A reader asks:

What do you do if this is a bubble? Sit it out? And maybe miss 2-3 years of 30% gains before it gets cut by 70%? I mean I think it’s too costly not to be in the game if your horizon is 8 plus years. I think I’m going to let my money sit. I’m 35. If this isn’t a bubble, timing it means missing out on significant gains in my portfolio. If it is a bubble, I’ll just keep shoveling money in. If I were older, I’d probably be more worried.

Here’s something I wrote in Everything You Need to Know About Saving For Retirement:

I have somewhere in the order of four or more decades remaining to prepare for financially over the rest of my life.

In the coming 40-50 years I’m planning on experiencing at least 10 or more bear markets, including 5 or 6 that constitute a market crash in stocks. There will also probably be at least 7-8 recessions in that time as well, maybe more.

I’d like to amend that statement. Maybe I was too high on the number of recessions (we’ll see). I also should have added that there will probably be 4-5 financial asset bubbles, maybe more.

Think about all of the bubbles we’ve seen in the past 30 years or so.

In the late-1990s we had the dot-com bubble. When we couldn’t accept the pain of those good times ending we immediately started a housing bubble in the early aughts like hopping from one bad relationship directly into another.

The 2008 financial crisis was caused by a credit bubble. We were relatively well-behaved in the 2010s when there was more of an anti-risk bubble with negative interest rate bonds.

The 2021 memestock mania was a mini-bubble of speculative activity.

And now we have the AI capex bubble.

We just can’t help ourselves.

As a young investor, should you care about bubbles? Or should you do anything about it?

You can’t control your feelings and emotions but you can control how you react to them. The same is true of your portfolio and and periods of excess in the markets.

It also depends on the following:

- Do you have an investment plan in place?

- Do you have a reasonable asset allocation in place?

- Are you investing regularly in the market?

- Do you have the intestinal fortitude to hold onto your stocks AND keep buying when they inevitably fall?

With buy and hold sometimes the holding part is more difficult and sometimes the buying part is more difficult. For buy and hold to work best you need to do both even when it doesn’t feel right.

You should be more concerned about bubbles if you’re 65 than 35. At 65 you have more to lose and not as much time to save and wait out market turmoil. That’s why diversification increases in importance as you age.

If you’re 35, you should hope stocks crash so you can buy more at lower prices.

Trying to time these cycles is nearly impossible. You’re likely to make unnecessary mistakes timing the market.

You’re better off building the occasional mania into your plan and investing accordingly.

So that’s one side of the bubble investor sentiment.

Here’s one from another reader:

I know my judgement might be clouded by the last 15 years but I have such strong conviction about the upcoming technological growth and profits over the next 10-15 years (which aligns with my investing time horizon) that will come as a result of AI, quantum computing, robotics, etc. and this has caused me to seriously reflect on my portfolio allocations. VGT is currently 10% of my portfolio and I recently made it a goal to increase that allocation to 20%. Talk me out of an allocation to 30%…. If I can stomach the volatility and have strong conviction in the future of tech, why would I not do it?

Some people worry stocks are going to go bust. Other worry they’ll miss even further upside. That’s what makes a market.

The Vanguard Information Technology ETF (VGT) has been on a tear for quite some time now:

Ten thousand dollars invested in this fund back in 2010 would have turned into nearly $165,000. That’s a total return of more than 1500% which translates into annual returns of more than 19% per year.

The biggest question I would ask when considering going more heavily into tech is this: What do you already own?

If you own an S&P 500 index fund, the top 10 stocks make up around 40% of the holdings. Nine of those 10 names are tech stocks.1

If you own a Nasdaq 100 fund, the top 10 stocks make up 54% of the holdings, all of them technology names.

Basically, if you own anything market cap weighted in the U.S. stock market you already have heavy tech exposure.

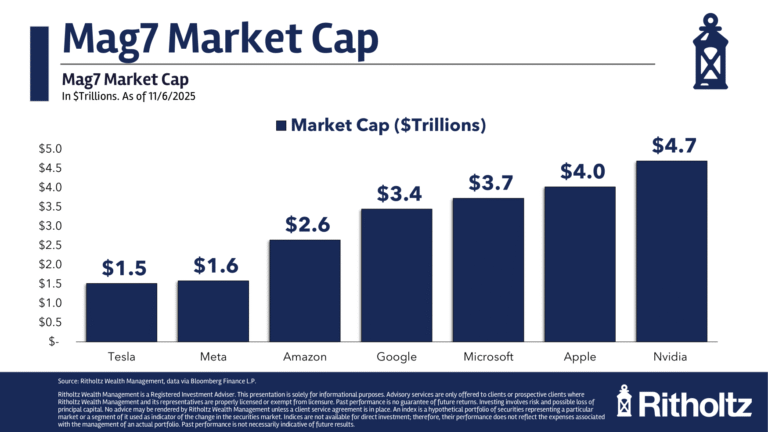

Just look at how big the market caps are on these companies are now:

That’s about $22 trillion in market cap for the Mag 7. The sheer size is breathtaking.

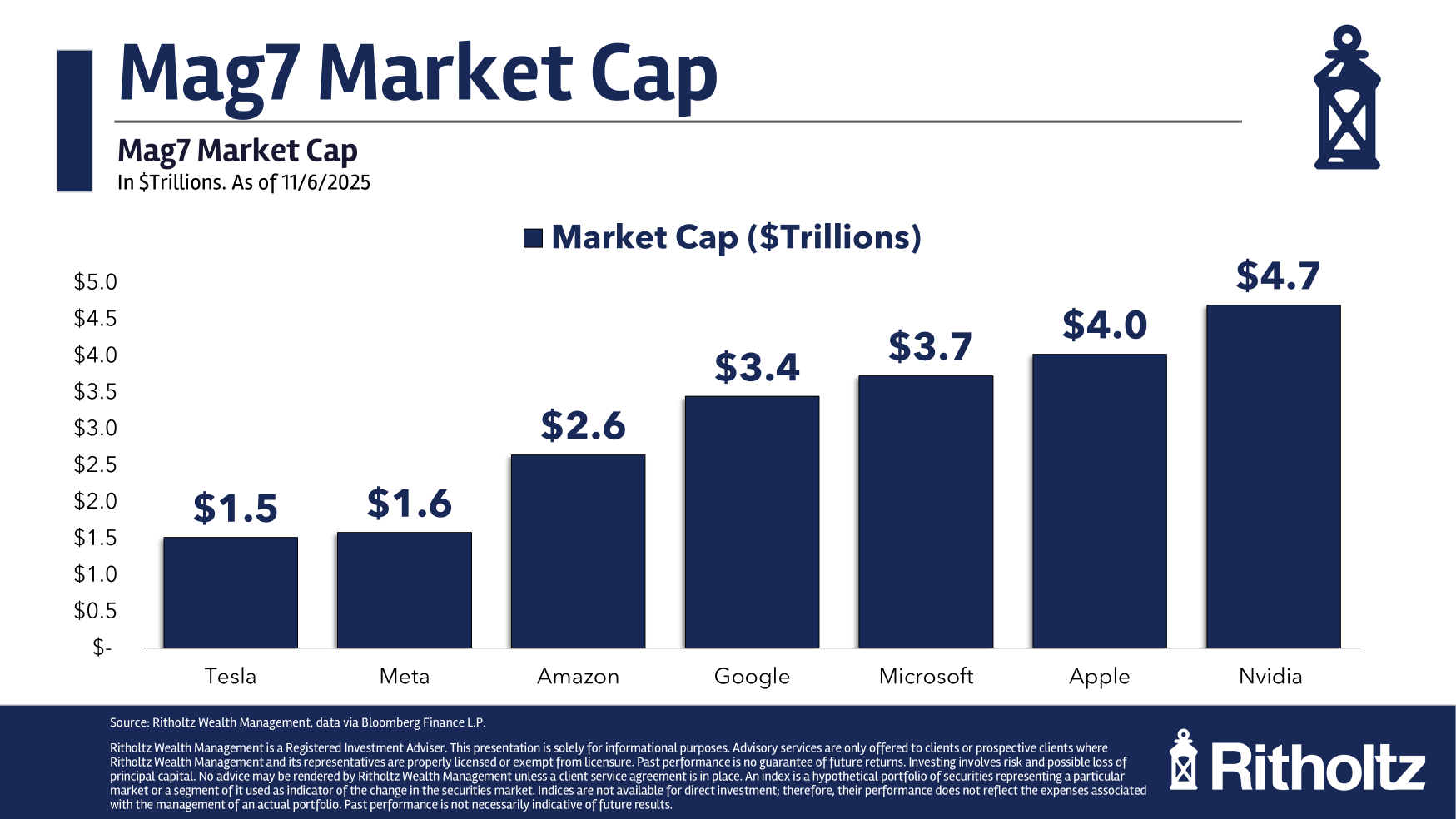

Check out this chart2 on the size of Apple’s revenue by product line compared to other corporations:

The iPhone produces more revenue than Bank of America or Meta. The iPad makes more money than AMD. Technology companies are now inextricably linked in all of our daily lives.

On the one hand, it does feel like we have to be late cycle because the returns have been so otherworldly.

On the other hand, we haven’t even seen how transformational AI is going to be. Robots are coming. Self driving cars will be more ubiquitous. There will be alternative forms of energy.

Innovation isn’t slowing down anytime soon.

It feels greedy to go all-in on tech at this point but you could have said the same thing in 2017 or 2020 and you would have been wrong.

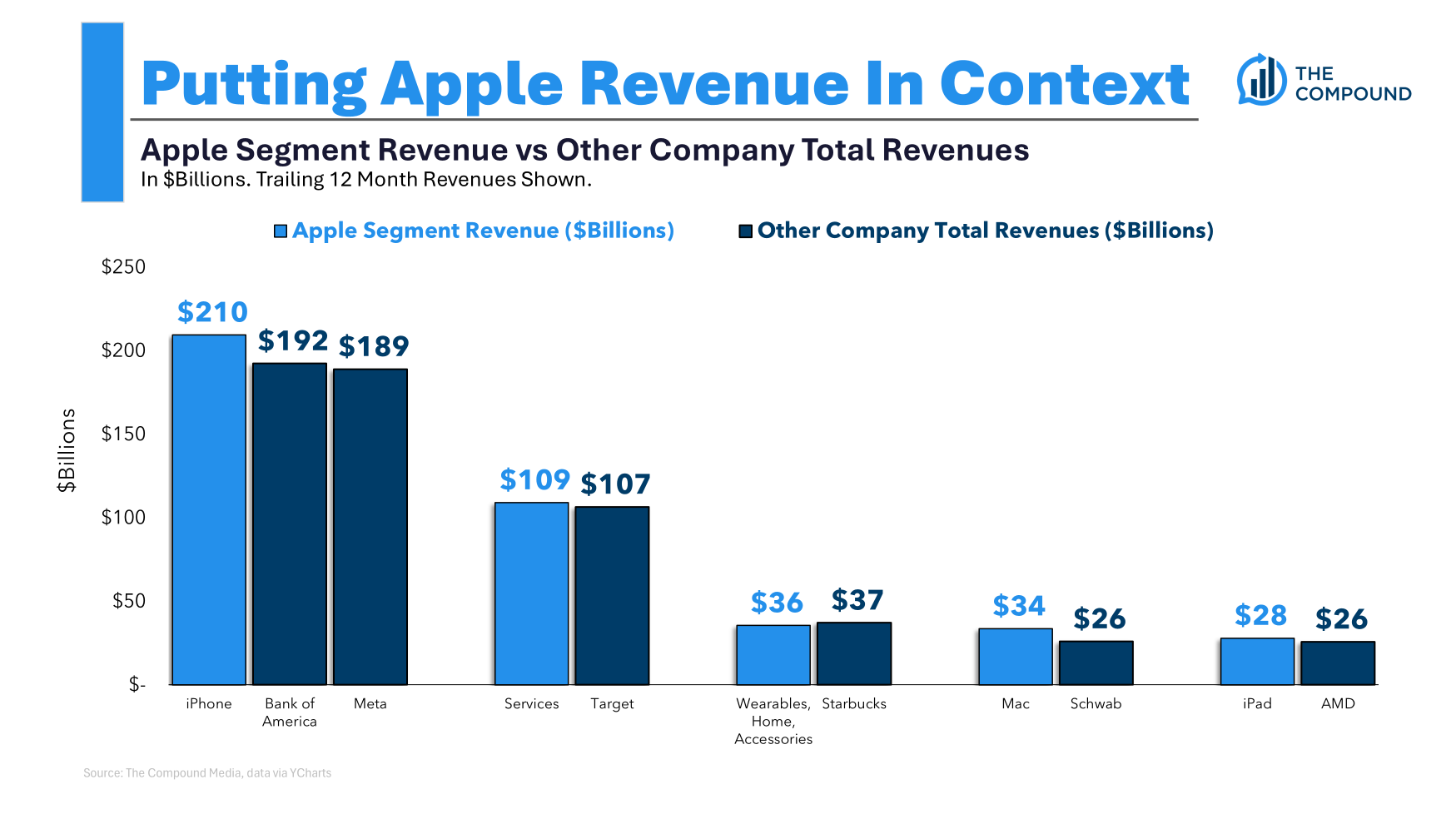

If you’re going to do this you do have to have a stomach for more volatility.

These stocks can and will get crushed at times:

If you want more tech exposure, size it appropriately and make sure you can handle more volatility in both directions.

No pain, no gain.

And sometimes, lots of pain with no gain.

I answered both of these questions in greater detail on the latest edition of Ask the Compound:

We also tackled questions about when to pay off your mortgage early, using cash in your fixed income allocation and the difference between the buyside and the sellside.

Further Reading:

The Melt-Up

1The other one is Berkshire Hathaway.

2This one was Michael’s idea with some help from Chart Kid Matt on the execution.