In the past 30 years the following has occurred:

1995-2000: Dot-com bubble

1997: Asian financial crisis

1998: Russian default and LTCM collapse

2000-2002: Dot-com bust (S&P -50% and Nasdaq -83%), 9/11, Enron/WorldCom scandals

2003: Iraq War

2007-2009: Great Financial Crisis, housing prices collapse 26%, U.S. stock market falls 56%, Bernie Madoff Ponzi Scheme outed

2009-2012: European Debt Crisis

2013: Taper Tantrum

2016: Brexit

2018-2019: U.S.-China Trade War

2020: Global pandemic, oil prices go negative

2021-2022: Supply chain shock, Russia-Ukraine war, 9% inflation, rates spike

2025: Liberation Day

This list could go on and on. There’s plenty of other stuff that happened that I missed.

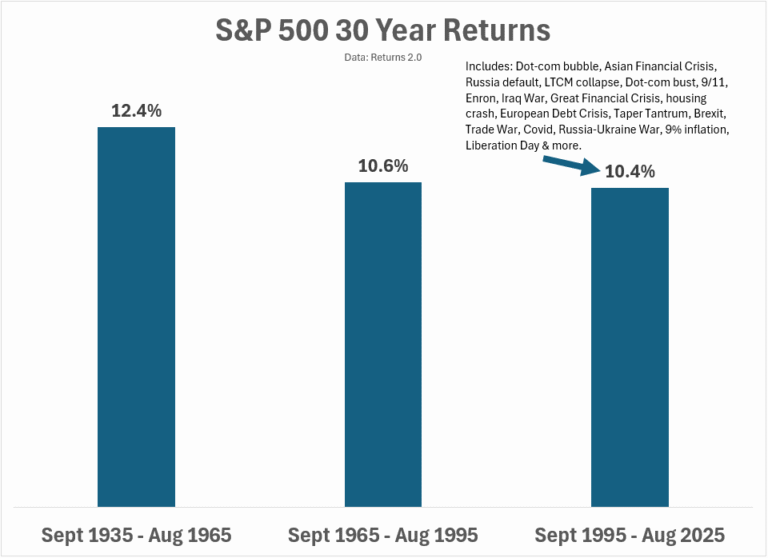

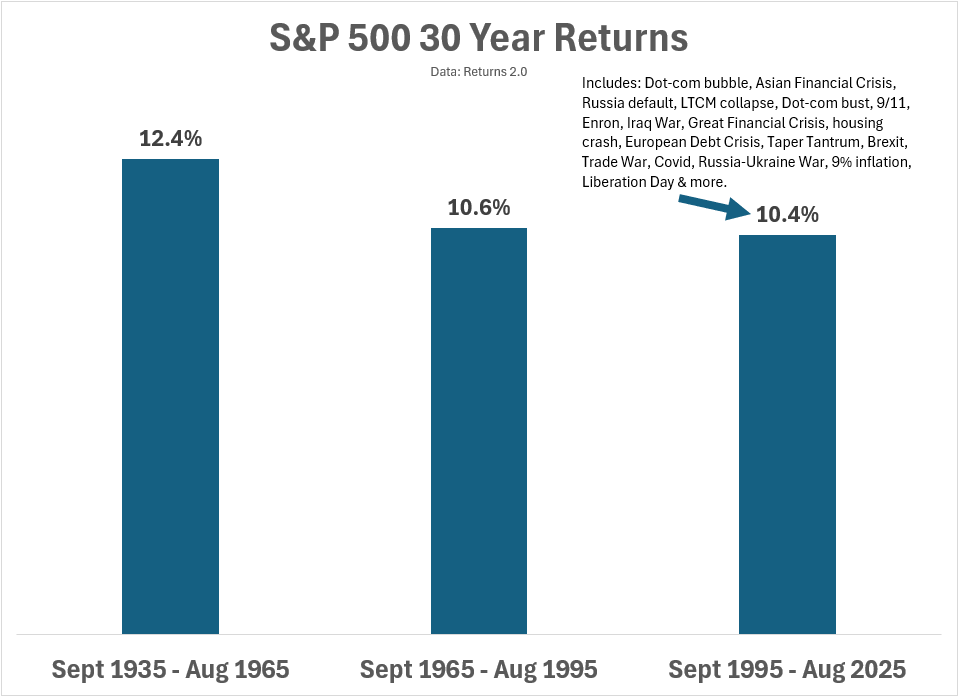

Despite all of this, the S&P 500 returned 10.4% per year:

The 1960s, 1970s and 1980s were no picnic either. Yet the previous 30 years saw annual returns of 10.6% per year.

A lot of really bad stuff happened in the 1930s and 1940s. That’s two of the worst decades in modern history. The stock market was up more than 12% per year in the 30 years from the summer of 1935 through the summer of 1965.

A lot of bad stuff will happen again. I can guarantee it.

I don’t know when and I don’t know why but there will be crashes, recessions, financial crises, war, geopolitical upheaval, and more.

And I still invest in the stock market.

Why?

Bad things happen and life goes on.

People wake up every day looking to better their place in life.

Corporations are constantly looking for ways to make more money.

The stock market is the only place where anyone can invest in human ingenuity.

I’ll take that bet even if there will surely be setbacks along the way.

Further Reading:

31 Years of Stock Market Returns

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.