A reader asks:

I’ve seen some pundits (*cough* Chamath *cough*) now shifting their stance to “short-term pain for long-term gain” from all of the political upheaval we’re seeing. Basically the idea is a recession will actually be useful because home prices, stock prices and interest rates will go down. I think this is nuts but wanted to hear your take — are there any positives from a recession?

In just a few short months we’ve gone from worries about an economy that could be at risk of overheating to worries about the economy slowing dramatically. GDP estimates for Q1 have gone from nearly +4% a month ago to -2.8% in a hurry:

These estimates are not set in stone, but economic activity is slowing.

One thing we’ve learned these past few years is that no one is good at predicting the timing of recessions, but that doesn’t stop people from speculating about the potential ramifications of an economic contraction when it finally arrives.

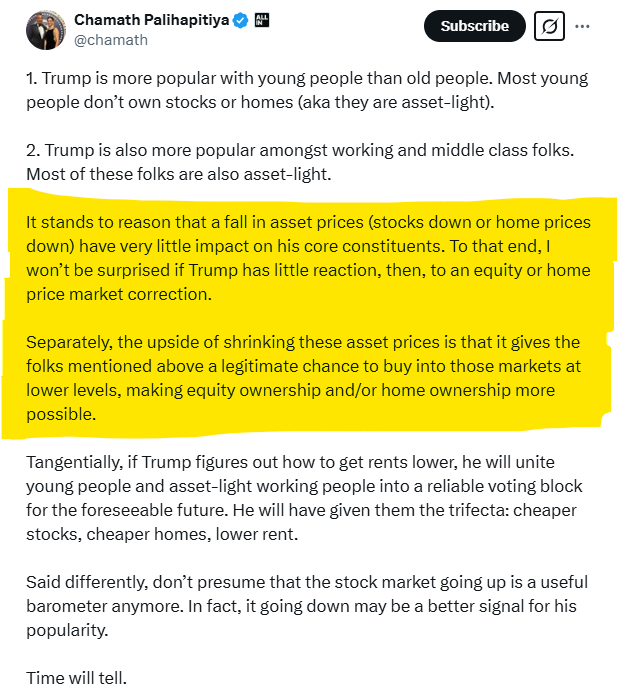

Here’s what Chamath had to say on Twitter about the prospect of Trump’s no policies potentially throwing the country into a recession:

It’s a long one so allow me to summarize: A significant percentage of the country doesn’t own much in the way of financial assets like stocks or a house. If we have a recession that should bring stock prices and housing prices down which would make them more accessible to more people.

He’s looking for a silver lining. I get that. I’m a glass-is-half-full guy too.

This sounds great in theory.

Plenty of young people would like more affordable home prices and a better entry point into the stock market. A recession would also likely mean lower borrowing costs so mortgage rates would be lower.

What’s not to like?

Since 1950, there have been nine bear markets. The average drawdown in those bear markets was a loss of 35.5%, lasting 406 days from peak to trough. The ability to buy stocks on sale should be a welcomed development for young people or anyone who will be a net saver in the years ahead.

The problem is you don’t get to experience recessions in a vacuum.

People lose their jobs. Businesses cut back or go belly up. People spend less money. It’s harder to find new employment or get a promotion. Wages fall. Big raises go away.

During the 2008 financial crisis and its aftermath there was a constant drumbeat of:

You’re lucky to even have a job.

You want a raise. In this economy?!

That lasted for years after the technical recession had ended.

A lot of finance people look at recessions through the lens of spreadsheets and charts. I’m guilty of this too. But the human toll from a recession cannot be overstated. Ronald Reagan once said, “A recession is when your neighbor loses their job. A depression is when you lose yours.”

Be careful what you wish for.

JP Morgan once said, “In bear markets, stocks return to their rightful owners.”

Some interpret that as a behavioral lesson where only those investors with enough intestinal fortitude to lean into the pain will buy when stocks are on sale. There is some truth to that.

However, those “asset-light” individuals will struggle to pay their bills or keep their jobs during a recession because they have no support from financial assets. Who do you think is going to lean into the pain and buy? The people who buy will be the ones who already have the money.

The top 10% of households by wealth own nearly 90% of the stocks in the United States. They’re the ones who can keep buying in a downturn. Right or wrong, those are the rightful owners JP Morgan was referring to.

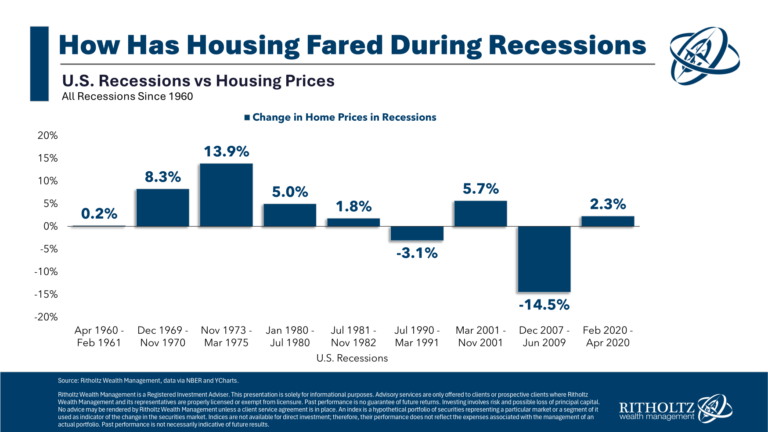

I also hate to be the bearer of bad news to prospective homebuyers but there is no guarantee that housing prices will fall, even if we go into a recession. This is housing price performance during every recession going back to 1960:

There was a brief decline in the 1990 recession and of course the Great Financial Crisis saw housing prices get walloped. Other than that, housing prices have been among the best hedges against a recession.

If the economy contracts, we may see some relief in mortgage rates. However, that doesn’t necessarily mean housing prices will drop. In fact, lower rates could actually drive more demand for homes, especially since activity has been sluggish with 7% mortgage rates. While increased market activity would be a positive development, it wouldn’t automatically lead to lower prices. It would be a good thing to see more activity in the housing market but that might actually lead to higher prices.

Personally, I would rather we don’t have a recession. Job loss is painful. It can set people back years of their lives.

However, you also have to recognize that you have no control over the reason for a recession–whether it be a financial crisis, pandemic, government policy, inflation or something else.

Whatever your station is in life you have to be prepared for a national or personal recession at some point:

- Ensure your emergency fund is well stocked.

- Have some other financial backstops in place.

- Create a thoughtful financial plan.

- Keep yourself employable.

- Keep saving money.

- Build a margin of safety into your budget.

Recessions can be a good thing for certain individuals and businesses. There have been a handful of great businesses founded during periods of economic pain — Airbnb, Uber, FedEx, Microsoft and LinkedIn to name a few.

But I’m not going to sit here and tell you to hope for a recession. Recessions are bad and we should avoid them if possible.

The drawbacks far outweigh the benefits.

We covered this question on this week’s Ask the Compound:

My tax guy Bill Sweet joined us on the show to discuss questions about Roth 401ks, dealing with uncertainty in a financial plan, buying a golf membership to a premium club and traditional vs. Roth assets in retirement.

Further Reading:

Market Timing a Recession