Bonds have had a rough go at it these past few years.

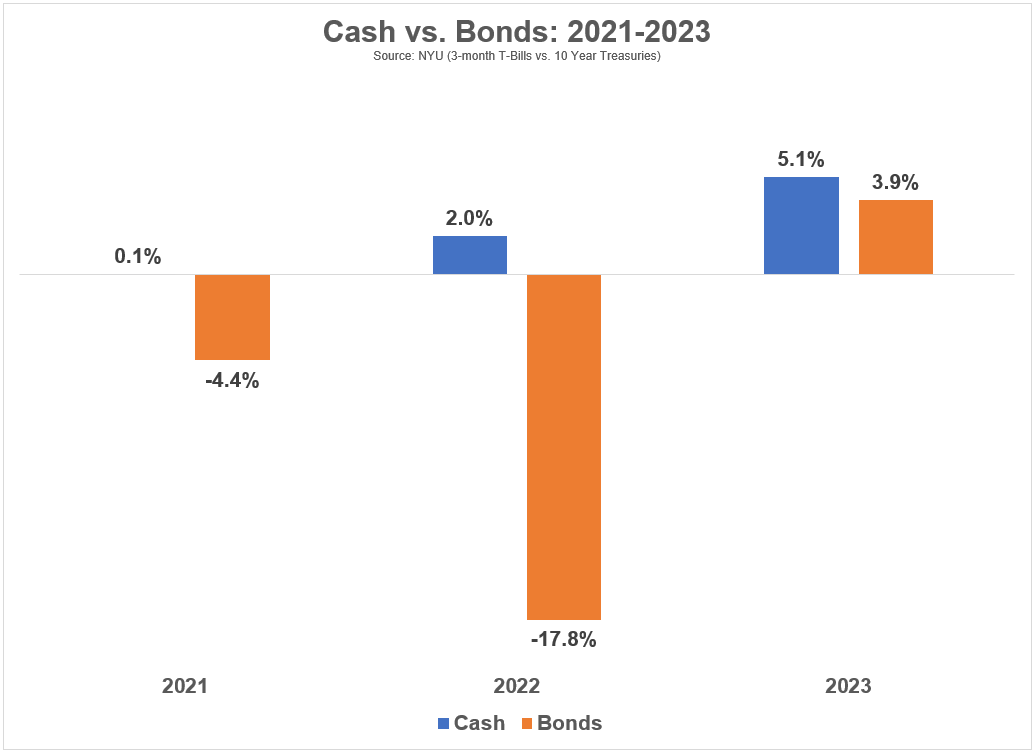

2021 was a down year. 2022 was the worst year in history for bonds. 2023 was better although rates were so volatile that the ride certainty wasn’t much fun to be on.

In the 10 years ending 2023, 10 year Treasury bonds had an annual return of just 1.5%. The annual inflation rate over that same time frame was 2.8%, meaning you lost money on a real basis in the benchmark U.S. government bond.

Returns were so bad, cash (3-month T-Bills) almost outperformed bonds with a 10 year return of 1.3% in that same time frame. That’s pretty impressive considering most of that 10 year period was consumed by 0% interest rate policy from the Fed.

Cash has now outperformed bonds for three years in a row:

The good news is stocks did their part during this bond sell-off. Despite the bear market in 2022, the S&P 500 was up more than 32% in total from 2021-2023, an annualized return of around 10% per year.

One asset class performed poorly, but the other two asset classes picked up the slack.

This is the beauty of diversification.

It’s easy to pick on bonds right now but there was a time when it was bonds holding things together while the stock market had a meltdown.

From 2000-2011, the S&P 500 was up a party 0.5% per year. After inflation, you would have lost 2% per year on a real basis for a lost decade and then some.

Cash held up okay during this period with a 2.3% annual return.

But it was 10 year Treasuries that provided the ballast during a financial hurricane. Bonds returned more than 7.2% per year during this 12 year period.

Sometimes it’s cash that comes off the bench for a spark.

In the 10 year period from 1969-1978, the S&P 500 was up a scant 3.2% per year. Tack on annual inflation of more than 6% and real returns were negative. Bonds did better since interest rates were higher back then, returning 4.8% per year, but they were also swallowed up by inflation.

The best of the bunch was short-term T-bills, which returned 6% per year over this 10 year stretch.

I’m cherry-picking time frames here to prove a point but it’s an important one for investors.

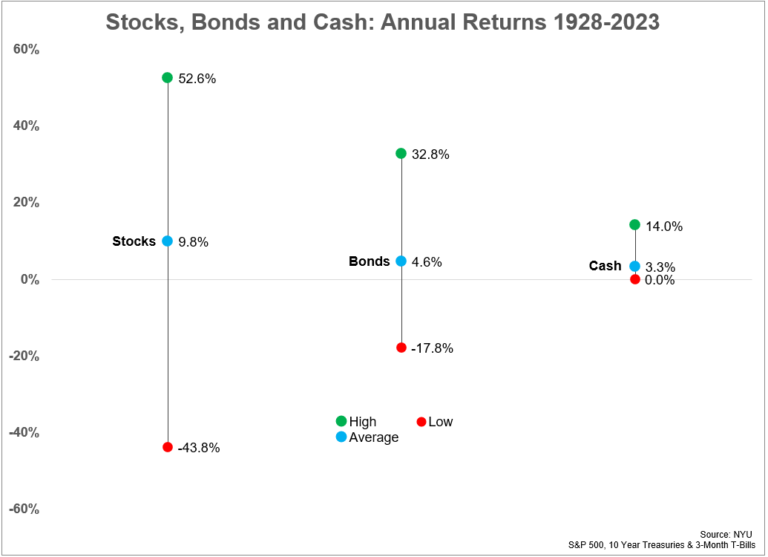

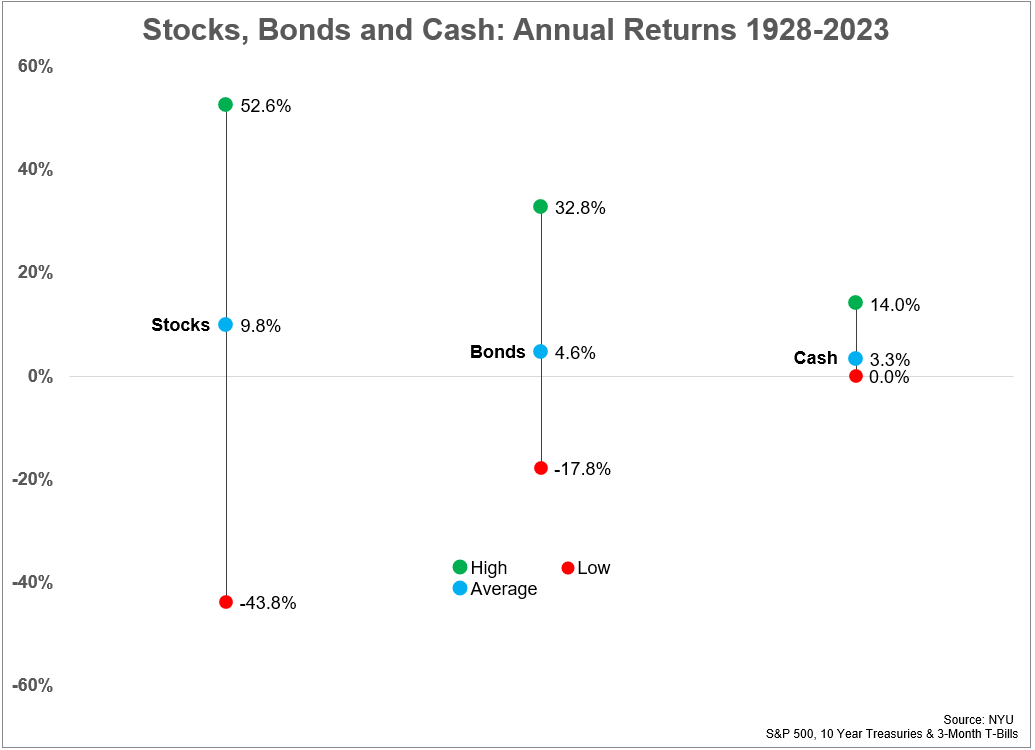

If you look at the really long-term, stocks are obviously the best bet:

With a long-term inflation rate of 3% over this period these are the historical real returns for each asset class since 1928:

- Stocks +6.8%

- Bonds +1.6%

- Cash +0.3%

Stocks are a no-brainer over the long run.

But just look at the range of returns from best to worst. One of the reasons stocks pay you a risk premium over the long haul is because they are so volatile in the short run.

In the short run, anything can happen.

In fact, over the past 96 years, stocks have outperformed bonds and cash 59 times (61% of all years). Bonds have outperformed stocks and cash 23 times (24% of the time). And cash has outperformed stocks and bonds 14 times (15% of the time).

Stocks win most of the time but not always.

One of the reasons bonds have had such a rough go at it over the previous 10 years is because yields were so low. The average yield for the 10 year from 2014-2023 was a little more than 2%.

That helps explain the low returns. Yields tell the story when it comes to bond performance over the long-term.

Starting yields coming into this year were around 4%. That’s not out-of-this-world but it’s much better than fixed income investors have become accustomed to in a 0% interest rate world.

Every asset class is bound to experience periods of good returns and poor returns at some point. Everything is cyclical — the economy, the financial markets, investor emotions, investment performance.

Periods of good performance are eventually followed by periods of mediocre performance. And periods of mediocre performances are eventually followed by periods of good performance.

The hard part is, as always, the timing on these cycles.

Investors essentially have two choices since market timing is next to impossible:

1. Diversification. A portfolio made up of stocks, bonds and cash is far from perfect. But a diversified mix of these building block asset classes can be durable under a variety of market and economic environments.

2. Intestinal Fortitude. If you’re going to concentrate all or most of your money in a single asset class like stocks you need the be disciplined when they get crushed from time-to-time. Having a liquid asset like cash can help but some people do have the ability to sit on their hands when stocks fall.

The choice boils down to your emotional make-up as an investor.

Choose wisely.

Further Reading:

Historical U.S. Stock Market Returns Through 2023