A reader asks:

There is a lot of data on the probability of positive returns for different time periods (S&P 500). Does anyone have similar data for different portfolio allocations? 60/40 stocks/treasuries, etc.

This one is right in my wheelhouse.

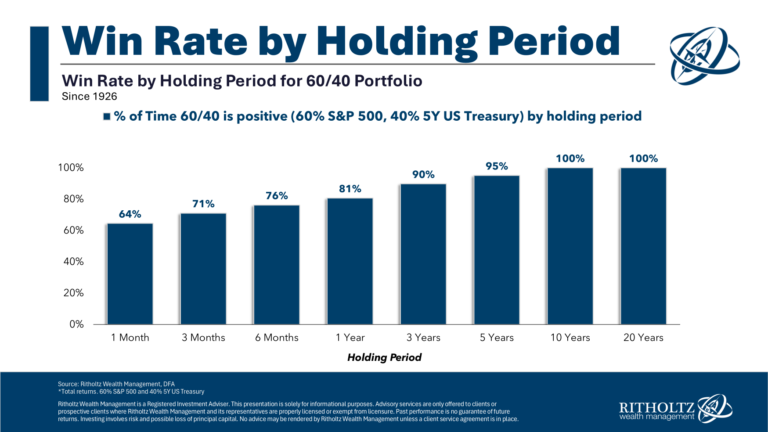

As a staunch advocate for long-term investing, I love the charts that show the win rates for the stock market over various time frames:

This is one of my all-time favorite stock market charts.

The historical win rates for international stocks are similar.

But I’ve never done this exercise for a diversified portfolio.

Let’s get to the data!

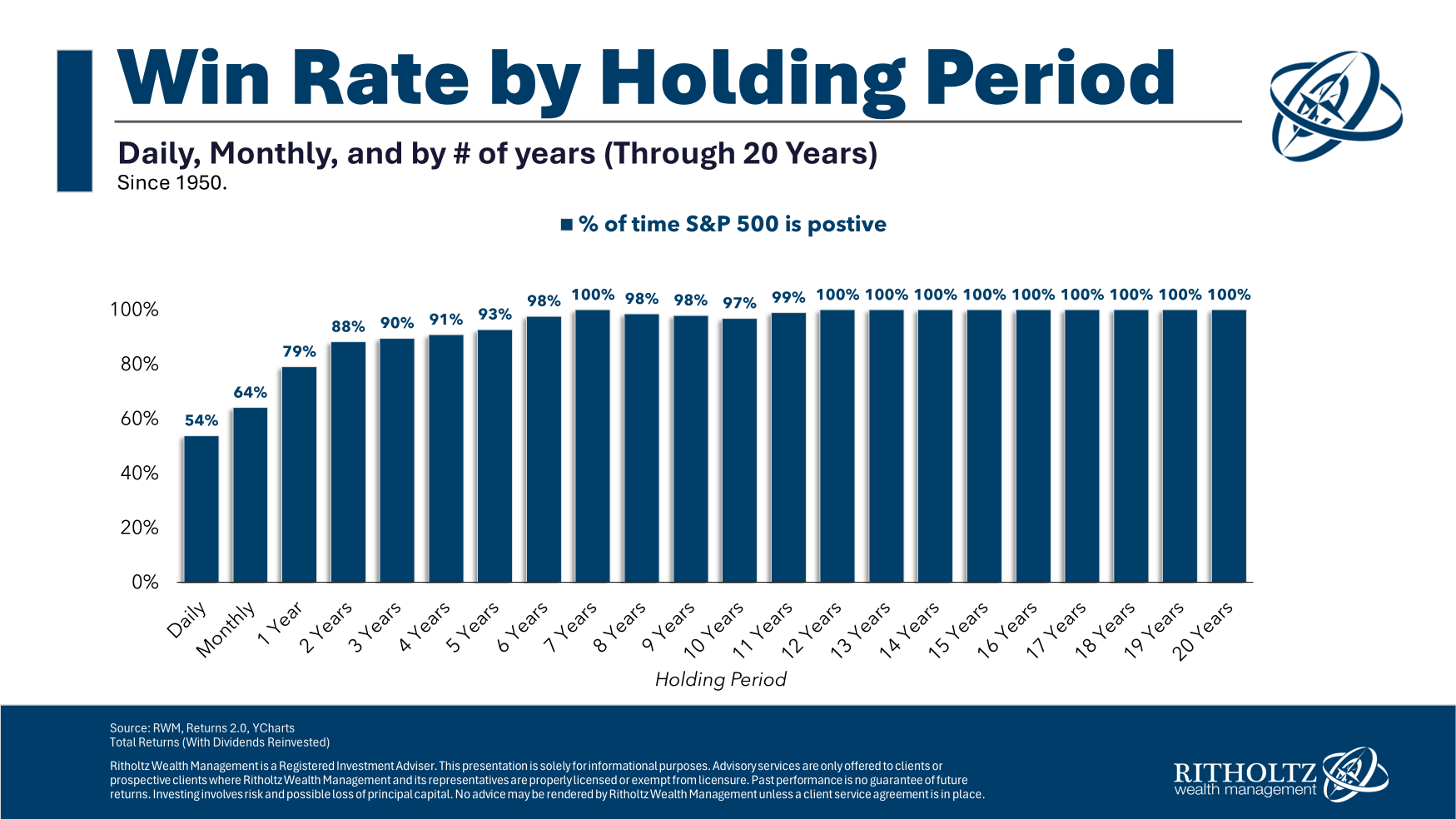

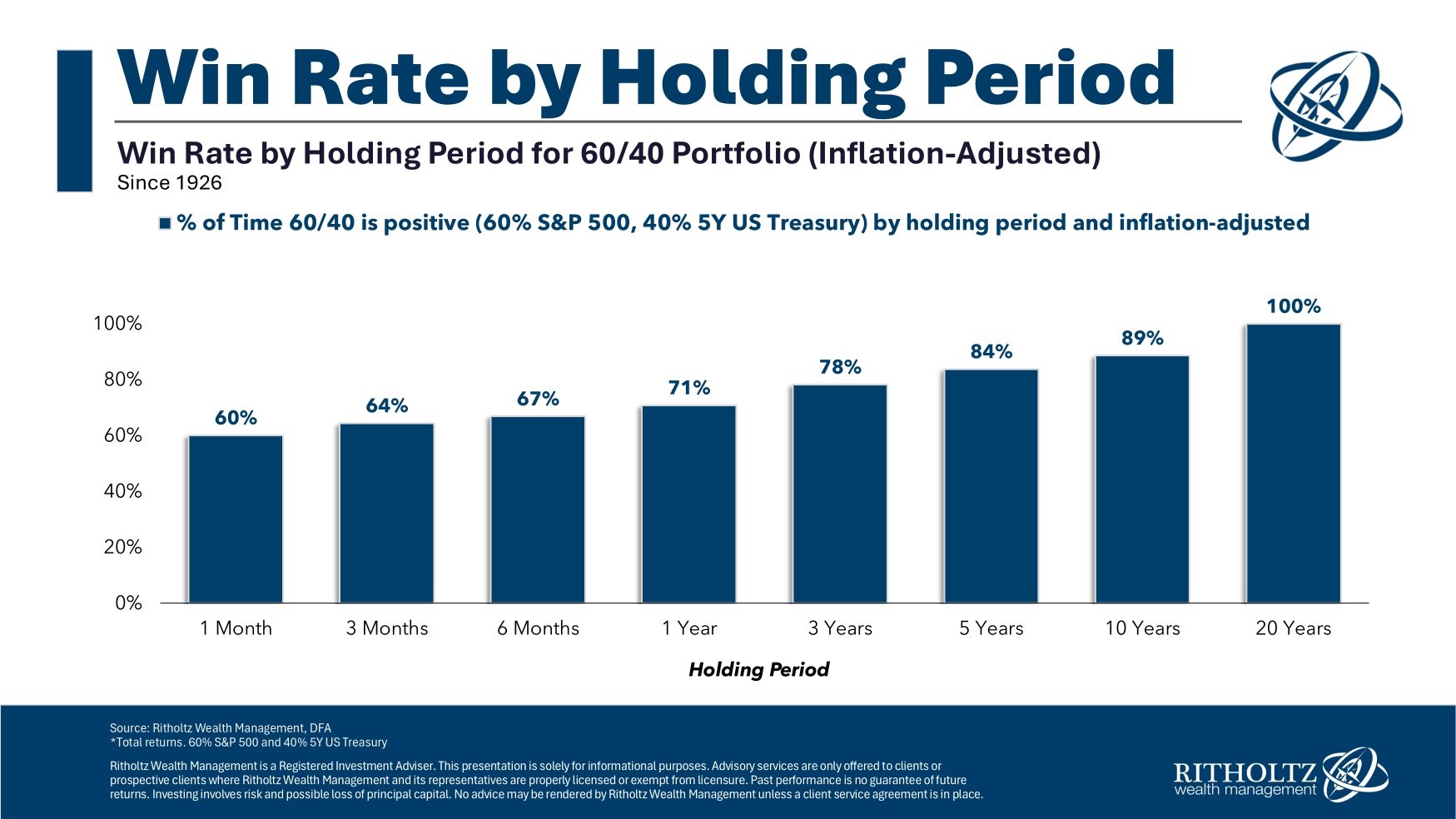

I looked at a diversified portfolio using 60% in the S&P 500 and 40% in 5 year Treasuries going all the way back to 1926:

That’s pretty, pretty good.

The monthly numbers are the same as the stock market while the 1 year, 3 year, 5 year and 10 year win rates were slightly better for a 60/40 portfolio.

In the history of this data, there has never been a negative 10 year return for a diversified mix of U.S. stocks and bonds. That’s a phenomenal track record.

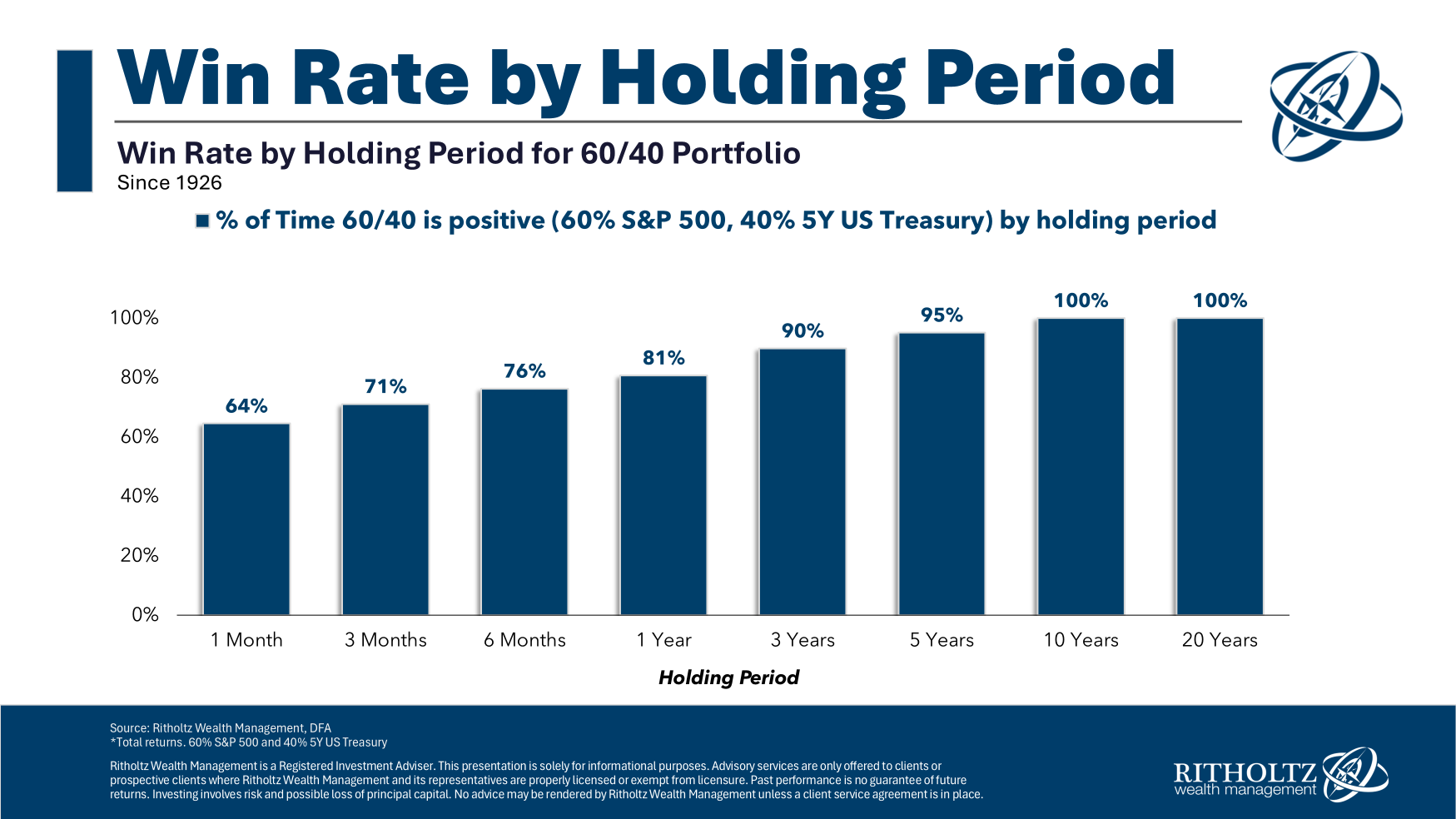

The biggest pushback I typically receive when producing these kinds of charts is the lack of an inflation adjustment.1

For all of the real return people, here are the inflation-adjusted win rates over the same holding period for the same 60/40 portfolio:

That knocks things down a little bit but it’s in the same section of the ballpark.

The data is pretty clear — the longer your time horizon, the more likely you will experience positive results.

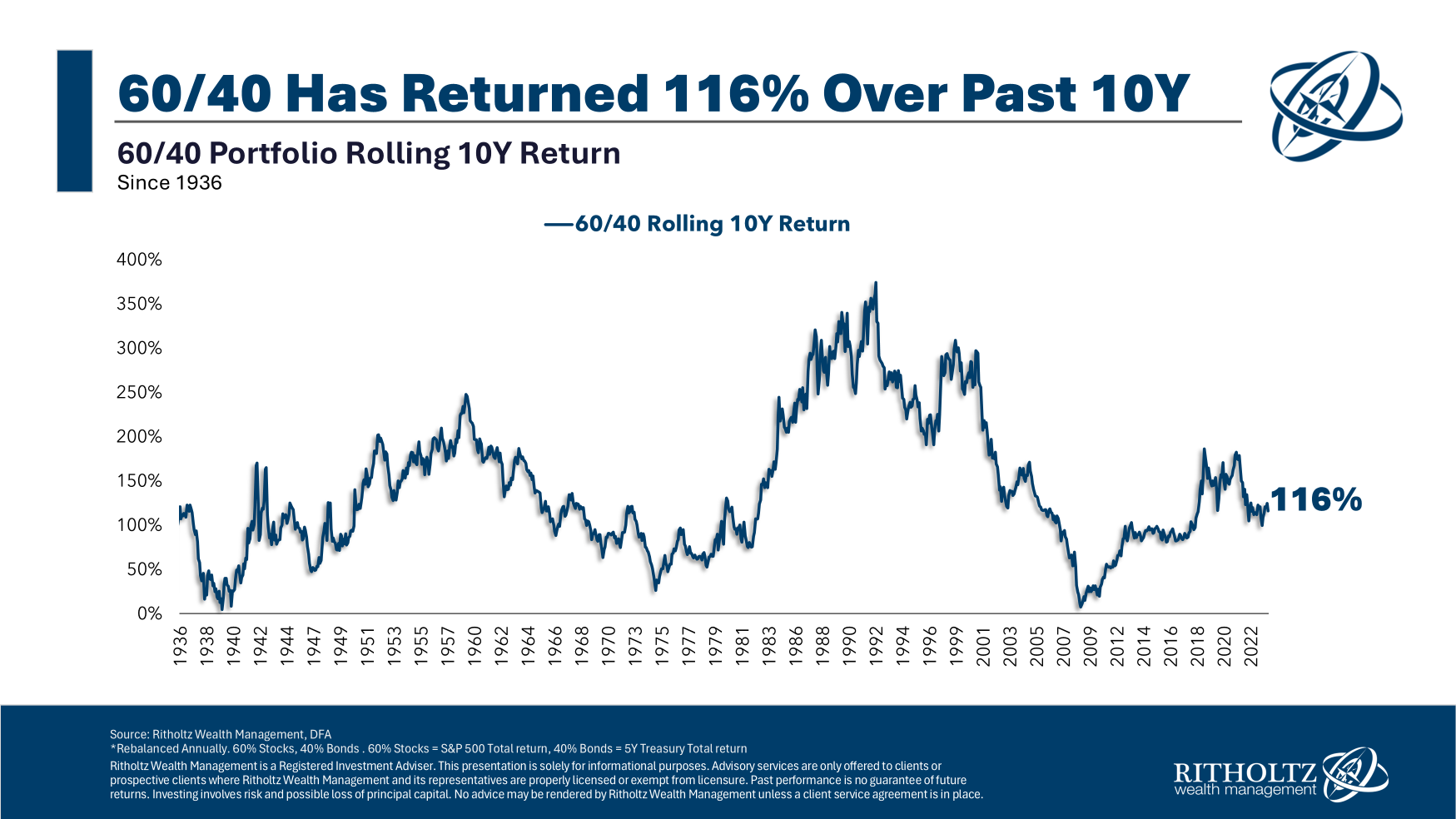

Of course, the level of returns are promised to no one and end up all over the map. These are the historical rolling 10 year total returns:

Some 10 year returns have been better than others but the results have been impressive nonetheless.

Long-term investing continues to give the vast majority of investors the best odds of success.

We dissected this question on this week’s all-new Ask the Compound:

Callie Cox, our new Chief Market Strategist at Ritholtz Wealth, joined me on the show this week to discuss questions about the potential for a recession, what the Fed should do now, going all in on the Nasdaq 100 in your retirement accounts and how markets move in off hours.

Further Reading:

What’s the Worst Long-Term Return For U.S. Stocks?

1Taxes and fees are excluded as well, of course.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.