Author James Playsted Wood once wrote, “The thing that most affects the stock market is everything.”

The list does seem endless when you start ticking off the factors that influence stock market returns over time.

Headlines, geopolitical events, economic growth, government policies, human emotions, investor positioning, interest rates, inflation, risk appetite, demographics, quarterly earnings reports and the list could go on.

In the 2010s most people assumed low interest rates and quantitative easing were propping up the stock market. In the early-2020s it was government spending. Right now it feels like the AI boom is powering everything.

It’s always something.

But if you really want to know what’s been driving the U.S. stock market higher look no further than earnings.

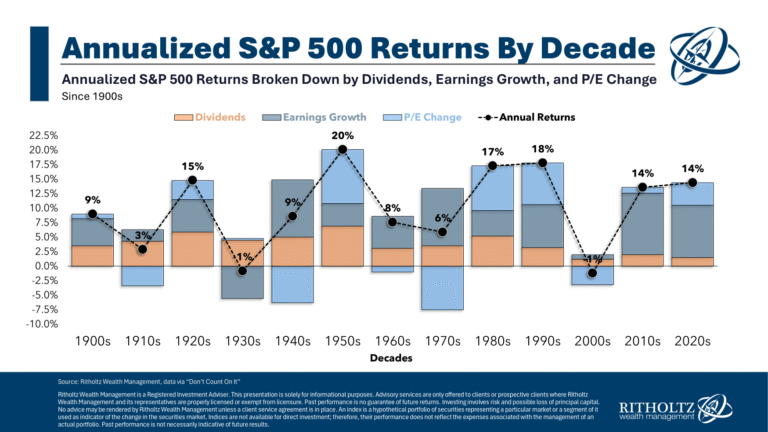

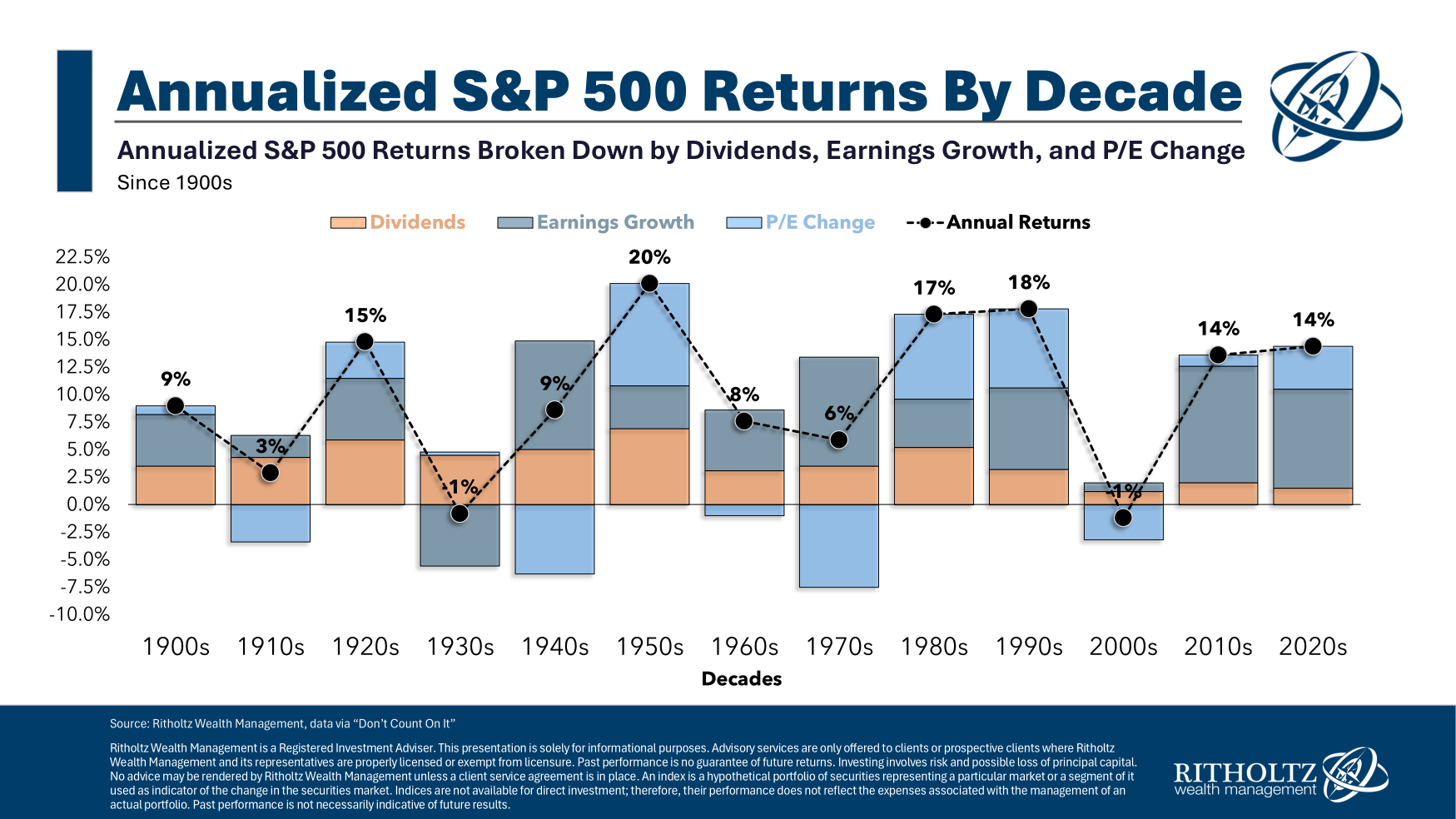

This becomes apparent when you look at the composition of stock market returns by decade:

What’s driving the stock market during this bull market?

Earnings!

In the 2010s we had annual earnings growth of nearly 11%. Earnings have grown at just shy of 10% per year in the 2020s. That’s much higher than the long-term average of around 5% per year.

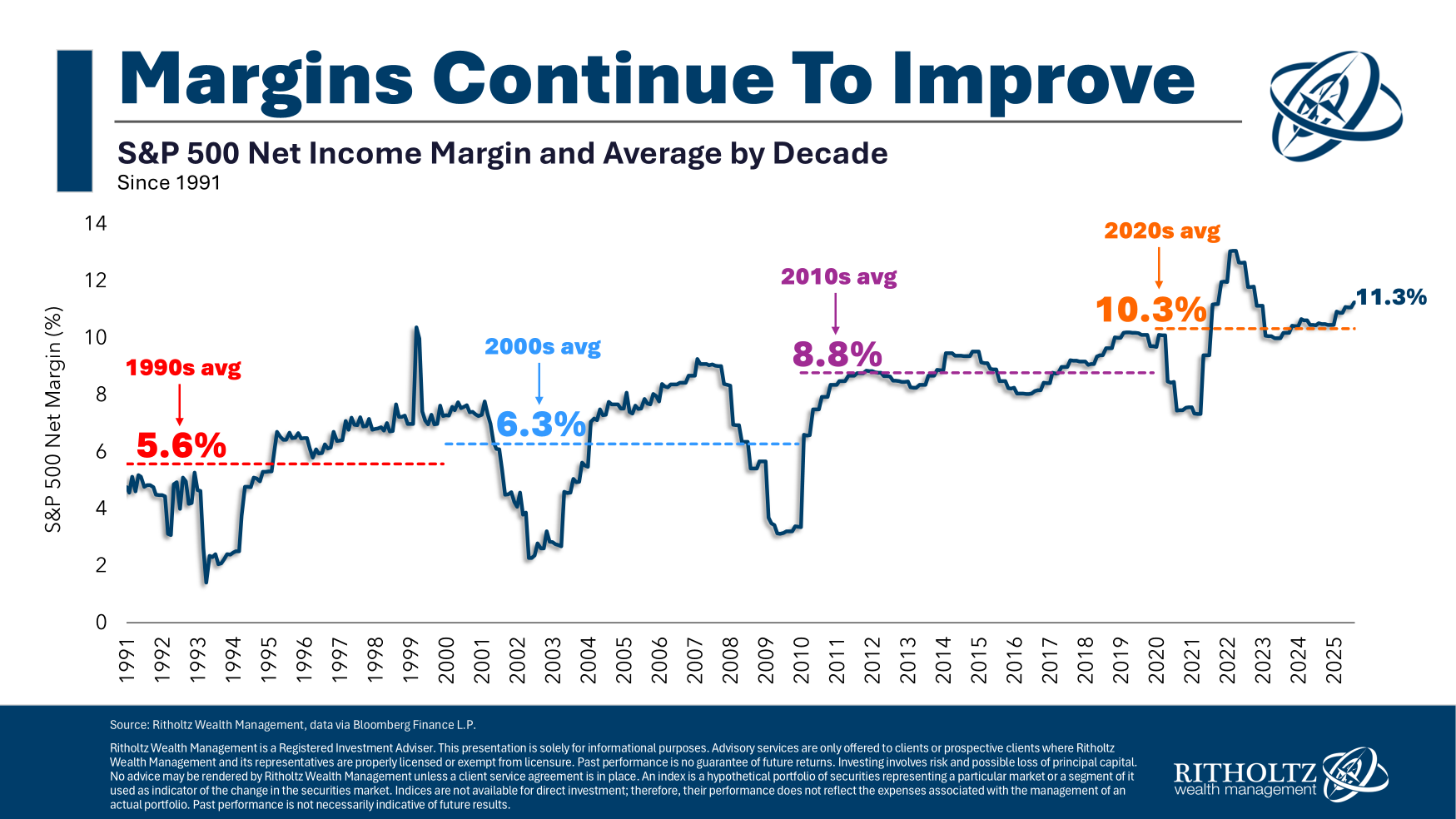

Consumers and businesses are spending money. That money is revenue for corporations. After subtracting costs from those sales you get profits. Those profits are higher now in part because margins are higher:

It really is that simple.

Earnings growth doesn’t guarantee high stock market returns. Earnings growth was high during the 1940s (+9.9%) and 1970s (+9.9%) but so was inflation and there were extrernal factors that caused returns to be muted in those decades.

Earnings growth wasn’t all that strong in the 1920s (+5.6%), 1950s (+3.9%) or 1980s (+4.4%) but annual returns were lights out in each of those decades.

So these relationships aren’t written in stone.

However, you can see that the lost decades of the 1930s and 2000s both had terrible earnings growth of -5.6% and +0.8%, respectively.

If you want to know why stocks are up over the past decade and a half, look no further than earnings growth.

It won’t last forever because nothing does but this bull market has been carried by strong company fundamentals.

Further Reading:

Expected Returns in the Stock Market

1It should also be noted that one of the reasons dividend yields are lower now than they were in the past is because buybacks (essentially the same thing as dividends in a different form) are more prevalent today. Share repurchases also increase earnings per share by reducing the number of shares on the open market.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.