At a recent investor day presentation, KKR CEO Scott Nuttall talked about the huge potential for private investments in retirement plans like 401ks and targetdate funds:

Apollo’s Marc Rowan made a similar pronouncement on the company’s latest earnings call:

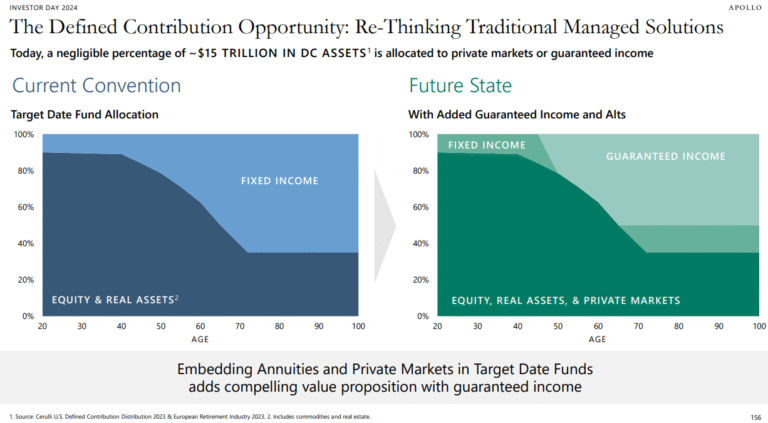

There is something like $15 trillion in the defined contribution retirement plan space. Apollo envisions a scenario where targetdate funds include strategies like private credit and private equity:

I know this makes some people nervous.

On the one hand, retirement plans would seem to make a lot of sense for these fund structures. Your time horizon in a 401k plan is generally long, measured in decades in most cases. Plus, you don’t need short-term liquidity in a retirement plan where your money is essentially locked up already. So the illiquidity piece shouldn’t matter as much.

On the other hand, I do worry about the complexity of these products.

Do 401k investors have the financial acumen to understand these types of products? Do they know what the fees are? Do they grasp the illiquidity involved? Do they get how often the prices are marked to market?

I have some concerns.

Regardless of those concerns, it sounds like this is coming.

Bloomberg had a long profile last month on the push from private investment managers into the wealth management channel:

Less than a week before President Donald Trump’s second inauguration, more than 30 money managers gathered on Zoom to strategize about how to pull America’s retirement savers into investments far beyond stocks and bonds.

During the meeting attended by Blackstone Inc., UBS Group AG, Neuberger Berman and others, participants assembled a manifesto articulating private equity’s rightful position in 401(k) plans, including in the default portfolios for workers who don’t select their own investments.

I understand why the industry is doing this. Institutional investors are more or less tapped out.

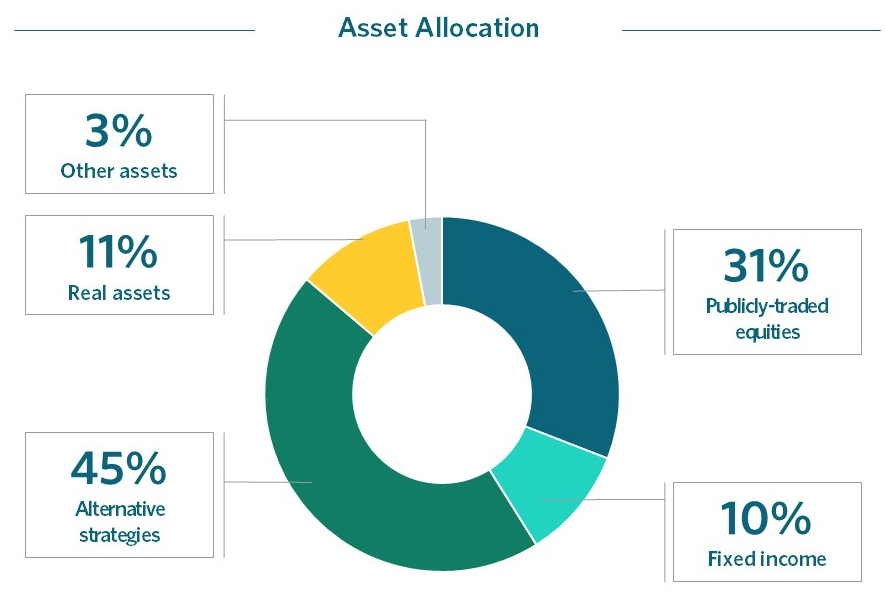

The NACUBO study of endowment funds looks at the average asset allocation of these giant investors:

Endowments, foundations and pension plans have been adding to alternative assets for years now. Sure, there will always be more money in this space but the big moves are essentially over.

Private asset managers need the wealth management channel for growth.

RIAs manage more than $100 trillion in assets. Private investment managers are salivating at the growth potential in that space.

In his annual letter to investors, Blackrock’s Larry Fink envisions a future balanced portfolio that looks less like 60/40 and more like 50/30/20:

The future standard portfolio may look more like 50/30/20–stocks, bonds, and private assets like real estate, infrastructure, and private credit.

There are plenty of challenges to get from here to there. There are new fund structures that try to make access more seamless (interval funds, evergreen funds, etc.) but most investors don’t have experience with private investments.

It’s a whole new world.

I’m not even sure how many investors are clamoring for access to private investments. One way or another, it’s coming. Financial advisors and retirement plans will offer investors access to more private market strategies in the years ahead.

The educational component is going to be huge here. We’ll see if the industry is up to the task. I’m skeptical but happy to be proven wrong.

One thing I am sure of — if you don’t understand something you shouldn’t invest in it.

That goes for public and private market strategies alike.

I had Michael Sidgmore on Ask the Compound this week to discuss how private assets will work in wealth management:

We also answered questions about how private investments work, who should and shouldn’t be invested in these strategies, illiquidity, private credit and more.

Further Reading:

How Will Private Equity Work in 401ks?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.