A reader asks:

Which presidential candidate is more likely to cause a recession/bear market: Trump or Harris?

This question obviously came in before we had the election results but my answer would be the same regardless of who won.

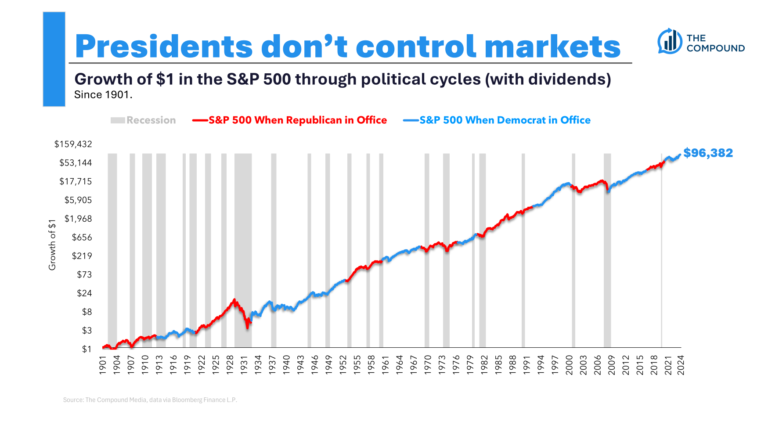

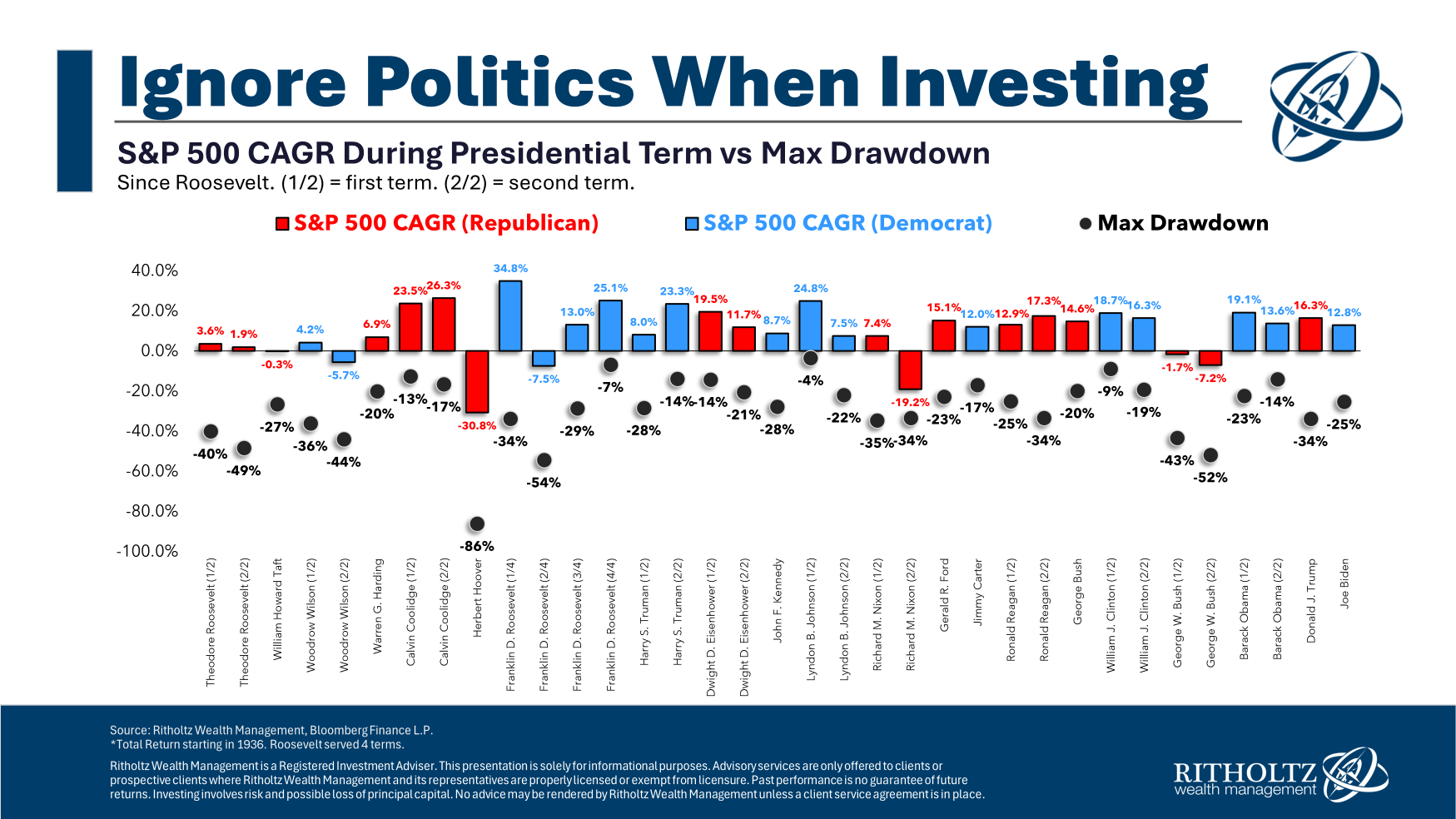

Here’s a look at the max drawdown by presidential term going all the way back to Teddy Roosevelt:

Some are worse than others but it would be hard to pinpoint any kind of relationship between presidents and stock market downturns.

I’m pretty confident we will have a big correction or bear market at some point over the next four years. The president can’t stop the stock market from going down. It just happens.

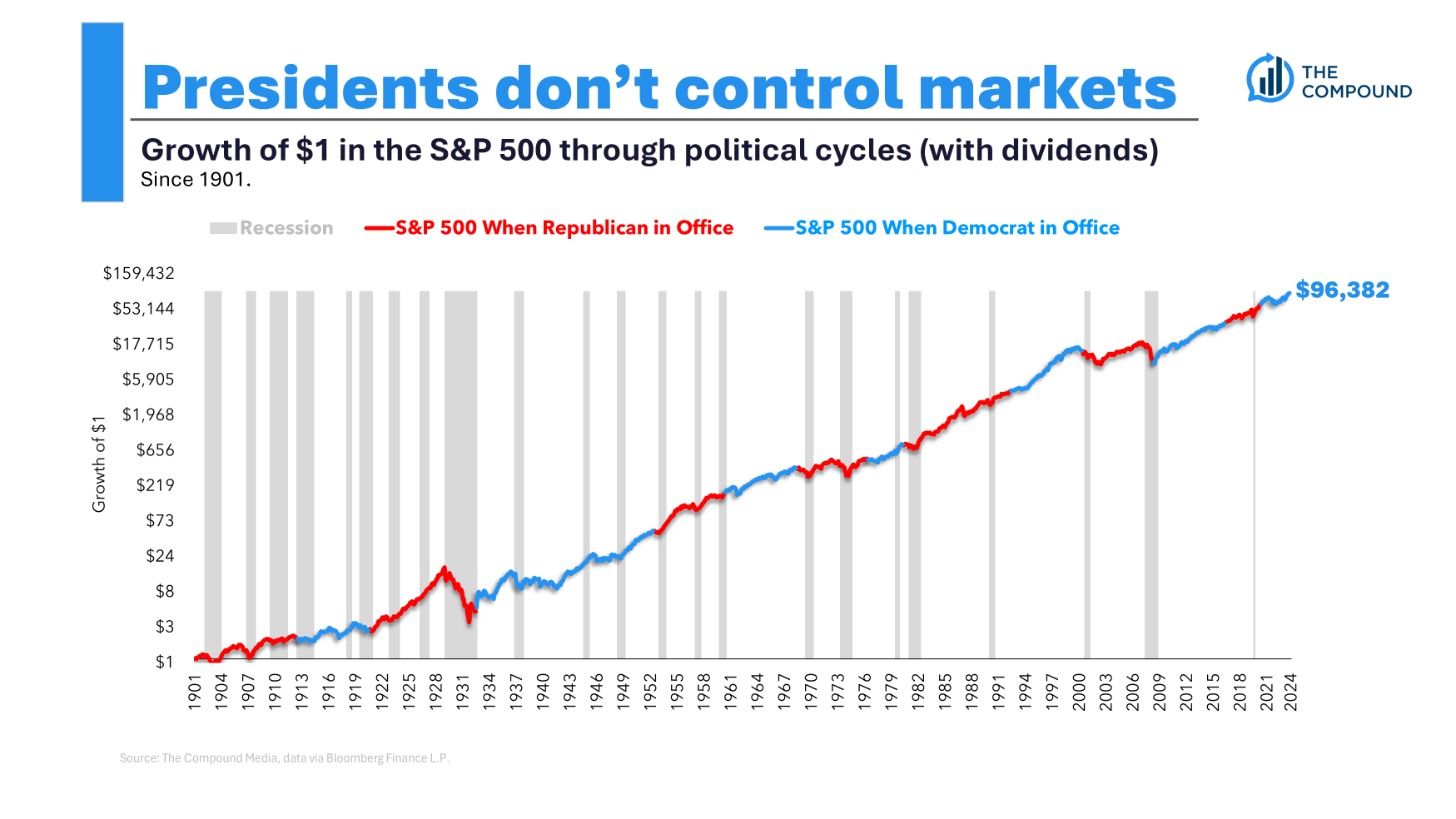

As far as recessions go, here’s a look at how they stack up by administration and the long-term stock market chart:

There were obviously far more recessions in the pre-WWII era than more modern economic times.

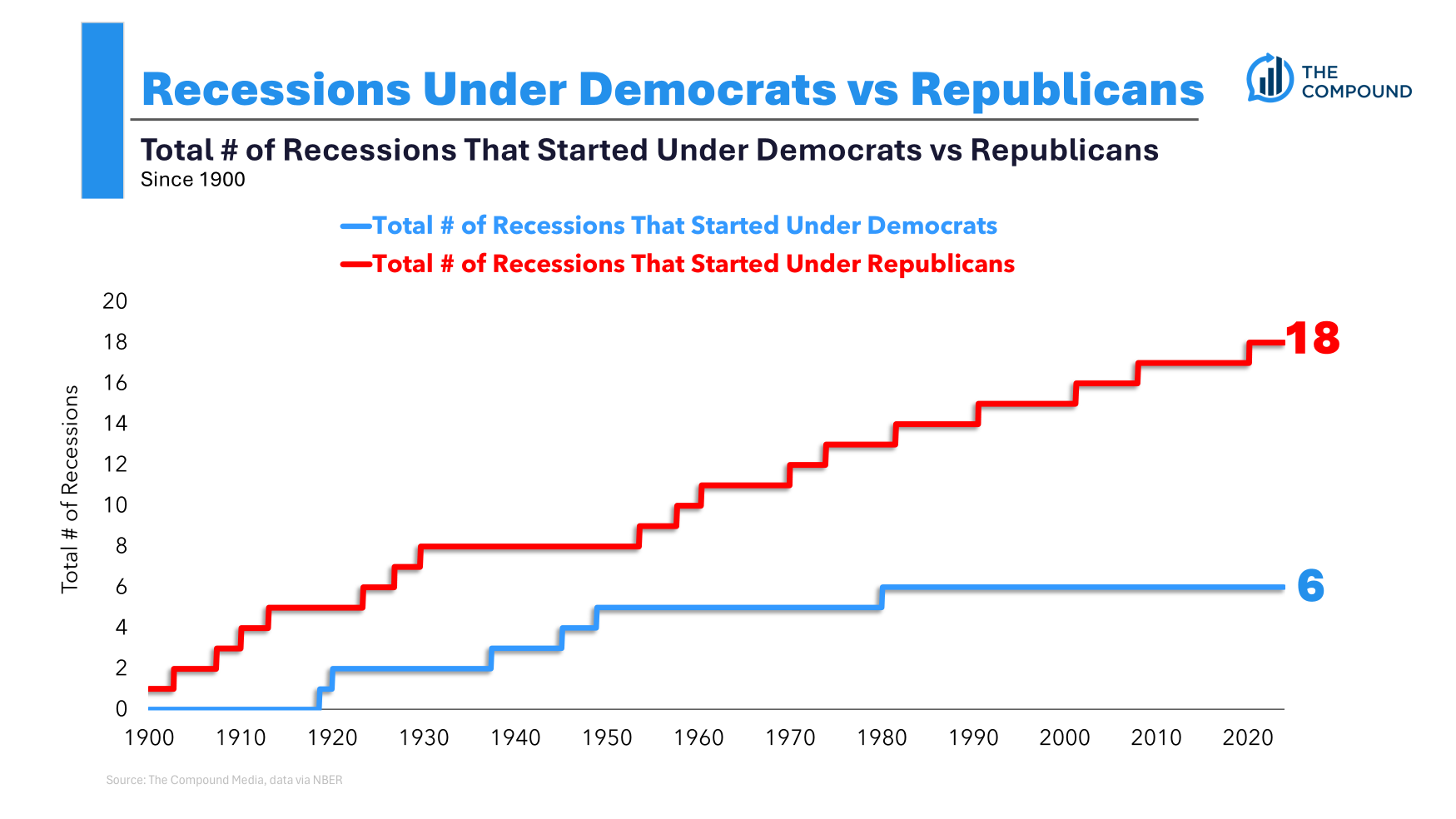

I also had our research team look at the number of recessions started by the two political parties:

I was surprised here. There have been way more recessions started during Republican presidential terms than Democrats.

However, I don’t think this really tells us anything. Context is required here.

Was Ronald Reagan an economic maestro, or did he take over during a period of disinflation and falling interest rates?

Was George HW Bush a terrible student of finance or did his re-election fall during a slowdown in the economy?

Was Bill Clinton an economic savant, or did he happen to run the country during a period of economic nirvana, favorable demographics and the dot-com bubble?

Was George W. Bush bad at the economy or did he happen to take office coming out of a two-decade-long bull market and two of the biggest bubbles in history (stocks and housing)?

Were Obama and Trump masters of finance or were they presidents coming into an economic recovery, technology boom and low rate environment?

Did Joe Biden personally push up the stock market and housing prices or did the pandemic spending binge cause a boom in the 2020s?

You can nitpick if you’d like and point to certain policies and decisions made or not made but the point is this stuff is cyclical. Sometimes presidents are simply lucky or unlucky depending on the timing of when they come into office.

So is Trump going to be lucky or unlock in the next four years?

On the one hand, we’ve had exactly one recession over the past 15 years and it lasted just two months. You could say we’re due for a recession (regardless of who the president is).

On the other hand, here’s a look at the current set-up he’s walking into:

- Unemployment rate 4.1%

- Inflation rate 2.4%

- 10 year treasury rate 4.4%

- Real GDP growth 2.8%

If there is such a thing as a sweet spot for the U.S. economy, we’re in it right now. Plus you have the Fed in an easing cycle.

Surely, that can’t last forever of course. Then, there is the prospect of higher inflation if Trump enacts his tariff plans. But we just lived through a period where higher inflation didn’t lead to a recession and round and round we go.

If the past three years have taught us anything about the economy it’s that predicting recessions is hard.

It’s hard when using economic data. It’s hard when using the stock market or yield curve as an indicator. It’s hard when using vibes. And it’s hard when using politicians.

Recessions and bear markets are features of the financial system in which we operate.

You must take them into account in your investment plan.

But that doesn’t mean you have to forecast them in advance.

We talked about this question on this week’s Ask the Compound:

Bill Artzerounian joined me on this show this week to talk about the election’s impact on your taxes, the downsides of early retirement, tax planning for retirement and when to fill up your Roth buckets for retirement savings.

Further Reading:

Some Things I Don’t Believe About Investing

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.