Today’s Animal Spirits is brought to you by Cache Financials and Fabric:

Today’s episode is brought to you by Cache Financials, which operates the Cache Exchange Fund. Find out more at: https://usecache.com/?invited_by=animal-spirits

Join the thousands of parents who trust Fabric to help protect their family. Apply today in just minutes at: https://meetfabric.com/SPIRITS

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky:

7% of Russell 3000 members made a new 52w high at the end of last week … highest share so far YTD pic.twitter.com/z6yo7UCU1y

— Kevin Gordon (@KevRGordon) July 7, 2025

The Magic 3 vs. the Meh 3? pic.twitter.com/LzgteS7vwN

— Bespoke (@bespokeinvest) June 25, 2025

Once again, for those in the back: multiple job-holding is a pro-cyclical indicator. That means that the share of workers with multiple jobs rises when times are good. That’s because there are more job opportunities in a healthy labor market. https://t.co/vSvKVIxrTA pic.twitter.com/wYs81EeSrK

— Ernie Tedeschi (@ernietedeschi) July 6, 2025

Life in 1776:

– heat is such a luxury that Thomas Jefferson can’t write in deep winter bc his ink freezes (one reason perhaps why Independence Day is in July)

– nighttime darkness is such a burden that George Washington reportedly spent $15k in today’s dollars on candles every… pic.twitter.com/lYwd9uW4jK

— Derek Thompson (@DKThomp) July 6, 2025

People who weren’t alive in the 80s always claim it was a time of plenty, richer than now.

But nearly 100% of people who were actually alive and conscious then recall middle class parents engaging in bizarre hyper-thrift and money anxiety that basically no one has now. https://t.co/hEIKm3BH0A

— VB Knives (@Empty_America) July 6, 2025

It’s so funny that in 2025, people are still describing certain cities as having good food. No shit. They all do now.

— Joe Weisenthal (@TheStalwart) July 6, 2025

damn this is pretty crazy, not gonna lie pic.twitter.com/jJRmj3dY84

— Nikhil Krishnan (@nikillinit) July 3, 2025

To keep up, I’ve put together this ✨very sophisticated✨ table.

These new numbers don’t look that small pic.twitter.com/t2oPu88AmK

— Kevin Gordon (@KevRGordon) July 7, 2025

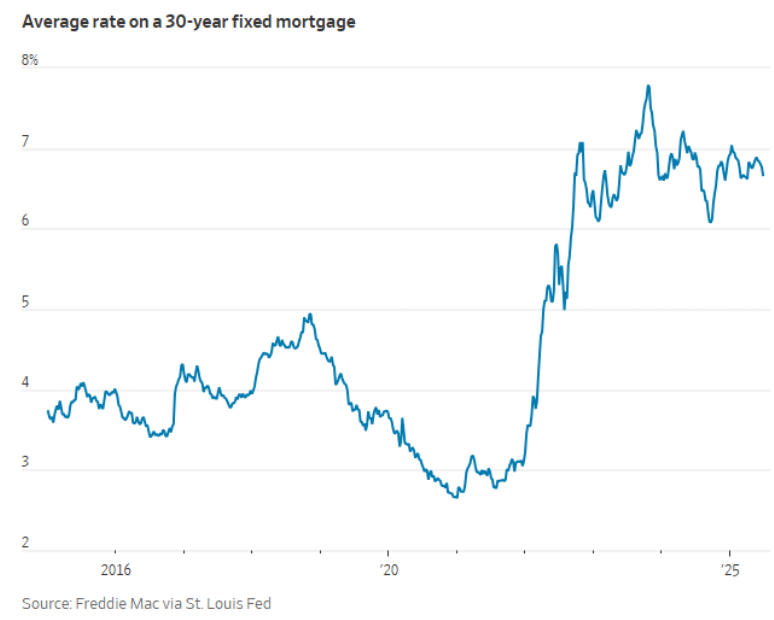

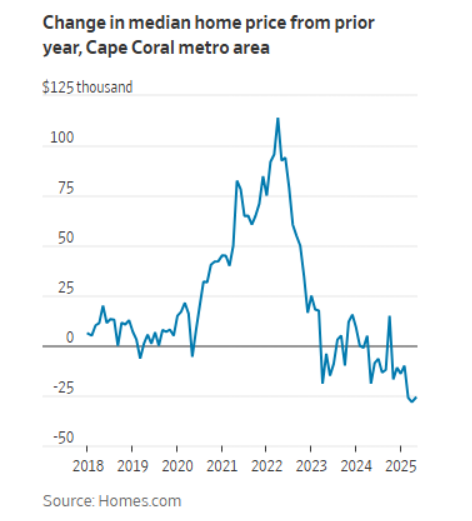

You don’t want a recession now; rates would go lower, demand would pick up, and inventory isn’t back to normal yet. https://t.co/szavxiwHZR pic.twitter.com/1DWLQ69YMV

— Logan Mohtashami (@LoganMohtashami) July 5, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.