid so if you remember nothing else that we talk about today remember that all contributors to the students FAA must consent to having their federal tax information imported from the IRS students parents um if a stpp parent has to submit information everybody has to consent to having their tax information

Imported from the IRS if they don’t the students F will not be considered for financial aid and there isn’t a workaround for this even if they decide to submit a paper copy of the FASA submitting a paper copy implies consent so even then they will have their federal tax information imported or

Shared from the IRS if a student or their parent contributor decides at that moment that they don’t want to offer uh or um give consent they will be able to manually input federal tax information but they still won’t be considered for financial aid if they go through the

Process submit the FAFSA without that consent and then later change their minds they will be allowed to go back into the FAA and to make a correction and to um to give that consent and then at that point the students FAA will be considered for financial aid so again y’all this is just

Highlevel information the nitty G steps about the Fasto we aren’t doing those steps today we’ll be doing those on um at the end of the month I’ll give you the information about that session so this is just high level okay after the student submits the FAFSA they get um what’s called the FASA

Submission summary okay the FFA submission summary is going to show a few things so first it’s going to show their estimated federal aid so whether they are eligible for a pale Grant whether they’re eligible for a work study whether they’re eligible for federal student loans and it’s also guil

To give them a number called the student aid index so for those of you who have submitted a FAFSA in the past or have walked a student through the process you’ll know that at the end of the FAA there was a number called the EFC or expected family contribution well that

Term is out and student aid index is in so the student a index is just what it says it’s a number it’s an index that colleges will use to determine whether or not a or how much a student is eligible for in financial aid it’s going to be used to determine their financial

Need so once they submit the faasa and they get their um FAA submission summary they will see their student aid index they’ll be able to see their estimated federal aid and they’ll also be able to click a tab at the top to show them the answer that they input on their actual

FASA the school information tab of the FASA submission summary will give the the graduation rates and some other really important percentages for every college that they submit or that they sent their FAA to students can send their FAA to up to 20 colleges at one

Time here on this on this new version of the FASA so that’s a change from 10 um 10 colleges before so on the school information tab for each one of those colleges students will see the graduation rate for that school the retention rate so how many students are

Coming back from the first year to the second year the transfer rate what percentage of students are transferring out they can also see the default rate so what percentage of students are defaulting on their student loans these are huge huge tools that students and families can use to make um the best

Decisions for them and then there’s this next steps um tab as well that students will have highlighted with a red exclamation point if there are some steps that the student needs to take in order to make sure that their FA FAA excuse me um goes from submitted to

Completion so if a student has been selected for verification if there’s any follow-up documentation needed or if if um the student parent contributor hasn’t done their part yet then their FSA will go directly to this next step screen and there’ll be a red exclamation point there so some best practices for a fast

Of completion where possible work with students and parents together and if you can’t do that then consider starting with the parent um we mentioned earlier encourage students to accept all of the methods to authenticate their account text email and authenticator app um set up the FSA

IDs now before the FAA opens because you won’t be able to set up an FSA ID and use it to create a FAA in the same day the one caveat there is for um family members who don’t have social security numbers because a social security number

Is tied to the fsaid there is a unique process for um um users or parents who don’t have social security numbers where they will be able to create their FSA ID and use it the same day they will have their account verified through a TransUnion credit bureau process we

Won’t get into the details of that today either but there is more information available at ncasa hub.org even though FAFSA um the direct data exchange will allow parents to import their tax information directly from the IRS families should still have their tax returns with them and then if possible

If you’re having a FAA event at your institution work with your school leaders um to to make sure that the Wi-Fi is um accessible to everyone that day and that the internet is up and running then we also want to um use the finish the faster tool which Cathy will

Talk about a little bit more to make sure that students um fastest go from submitted to completed and then think about who are some trusted leaders that you can involve in the process so um we know that based on our research that teachers and counselors and college

Advisors are some of the most highly trusted sources for financial aid but think about who else is out there in your community in your schools that can help students um help deliver messages and um help deliver messages about financial aid excuse me to students so we do have some wonderful tools to

Help you all in this process I’ve mentioned the North Carolina fter Hub several times um it is a wonderful resource that is solely for practitioners only for counselors College access um organizations College advisors to stay up to date on the most um or to stay a breast on the most upto-date financial

Aid information this year the FSA um has presented a FAA demo on August 17th and so um look for that on the fsa’s YouTube page and then we haven’t talked much about the next NC scholarship but we will be launching a website soon to tell you all all about the next North

Carolina scholarship next NC scholarship excuse me the biggest thing to know there is that if a student and Family’s adjusted gross income is $80,000 or less then most of them will qualify for the next NC scholarship which guarantees $5,000 in Combined federal and state aid um for students who are attending UNCC

System institutions and $3,000 in Combined federal and state a to attend a community college here in North Carolina so again that’s $80,000 most students will qualify for that base guarantee of $5,000 at a UNCC system Institution or $3,000 at a um Community College and I’ve referenced this several times but

On November 30th at 11:00 a.m. we are having a line by line fael walkth through specifically for counselors and college advisors students and families will have one later in January this is just for y’all a financial aid professional will be there to walk you through what to expect in the fa with

The faasa when it’s released in December and so now I’m going to turn things over to Kathy and she’ll talk with us about finishing the faasa hi folks I’m great to be back with you yes for those of you who are not already familiar with finish the FAFSA

We actually have two FAFSA tools uh to help you with your FAFSA completion efforts at your schools and in your community the first is the FAFSA tracker that gets updated every week and that is on the cfnc website at the very top of the website you’ll see something that

Says FAFSA tools both tools you can link to through that tab um the Fafa tracker will get updated once we start getting new data which most likely will be about mid January would be my um my guest that tool will give you information on total submissions and completions of fses at

Your school and at your District level by then we should also have class counts as well so we should be able to calculate the rate of completion unless you happen to be at a private school uh or an early college school but everyone else should get it um with regards to

Finish the FAFSA that’s for folks who work directly with high school seniors on FAA completion that’s part of our suite of Pro Tools that’s on the cfnc website that is restricted information because it does have student names and their Fafa completion status so you do actually have to record Quest EST access

Um it’s a report that you all can use to see at the student level if a student has um not submitted started or or uh submitted or completed a FAFSA and uh I think we go to the next slide we’ll see the actual actually it’s probably the

Steps Jenny can you advance the slide thank you so it’s three steps if you haven’t already set up an account you need to have a cfnc account that’s tied to your work email so your your school or if you’re a College advising Corp with your College advising Corp account

Um then you submit a request to get pro tool set up and then once that’s done um there’s a separate request for finish the faps and we can get you set up with finished faps up for the schools that you support next slide um once you have access if you

Sign into Protools you’ll open you you’ll know that a bunch of the reports on your left are accordion style so if you click on College reports it’ll pop open you’ll see finish the fasts is one of the reports you can see in the upper right hand corner you’ll see your school

If you support more than one school that will be a a short dropdown of the schools that you support so you can select the school that you want to look at at on this summary page we’re reminding you of some of the information you need to this is protected

Information we do have a assigned data use agreement with your school district or your organization and so you are required to protect that information so we we just want to remind you that um uh of your responsibilities with that on the the next slide or typically when you’re unfinished the fapa you’ll scroll

Down we this is a new um summary report that we have put together for you so you’ll be able to see it at the school level if you’re a district Personnel you’ll be able to see it District um summary as well but you’ll be able to see the total number of school of

Students that we have in your school records the number who have submitted completed um not submitted a FAFSA and then the if there’s any errors like a missing a student signature a parent signature or if it’s been flagged for verification you’ll get a sense of in

Total what your school looks like so you have a sense if there’s a bunch of errors that need to be followed up on the error code at the bottom of the screen gives you an indication of which type of error um a number of your students are experiencing on the next

Slide we’ll show you a little bit about the look and feel of the report student name obviously we’ve wided those out because that that’s um protected information but normally you would see your list of students there the current status so either not submitted submitted or completed and then you can see right

On that main screen screen um down to the student level if they’re missing a student or parent signature or whether it’s been flagged for verification we don’t unfortunately have an example of the error code but normally if there is an error code you would see that in the

Error code column when you hover over it it’ll pop up and let you know what the error is and the next steps the students need to take to um remove that error and then the last column is a um request that one of you all made of us so we

Added and made this available is the date submitted column and with any I believe any of the columns if you go to the top you can click on it and it’ll sort by that particular column and so what’s great about the date submitted column is if you click on the top of

That it’ll show you which are the most recent FAFSA completions in your senior class so if you’re supporting a large senior class you can see the ones who have submitted a FSA since the last time you logged on you don’t have to go hunting through um the table to to see

Who who it who newly has submitted a fat some and with that I’m going to turn it back to Jenny awesome thank you Kathy so I am really excited to talk to you all about F today um those of you who might have been around in North Carolina for a

While even if you weren’t working directly with students may have heard of fa a day we didn’t have it last year it had turned to a virtual event through the the years of the pandemic but we’re bringing it back in full strength um this year well excuse me this fasta

Sequel this FAA cycle um so fa a day is an event where students can go to a participating institution participate in college or university on a set day in time again this cycle is going to be January 27th from 9:00 a.m. to 12:00 p.m. and they can get oneon-one or small

Group help with their FASA um get that help from trained financial aid counselors who work at the University so every Co every County that is lit up in Orange is a county that has at least one participating fast a day events so right now we have 51 participating um

Institutions actually we have 54 but a couple of them are doubling up they’re working together so we have 51 separate events where a student can go on Fast a day between the hours of 9:00 am to 12:00 p.m. um to get get help with their FASA

If you live in a state I mean in a county excuse me that’s green right now and you have a strong relationship with the co the community college or the four-year College that’s in York County and you don’t see them here nudge them reach out to them and ask them if they

Would be willing to participate in finan in um in faf today share their contact information with me uh my email address will be at the end of the slides so we are going to need your help in a couple of different ways we’re going to have

Some tool we have a toolkit with some um advertising that we will be sharing and we would love for you and really need you all to share that information with your students when the time comes so post it all over your school if your school has like a College and Career

Based Instagram put it there too share all of the information about fast today we’ll be sending out some save the dates soon we recognize this is like two months away and people got to get through like the end of the year lack of Mo end of the semester lack of

Motivation first um so we will share that um far and wide when the time comes and this event is for high school seniors and it’s for adult Learners as well and then also we ask that you all would volunteer at a fast today event so the

QR code on the screen would take you directly to um a Google form that would allow you to indicate your interest in being a volunteer at your local fast Day event so if you’re not comfortable with the faster but maybe you want to help check people in or help folks with

Parking help with registration um maybe you just want to be a friendly face there where students um be in an unfamiliar place please please sign up to be a volunteer at your local fast a day event if you’re looking for a college that is a confirmed host

Institution and they’re not on the drop down box that just means that they don’t need volunteers outside of the folks who work in their office so consider volunteering at another event one that’s closest to you um we’re looking forward to it we’re happy we’re very excited

About fav today and um we want to make sure that it’s is um the best that it can be for for students and families again this is for high school students and for adult Learners so are there any questions that we can answer for you all that haven’t haven’t already been answered throughout

The session any we’ve been answering questions along the way so so far we’re in pretty good shape but if thanks if anyone has any additional questions we we’ll keep the the lines open for another couple of minutes and while we wait on that we’ll share our contact information with you all um so

If you have any questions about the FAFSA tracker which we didn’t talk about today but the FAFSA tracker allows you to see FAFSA completion rates for the state of North Carolina for your district and for your school um you can reach out to me if you have questions

About the cfnc scholarship portal also feel free to to reach out to me if you have finished the fasta and Pro Tools access um uh questions feel free to reach out to um our colleague nef T cabales Jenny Sarah’s asking uh how soon in advance should folks fill out their

FSA ID that’s a great question so I’ve been telling people um it it takes about one to three days for the Social Security Administration to verify that the information U or to match the information on the FSA ID to um to the person who’s submitting the request and

So I would say three days or so we are encouraging folks now though um if you are a legal resident of North Carolina and you have a valid social security number go ahead and create FSA IDs now uh so that when the FAFSA opens there’s nothing to hinder you from from going

Through with that process uh for those um families who do not or parents who do not not have a Social Security number they will have to go through the um a TransUnion credit bureau process to have their identity verified so they will um in this process for f for parents who

Don’t have social security numbers that will not open until the date that the FAFSA launches so again it’ll launch by December 31st we don’t have an exact date by December 31st but when it does the FSA ID process for Parents Without a social security number will open

Then next question Karen’s asking uh to confirm that parents use the same FSA ID uh they use the same FSA ID as they used if they had other students you know older students have already been in college but if it’s a a parent If the parents aren’t living together and

They’re not sharing a household and they they have they need they each need their own FSA ID not saying that very clearly but hopefully you know what I’m trying to say yeah so if a if a if a set of parents a legal parents are married and they live together they

File their taxes jointly only one parent needs an FSA ID and if they had an older child who submitted a FAA and they use an FSA ID for that child then that parent can use the same FSA ID they don’t have to create a new one um to

Help their young a child uh through the the financial aid process okay great questions yeah it’s two o’clock we’re GNA respect your time here um and stop recording number one

source