A reader named Andy asks:

I’m 25 and live in Belgium. I make €2,000/month net in a factory job and save €500-€1,000/month (living at home). My net worth is ~€67,000. I’m debt free.

My goal is to grow this into €200K-€400K within 4-5 years. That would allow me to relocate to Southeast Asia (ideally the Philippines) and start a business.

If you were like me at 25, debt-free with ~€67K net worth, what investing or allocation strategies would you prioritize to realistically reach €200K-€400K in 4-5 years?

I absolutely love this question.

It’s got numbers. It’s got an end goal. And it’s got meaning behind that end goal.

I wrote about trying to build a nest egg in a relatively short period of time in my book Everything You Need to Know About Saving For Retirement from the perspective of people who get a late jump on retirement savings.

I told the story of Carl and Carla Carlson, both 50 years old who had nothing in the way of retirement savings. The Carlsons wanted to know if they would be better off trying to shoot the moon with their investments or save more money to make up for lost time.

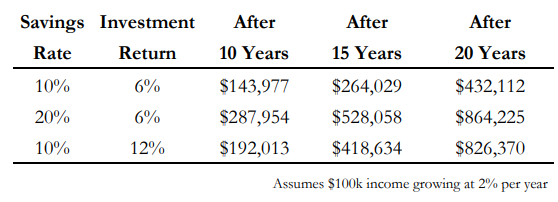

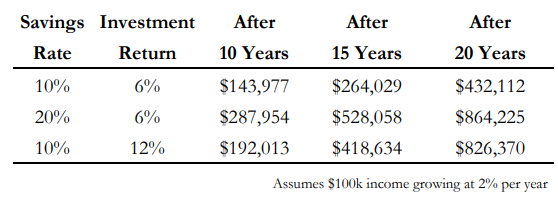

These are the numbers I came up with for a simple scenario analysis:

This was my conclusion from the book:

Even if Carl knocked it out of the park in his Robinhood account and doubled up Carla’s 6% return target, a higher savings rate would have still led to better results. A doubling of the Carlson’s savings rate from 10% to 20% led to a better outcome than a doubling of their investment returns from 6% to 12%, even over a two decade period. And chances are Carl is not the second-coming of Warren Buffett so increasing their savings rate is far easier than increasing their investment returns.

Andy from Belgium has an even shorter time horizon but he’s seeking a sizable increase in his net worth on the order of 3-6x. That’s a big leap in such a short period of time, which means compounding from your investments matters even less.

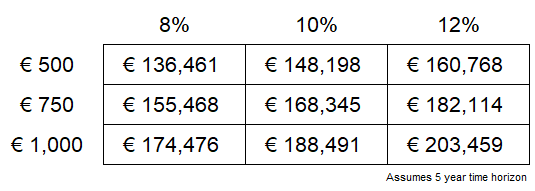

I did a similar exercise using the data provided and some different monthly saving and investment return assumptions (and yeah I found the Euro sign on Excel):

This is the growth of his net worth over a 5 year period using these various assumptions.1

Much like the example from my book, increasing your savings rate has a larger impact on your ending balance than increasing your investment returns over this time frame.

The good news is, if Andy can hit the higher end of his current monthly savings range, he’s in pretty good shape to come close to reaching the lower range of his net worth goal.

The bad news is that if he wants to hit €400k, he’ll either have to get a huge raise or become the next Jim Simons overnight.

At his current savings level, you would need something like 30% annual returns over 5 years. At a more reasonable rate of return, you would need more like €3,500 to €4,000 a month to get to €400k.

I could give you all sorts of allocations and investment ideas to 5x your wealth in 5 years, but you’re probably not hitting the high-end of your goal unless you start making a lot more money or hit on a lottery ticket investment.

My advice would be to try to hit the top of your savings range at €1,000/month or figure out how to earn a side income.

There is another consideration:

What’s holding you back from moving to the Philippines now? Why wait?

You’re 25 and live at home. You’ve already shown you have the ability to save money. Why not try to do it from your dream destination?

Consider setting your goal at €100k so you can get there sooner.

Life can be a lot different at 30 than it is at 25. You have the ability to be adventurous at 25. If you want to move to the Philippines don’t let some spreadsheet calculation hold you back. You could always move back home if things don’t work out.

There are some life events where you’re never going to be completely ready when it comes to your finances and you just have to take a leap of faith and figure it out as you go.

This might be one of those times.

I discussed this question on the latest episode of Ask the Compound:

Callie Cox joined me on the show again to chop it up about questions on an AI preventing a recession, investing in intertwined markets, hedging your biggest winners and paying off an auto loan from a brokerage account.

Further Reading:

Everything You Need to Know About Saving For Retirement

1I know this question was in Euros but it’s just easier to find the dollar sign on Excel.