It’s hard to believe we’re debating a potential bubble right now considering we had a mini-blink-and-you-missed-it bear market in April.

That downturn feels like an out-of-body experience because it happened so quickly.

That first week or so of April saw back-to-back down days of -5% and -6%. A few days later the market was up almost 10% in a single day and we were off to the races.

These V-shaped rallies feel like a product of the information age where markets move faster than ever and are being driven more and more by outlier events.

That’s how it feels at least.

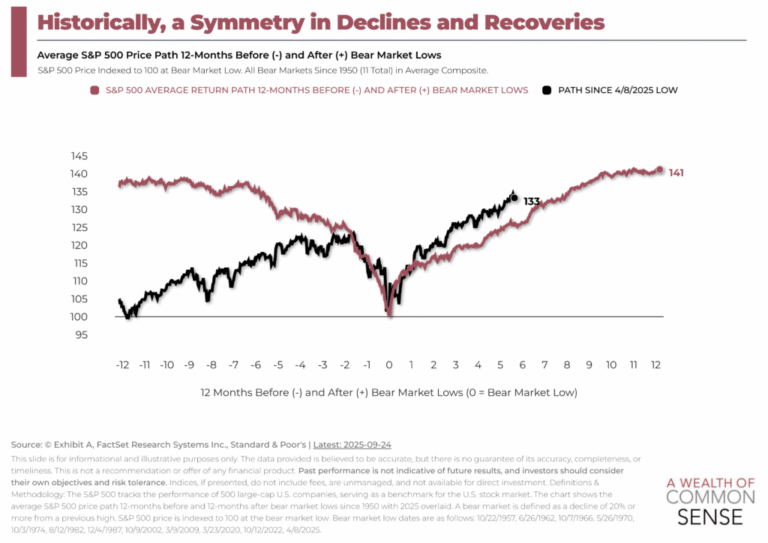

However, if you look at the average path of every bear market since 1950, the current iteration looks pretty darn close:

It’s not perfect but you get the waterfall drop followed by the big recovery on the other side of it. V-shaped rallies are nothing new. That’s the norm.

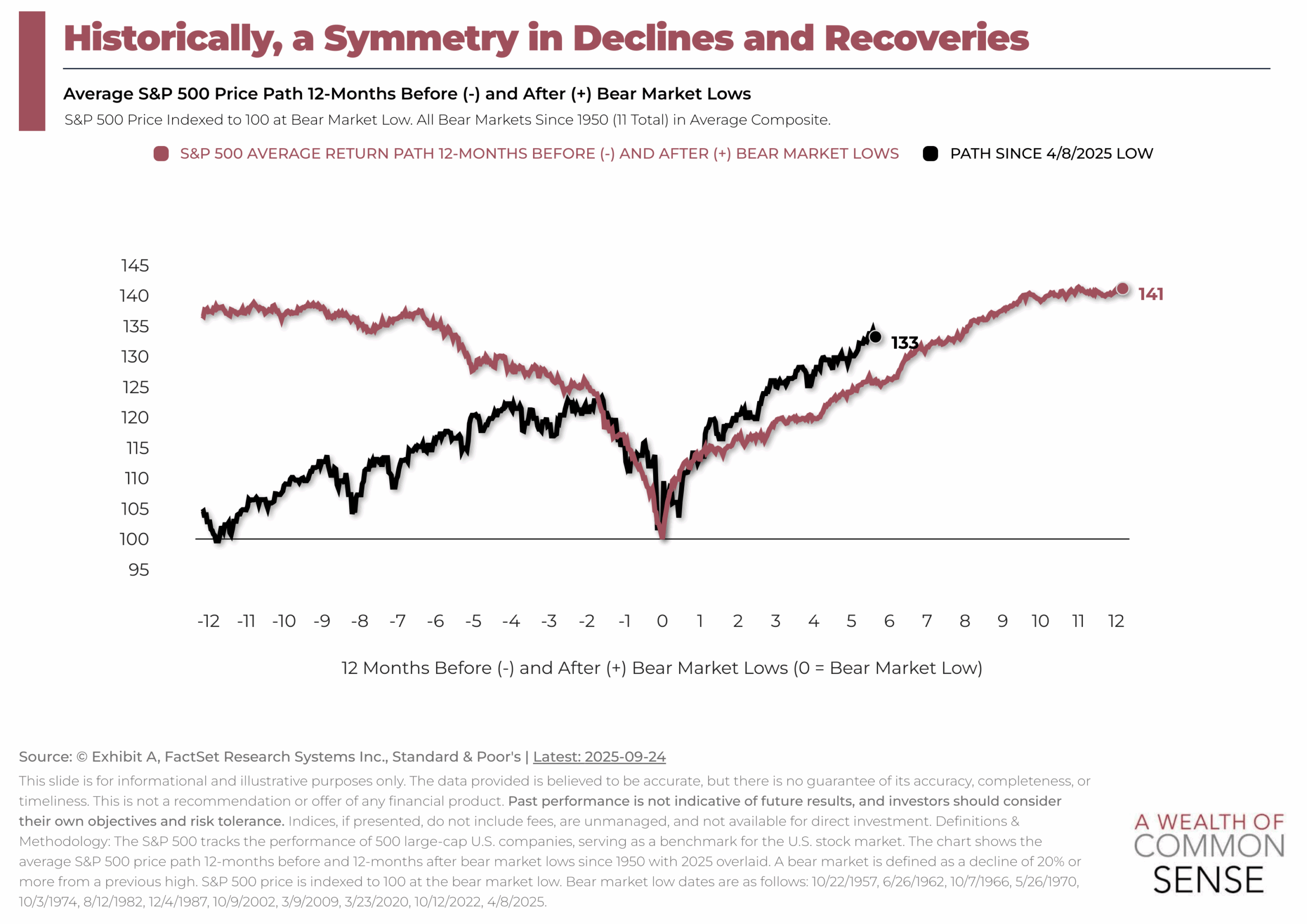

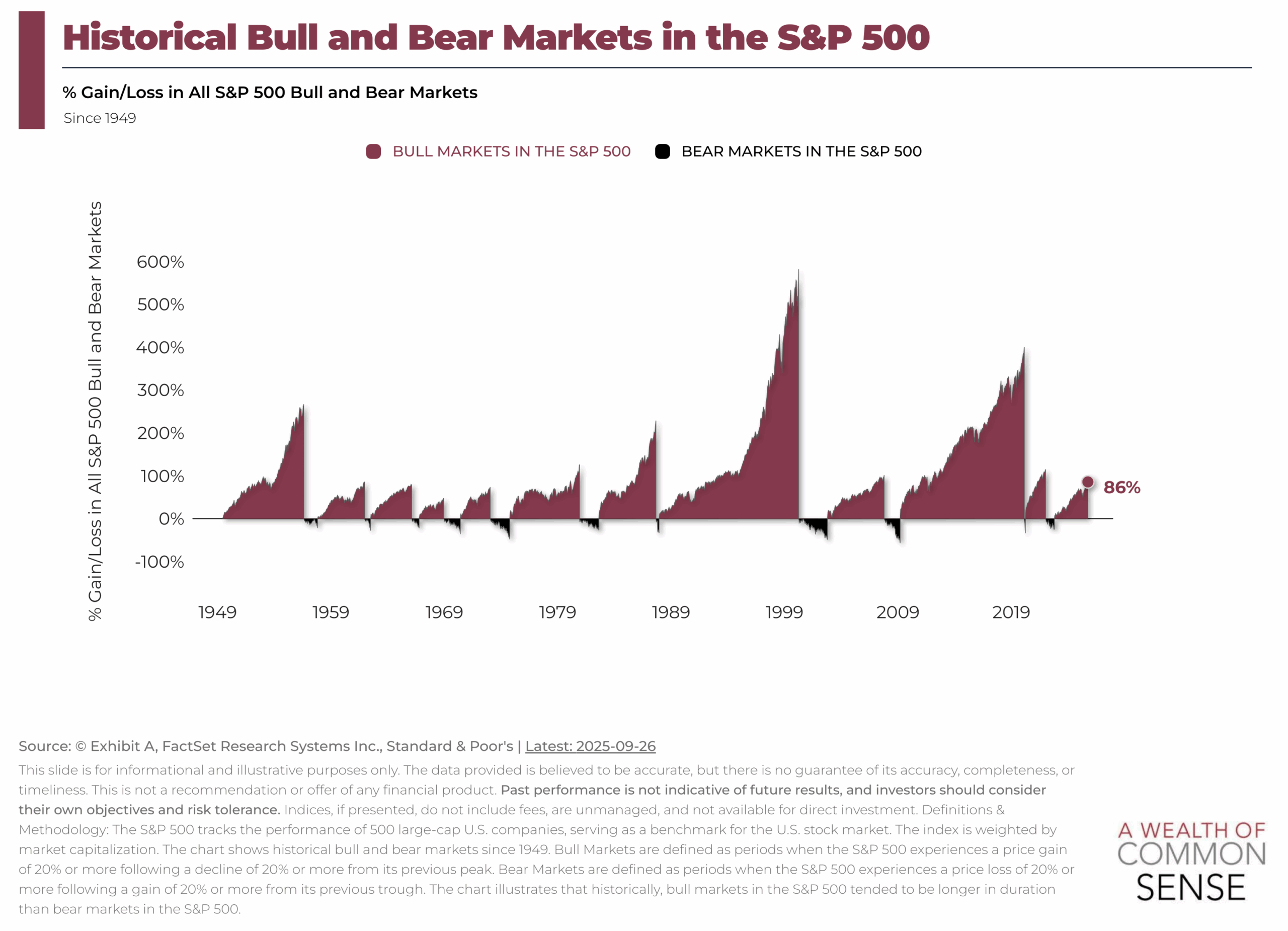

We’ve seen a similar profile in sector performance this year:

Technology and communication services (basically tech) both experienced massive drawdowns earlier this year but are now each sitting on 20%+ gains for the year. That’s another V.

Of course, these relationships are not set in stone. Consumer stocks also got hammered in the downturn but haven’t seen similar year-to-date gains.

Bear markets have some symmetry to them, at least in the short-term.

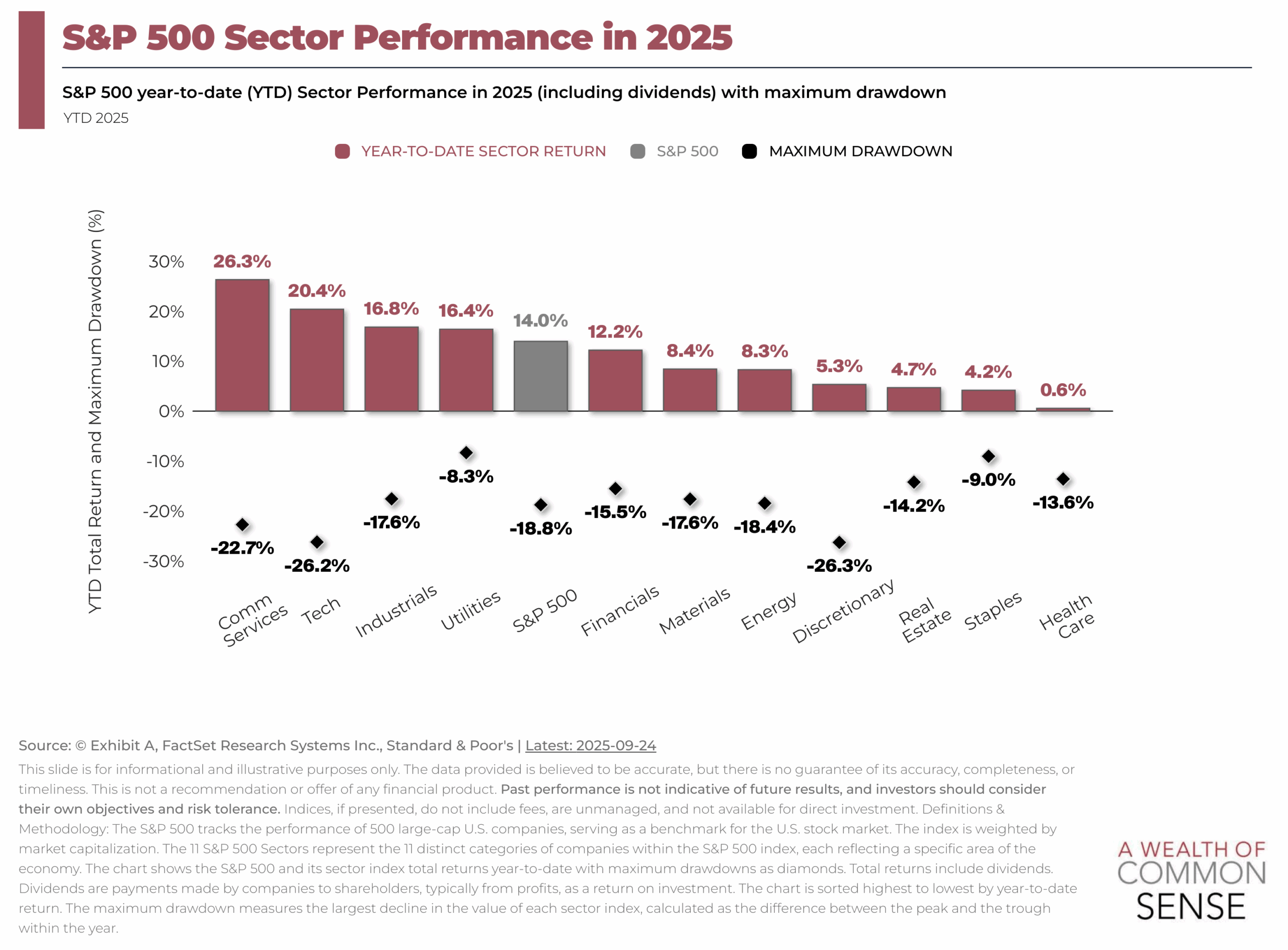

In the long-term, bull markets versus bear markets are asymmetric. Things are not balanced.

Look at the gains versus losses:

The bear markets are blips.

To be fair, those losses don’t feel like blips when you’re in them. Bear markets can be brutal. Losing money is not fun. Seeing a large portion of your portfolio get vaporized can cause you to question your sanity as an investor.

And yet…the bull markets completely overwhelm the bear markets.

It’s not even close.

That’s the beauty of the stock market. Despite all of the lousy things that can and will happen at times, it still pays to stay invested over the long haul.

You just have to survive many short hauls to get there.

Further Reading:

The Best Time to Invest

Like these charts? Try a free 7 day trial at Exhibit A where financial advisors can use their own logos and color schemes to create charts, presentations and decks for clients.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.