Today’s Talk Your Book is sponsored by LifeX:

- See here for more information on the LifeX Longevity Income ETFs

On today’s show, we discuss:

- How the Longevity Income ETFs work

- How this product fits within the income market

- What LifeX is investing in

- Aligning spending and financial plans with predictable cash flow

- Understanding bond ladders and why they work well within ETFs

- How the inflation-adjusted longevity income ETFs work

- Choosing between inflation-adjusted vs non-inflation adjusted income ETFs

- LifeX fees over time

Listen here:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

Important Disclosures – Stone Ridge Longevity ETFs

Investors should carefully consider the risks and investment objective of (i) the Stone Ridge Longevity Income 2048 ETF and each other series of Stone Ridge Trust with the same investment objective and strategy that is part of the same fund family (the “Stone Ridge Longevity Income ETFs”) and (ii) the Stone Ridge 2048 Inflation-Protected Longevity Income ETF and each other series of Stone Ridge Trust with the same investment objective and strategy that is part of the same fund family (the “Stone Ridge Inflation-Protected Longevity Income ETFs” and, together with the Stone Ridge Longevity Income ETFs, the “Stone Ridge Longevity ETFs” and each, an “ETF”), as an investment in the Stone Ridge Longevity Income ETFs may not be appropriate for all investors and are not designed to be a complete investment program. Before making an investment decision, investors should (i) consider the suitability of this investment with respect to an investor’s investment objectives and individual situation and (ii) consider factors such as an investor’s net worth, income, age and risk tolerance. There can be no assurance that an ETF will achieve its investment objectives.

Investors should consider the investment objectives, risks, and charges and expenses of the Stone Ridge Longevity Income ETFs carefully before investing. The prospectus contains this and other information about the investment company and may be obtained by visiting www.lifexfunds.com. The prospectus should be read carefully before investing.

An investment in the Stone Ridge Longevity Income ETFs involves risk. Principal loss is possible.

The purpose of each Stone Ridge Longevity Income ETF is to provide reliable monthly distributions consisting of income and principal through the end of a calendar year specified in the ETF’s prospectus. The purpose of each Stone Ridge Inflation-Protected Longevity Income ETF is to provide reliable monthly inflation-linked distributions consisting of income and principal through the end of a calendar year specified in the ETF’s prospectus.

Each Stone Ridge Longevity Income ETF intends to make distributions for which a portion of each distribution is expected and intended to constitute a return of capital, which will reduce the amount of capital available for investment and may reduce a shareholder’s tax basis in his or her shares.

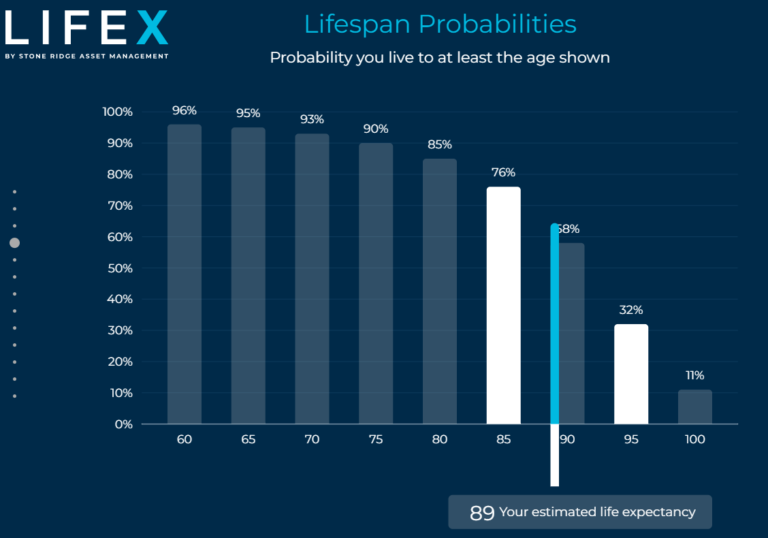

Each Stone Ridge Longevity Income ETF is designed to make distributions at a rate calibrated based on the life expectancy of persons born in a specified calendar year (the “Modeled Cohort”), with the understanding that members of its Modeled Cohort are expected to be able to invest in a closed-end fund (each, a “Closed-End Fund”) that seeks to continue to receive that distribution rate beyond age 80.

Each Stone Ridge Longevity Income ETF intends to make an identical distribution each month equal to $0.0833 per outstanding share of the ETF (multiplied, in the case of the Stone Ridge Inflation-Protected Longevity Income ETFs, by an inflation adjustment as specified in the ETF’s prospectus, which is intended to reflect the cumulative impact of inflation since the launch of the ETF) until April of the year in which members of the Modeled Cohort reach age 80. Thereafter, the ETF will reduce its per-share distribution rate to a level estimated to be sustainable through the year in which the Modeled Cohort reaches age 100. This event is referred to herein as the “recalibration.” An estimate of this reduced distribution rate is provided in each ETF’s prospectus; however, there is a risk that the ETF may ultimately recalibrate its distribution to be higher or lower than this estimate.

Unlike a traditional investment company with a perpetual existence, each ETF is designed to liquidate in the year that its Modeled Cohort reaches age 100, and there will be no further distributions from each ETF beyond that year. Each ETF’s distribution rates will be recalibrated in April of the year in which the applicable Modeled Cohort turns 80 to a level designed to be sustainable until the year in which the applicable Modeled Cohort reaches age 100. However, due to certain risks impacting the market for the ETF’s investments, such as the risk of a U.S. government default, it is possible that an ETF may run out of assets to support its intended distributions prior to its intended term. Investors should consider the price of the ETF’s shares and the remaining term of the ETF at the time of their purchase when determining whether the ETF is appropriate for their financial planning needs.

The planned distributions by the ETFs are not intended to change other than in connection with the one-time recalibration of the Fund’s distributions in the year in which the Modeled Cohort turns 80. While the Fund’s investment strategy is intended to substantially reduce the impact of changes in interest rates on the recalibration of its distribution rate, the recalibrated distribution rate may nonetheless be lower than currently estimated if interest rates decrease prior to the recalibration date. On the other hand, if interest rates increase, shareholders face the risk that the value to them of an ETF’s distributions will decrease relative to other investment options that may be available at that time, and that the market value of their shares will decrease. Similarly, if inflation is higher than expected, shareholders face the risk that the value to them of the ETF’s distributions will decrease relative to the cost of relevant goods and services.

In the case of the Stone Ridge Inflation-Protected Longevity Income ETFs, the amount of an ETF’s distributions will be adjusted for realized inflation, not changes in market interest rates. If interest rates increase, shareholders face the risk that the value to them of an ETF’s distributions will decrease relative to other investment options that may be available at that time, and that the market value of their shares will decrease. Additionally, each Stone Ridge Inflation-Protected Longevity Income ETF will generally seek to fund its distributions and payments by purchasing Treasury Inflation-Protected Securities (“TIPS”) with cash flows that approximately match, in timing and amount, or in interest rate exposure, those distributions and payments. Because TIPS are only available in a limited number of tenors (i.e., lengths of time prior to expiration), this matching will only be approximate, and the ETF will need to periodically buy and sell securities issued by the U.S. Treasury, including TIPS, to fund any additional amounts needed to meet its distribution and payment obligations. This buying and selling activity exposes the ETF to interest rate and inflation risk, as changes in interest rates or expected inflation could make the securities it needs to purchase more expensive or make the securities it needs to sell less valuable. These risks are heightened in the early years of the ETF. These risks are also heightened in the case of a change to interest rates or expected inflation that disproportionately impacts particular tenors of U.S. Treasury securities (what is sometimes referred to as a “non-parallel shift”) because such a change could make the U.S. Treasury securities the ETF needs to buy more expensive without simultaneously making the U.S. Treasury securities already held by the ETF more valuable, or could make the U.S. Treasury securities the ETF needs to sell less valuable without simultaneously making the U.S. Treasury securities the ETF needs to buy less expensive.

The Stone Ridge Longevity Income ETFs invest in debt securities issued by the U.S. Treasury (“U.S. Government Bonds”) as well as money market funds that invest exclusively in U.S. Government Bonds or repurchase agreements collateralized by such securities. U.S. Government Bonds have not historically had credit-related defaults, but there can be no assurance that they will avoid default in the future.

Each Stone Ridge Longevity Income ETF is designed to support the option for members of its Modeled Cohort to continue to pursue substantially identical monthly distributions beyond age 80 by investing in a Closed-End Fund. However, the Closed-End Funds may not become available as intended. For example, the Adviser may determine that it is not appropriate to launch the Closed-End Funds if the Adviser believes may not be a sufficiently diverse investor base, which is expected to be at least 100 shareholders. In the absence of a Closed-End Fund, investors may remain invested in the relevant ETF; alternatively, an investor may sell his or her shares, though investors may not have available to them an alternative investment option that provides the same level of distributions as they might have been able to receive if a Closed-End Fund were available. Shares of the ETFs may continue to be held by a shareholder’s beneficiary or may be sold at the then-current market price. However, a beneficiary of an ETF shareholder will not be eligible to invest in a corresponding Closed-End Fund unless the beneficiary is a member of the Modeled Cohort. The Closed-End Funds will be subject to different and additional risks as will be disclosed in the Closed-End Funds’ prospectuses. This is not an offer to sell or the solicitation of an offer to buy securities of the Closed-End Funds. A form of a Closed-End Fund’s prospectus (which is subject to revision) is included as Appendix A to each ETF’s prospectus.

If made available, Closed-End Funds shares will be subject to additional risks, including:

The ETFs are subject to risks related to exchange trading, including the following:

- Each ETF’s shares will be listed for trading on an exchange (the “Exchange”) and will be bought and sold on the secondary market at market prices. Although it is expected that the market price of ETF shares will typically approximate the ETF’s net asset value (“NAV”), there may be times when the market price reflects a significant premium or discount to NAV.

- Although each ETF’s shares will be listed on the Exchange, it is possible that an active trading market may not be maintained.

- Shares of each ETF will be created and redeemed by a limited number of authorized participants (“Authorized Participants”). ETF shares may trade at a greater premium or discount to NAV in the event that the Authorized Participants fail to fulfill creation or redemption orders on behalf of the ETF.

Each ETF has a limited operating history for investors to evaluate, and new ETFs may not attract sufficient assets to achieve investment and trading efficiencies.

For additional risks, please refer to the prospectus and statement of additional information.

The information provided herein should not be construed in any way as tax, capital, accounting, legal or regulatory advice. Investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Opinions expressed are subject to change at any time and are not guaranteed and should not be considered investment advice.

The Stone Ridge Longevity ETFs are distributed by Foreside Financial Services, LLC.