A reader asks:

Sure it’s great the S&P 500 is up 20% this year but aren’t we just pricing in the inevitable Fed rate cuts in 2024? Should we really expect the market to go up again next year after surprising to the upside this year? Color me skeptical. Full disclosure: I’m naturally bearish and take a bit of an anti-Ben stance about the markets.

See this is what makes a market!

It’s fair for anti-Ben to ask if the current run-up in the stock market is pricing in rate cuts for next year. The stock market is forward looking after all.

I love studying historical market returns. Looking at market history is never going to help you predict the future but it can help you better understand the way the stock market generally functions.

For instance, looking at annual returns in the stock market won’t tell you what happens next year but it can help you prepare for a range of outcomes to set something of a baseline.

One of my all-time favorite market stats is the fact that the U.S. stock market has more 20% up years than negative years since the 1920s. It’s true.

Since 1928, there have been 34 calendar years1 where the S&P 500 has finished up 20% or more against 26 total down years.2

This means the stock market has been up 20% or more 36% of the time and down 27% of all years. That’s a pretty good trade-off, especially when you consider the average down year is a loss of ~13%.

The question anti-Ben seems to be asking here is: What happens after a 20% gain?

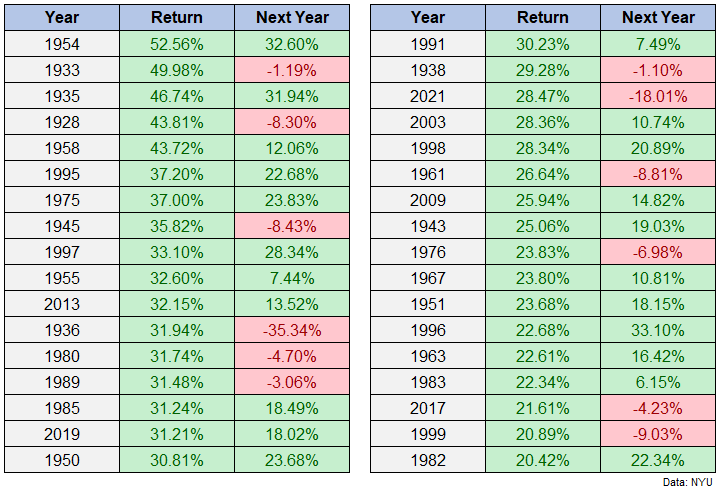

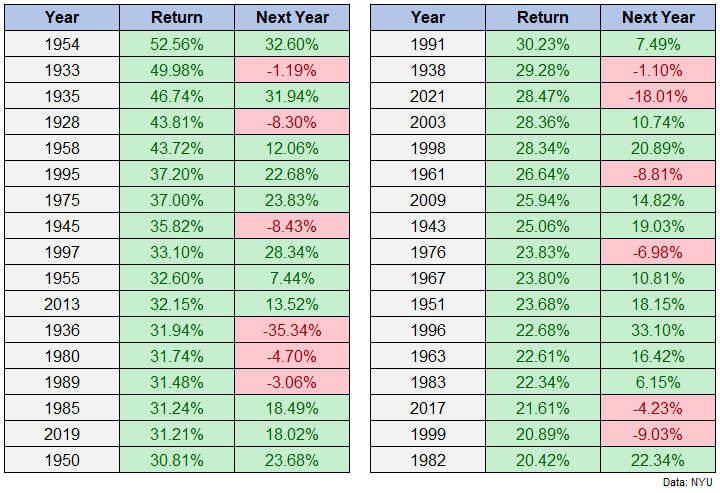

Here are all of the 20% up years along with the following year returns:

Not too bad. More green than red for sure. Here are the summary statistics:

- The stock market was up 22 out of the 34 years following a 20% gain (65% of the time).

- The stock market was down 12 out of the 34 years following a 20% gain (35% of the time).

- The average return following a 20% up year was 8.9%.

- The average gain was +18.8% in up years.

- The average loss was -9.1% in down years.

- There were 19 double-digit up years.

- There were just two double-digit down years (1936 and 2022).

This year is teetering on the edge of another 20% up year. We’ll see if Santa comes through for us by the end of the year or not but so far so good.

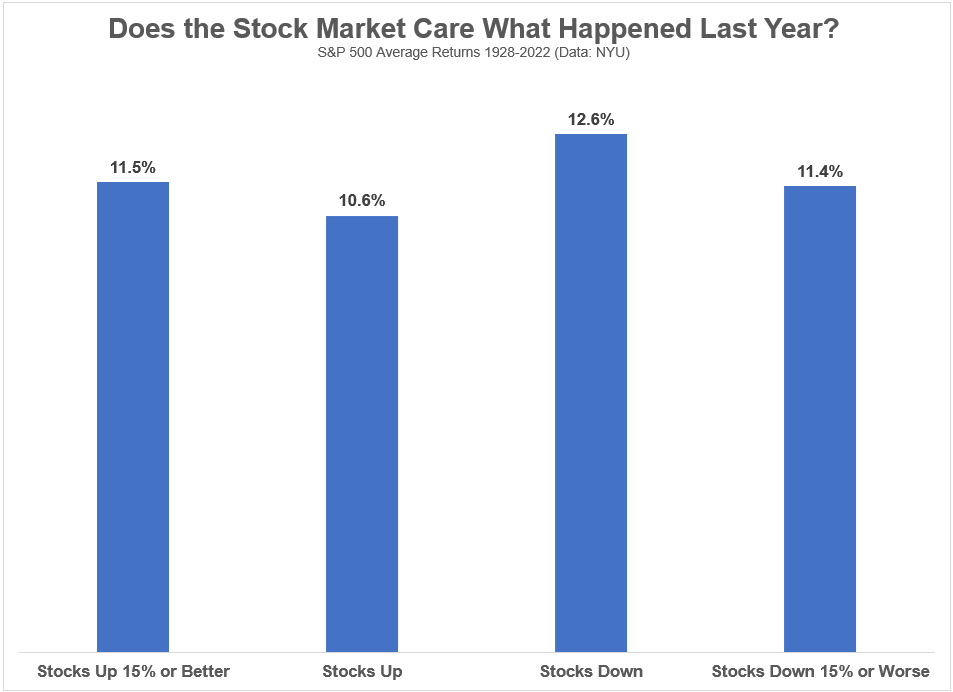

It’s also important to ask how much returns in one year actually impact returns in the following year. Here’s a look at average returns following a big up year, an up year, a down year and a big down year:

So maybe the 20% starting point matters less than one would assume.

I’m sure you could slice and dice the data to offer up some more signal but there doesn’t appear to be much correlation from one year to the next.

Most of the time stocks go up but sometimes they go down is about as good as you’re going to get.

It’s certainly possible the stock market has been pricing in Fed rate cuts for early next year. The S&P 500 isn’t going to wait around for Jerome Powell to spell it out. The inflation rate is falling, interest rates are falling, and wage growth is falling so it makes sense for the Fed to start cutting sometime in the first half of 2024.

But I can’t pretend to be smart enough to know how much of that is priced into the stock market or what comes next.

Historical return numbers can help set expectations but it’s also true that things happen in the markets all the time that have never happened before.

I don’t know if we’re setting up for a new bull market or a flat market or a new bear market.

Successful investors understand it’s impossible to predict the type of market environment that’s coming. The best thing you can do is prepare for a wide range of outcomes to avoid allowing short-term movements in the market to affect your behavior.

We tackled this question on the latest Ask the Compound:

Tax expert Bill Sweet joined me once again to answer questions about bond fund yields, selling down large single stock positions, direct indexing, and when to pay your mortgage off early.

Further Reading:

What Returns Should You Expect in the Stock Market?

1Not including 2023…yet.

2There have been just six down years of 20% or worse losses.