Here’s a take from Dave Portnoy:

A lot of people share these views. It’s the kind of thing that gets people riled up.

The market is rigged!

It’s one giant casino where the house always wins!

That narrative tends to accompany stories like this:

Investors who jumped into the latest online frenzy over shares of the struggling video game retailer lost $13.1 billion in just three days from the mania’s high, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge. That loss from the May 14 high now far exceeds GameStop’s (GME) total value of $6.8 billion.

I’m not sure that measuring market cap losses from the peak of a meme stock mania is the right way to think about gains and losses. But some people will use stories like this as proof the stock market is rigged against the little guy.

Look, if you’re looking to get rich overnight, the stock market probably does feel like a casino where the house always wins. The stock market is rigged against you if you’re looking for easy money

The big money has more brainpower, more computing power and better information than you. And it’s still difficult for many of them to beat the market.

Sure, there are one-off lottery tickets but the stock market is for patient people.

When I was in middle school every month or so we would have an assembly in the gym.

Those beefy guys who would tear phonebooks in half. Someone from the D.A.R.E. program. Maybe a musical act if we were lucky.

One time, a guy came in to shoot free throws and offer motivational advice. This guy didn’t even look like a basketball player, more like a middle-aged dad with a polo shirt tucked into his 1990s-era Nike warm-up pants.

But he stepped up to the line and knocked down free throw after free throw as we all watched sitting cross-legged around the three-point line and baseline.

He shot hundreds of free throws, all while giving a well-thought-out speech about the benefits of practice and process. There wasn’t a single miss. Not even close.

It was the same exact form every time. The same set up. The same release point. The same follow-through. It was impressive how he never deviated from that process.

The same theory applies to the stock market.

If you don’t deviate in the short-run, you’re bound to be better off in the long-run.

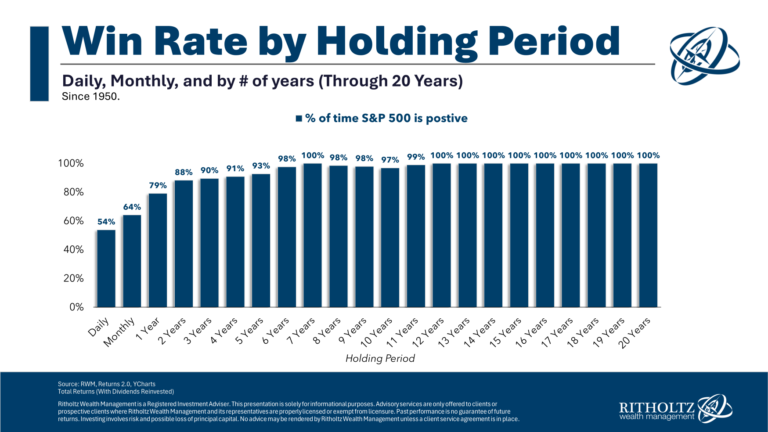

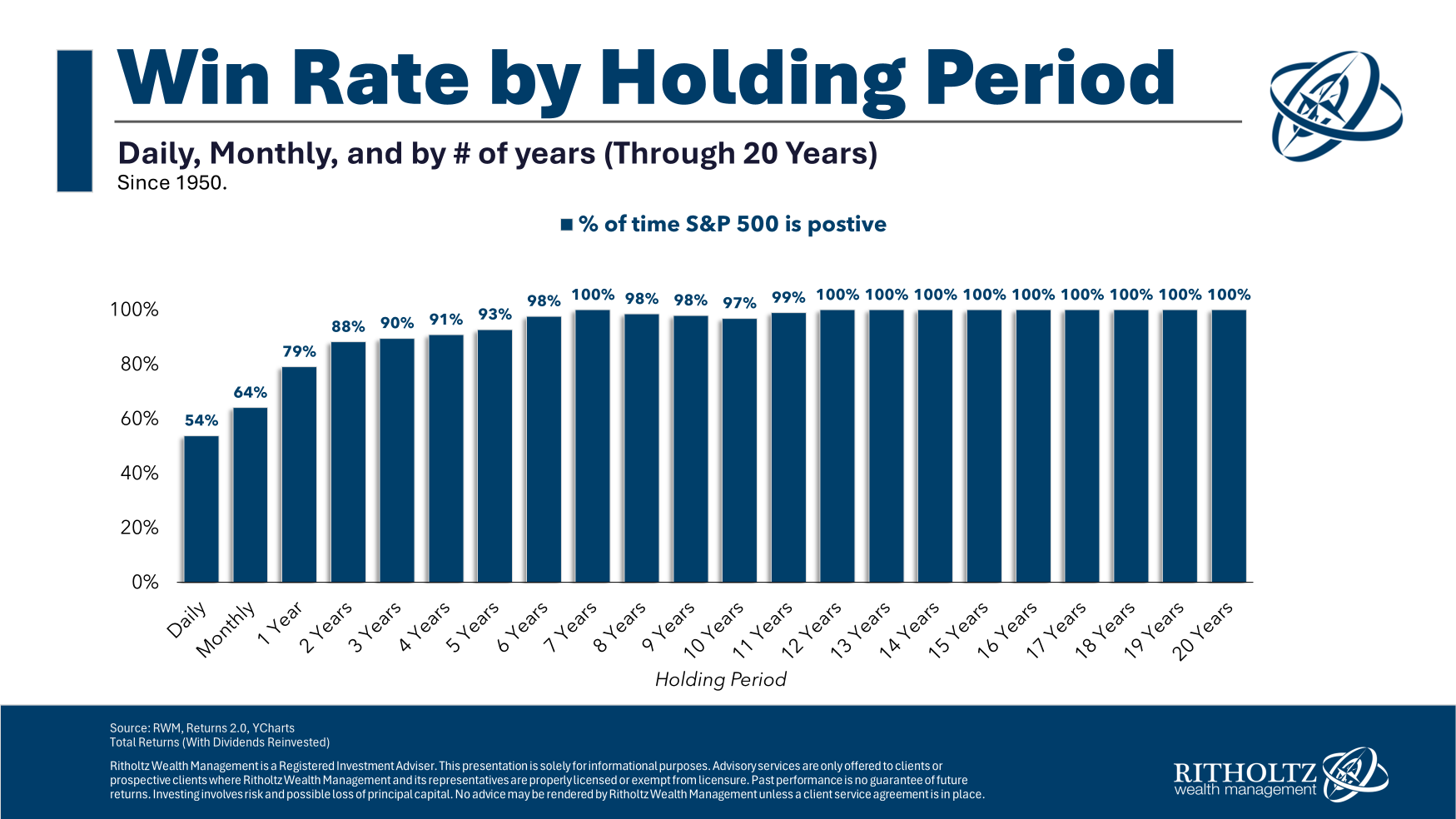

This is the historical win rate for the S&P 500 since 1950 over various holding periods:

If the stock market is a casino, it’s the only one in the world where your odds of success increase the longer you play the game.

On a daily basis, the stock market is only a little better than a coin toss in terms of gains and losses. The further you extend your time horizon historically, the higher the chance of seeing gains.

If you try to outsmart the stock market over the short-term, it will feel rigged against you.

Ironically, there has never been a better time to be an individual investor — index funds, ETFs, targetdate funds, tax-deferred retirement accounts, zero dollar trading commissions, automated investing and access to more information than ever before.

In many ways, individuals have a leg up on Wall Street.

You don’t have a benchmark you need to beat. No committees or donors to keep happy. You don’t have to answer to outside investors about meaningless short-term performance numbers.

The market is rigged against Wall Street over the long run in favor of the little guy! They’re the ones who are forced to play the short game.

The only dumb money is those investors who assume there is easy money available in the short-run.

Making money isn’t supposed to be easy. The stock market is hard.

But it works for patient investors with a long enough time horizon.

Further Reading:

The Stock Market is Not a Casino