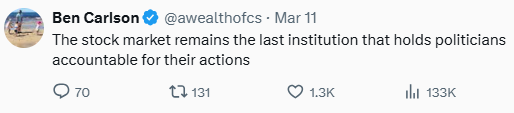

Here’s something I shared on Twitter recently:

Some people thought I was being hyperbolic. Maybe so. That’s the point of social media sometimes.

Then I read the latest Eye on the Market from Michael Cembalest who said what I said only much more eloquently:

Here’s the interesting thing about the stock market: it cannot be indicted, arrested or deported; it cannot be intimidated, threatened or bullied; it has no gender, ethnicity or religion; it cannot be fired, furloughed or defunded; it cannot be primaried before the next midterm elections; and it cannot be seized, nationalized or invaded. It’s the ultimate voting machine, reflecting prospects for earnings growth, stability, liquidity, inflation, taxation and predictable rule of law.

While market consensus assumed the administration would carefully balance inflationary, anti-growth policies with pro-growth policies, it has come storming out of the gate in the first fifty days with more of the former than the latter.

The stock market doesn’t care what you say or how you feel. It doesn’t care about spin, narrative or political posturing. If the stock market doesn’t like how your policies will impact earnings it will let you know about it.

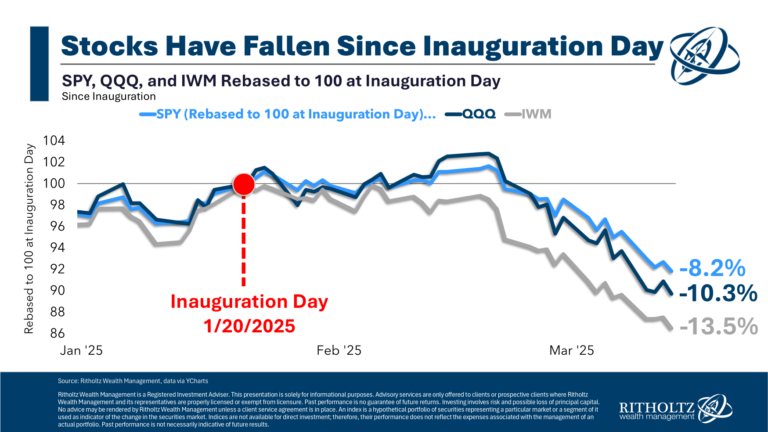

And the stock market is telling the new administration that it does not like tariffs:

Here’s how Ed Yardeni laid it out this week:

The Stock Market Vigilantes have spoken. They don’t like tariffs, and they don’t like mass firings of federal workers. That’s because they don’t like stagflation, and they fear that Trump 2.0’s focus on these measures could cause a recession with higher inflation.

And JP Morgan’s David Kelly:

The trouble with tariffs, to be succinct, is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity and increase global tensions. Other than that, they’re fine.

To see this, consider what would happen if the U.S. imposed a blanket 20% tariff on all imported goods.

The immediate effect would be to raise prices for American consumers and cut output, profits, wages and employment for those who export to us, whether they be foreign farmers, manufacturers or commodity producers. We can argue about how the full cost of the tariffs would be distributed between these two groups but both would be hurt.

However, our tariffs would immediately be met by retaliatory tariffs on our exports by other countries. These would increase prices for foreign consumers and cut output, profits, wages and employment for U.S. farmers, manufacturers and commodity producers.

The stock market knows all of this and is re-pricing risk accordingly. Maybe the market is overreacting. The stock market is not infallible. It’s possible the tariffs are walked back or things don’t look nearly as bad as they feel at the moment.

But the stock market cares about margins and earnings. If they are hurt by government policy, it will let them know.

This is not a political stance I’m taking here. I don’t have a political party. The stock market is my party. Market forces don’t pick a side either.

A lot of people are concerned about government debt levels. The market provides checks and balances there too.

One of the only reasons we could borrow so much money during the pandemic is because interest rates and inflation were so low. Guess what happened after trillions of dollars were spent?

Rates shot up and inflation reached a four-decade high. The Biden administration would have loved to keep spending money, but the market stepped in and made it much harder to justify. The market spoke and it told the administration it did not like unchecked spending indefinitely.

Stocks got killed. Bonds got killed.

In the spring of 2021, I asked if inflation could give us a wonderful buying opportunity. It did. The S&P 500 dropped 25%. The Nasdaq 100 was down 34%. If you bought stocks in 2022 you were very happy in 2023 and 2024.

Could the Tariff Tantrum be offering us another wonderful buying opportunity in 2025?

My general stance is the more bearish things feel in the short-run the more bullish you should be over the long-run. Maybe things will get worse from here, maybe not.

Whatever the reason, buying stocks when they are going down is typically a winning strategy as long as you can hold on for the ride.

Michael and I talked about the stock market correction, economic policy and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

How to Make it a Healthy Correction

Now here’s what I’ve been reading lately:

Books: