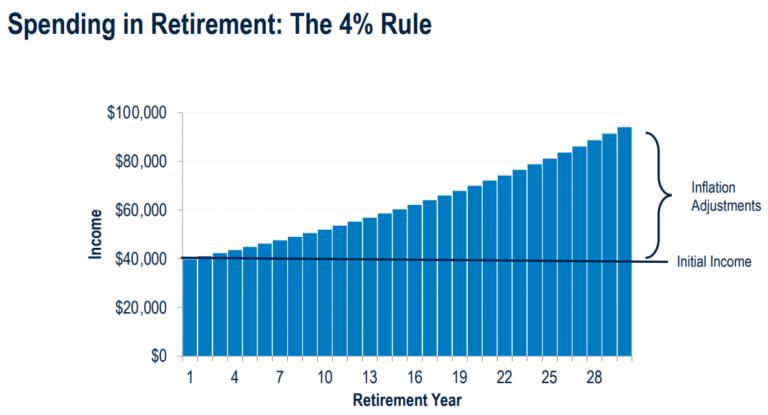

I talked to Bill Bengen last month about his 4% rule for retirement withdrawals.

I’ve been getting all sorts of questions from retirees and people approaching retirement about what the right number is: Should I take 4% from my portfolio? 4.5%? 5%? 7?!

The truth is there’s no right answer for something like this.

The best retirement withdrawal strategy requires flexibility and course corrections depending on the market environment, inflation and your personal spending levels. No one actually follows through with this stuff like it shows on a spreadsheet.

Whatever your desired number is when it comes to drawing down your portfolio, we have research that shows how much people are actually spending from their portfolios during retirement.

It’s way lower than 4%.

David Blanchett and Michael Finke examined how much retirees spend from their various sources for retirement income. Their research discovered the following:

- Retirees spend around 50% of their savings.

- Married 65-year-olds with at least $100k in assets withdraw just 2.1% per year from qualified and non-qualified accounts.

- People in the top 20% by net worth could spend more than a million dollars over and above what they’re spending over a 30 year period and still be fine.

Lots of retirees worry about the 4% rule but most of them don’t even come close to that safe withdrawal rate for a multitude of reasons.

I hear from people who don’t want to touch their principal and only want to spend their portfolio income. You could always sell shares in your investments to create your own income stream but many people can’t bring themselves to do this.

There is a psychological hurdle that exists with some people because you worry about outliving your money, inflation, high healthcare costs, sequence of return risk or something coming out of left field.

It’s a first-world problem, but a problem nonetheless for a certain segment of the population.

Interestingly enough, annuities solve for this psychological hurdle for certain people.

Blanchett’s research shows that retirees with some annuitized income tend to spend more of their savings than those who don’t have a guaranteed income stream. Annuities essentially pay you back a chunk of your principal to spend but many people find comfort in that regular income. This makes sense because most of us are used to getting a paycheck.

The lack of a paycheck is one of the scary aspects of retirement.

The problem is most people like annuities about as much as a colonoscopy, advisors included.

There are a lot of dichotomies like this when it comes to financial planning.

I find this topic fascinating and there are lots of angles to cover here so I talked to Blanchett to learn more about his findings on creating lifetime income streams, spreadsheets vs. psychology in retirement, how to enjoy your savings, the role advisors play in the process, the 4% rule and much more:

If you’re a financial advisor, subscribe to our YouTube channel and newsletter for more.

Further Reading:

Does the 4% Rule Still Apply

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.