In economics classes in college I learned about cost-push inflation and demand-pull inflation and stagflation and hyperinflation and probably another flation I can’t recall at the moment.

But I don’t want to talk about textbook forms of inflation because that stuff is boring.

Here are the 3 types of inflation that matter for most people:

1. Price Inflation. Inflation is the kind of economic phenomenon that most people don’t think about a lot until it gets really high or impacts their spending habits.

There have been plenty of complaints about inflation this decade but it’s not like inflation was nonexistent in the 2010s. It was just shallower and less volatile.

And even when this period of high inflation is officially behind us it’s not like prices will revert back to their previous levels. Inflation is alsmot always going higher.

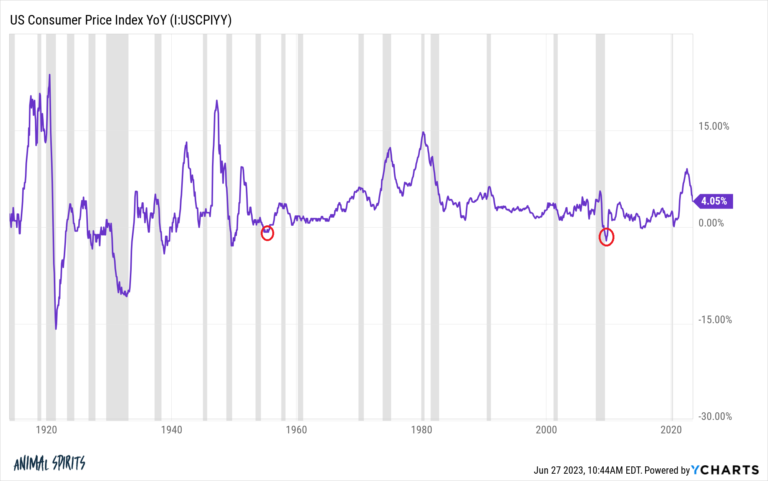

Just look at the year-over-year percentage changes in the U.S. CPI data:

In the Great Depression and war years of the early-1900s price volatility was off-the-charts. The economy would go from booms that came with ridiculously high inflation to busts that led to massive deflation in prices.

Our economy doesn’t work like that anymore which is a good thing.

You can see from the highlighted circles on the CPI chart that the last time we had deflation was during the 2008 financial crisis. The last time it happened prior to the GFC was in the 1950s following the Korean War. Both of those periods were brief though.

Inflation is basically the lesser of two evils if we’re comparing it to deflation.

I’m sure everyone would love to see prices go back to 2019 levels but the biggest reason we don’t want to see that scenario is because wages would have to go back to those levels as well to make it happen.

That brings us to the second type of inflation.

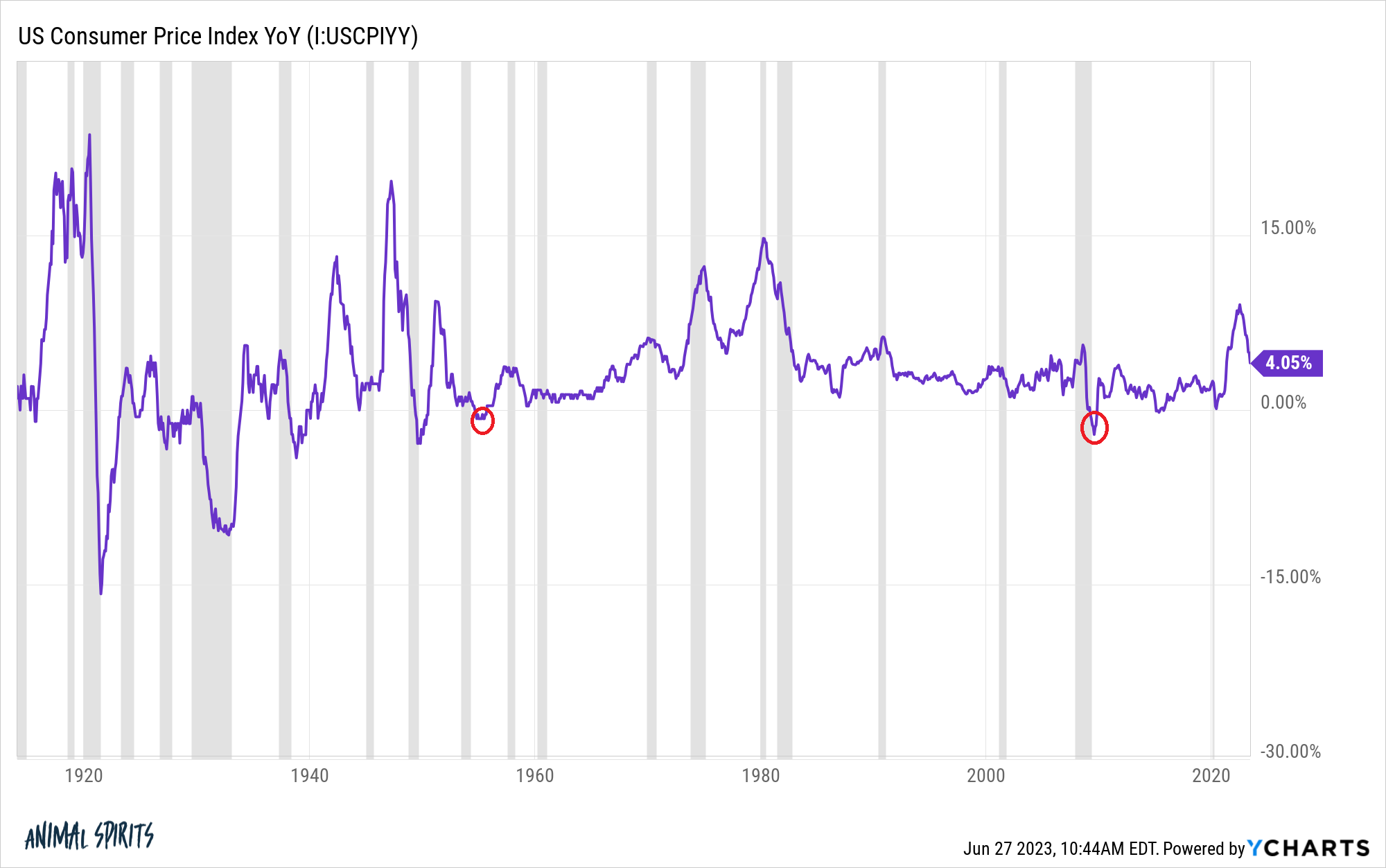

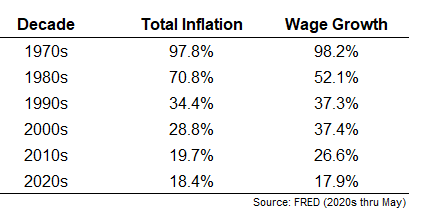

2. Wage Inflation. Here is some good news on the inflation front — wages are finally growing at a rate that is higher than price inflation:

The Fed’s wage growth tracker pegs that number currently at 6%. The latest inflation reading was a little more than 4% annually.

This has been one of the problems with inflation during this cycle — wages have been growing at a slower pace than prices. I don’t know how long this will last but this is a good thing for household finances.

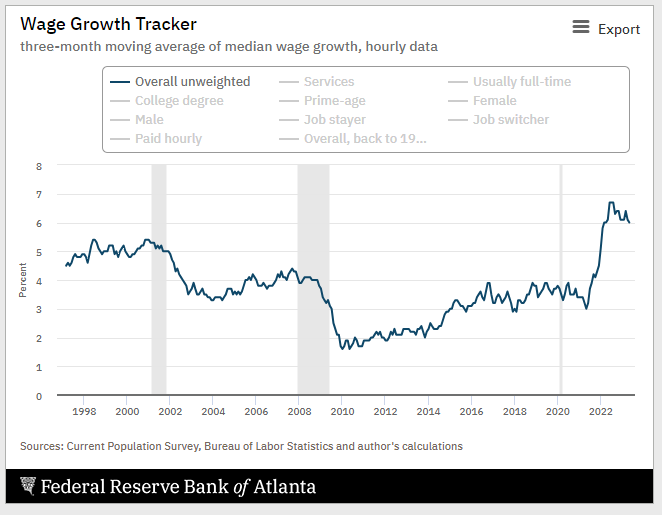

The dilemma when it comes to wage inflation is that it tends to coincide with price inflation:

It’s hard to get one without the other tagging along. The good news is that most decades see wages outstrip prices.

Of course, it’s important to note that averages in the economy almost never precisely describe your personal situation.

Everyone has their own personal economy and inflation based on their circumstances and habits.

Which brings us to the third type of inflation.

3. Lifestyle Inflation. There was a story in the New York Times that profiled a guy who has experienced both wage and price inflation to show how it has impacted his own personal economy:

Cylus Scarbrough, 42, has witnessed both features of today’s economy: fast wage growth and rapid inflation. Mr. Scarbrough works as an analyst for a homebuilder in Sacramento, and he said his skills were in such high demand that he could rapidly get a new job if he wanted. He got a 33 percent raise when he joined the company two years ago, and his pay has climbed more since.

Even so, he’s racking up credit card debt because of higher inflation and because he and his family spend more than they used to before the pandemic. They have gone to Disneyland twice in the past six months and eat out more regularly.

“It’s something about: You only live once,” he explained.

He said he felt OK about spending beyond his budget, because he bought a house just at the start of the pandemic and now has about $100,000 in equity. In fact, he is not even worrying about inflation as much these days — it was much more salient to him when gas prices were rising quickly.

“That was the time when I really felt like inflation was eating into our budget,” Mr. Scarbrough said. I feel more comfortable with it now. I don’t think about it every day.”

This guy is making way more money but also spending way more. That’s lifestyle inflation.

I understand some of the thinking here.

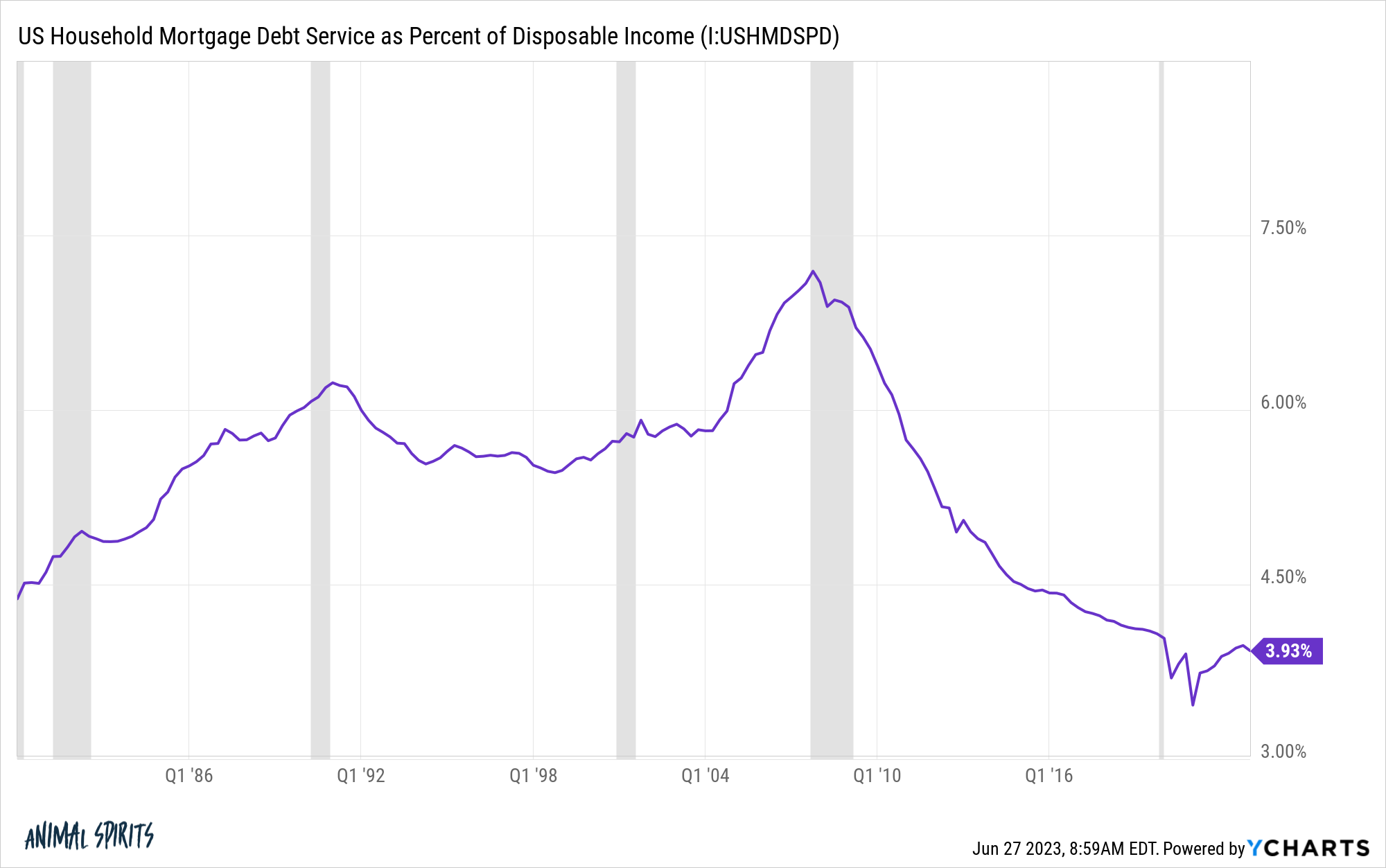

If you owned a home before inflation and housing prices really took off you’ve not experienced a once-in-a-lifetime bump in home equity but you’ve also locked in extraordinarily low housing costs which has proven to be one of the best personal finance hedges against inflation.

I can see how that mentality could give you a sense of playing with house money.1

The problem with lifestyle inflation is it can leave you worse off even when you make more money if you’re not careful.

If your spending outpaces your wage increases it doesn’t matter how much you make, eventually, you’re going to fall behind financially.

There are two simple options when it comes to combatting lifestyle inflation:

(1) Keep your savings rate constant. Let’s say our guy Cylus from the New York Times article was earning $75k a year before he got his 33% raise and saving 15% of his income. That’s a little more than $11k a year in savings.

After that 33% raise he would now be earning close to $100k. If he kept his savings amount per year at $11k his savings rate would drop to 11%. But if he kept it steady at 15%, he’s now saving $15k a year.

This is simple math and I’m stating the obvious here but keeping your savings rate steady (or increasing it over time) as you make more will allow you to see a commensurate relative gain in both spending and disposable income.

(2) Save a portion of every raise you earn. Another option would be to save a set portion of each raise. I like 50/50 to keep things simple. So that 33% raise would see half go to disposable income and the other half go to an increase in savings.

The beauty of saving a portion of your increase in income is that it allows you to give both yourself and your savings a boost at the same time and you never see that money to begin with.

I’m perfectly fine with spending more money as you earn more. What’s the point of working hard to increase your income if you’re not going to enjoy some of it?

But earning more and spending more should be combined with saving more if you ever hope to get ahead financially.

You have no control over the CPI rate or price changes in the economy.

You can control your lifestyle inflation and how much you save.

Further Reading:

Demographics vs. Inflation

1Pun intended I guess.