Last week I wrote about how the collective net worth of Americans is at a new all-time high.

A reader asked a fair follow-up question:

I’d be interested in seeing the concentration of that net worth though…I’m guessing it’s an inverted direction.

Just because many households are richer than ever doesn’t mean all of them are. Unfortunately, wealth inequality is still an issue (and probably always will be).

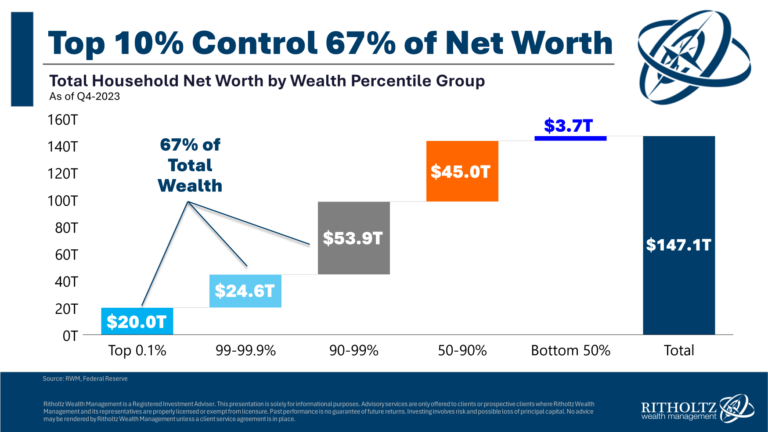

The Fed breaks down this data by wealth percentile:

The top 10% holds more than two-thirds of the wealth in this country. The bottom 50% holds less than 3% of wealth.1

That’s not great.

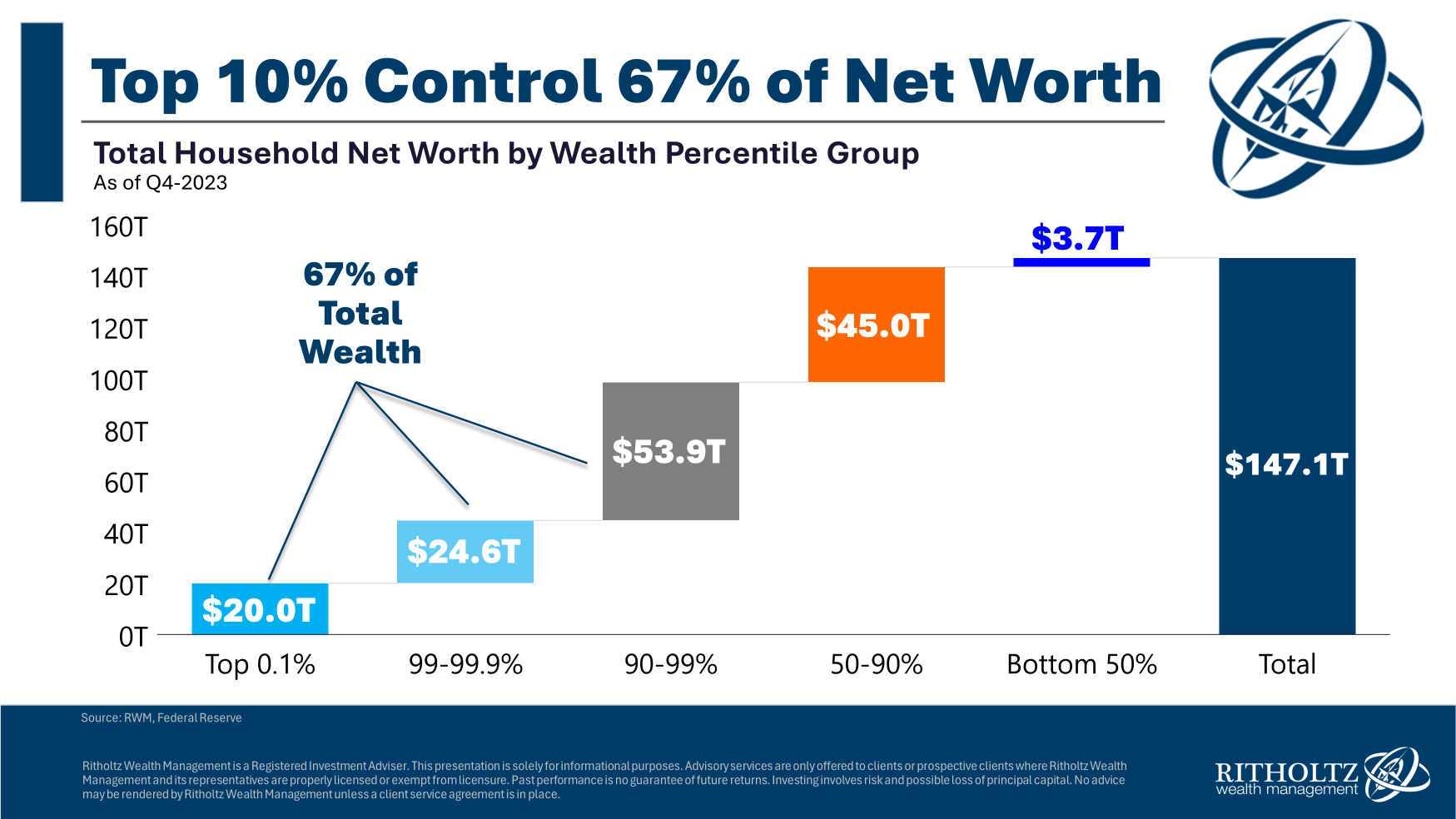

If you look at the cumulative gains by wealth cohort since 1989, you can see the biggest growth has gone to the top 1% (and the top 1% of the top 1%):

Of course, the households in these buckets aren’t static over time. There is some turnover in where people find themselves along the wealth spectrum over time.

But we live in a country where the rich have only been getting richer for some time now.

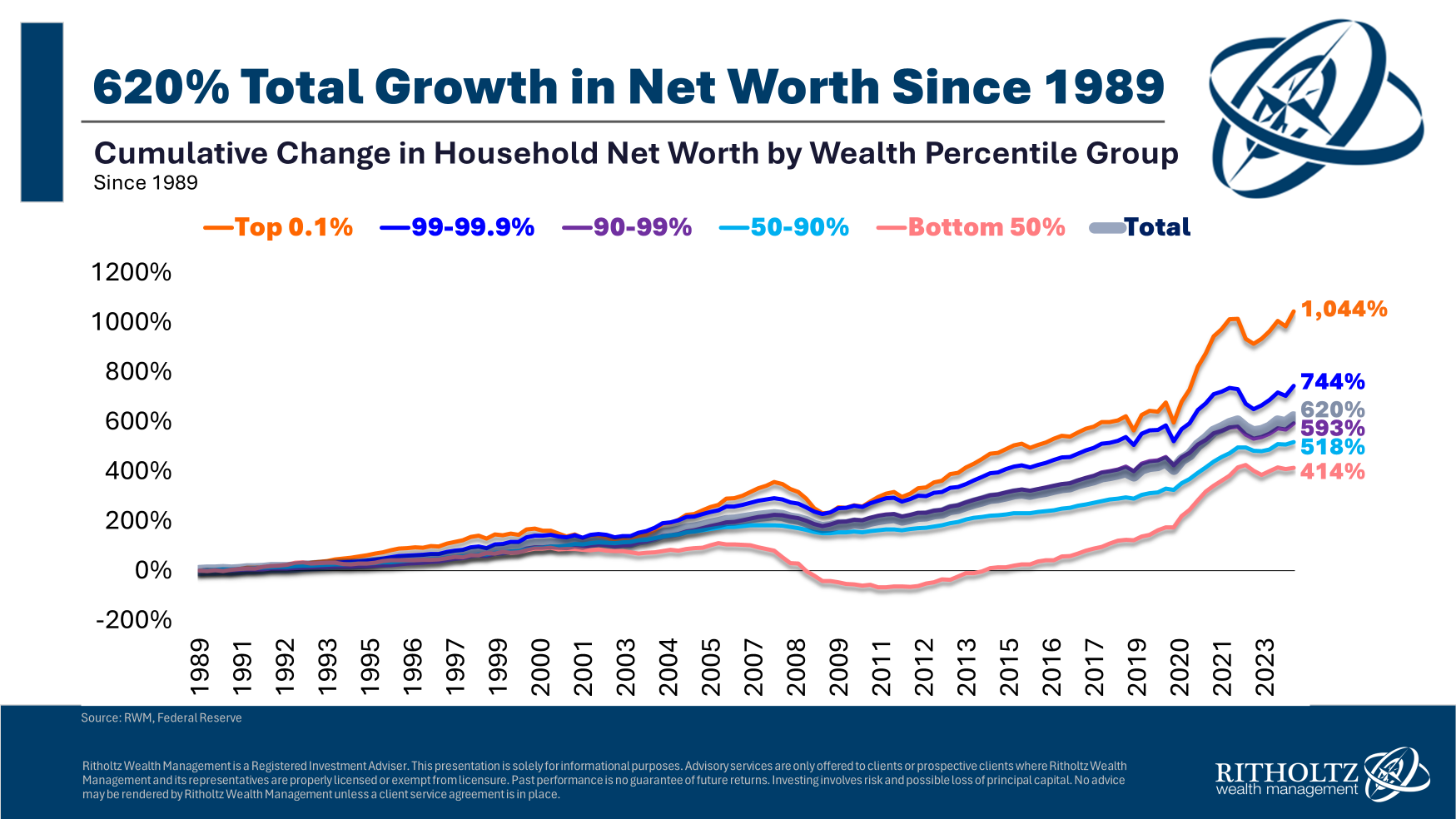

Surprisingly, the pandemic has made things better on the margins. Here’s the growth by wealth segment since the start of 2020:

The biggest relative growth has gone to the bottom 50% in this time. That growth is coming off a low base but you have to start somewhere.

We can build on this.

Hopefully this trend continues.

The Fed also breaks down the data by the different types of financial assets.

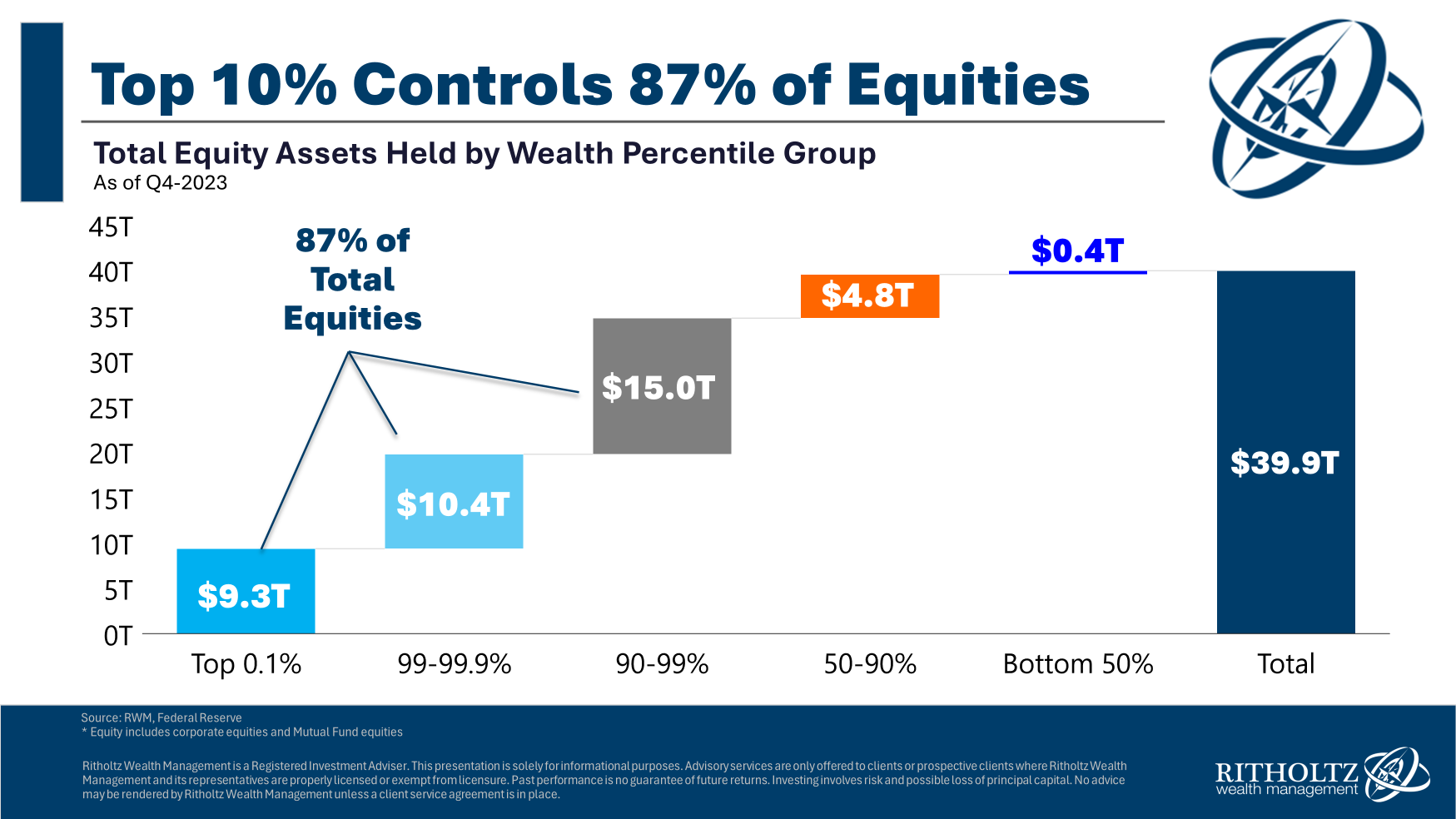

The most apparent inequality exists in the stock market:

The top 10% owns almost 90% of the stocks in the United States. The bottom 50% owns a little more than 1%.

Again, not great.

I stand by my take that we should open a Roth IRA for every baby born in America and put the money into index funds. We need more people participating in the stock market.

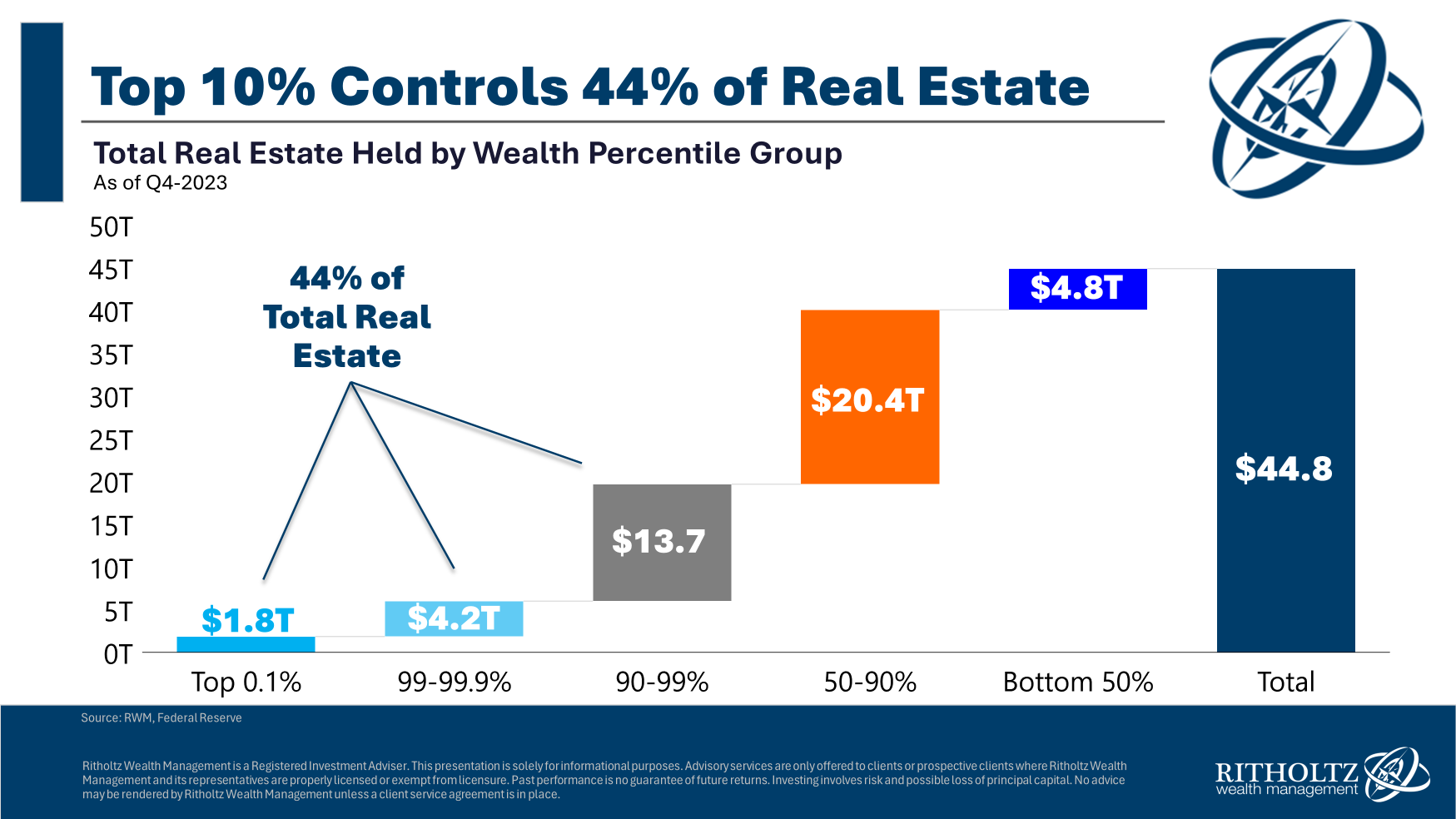

There is not nearly as much inequality in the housing market as the stock market:

The top 10% still controls a decent chunk of these assets but things are more evenly distributed relative to overall net worth and stock market ownership. The bottom 90% owns 56% of the housing market, compared to just 13% of the stock market.

This is one reason the housing market is so important in the United States. For most households, a home is by far their biggest financial asset.2

I don’t think we’ll ever solve wealth inequality under our current system. Sure, there are policies that could redistribute the top-heavy wealth but it’s probably a feature we’re never going to get rid of.

So if you are one of the households with a net worth at all-time highs, consider yourself lucky.

Not everyone is in the same boat.

Further Reading:

How to Become a Millionaire

1It’s pretty crazy the top 0.1% holds nearly as much wealth as the rest of the top 10%. They control 14% of total wealth.

2This is also one of the reasons housing affordability is such a pressing issue — if more of the middle class is left out of the housing market it’s only going to widen inequality.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.