I track all of my savings and investments on Excel.

Guess I’m old school and, yes, kind of a personal finance dork.

I can’t help it.

It’s nothing fancy. Just a collection of the holdings in our various accounts along with some simple calculations — net worth, annual retirement contributions, asset allocation, how much we’re saving each year, etc.

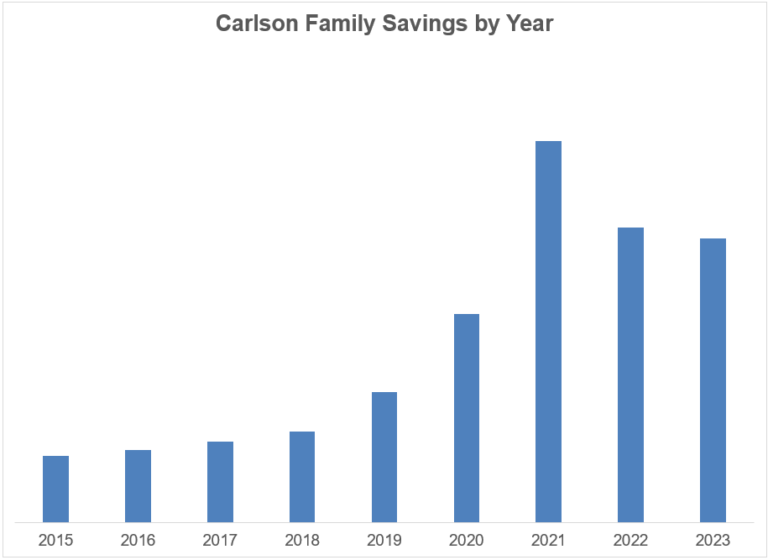

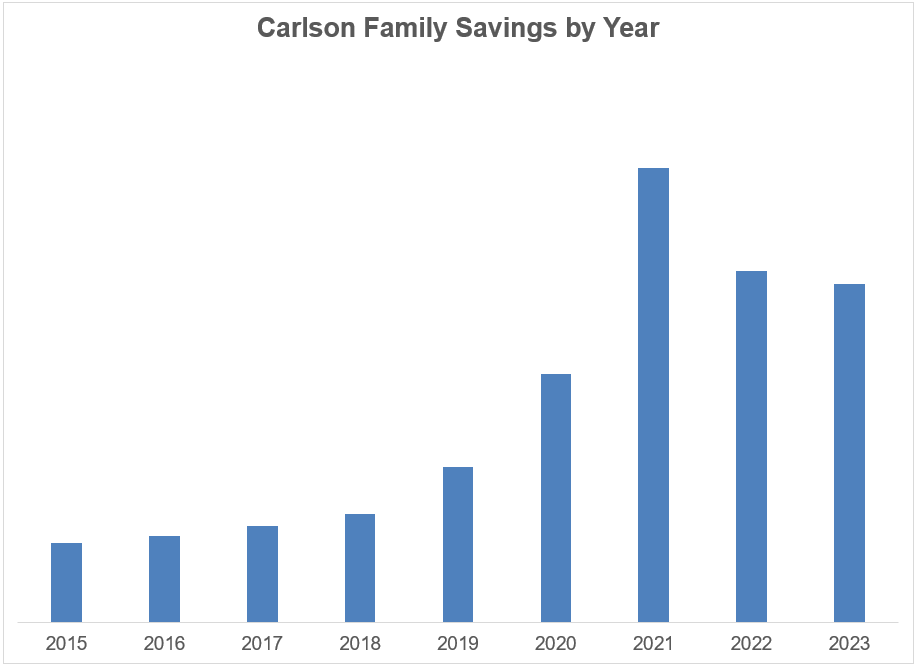

I was looking at my annual savings figures recently and decided to perform some analysis on the changes from year to year:

The numbers don’t matter as much as the trend. A couple of things stood out.

There was a nice breakout starting in 2019 and throughout the pandemic. Not to brag, but I started making more money, and my savings went up commensurately.

Except for 2021, which was an outlier. Our savings took a massive leap that year.

There are a few reasons for that spike.

We weren’t spending as much because of the pandemic. Travel was in a bear market.

If I’m being honest, there was also a bit of FOMO going on. That was the year it felt like everyone was investing in everything — stocks, start-ups, real estate, crypto, private deals, etc. I got caught up in that and put a lot of money to work.

The younger version of me would have been mighty proud of that all-time high in savings. Looking back now, it feels like more of a mistake than an accomplishment.

Don’t get me wrong, saving and investing is still a priority. But it’s not the only priority in our financial plan.

For as long as I can remember, I’ve been a saver through some combination of my personality and upbringing. I’m still a saver, but I now have a more balanced attitude when it comes to money.

I don’t want to delay all gratification until I’m in my 60s or 70s. These past few years, I’ve been getting regular reminders that the future is promised to no one.

I’m no longer impressed or driven by specific goalposts in my portfolio.

I prefer to save a reasonable amount of money and enjoy the rest.

I’m still maxing out my retirement accounts, saving for the kids in their 529 plans, keeping enough liquid reserves for unexpected expenses and putting money into my taxable brokerage accounts.

But I no longer feel it’s necessary to go over and above when it comes to saving. I want to enjoy some of my money now while I can.

That’s the biggest reason our savings fell off a little in 2022 and 2023. We took a bunch of trips. We did some minor renovations to the house that added hangout spaces. We bought a boat. We own a lake house.1

I could add up all those expenses and slap a forward return on them to see how much compounding I’m missing out on.

But so freaking what?!

That money in 10, 20 or 30 years won’t make up for the experiences and memories we’re investing in now while our kids are young.

Call this bull market behavior if you’d like. Savings rates tend to go down when financial asset prices go up.

For me this has nothing to do with the markets and everything to do with priorities.

I’m dollar cost averaging my spending while I can enjoy it with loved ones rather than saving it all up for when I’m older.

Michael and I talked about saving, spending, perspective and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

You Probably Need Less Money For Retirement Than You Think

Now here’s what I’ve been reading lately:

Books:

1At some point I’ll do a more detailed write up about how this was the best investment I’ve ever made.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.