Paul Tudor Jones made some waves last week on a CNBC interview:

He’s worried government spending and deficit levels are going to lead to a crisis:

“The question is after this election will we have a Minsky moment here in the United States and U.S. debt markets?” Jones said, referring to shorthand for a dramatic decline in asset prices.

“Will we have a Minsky moment where all of a sudden there’s a point of recognition that what they’re talking about is fiscally impossible, financially impossible?” he continued.

I received a lot of questions about this one. Tudor Jones is a legendary hedge fund manager. He’s articulate, intelligent and well-respected.

I’m not as worried as hedge fund managers are about government debt levels. Could our government spending levels become a problem down the line? Sure, I understand the worry.1

But you also have to understand hedge fund managers are always worried about this kind of stuff.

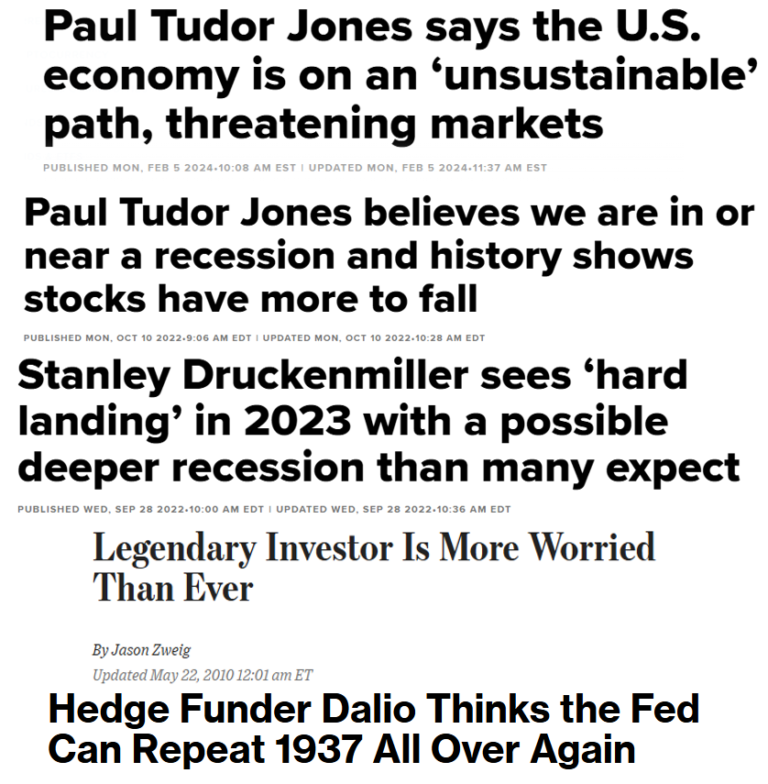

Here’s Tudor Jones earlier this year:

It sounded smart at the time, yet markets are having one of their best years ever.

And in 2022:

He called for a recession just like everyone else that never came.

He was also warning about the deficit back in 2018 to CNBC:

“I want to own commodities, hard assets, and cash. When would I want to buy stocks? When the deficit is 2%, not 5%, and when real short-term rates are 100bp, not negative. With rates so low, you can’t trust asset prices today.”

The stock market is up 140% since then and the deficit has only increased. Rates are higher too.

How about some other hedge fund manager predictions?

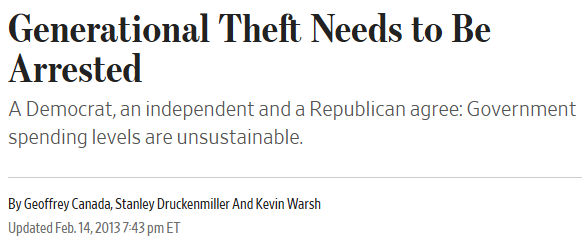

Stanley Druckenmiller wrote a piece for The Wall Street Journal sounding the alarm on government debt all the way back in 2013:

I guess government spending is even more unsustainable now.

It’s not just government debt they try to scare you about.

Ray Dalio was predicting a repeat of the 1937 Great Depression echo crash for years (see here and here). He said the supercycle was coming to an end in 2015. Nope.

Value investor Seth Klarman told Jason Zweig the following all the way back in 2010:

By holding interest rates at zero, the government is basically tricking the population into going long on just about every kind of security except cash, at the price of almost certainly not getting an adequate return for the risks they are running. People can’t stand earning 0% on their money, so the government is forcing everyone in the investing public to speculate

I am more worried about the world, more broadly, than I ever have been in my career.

The S&P 500 is up more than 530% since these warnings.

Look, I’m not trying to make these guys look bad. Everyone is wrong about the markets and the economy. These guys are all billionaires. They’re going to be fine either way.

I’m sure Paul Tudor Jones, Stanley Druckenmiller, Ray Dalio and Seth Klarman have all done just fine with their portfolios during this cycle despite their dire warnings. You have to watch what they do, not what they say.

Are hedge fund managers brilliant?

Absolutely.

Excellent traders, investors and risk managers?

Yes they have enviable track records.

Are they accurate with their macro predictions?

Occasionally they get lucky, but they’re wrong far more often than they’re right.

They’re hedge fund managers who are apt to change their minds. Their positions can and will change and don’t always match their talking points. Talking about gigantic risks on CNBC is also a great way to market your funds to potential clients.

Fear sells.

You can listen to legendary hedge fund managers all you want. These people are obviously richer and more successful than I am. But here is a handy rule of thumb I have about these masters of the universe:

Never take financial advice from hedge fund managers.

Words to live by.

Michael and I talked about Paul Tudor Jones, government debt levels and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

You Are Not Stanley Druckenmiller

Now here’s what I’ve been reading lately:

Books:

1The people screaming from the rooftops about government debt levels are always predicting a crisis. My take is inflation is the biggest constraint on government spending because we have the ability to print our own currency.