Millennials around my age group graduated into the teeth of the Great Financial Crisis.

The labor market stunk and not just for a short while.

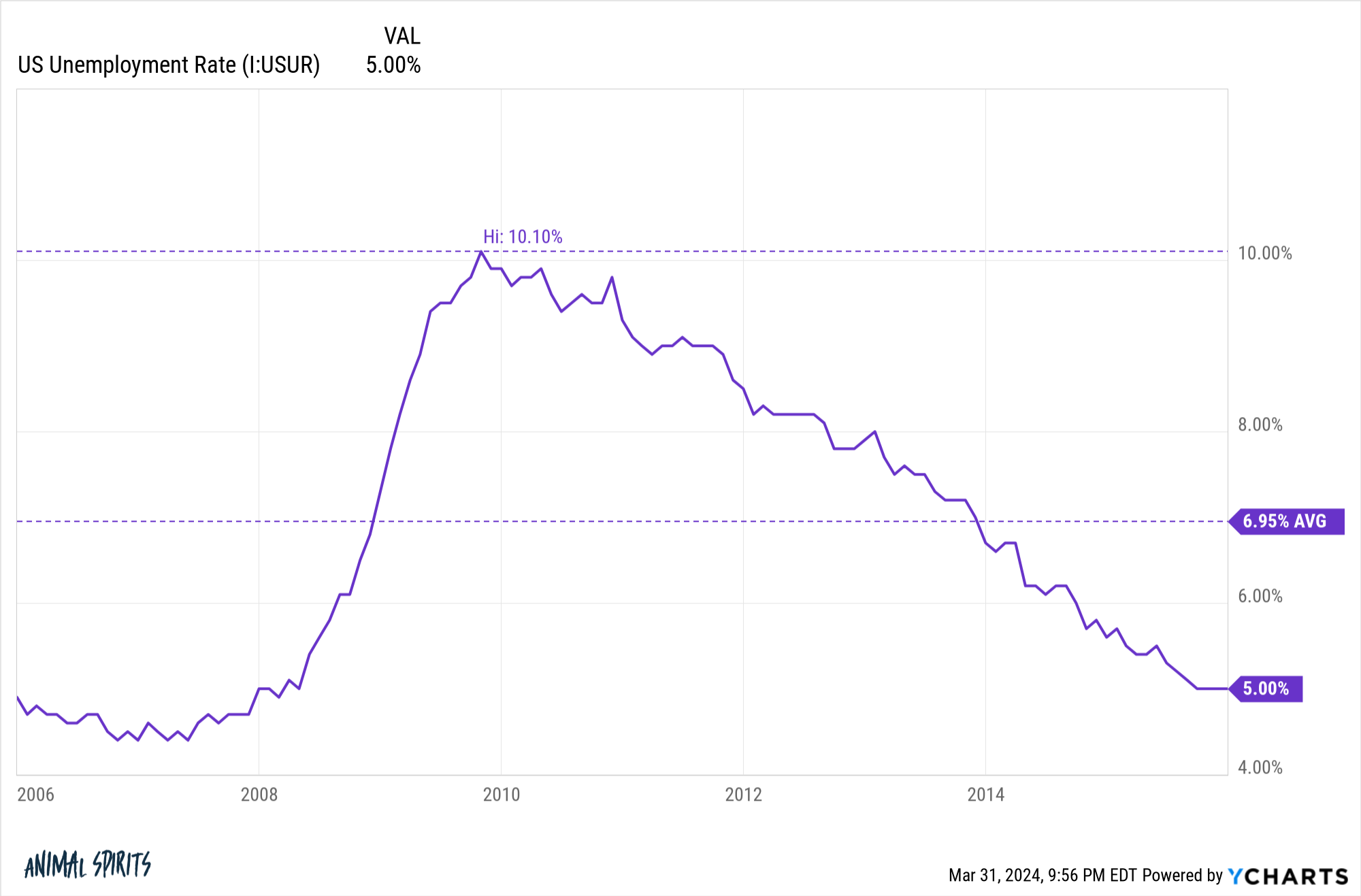

The unemployment rate in America averaged nearly 7% from 2006 through the end of 2015:

It was hard for young people to find work. And if you did find a job it probably wasn’t something you actually wanted to do.

There was a lot of this going around: Just be happy you even have a job right now.

That’s always helpful advice.

It was hard to get started. It was hard to change jobs if you were unhappy. And it was hard to make more money.

But houses were cheap. Borrowing rates were also cheap. If you earned a decent living as a young person you could find affordable housing and finance it at a low rate.

For Gen Z, it’s the complete opposite.

We’ve just lived through the strongest labor market in decades. The unemployment rate has been historically low. And people changing jobs have seen the largest wage gains these past few years.

The problem is you’re screwed if you weren’t lucky enough to buy a house before 2022.

Housing prices are high relative to the recent past. Financing is also way more expensive. This double whammy of higher housing prices and higher borrowing costs happened really fast too.

The days of 3% mortgage rates and lower housing prices are still fresh in everyone’s mind.

Imagine you’re a Gen Z person with a good job who makes decent money. Does the strong labor market make you feel any better about how out-of-control housing costs have gotten in the past few years?

How do you compete in a housing market with baby boomers buying houses with cash and elder millennials who are sitting on a boatload of home equity who can trade up?

House price gains have been so strong since the pandemic you’re almost always going to be at a disadvantage relative to those who hit the housing lottery.

And it’s not like the people who bought a house pre-2022 were making some financially savvy move. We all got lucky!

Take a look at the 20 years worth of U.S. housing price returns from 2004 through 2023:

The crazy thing is there was nothing going on in the tail-end of the 2010s that would have alerted you to the coming bull market on steroids.

Certain areas of the country have seen real estate prices explode higher. In a matter of years, we’re talking a decade’s worth of gains or more.

Someone who bought real estate in Boise or Austin or Miami in 2017 didn’t know how the pandemic would cause the biggest housing price move in history.

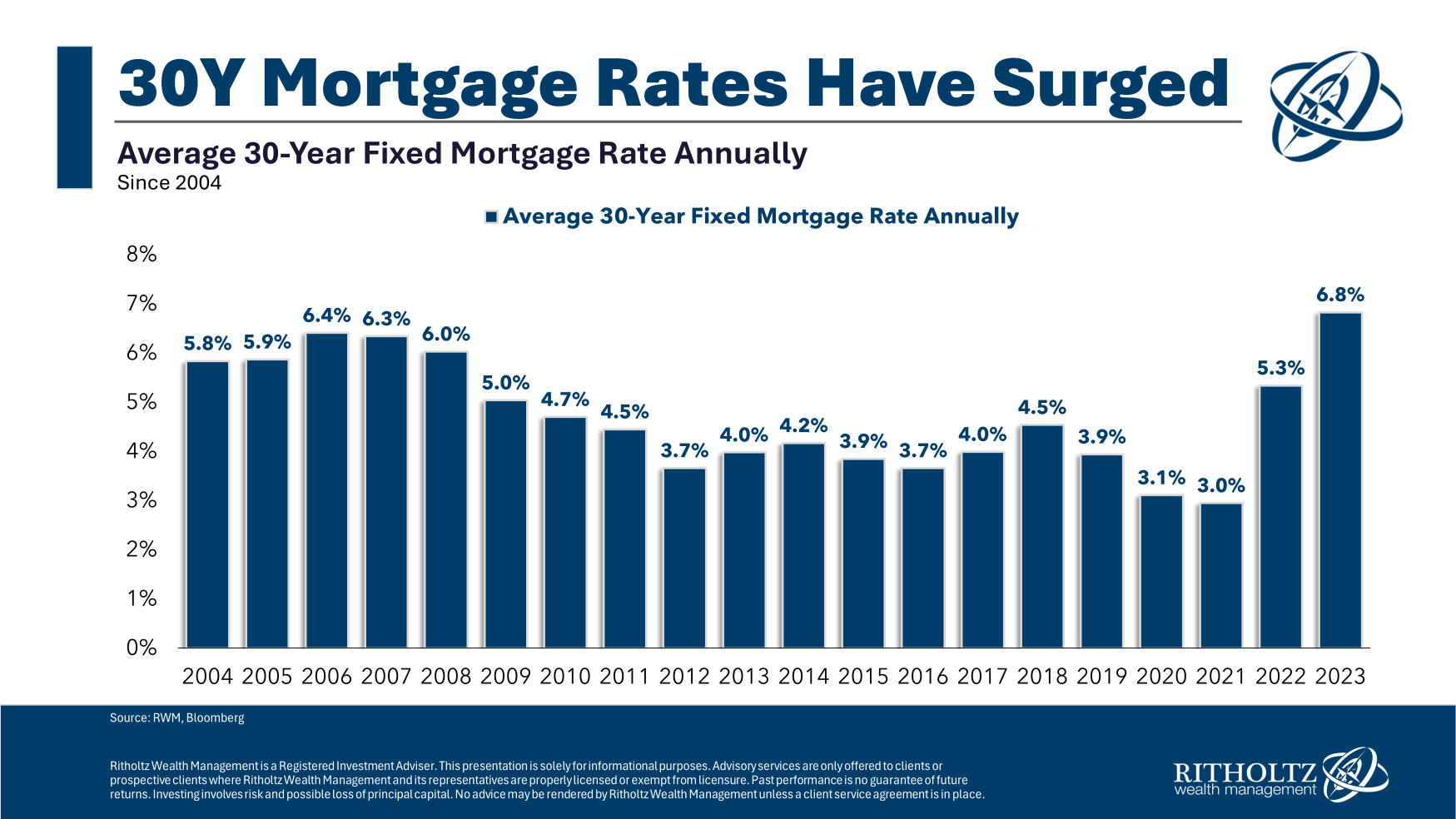

Now take a look at the average 30 year fixed mortgage rate in that same time frame:

The Great Financial Crisis gave us falling housing prices and falling mortgage rates. That’s a pretty good combination if you have enough income to afford a house.

Not so great if you can’t afford one.

The pandemic gave us rising housing prices and rising mortgage rates. That’s a pretty good combination if you already own a house.

Not so great if you don’t own one.

The Gen Z generation is going to hate millennials who bought houses just in the nick of time.

Millennials have spent years claiming baby boomers ruined everything and were just lucky. We’re becoming our parents!

The hard part about all of this is so many of these huge macro shifts are all about luck and timing. Then we go looking for narratives after the fact that make it seem like it was all preordained.

Short of a government mandate to build more houses and offer 3% mortgages, I’m not sure what we can do to level the playing field for young people in the housing market.

Gen Z caught a bad break.

Further Reading:

The Luckiest Generation

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.