International diversification has been an anchor around the necks of balanced investors for some time now:

Outperformance between America and the rest of the world has historically been cyclical. The latest cycle has lasted much longer than any of the previous iterations.

Just look at how dominant the United States has been in terms of grabbing market share:

Here’s what I wrote back in December:

In 20 years of managing money I have never witnessed more dismal sentiment for international stocks, value stocks and really valuations in general.

Investors I come into contact with have all but given up on this stuff. I know you could have said the same thing the past 5-7 years or so but it feels like the dam truly broke this year. Investors are throwing in the towel.

Here’s the thing — international stocks have been cheaper than U.S. shares for some time now. There’s not much of a tech sector — especially in Europe — either. So the big question has always been: What’s the catalyst? Valuations alone are not a catalyst.

I think it’s possible we look back on the 2024 presidential election as the catalyst. President Trump has signaled the U.S. will cut back on our defense presence in the EU. The European countries are realizing they are on their own and need to change course.

Germany is going to embark on a massive fiscal policy reform to fill the void (via Bloomberg):

Germany plans to unleash hundreds of billions of euros in debt-backed financing for defense and infrastructure investments in a historic shift to overhaul its notoriously tight limits on government borrowing.

Friedrich Merz, who will likely be the next chancellor, announced late Tuesday that Europe’s biggest economy would amend the constitution to exempt defense and security outlays from limits on fiscal spending to do “whatever it takes” to defend the country. This will allow Berlin to allot essentially unlimited amounts of money to bolster its military.Merz’s conservative bloc and the Social

Democrats of outgoing Chancellor Olaf Scholz — Germany’s main center parties — also agreed to set up a €500 billion ($528 billion) infrastructure fund for urgently-needed investments in areas including transportation, energy grids and housing.

This is a huge divergence from the austerity measures implemented by Germany in the 2010s, one of the big reasons the EU has lagged so badly behind the U.S. economy. Interest rates are moving higher. You could also see a falling dollar if there is lower foreign investment in the U.S. from new trade deals and tariffs.

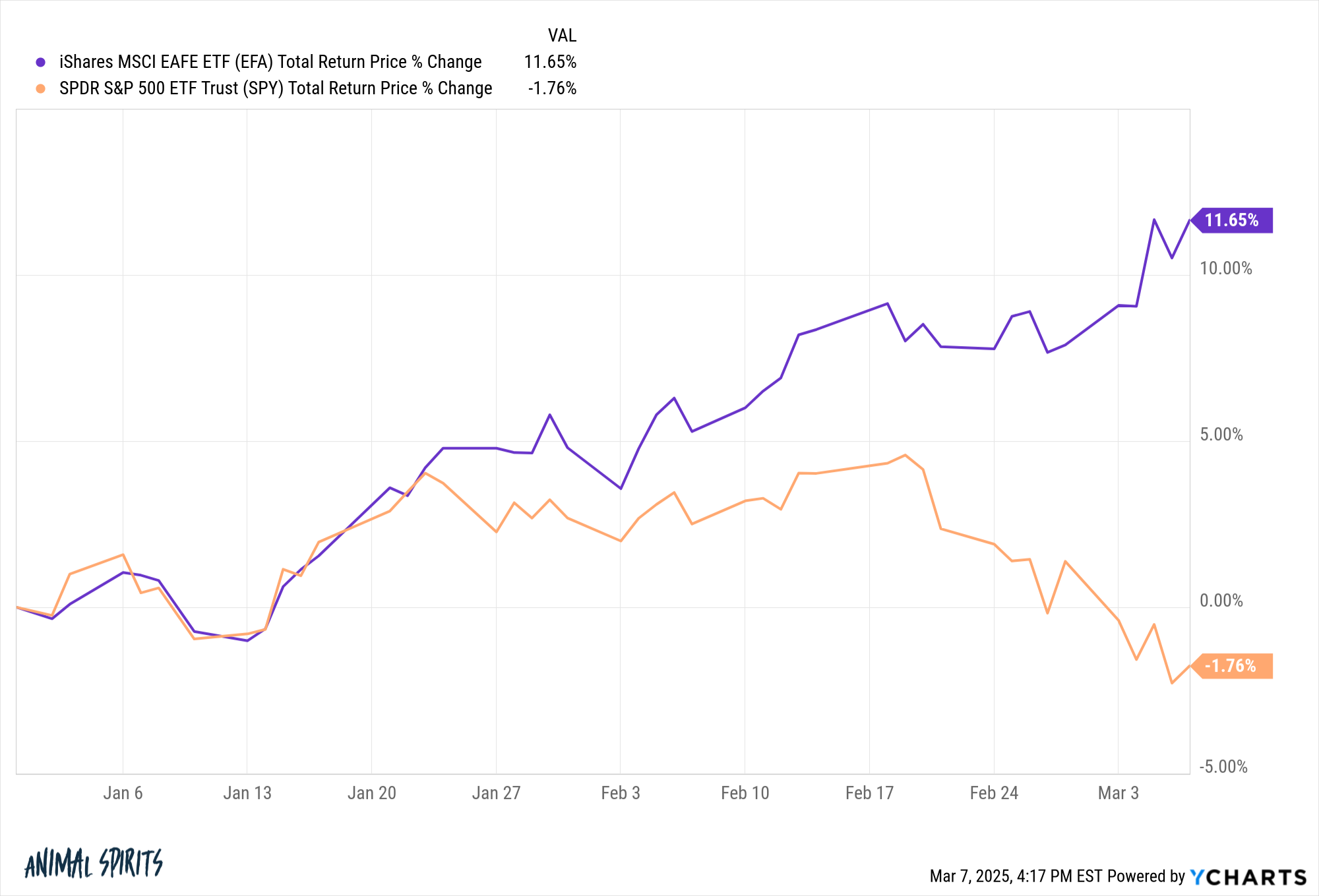

The stock market is taking notice this year as foreign-developed stocks are outpacing the S&P 500 by a healthy clip:

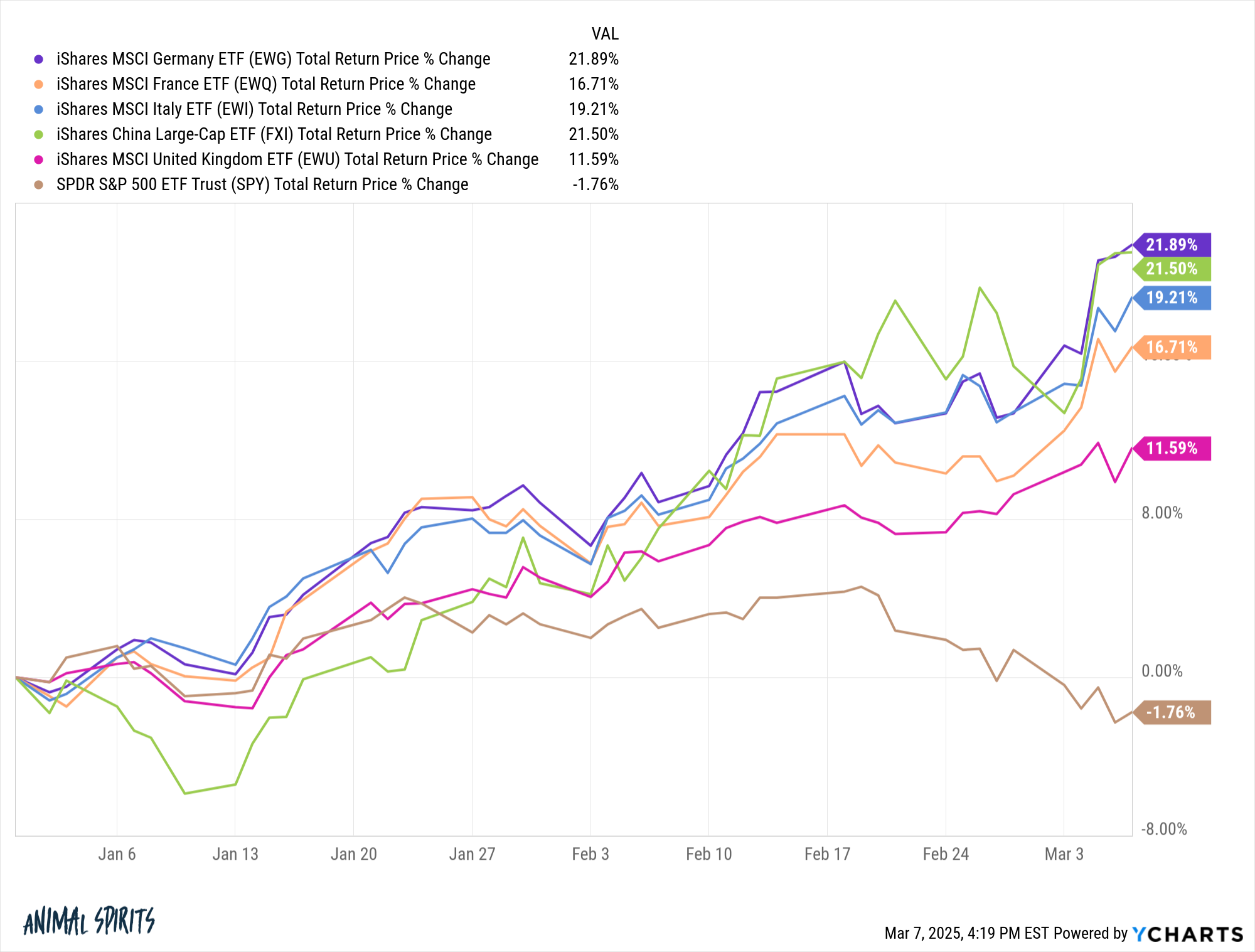

When you break it down even further by country you can see a potential breakout happening here in certain places:

Germany is going nuts a little more than two months into the year. So are Chinese stocks.

Obviously, this is just two months of performance. International stocks lagged badly last year. Maybe they’re just playing catch-up now. This could be another headfake in a series of headfakes over the years.

Maybe all of this won’t matter. Maybe AI will remain the dominant theme for the rest of this decade and beyond. Maybe all of the onerous rules and regulations and lack of innovation in Europe will make it hard to sustain the outperformance going forward.

But there is finally a logical path forward for international stocks. There is a catalyst that actually makes sense.

Maybe I’ll eat these words but I’m getting more and more bullish on diversification going forward.

Michael and I talked about international diversification and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Is Europe a Buy Here?

Now here’s what I’ve been reading lately:

Books:

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.