A reader asks:

I saw the report this week that said Social Security will be insolvent by 2035. As a card carrying millennial (I’m 35) I’m operating under the assumption that Social Security won’t be there for me when I retire. Is that a fair assumption considering the trillions of dollars we’ve added in government debt since the pandemic?

I saw all of the headlines too:

It sounds dire.

I know a lot of young people who feel the same way. There is too much government debt. Politicians won’t do anything to fix the entitlement shortfalls. The boomers are going to leave the cupboards bare.

Insolvency sounds scary but the situation is not quite as grim as the headlines would have you believe. I went through the actual report. Here’s what I found:

If Congress does not act by 2035, the trust fund reserves are projected to be depleted. However, the income from Social Security taxes would cover 83% of scheduled benefits.

While it is true that more money will be going out than coming in, the shortfall is only 17 cents on the dollar. So it’s not like there will be no coverage at all.

Now look at the chart they produced that takes things out even further:

By the year 2098, when I will be turning 117, they project the tax revenue will cover 73% of the benefits. That’s a long runway to shore things up.

There are three potential scenarios when thinking about these numbers:

(1) People should get used to the idea of their Social Security benefits getting slashed starting in the 2030s.

(2) Politicians still have time to act but taxes might be going up to avoid any shortfall.

(3) The U.S. government likes to spend money, we print our own currency and we will simply go into more debt to cover the shortfall.

If I had to guess, I would assume some combination of (2) and (3) makes sense. No politician in their right mind would slash Social Security benefits for retirees. You don’t win votes that way.

They could raise the tax limits for high-income earners or increase the filing age for younger people. Those fixes make sense to me.

Who am I kidding? We’ll probably just kick the can down the road and increase government debt (or decrease spending elsewhere). One of the lessons from Covid is if there is a political will for more spending, it will happen. The only constraint you have when you print your own currency is inflation.

There are no guarantees when it comes to the actions of politicians, but Social Security is the most important retirement plan ever enacted in America.

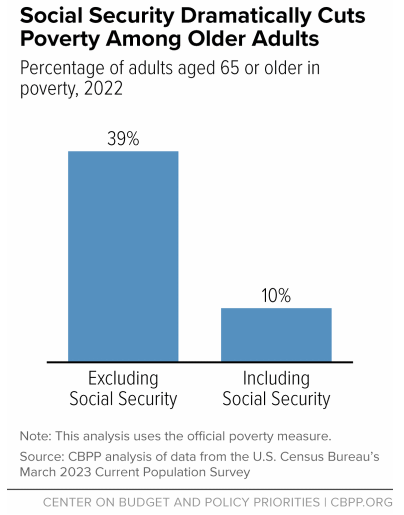

According to the Center on Budget and Policy Priorities, nearly 23 million adults and children would fall below the poverty line in the U.S. without Social Security. That includes nearly 17 million people 65 or older and almost 1 million children.

Without Social Security, 4 out of every 10 senior citizens would be in a life of poverty:

Instead, the actual number is 1 out of 10.

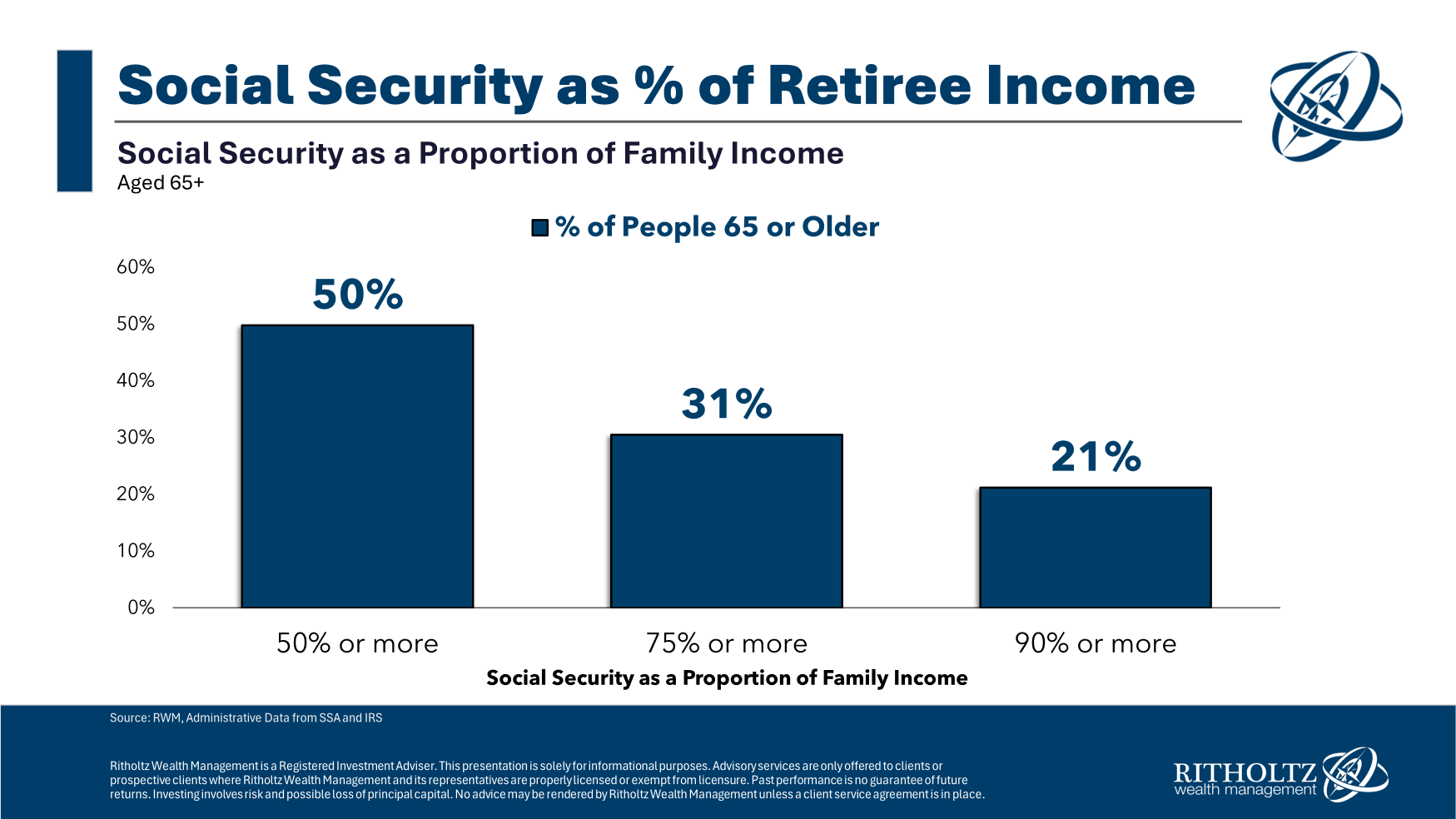

Social Security also provides a large source of income for many retirees. One study looked at Social Security as a proportion of family income for those 65 and older:

Nearly half of senior citizens receive 50% or more of their income from Social Security. One in 5 people 65 or older gets 90% of their income from the program.

To some people, Social Security is a supplement to other sources of income. To others, it’s one of their main sources of income.

Social Security is not bankrupt. Things will be fine as long as people keep paying Social Security taxes. The government will figure something out or prioritize this plan.

If they don’t, a lot of people will struggle to afford their retirement years.

We covered this question on the latest episode of Ask the Compound:

Your favorite tax expert Bill Sweet joined me on the show again this week to discuss questions about downshifting your risk as you approach retirement, the most tax-efficient way to pay for a medical procedure, when DIY investors should consider an advisor, the Rule of 55 and how to prepare for taxes in retirement.

Further Reading:

Can Young People Still Count on Social Security?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.