I heard an old Norm Macdonald joke once that went something like this:

An optimist looks at the glass as half full. A pessimist looks at the glass as half empty. I’m a pessimist and I look at the glass as half full…but I might have bowel cancer.

I am a glass-is-half-full guy but tend to lean optimistic unlike Norm.

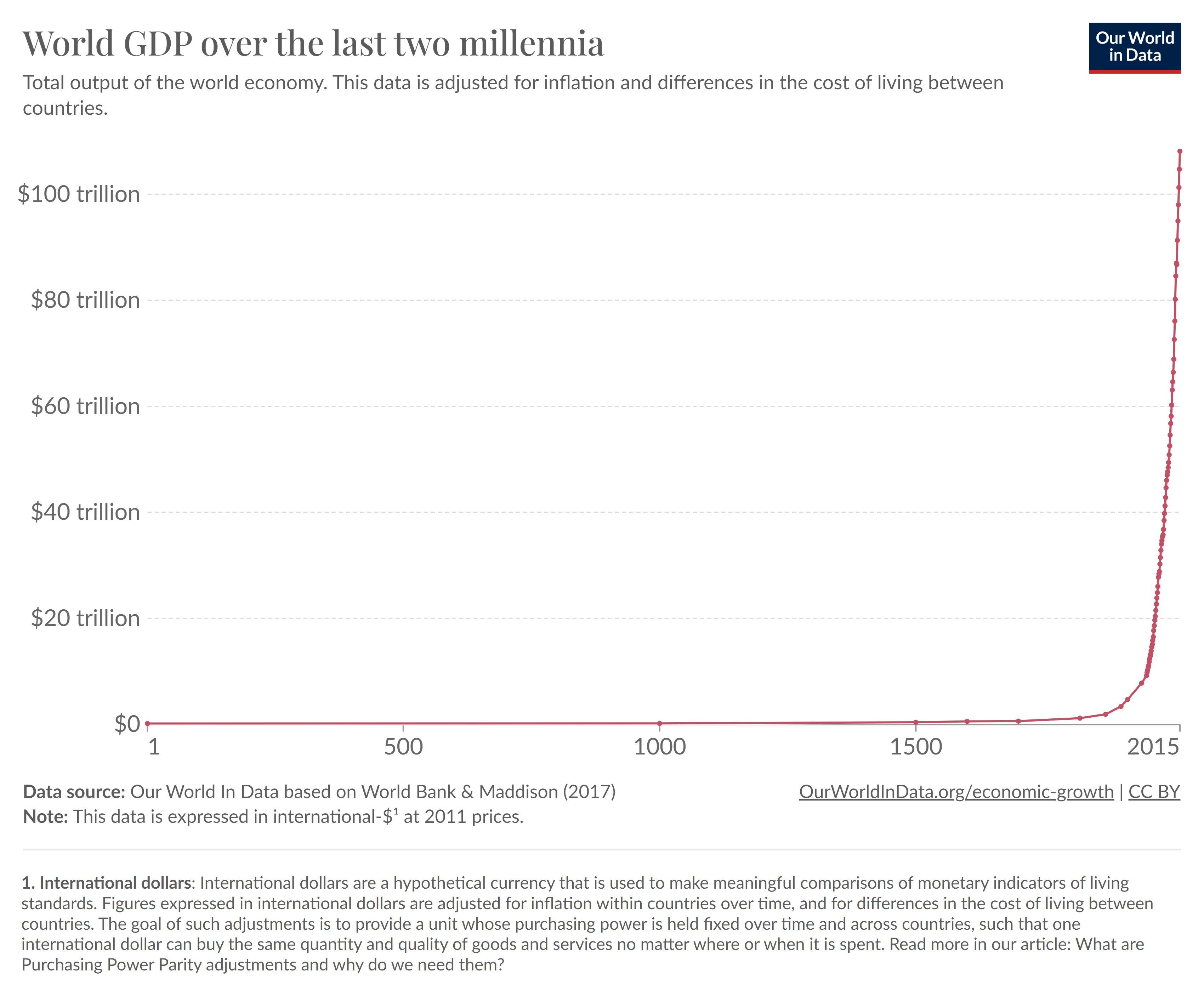

Just think about all that we’ve accomplished as a species.

The growth.

We’ve cured diseases.

We’ve created innovative technologies.

Things aren’t perfect but they’re never going to be.

I consider myself a long-term optimist when it comes to the world at large, the economy and the markets. How could you not be optimistic about the future after all that we’ve accomplished?

The problem is blind optimism can lead to problems if you’re not careful.

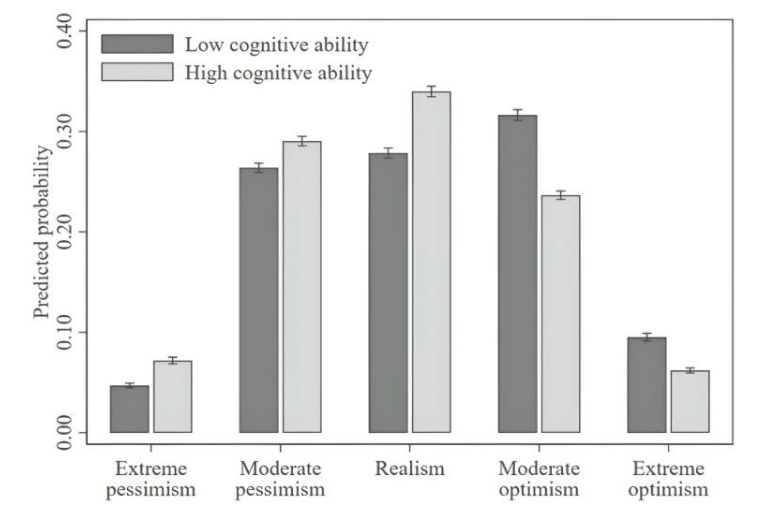

A new research paper by Chris Dawson concluded that higher levels of financial optimism are associated with lower cognitive ability:

The idea here is unrealistic optimism can lead to reckless behavior when it comes to your finances.

If you assume your returns will be abnormally high in the markets, maybe you won’t save as much money. Or if you assume financial markets only go up over time you’ll never be prepared for the inevitable setbacks.

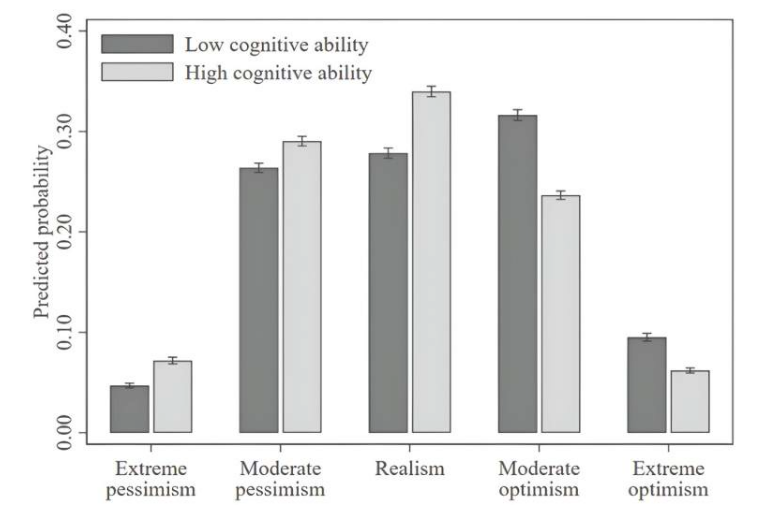

However, this study also found those with the highest levels of cognitive ability are more likely to exhibit extreme pessimism. I don’t see this as an edge when it comes to investing either.

If you’re too pessimistic your returns are bound to be bad over the long run.

In fact, many of the smartest people tend to be terrible investors because they’re too smart for their own good.

Warren Buffett once said, “If you have more than 120 or 130 I.Q. points, you can afford to give the rest away. You don’t need extraordinary intelligence to succeed as an investor.”

The way I see it there are two main types of mistakes when it comes to investing:

Some people are naive to the fact that they don’t know enough about the markets but act as if they do. Not knowing what you’re doing is a serious risk.

But others are so intelligent they become overconfident in their own abilities. They assume they can outsmart the markets and other investors with ease. Overconfidence can get you into trouble when you lack the self-awareness to see your own blind spots.

Another study published in 2012 looked into the blind-spot bias, the idea that people are better at recognizing irrationality in other people than themselves. Not surprisingly, they found everyone has difficulty seeing their own cognitive weaknesses.

But the researchers also discovered the smarter you are, the greater your blind spots to your own deficiencies:

Further, we found that none of these bias blind spots were attenuated by measures of cognitive sophistication such as cognitive ability or thinking dispositions related to bias. If anything, a larger bias blind spot was associated with higher cognitive ability.

The smarter subjects had bigger blind spots to their own faults on six of the seven cognitive biases studied.

As with most things in life, balance is the key.

You have to balance IQ with temperament.

You have to balance long-term optimism with the understanding that short-term risks always apply.

There is a difference between blind optimism and rational optimism. Yes, I think the stock market will go up over time but I’m not naive to the fact that there are going to be recessions, bear markets and crashes along the way.

Most of the time stocks go up but sometimes they go down.

You also have to balance confidence in yourself and your abilities with the self-awareness to recognize your weaknesses.

Einstein said there are five ascending levels of intelligence: smart, intelligent, brilliant, genius and simple.

Michael and I talked about optimism, pessimism and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

50 Ways the World is Getting Better

Now here’s what I’ve been reading lately:

Interview:

- Me on self-awareness and not meeting your heroes (Morningstar)

Books: