A reader asks:

I consider myself a good conservative money manager for my personal finances but recently I have been looking for a nice house that I can enjoy for years to come. I am 56 and an early retiree. I just sold my condo and now have a total of $3.6 million mostly invested in broad market ETFs except for the $450k in cash set aside for a new house. The houses that I really like are now $700k instead of the $450k-$550k that I had planned. I have an annuity that will start paying $3k per month at age 63, plan on $2k in Social Security at 67 and otherwise, have to live off my investments. I am single, no kids, no current health issues and lots of hobbies. I am wondering if I should splurge on a house like this or stay more conservative like I had originally planned.

There are really only two types of people when it comes to money:

1. People who spend too much.

2. People who save too much.

This is an extreme overgeneralization and there are obviously people somewhere in the middle but you get the idea.

Scott Rick, a researcher at the University of Michigan looked into the psychology behind these two types of people. He calls them tightwad and spendthrifts:

“Tightwads” experience too much pain when considering spending and therefore spend less than they would ideally like to spend. By contrast, “spendthrifts” experience too little pain and therefore spend more than they would ideally like to spend. Neither are happy with how they handle money.

I’ve noticed a similar bifurcation working with retirees over the years.

There’s a huge cohort of people who spent their entire career watching their spending and saving money. These tightwads have trouble spending down their nest egg in retirement for fear it will all be gone someday.

There is also a group of retirees who didn’t save enough and plan on spending everything they have before the clock runs out.

Both tightwads and spendthrifts worry about money but for different reasons.

There is a never-ending feeling of uncertainty when it comes to retirement planning.

That uncertainty includes longevity risk, rising healthcare costs, long-term care, inflation, interest rates, the timing of bear markets, financial market returns, sequence of return risk and more.

On the other side of the equation, the future is promised to no one. I’ve heard countless stories of people scrimping and saving their entire lives with hopes of living it up in retirement only to drop dead unexpectedly or contract a live-altering medical issue before they even have the chance to enjoy their money.

This question is being asked by someone tilted more towards the tightwad side of the money spectrum.

She is not alone.

There’s research galore from financial firms that shows certain people cannot bring themselves to spend in retirement.

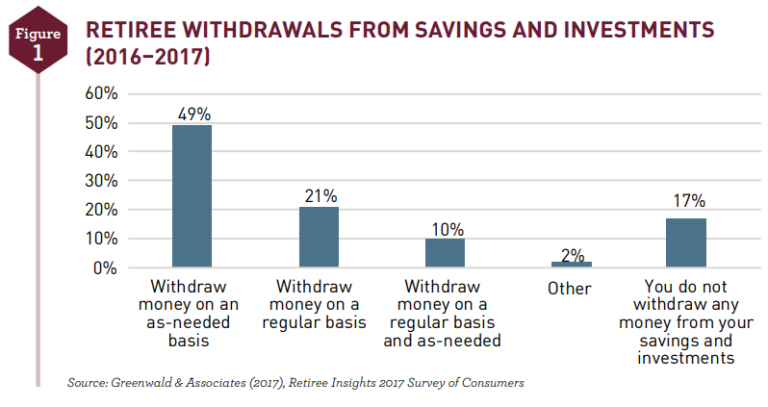

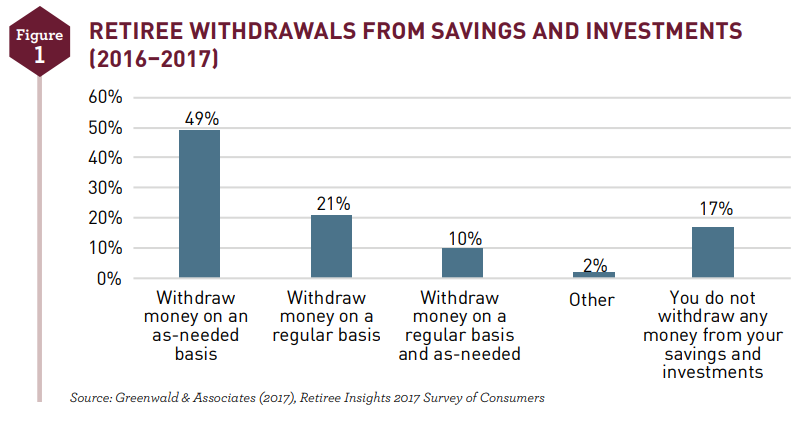

Here is some data from New York Life in a report called Understanding Underspending in Retirement:

Findings from a 2023 New York Life study show that only 16% of retirees withdraw from their portfolios on a regular, systematic basis and 30% do not withdraw any money from their savings accounts and investment portfolios at all.

Even when retirement expenses are higher than originally planned for, retirees are still reluctant to utilize portfolio assets.

According to the Society of Actuaries, they reduce their costs rather than deplete their assets whenever possible.

Instead of spending down their principal, these retirees would rather cut their spending.

Financial advisors often talk about the 4% rule but few people actually follow a disciplined withdrawal strategy:

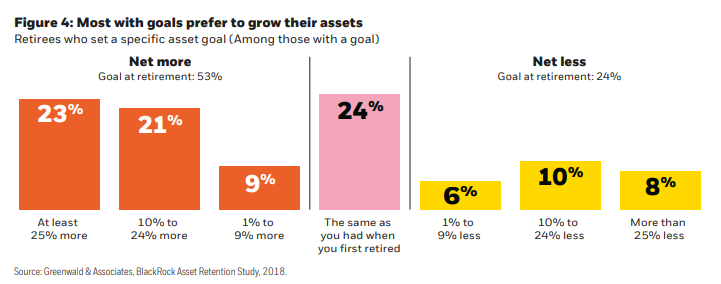

A study from Blackrock shows most retirees would rather grow their portfolio than spend them down:

Very few want to tap into their savings to finance their spending in retirement, especially those with high levels of assets who are very content to leave all or a significant amount of savings unspent. Only one in four feels they will have to spend down principal at all to fund their desired lifestyle. For most, retirement is not a time to live it up, it is more important to feel financially secure.

Here’s a visual of the results:

Another rule of thumb is that you’ll spend somewhere in the range of 70-80% of your pre-retirement income during retirement.

A Goldman Sachs report finds many retirees spend far less than that:

The report found that 51% of respondents who are currently retired reported that they are living on less than 50% of their pre-retirement annual income, including 29% who report living on 40% or less. Only 25% of retirees generate what many estimate as the amount needed to maintain their standard of living – 70% or more.

Having a giant nest egg and being too afraid to spend it down is a better situation than spending everything from a smaller pile of money. But this is a real psychological phenomenon for many people.

You have all of this money but fear of the unknown holds you back from enjoying it.

This person has a healthy seven-figure portfolio, a massive down payment, no dependents and some additional fixed income to look forward to in the years ahead.

My advice here is simple:

Buy a nice house!

Splurge a little (or a lot). You have plenty of money. You obviously know how to save and control your spending habits. Even if you purchase a million dollar home you have enough for a ~50% down payment.

You can’t say yes to everything in retirement but the whole point of delaying gratification when you’re younger is to allow yourself some gratification when you’re older.

You only live once.

Buy the house.

You won’t regret it.

Bill Sweet joined me on Ask the Compound this week to talk about this question and more:

We also discussed exit taxes, understanding Roth 401ks, the tax implications of annuities and financial planning for early retirement.

Further Reading:

You Probably Need Less Money Than You Think For Retirement