I have some good news and bad news about the state of retirement savings for Americans.

Let’s start with the bad news.

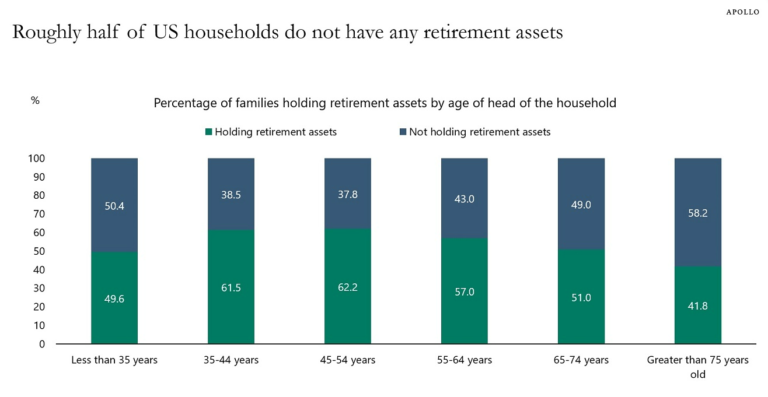

Torsten Slok shows half of American households have no retirement assets to speak of:

Young people still have time to play catch-up. It’s scary so many people 65 and older have no retirement assets to lean on. This is not great.

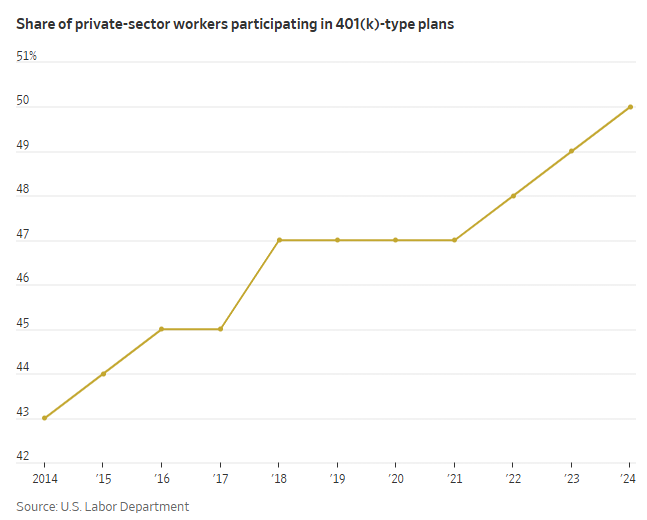

Now for some good news from The Wall Street Journal:

It took nearly 50 years, but half of private-sector workers are saving in 401(k)s for the first time.

Long after workplaces started using these retirement plans in place of traditional pensions, they are finally reaching a tipping point. Around 70% of private-sector employees in the U.S. now have access to a 401(k)-style retirement plan. A decade earlier, 60% had access and 43% contributed, according to the U.S. Labor Department.

Things are trending in the right direction:

Some 70% of private sector employees now have access to a workplace retirement plan, which means we have to work on getting that other 20% to sign up. Still, things are slowly but surely getting better with more retirement plans and automatic sign-ups.

So is the glass half full or half empty?

These numbers could always be better but I like the fact that more and more people are signing up for tax-deferred retirement plans each year.

Obviously, some of that 50% who have no retirement assets could have a brokerage account, own a home or have a pension.

But it’s also true that most of this group likely relies almost exclusively on Social Security to fund their retirement.

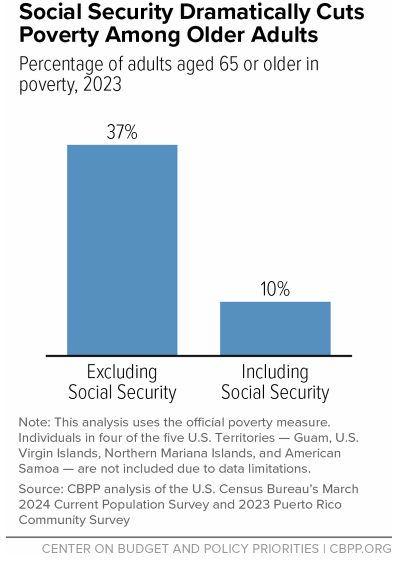

Almost 40% of adults would be living in poverty if it weren’t for Social Security:

This program is currently lifting 16.3 million adults out of poverty, or more than 22 million people in total.

It’s hard to overstate how important Social Security is to millions of people in this country.

Short of forcing people to save for retirement, Social Security remains the safety net for those who lack access to retirement vehicles or don’t have the means to save.

Hopefully we have far more people investing in tax-deferred retirement accounts in the years ahead.

But if that doesn’t happen, Social Security will remain a big source of retirement income for a large chunk of the population.

Further Reading:

Am I Going to Be OK?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.