Today’s Talk Your Book is brought to you by Helios:

See here to learn more about Helios’ AI developments and their new trading capabilities.

On today’s show, we discuss:

- How 2023 went for financial advisors

- Struggles with being a diversified investor during concentrated performance periods

- The growth of advisor tech in 2024

- Helios’ utilization of AI

- How difficult it is to explain quant models to advisors

- The issue with quant strategies and portfolio turnover for advisors

- Helios’ new trading execution

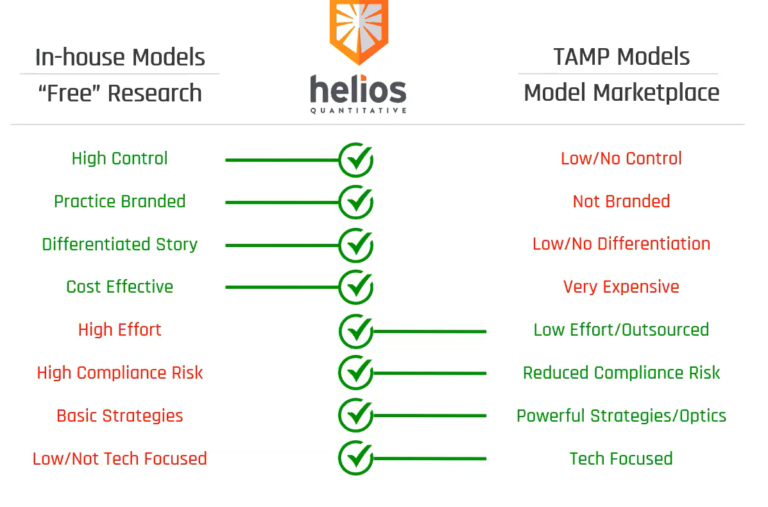

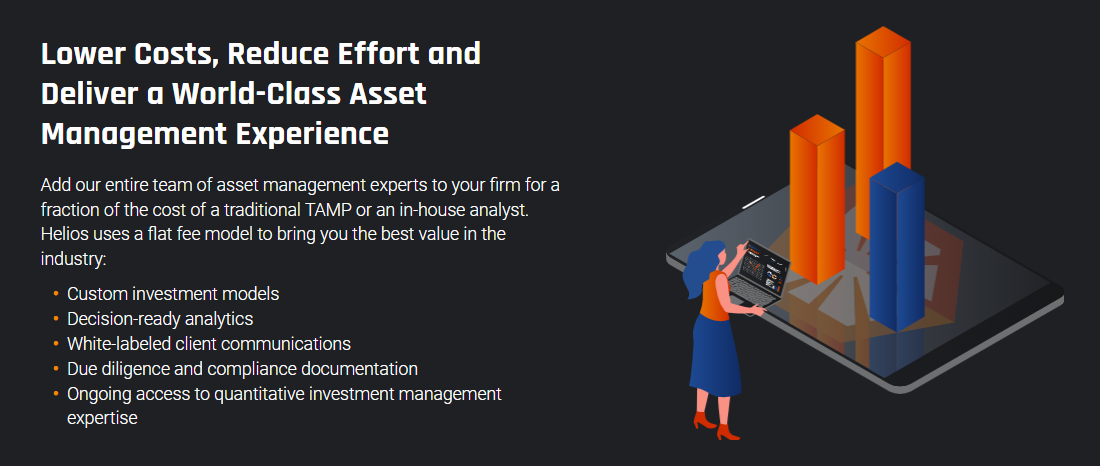

- The operational process between Helios and in-house CIOs

- Helios and crypto interest

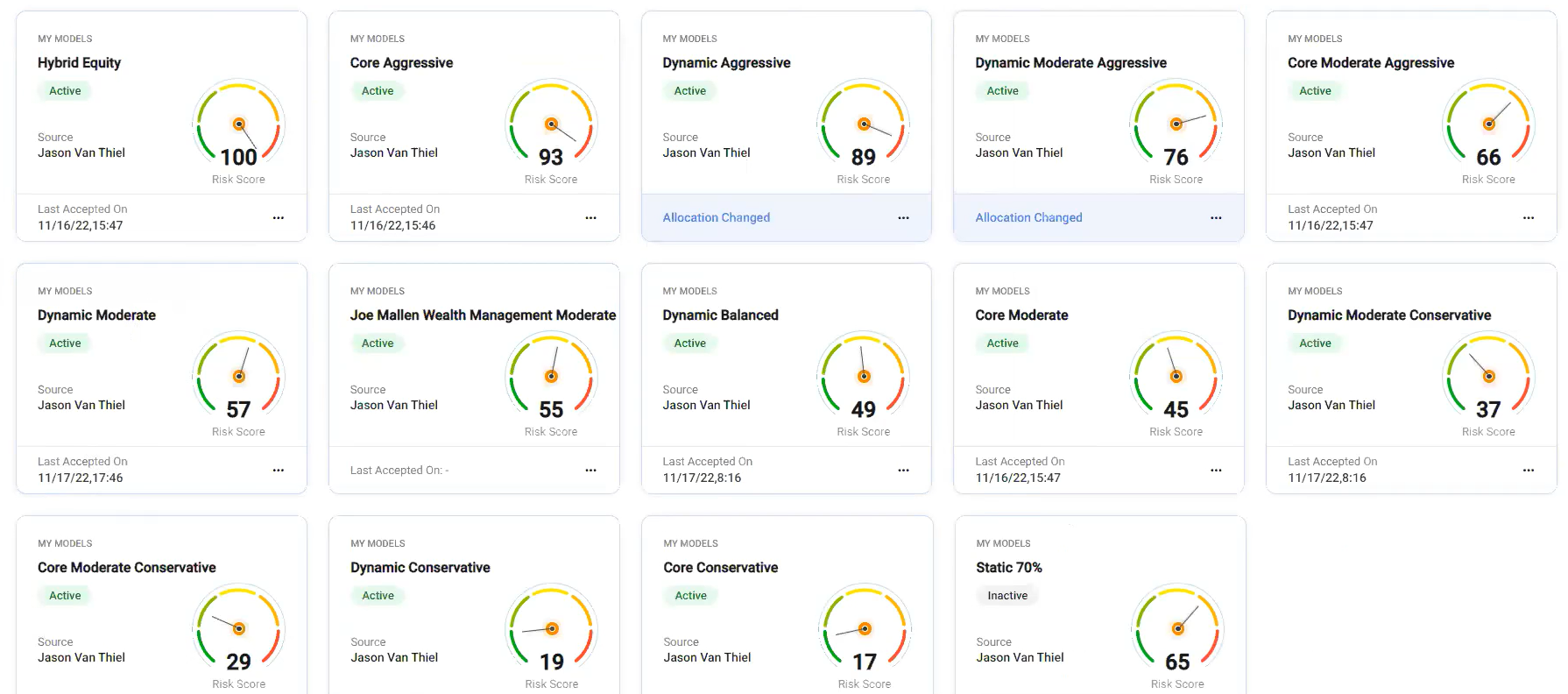

- Custom models and algorithms for advisors

Listen here:

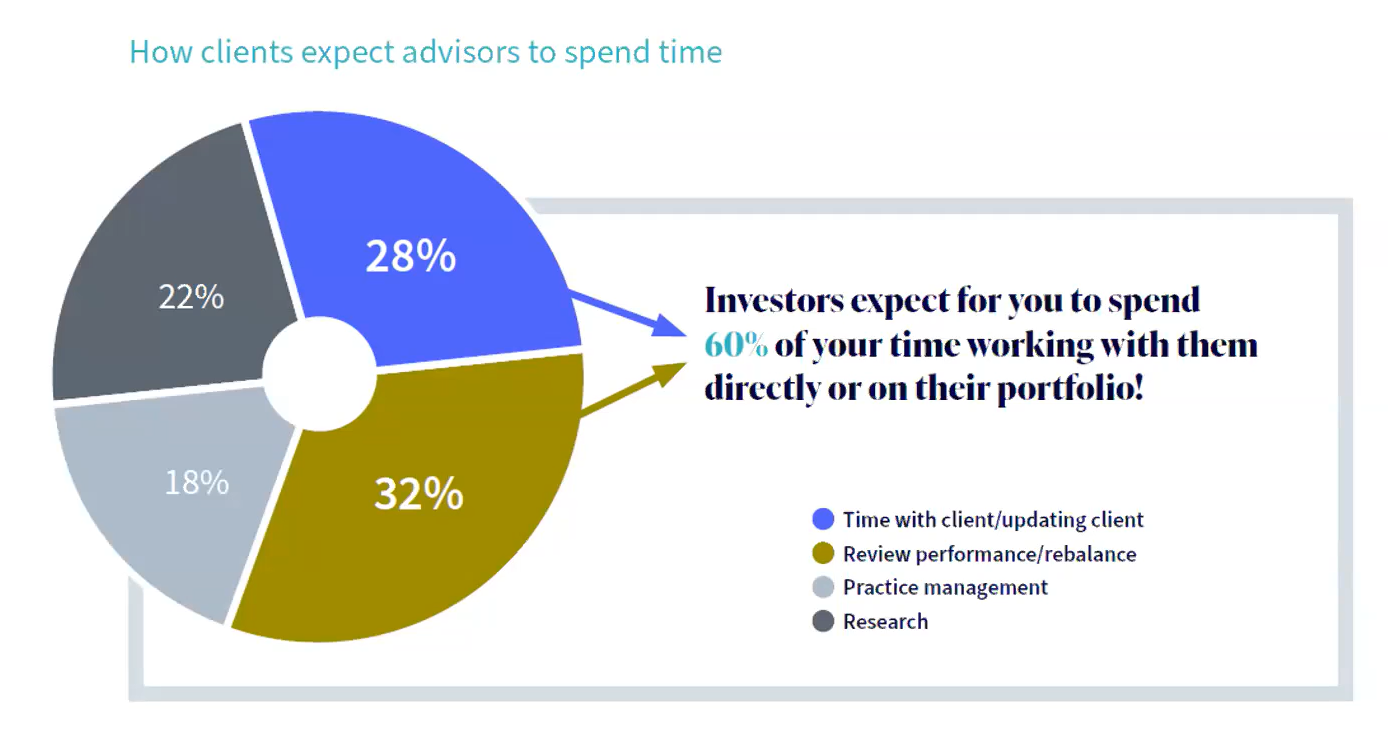

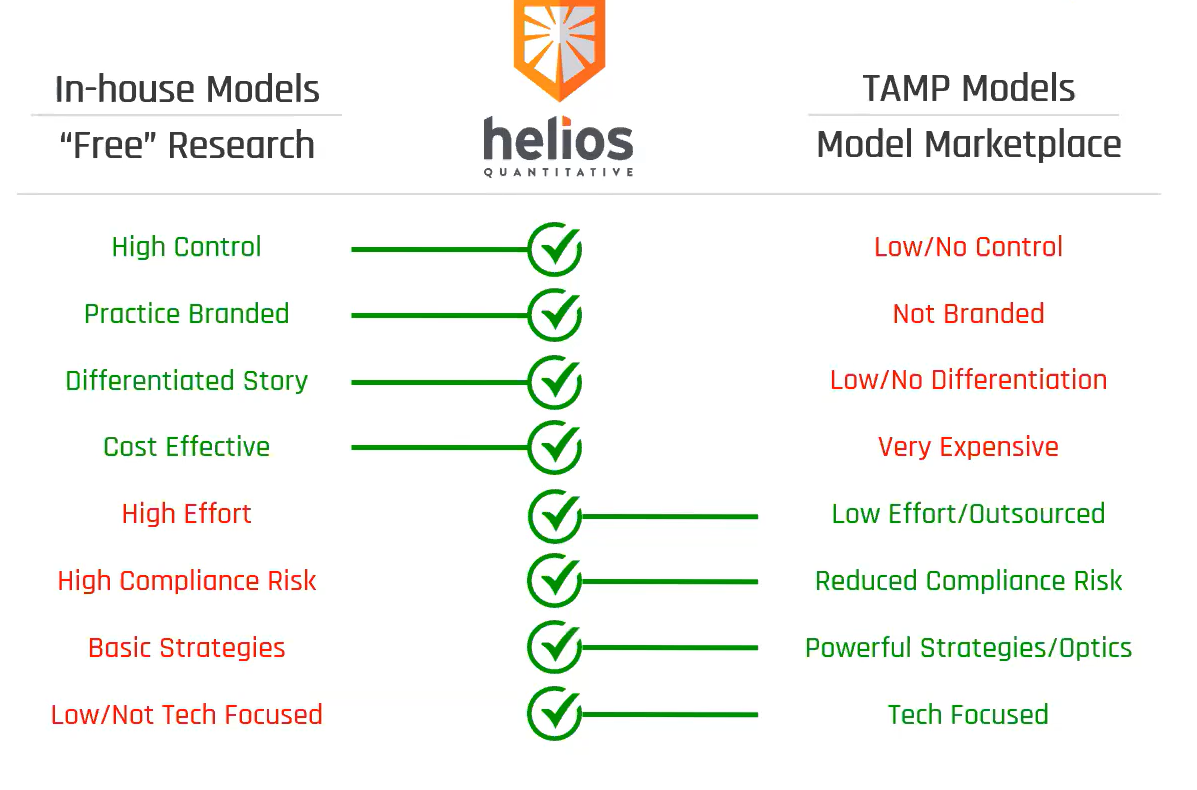

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.