Today’s Animal Spirits is brought to you by Nuveen and YCharts:

This episode is sponsored by Nuveen. Invest like the future is watching. Visit https://www.nuveen.com/future to learn more.

This episode is sponsored by YCharts. Register for the November 19th webinar with Nick Maggiulli here: WEBINAR REGISTRATION and get 20% off your initial YCharts Professional subscription HERE when you start your free YCharts trial through Animal Spirits (new customers only).

Audience Survey: https://www.surveymonkey.com/r/P6T79NB

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky

Completely agree.

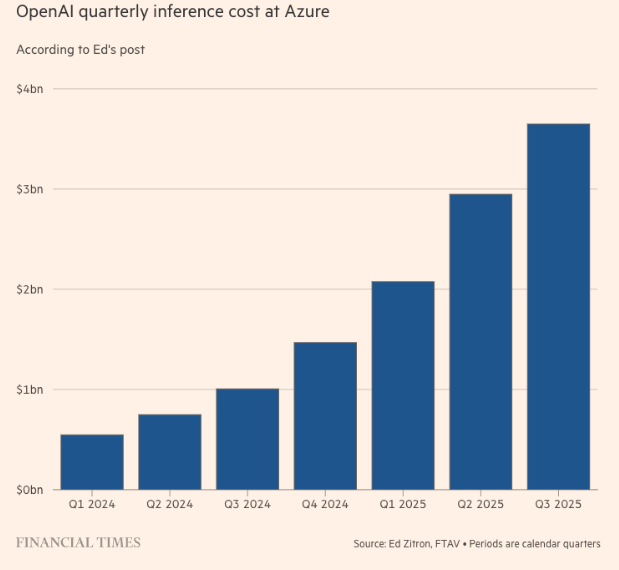

Sam Altman’s manifestly ridiculous $1 trillion of spending commitments shifted the AI investing landscape. The market is more skeptical now.

Ironically makes an IPO harder for them.

Also likely ended any potential for a 1999 style melt-up which is healthy. https://t.co/5TEgp3OfmO

— Gavin Baker (@GavinSBaker) November 15, 2025

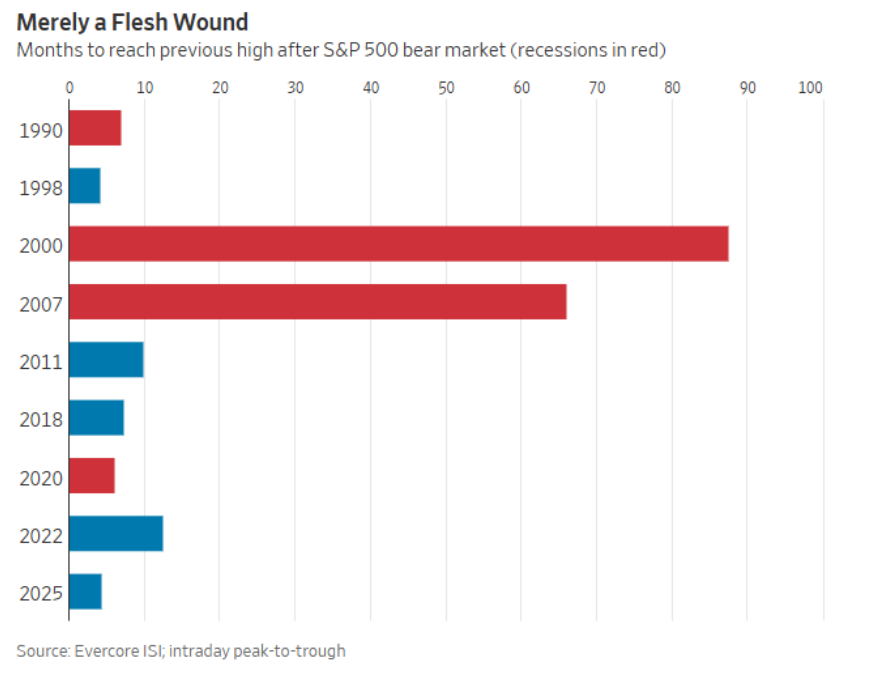

If you invested at the peak of the Nasdaq in March 2000, it would have been roughly 18 years before you were whole again: 15 years before the index reached the same point, plus another 3 for inflation.

— Paul Graham (@paulg) November 13, 2025

Tech bonds are getting hit hard of late as debt traders start wondering if they’re getting left with the bill for the stock market’s enthusiasm. Oracle’s $3.5 billion of 30-year debt issued in September has cratered by 8% from the October peak. pic.twitter.com/s3Exn7iqfs

— Lisa Abramowicz (@lisaabramowicz1) November 13, 2025

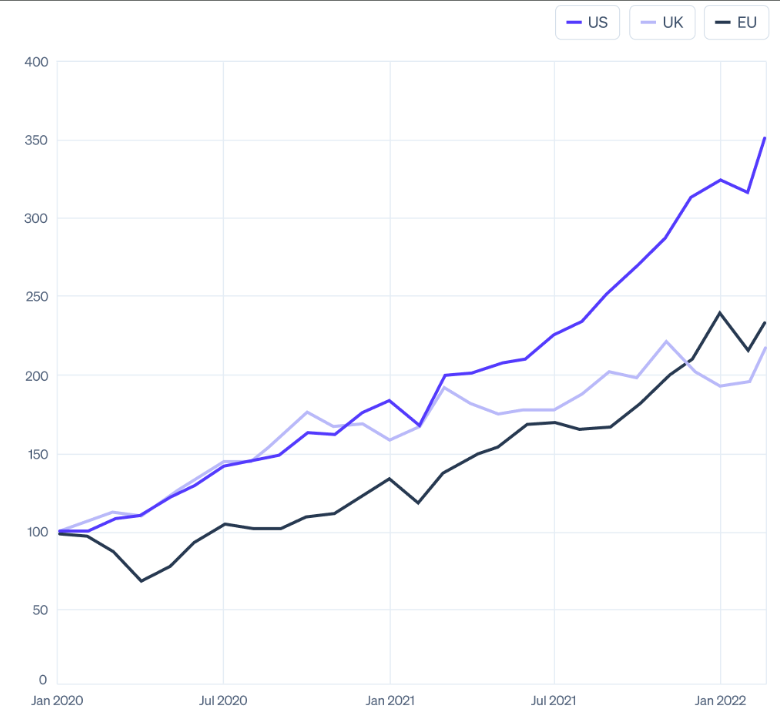

An interesting trend we’re noticing at Stripe: US startups are pulling ahead of their peers elsewhere.

These charts show averaged revenue growth for software startups in each location. US startups typically grow somewhat faster than those elsewhere. However, since mid-2023, US… pic.twitter.com/FWp6yUTUy9

— Patrick Collison (@patrickc) November 3, 2025

Me then, me now. Oh well.

It worked out. It will work out pic.twitter.com/vaordNav8d— Cassandra Unchained (@michaeljburry) November 12, 2025

The Trump administration is preparing tariff rollbacks on goods from countries beyond those that have reached trade agreements with the US in effort to lower prices @AnaSwanson @tylerpager me https://t.co/6fML7wxI3E

— Maggie Haberman (@maggieNYT) November 13, 2025

Brad Gerstner: “AI is becoming deeply unpopular in America”

“Silicon Valley is losing the battle around AI.”

“Doomers are now scaring people about jobs. They think all these job cuts that are going on in America are the result of AI.”

“And number two, they’re seeing their… pic.twitter.com/aDkC2Vkfsc

— The All-In Podcast (@theallinpod) November 8, 2025

19 stocks have fallen 30%+ on their earnings reaction days this season versus 14 that have gained 30%+.

Here’s both lists: pic.twitter.com/KKFg0wo05c

— Bespoke (@bespokeinvest) November 14, 2025

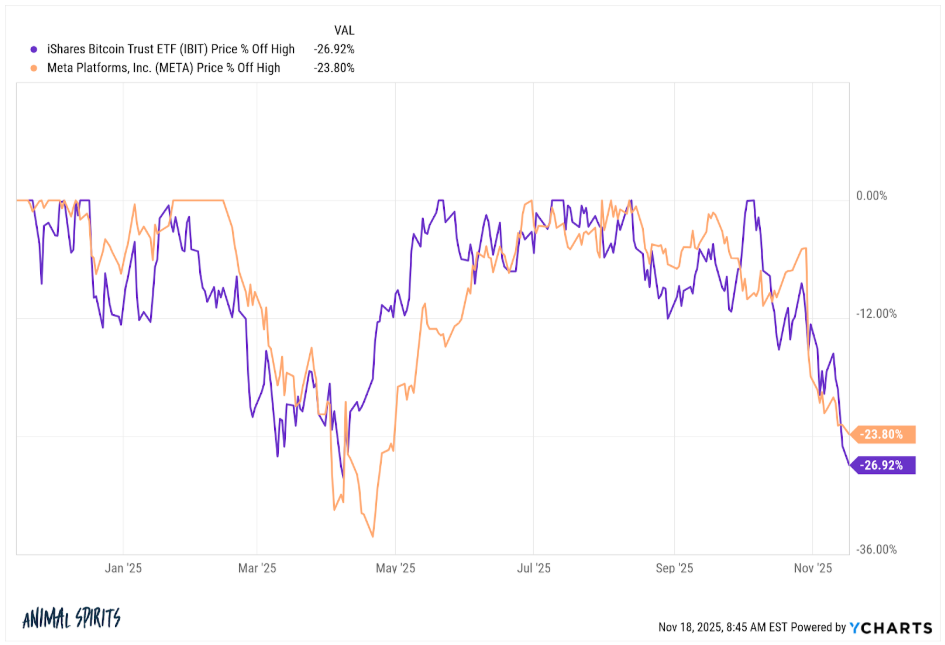

Sometimes compounders stop compounding. What lesson do you take away from this? pic.twitter.com/AI8yzQvVqX

— Long Equity (@long_equity) November 15, 2025

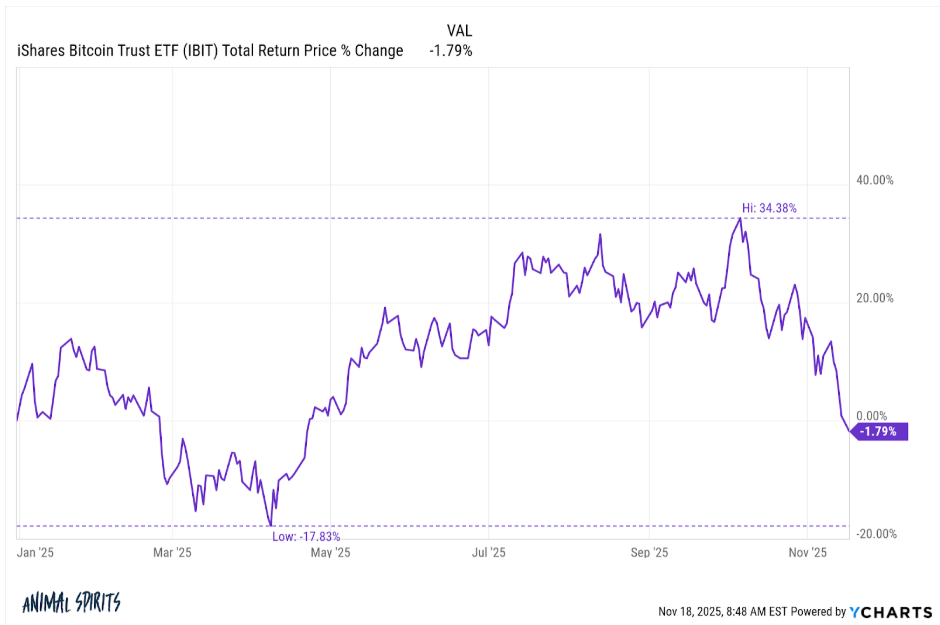

Just checked and yeah $IBIT is now Harvard’s largest position in its 13F and its biggest position increase in Q3. It’s super rare/difficult to get an endowment to bite on an ETF- esp a Harvard or Yale, it’s as good a validation as an ETF can get. That said, half a billion is a… https://t.co/oTiSL29llB pic.twitter.com/yw0tRcD1ad

— Eric Balchunas (@EricBalchunas) November 15, 2025

This is average, not median age, but the New York Fed finds that first-time homebuyers were *younger* in 2024 than in the 2000s. Haven’t gotten older on average in nearly 20 years.

h/t @MosesSternstein pic.twitter.com/6qTzoybCkD

— Connor O’Brien (@cojobrien) November 12, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.