These were some of the prevailing narratives from the post-GFC world:

- We only had a bull market in the 2010s because of the Fed juicing the economy.

- The only reason tech stocks did well is because of low interest rates.

- The only reason stocks kept recovering from every correction so quickly is because of the Fed put.

These narratives all have a kernel of truth to them.

The Fed was trying to juice the economy in the 2010s to get us out of the Great Financial Crisis malaise. Technology companies did benefit from low borrowing costs. And the Fed did step in during a handful of the downturns we’ve experienced.

But many people took these narratives as gospel.

That gospel was put to the test in 2023 and it turns out it wasn’t written in stone.

The Federal Reserve plays an important role in our economy and the functioning of the credit markets. But investors give the Fed far too much credit and blame for how things shake out in the financial markets.

The Fed does control ultra short interest rates by setting the Fed Funds Rate but they don’t control the long end of the curve.

Just look at 10 Treasury yield this year alone:

The 10 year went from a low of 3.3% in the spring then shot up to 5% this fall for no apparent reason whatsoever. Since then yields have fallen back to 4.2% in a hurry. That’s not the Fed; that’s the market.

A lot of people want to blame the Fed for allowing inflation to get out of control following the pandemic. I do agree the Fed should have acted sooner.

But would it have mattered as much as people think?

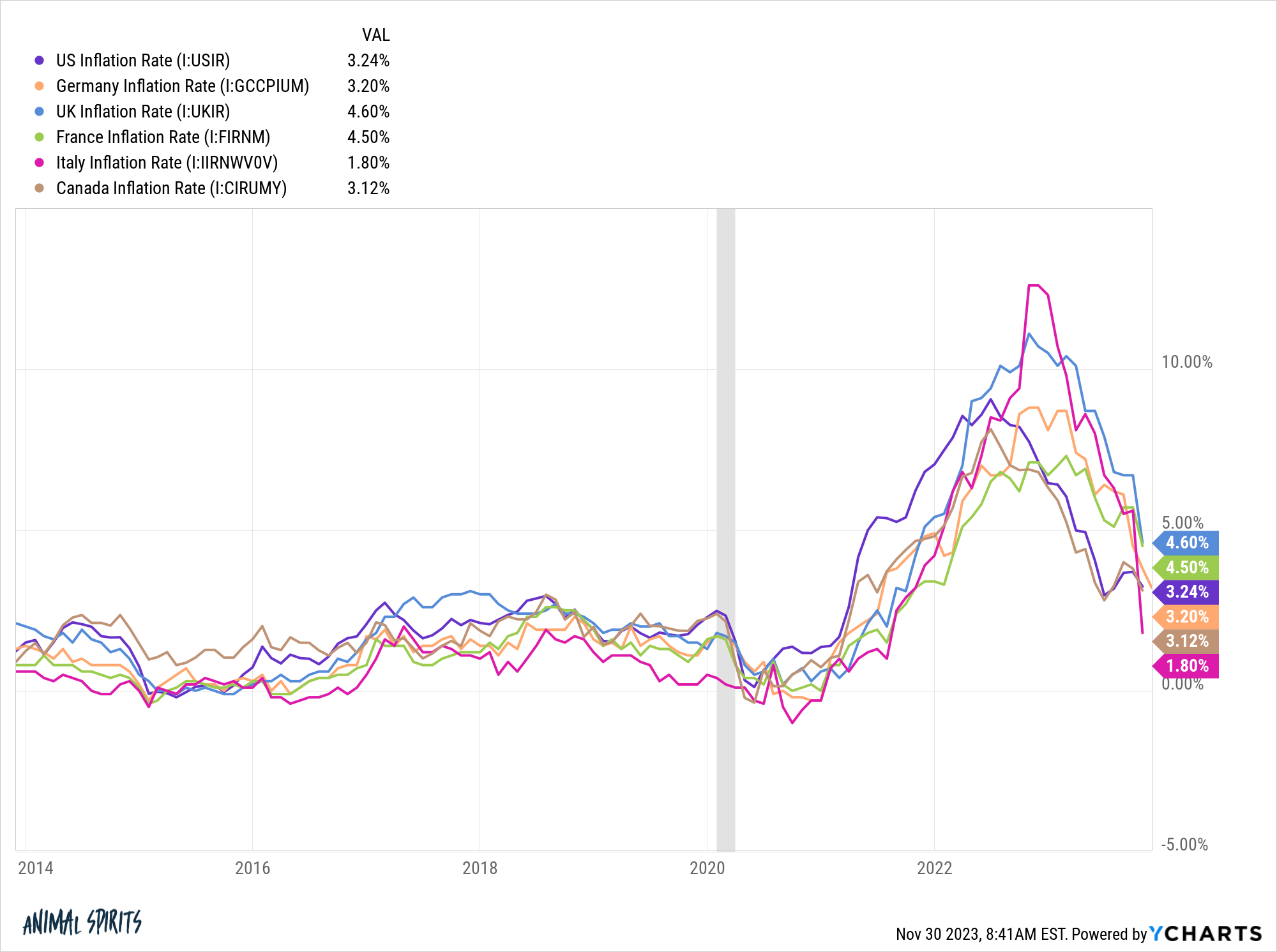

Just look at the path of inflation readings across other developed economies:

All of these countries had different fiscal and monetary policy responses to the Covid outbreak. And yet inflation rates all went up at the same time and fell at the same time.

Was the Fed and U.S. government spending really to blame for inflation around the globe?

And can we really give the Fed credit for bringing inflation down through interest rate hikes if inflation fell in these other countries concurrently?

Listen, I’m not saying the Fed’s rate hikes had no bearing on inflation. It certainly helped slow hot sectors of the economy like the housing market. And consumers trying to borrow are feeling the pain of higher rates.

But their actions have mattered far less than you think during this bizarre pandemic-induced economic cycle.

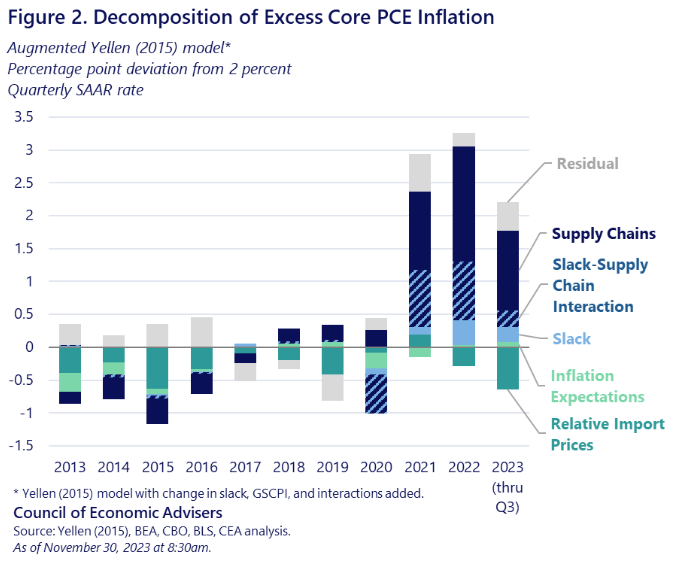

Look at this chart that breaks down the excess inflation we’ve experienced these past few years:

Most of it came from supply chain shocks.

Obviously, the increased consumer demand that came about because of the fiscal policy response played a huge role in these supply chain problems. Inflation came about from supply problems that coincided with pent-up consumer demand.

But that wasn’t the Fed’s doing. The government was trying to keep the economy afloat while corporations were preparing for armageddon.

The Fed’s low interest rate policies don’t control the stock market either. Rates matter but they’re not the be-all-end-all.

Yes, rising interest rates were one of the reasons for the bear market in 2022. Going from 0% to 5% in such a short period of time certainly changed the dynamic in the markets. But that doesn’t mean the stock market only goes up when interest rates are low.

That’s silly talk.

The Fed raised rates 375 basis points last year and the stock market sold off. But the Fed raised rates another 150 basis points and has shrunk the size of its balance sheet in 2023. The Nasdaq 100 is up almost 50% on the year. The S&P 500 has risen 20%.

Stocks went into a bear market and the Fed kept slamming on the breaks. There was no Fed put this time around. The Fed didn’t step in to lower rates like they did during the 2018 bear market.

Nope, the stock market has come charging back to within spitting distance of new all-time highs despite the actions of the Fed, 40 year high inflation, two wars, mortgage rates going from 3% to 8%, government bond yields spiking and Taylor Swift concert tickets selling for $2,500.

I know everyone wants to say the only reason we had a bull market in the 2010s is because of the Fed but isn’t it possible stocks went up a lot because they crashed 60% during the Great Financial Crisis?

And if low interest rates are the sole reason stocks go up, why didn’t we see massive bull markets in European and Japanese stocks in the 2010s as well? Their rates were even lower than ours.

There are loads of different variables that impact the financial markets and the economy. Monetary policy is one of those variables but it’s a blunt tool.

The Fed kept interest rates on the floor for the majority of the 2010s in hopes of increasing inflation and growth. It didn’t happen. Then they said they wanted inflation to run a little hot coming out of the pandemic. Instead it was scorching hot.

The Fed doesn’t control the economy or the stock market just like the president doesn’t control gas prices or inflation or wages or economic growth.

Life would be a lot easier if government officials could pull a lever to make stock prices go up and consumer prices go down but it doesn’t work that way.

The Fed can help as the lender of last resort during a financial crisis. They can also make the bubbles bigger during a boom if they’re not careful and have done so in the past.

The Fed doesn’t matter as much as you might think when it comes to something as big and complex as the $27 trillion U.S. economy or the $50 trillion U.S. stock market.

Further Reading:

Remember Don’t Fight the Fed?