I’m a big proponent of simplicity, mainly because I’ve witnessed the ill-effects of complexity in the finance world.

Advice doesn’t have to be complicated to be effective.

The two most important medical breakthroughs of the modern era are likely penicillin and washing your hands to stop the spread of infection in hospitals.

Life expectancies are rising because people quit smoking, wear seatbelts and apply sunscreen.

There are of course other factors at play here but most of the time the simple explanations get you most of the way there.

Stock market pundits, analysts and portfolio managers spend a lot of time and energy analyzing economic and financial data — economic growth, inflation, interest rates, corporate earnings, financial statements, government policies, etc.

Many different variables impact individual stocks and the stock market as a whole so it pays to cast a wide net when trying to understand the drivers.

I also think there are some simple explanations in the markets that people do not pay enough attention to.

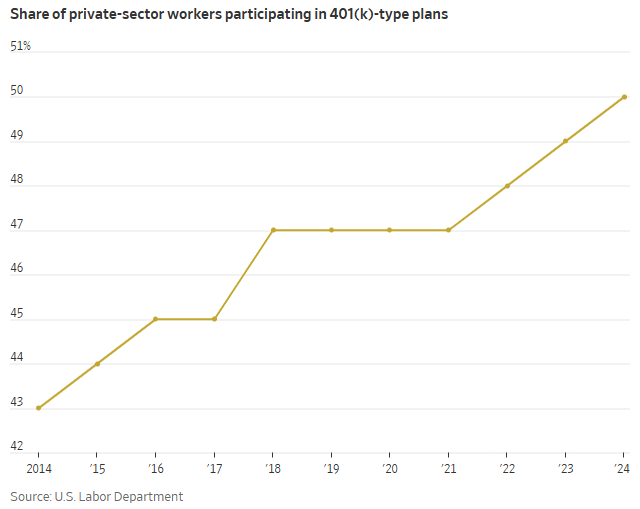

The Wall Street Journal talks about the growth in defined contribution retirement plans:

It took nearly 50 years, but half of private-sector workers are saving in 401(k)s for the first time.

Long after workplaces started using these retirement plans in place of traditional pensions, they are finally reaching a tipping point. Around 70% of private-sector employees in the U.S. now have access to a 401(k)-style retirement plan. A decade earlier, 60% had access and 43% contributed, according to the U.S. Labor Department.

This is good news.

The chart says a lot:

There is plenty of short-term speculative behavior going on in the markets these days but tax-deferred retirement plans encourage good long-term behavior — opt-out sign-ups, automatic contributions, targetdate funds, automatic rebalancing, escalated savings rates, etc.

People are buying stocks at regular intervals. The number of people doing so increases every single year.

Price is driven by supply and demand. More people buying stocks, regardless of the market environment, has to have an impact.

Demographics will also be one of the simpler explanations for many economic trends over the next 20-30 years.

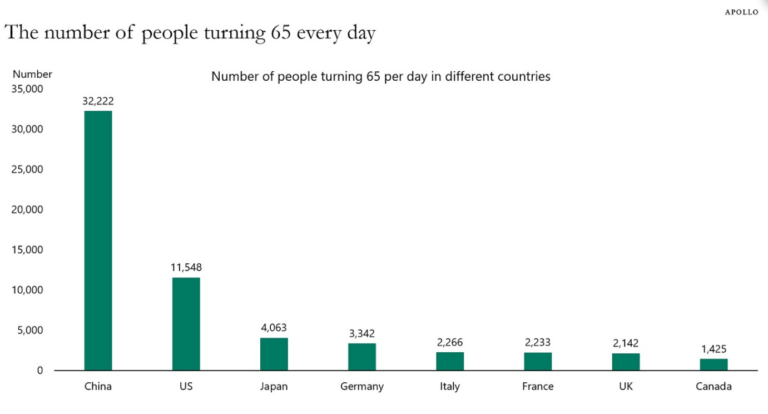

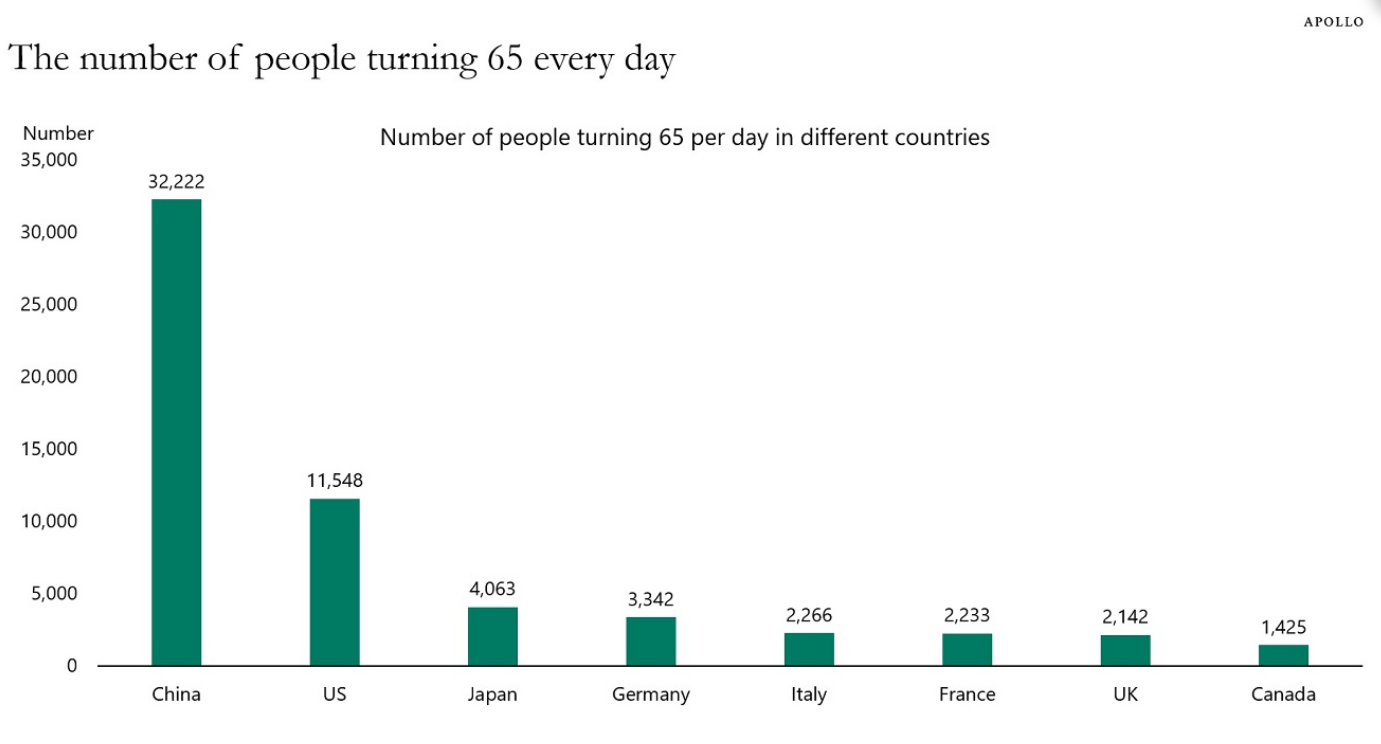

Torsten Slok shows the number of people turning 65 every day by country:

In China, more than 30,000 people are hitting retirement age every day. In the United States, it’s more than 11,000. This cohort controls an enormous amount of wealth (more than $82 trillion in the U.S. alone).

So where are the impacts of an aging population with a growing pile of wealth being felt?

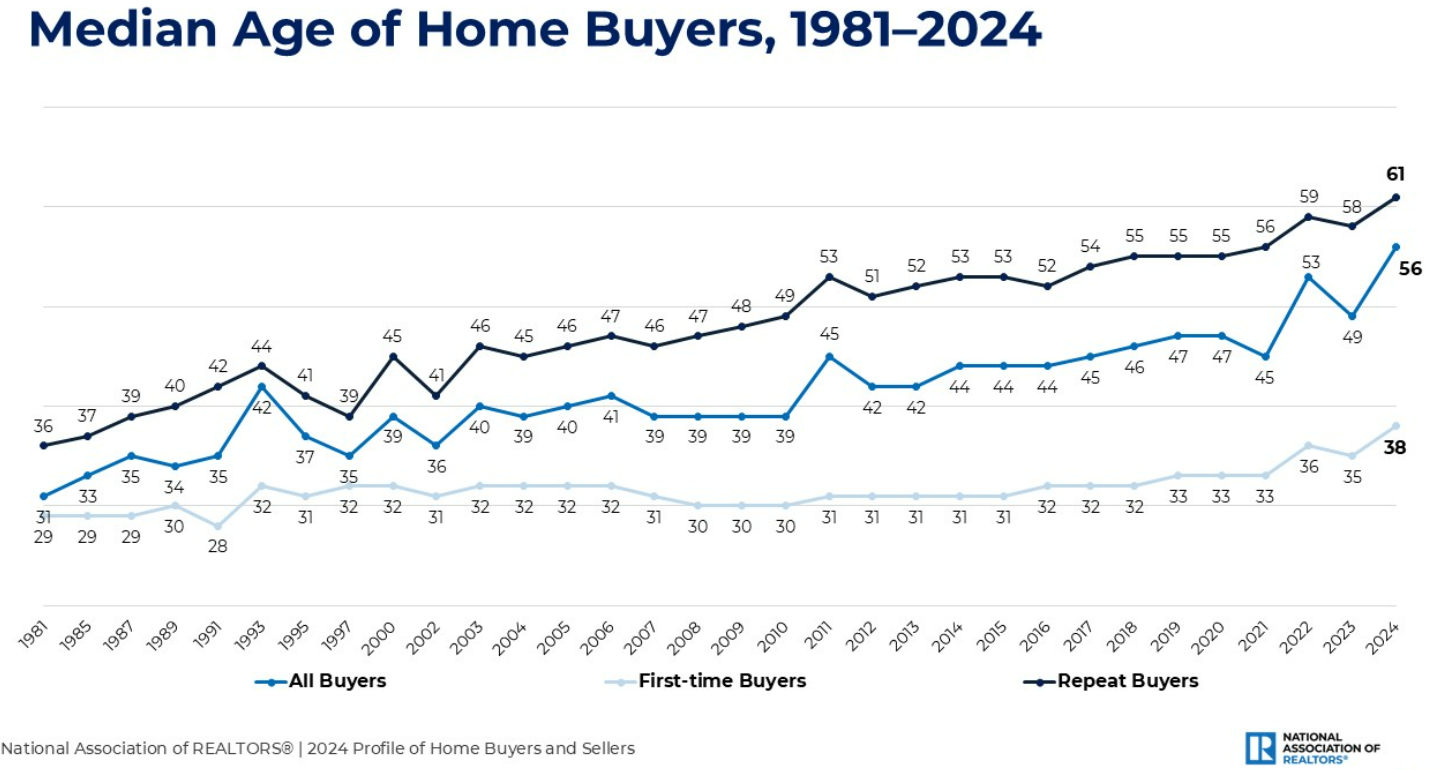

You can clearly see it in the housing market:

The median age of first-time homebuyers has gone from 31 in 1981 to 38 now. It was 33 as recently as 2021, which reflect how much more expensive it is to buy a house these days.

But look at the median age of repeat buyers — from 36 in 1981 to 61 today!

It certainly helps that many baby boomers have a large amount of equity in their homes. It’s also true that some 40% of all residential real estate is owned outright, meaning no mortgage.

That makes it much easier for older homeowners to move without having to deal with 7% mortgage rates in many cases.

All of that baby boomer wealth is going to make an impact for the next generation trying to buy a house too.

The amount of money that will be inherited in the coming years has been estimated at anywhere from $84 trillion to $105 trillion. But that money won’t be evenly distributed. The top 2% controls around half of that wealth.

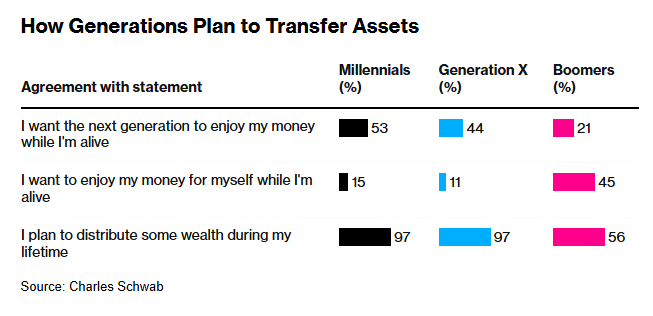

Many of the baby boomer generation plans on waiting to pass that money down:

If most of that money has a time horizon that skips a generation, as opposed to being spent down, it’s hard to envision the wealthiest generation in history crashing the stock market by selling their assets in retirement.

I’m not here to tell you the stock market can’t or won’t go down in the future. Of course it will. We just had a bear market two years ago.

But there are forces at play in the stock market that are extending investor time horizons.

Good luck betting against these forces in the long-run.

Further Reading:

The Automatic Investing Revolution