The hard part about markets and the economy is that there are often conflicting signals about what’s going on.

Even when things are good there are ominous signs about impending doom.

And even when things are bad there are promising signs of impending improvement.

I would describe the current situation as much better than expected considering the circumstances but there are still plenty of risks on the horizon.

Let’s play a little good news-bad news on the current situation to give a full appraisal of today’s environment.

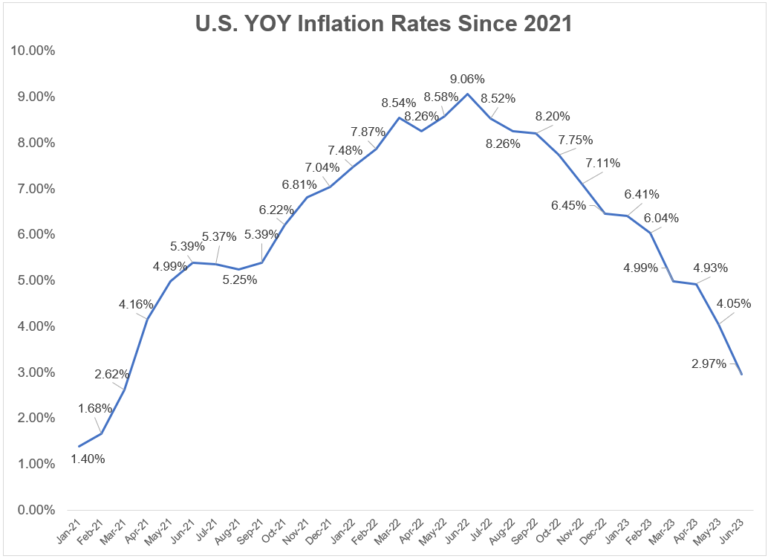

The good news is inflation is falling at a pretty fast clip:

After peaking at more than 9% in June of last year, the latest inflation reading was a hair under 3%.

It took 16 months for the inflation rate to go from under 3% to over 9%. It’s taken just 12 months to go from over 9% to under 3%.

We can build on this!

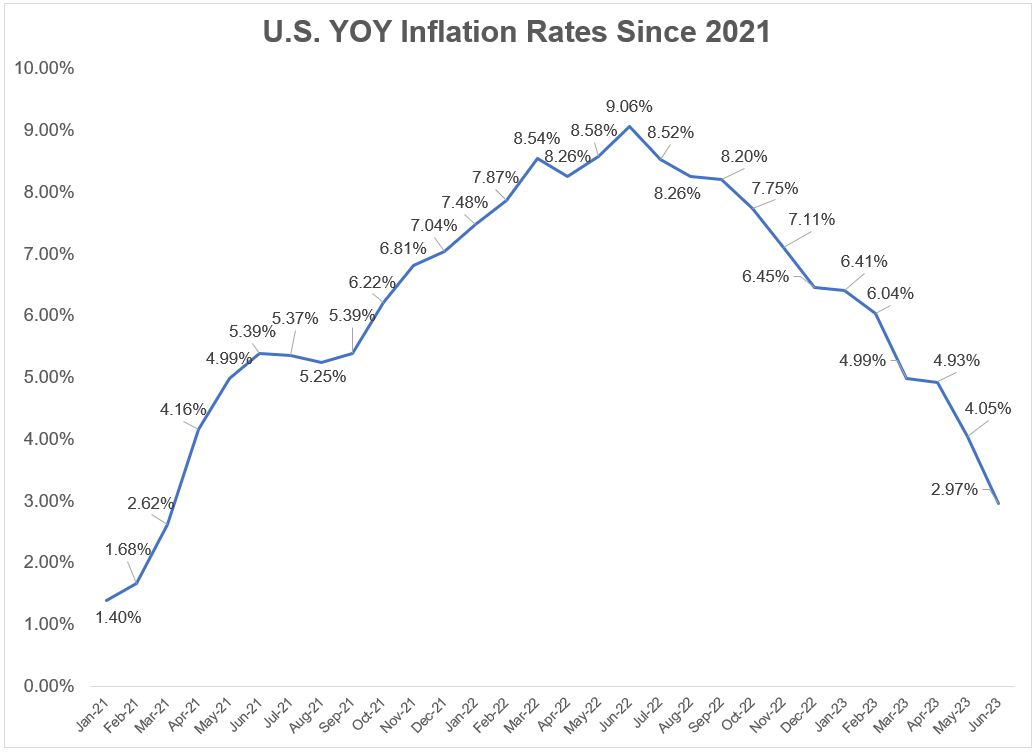

The bad news is inflation has been higher than wage growth for some time now:

We are finally starting to see some real wage growth but many workers have seen their wages fall after accounting for inflation for a while now.

One of the reasons consumer sentiment has been so poor despite a booming labor market is that so many people’s wages haven’t kept up.

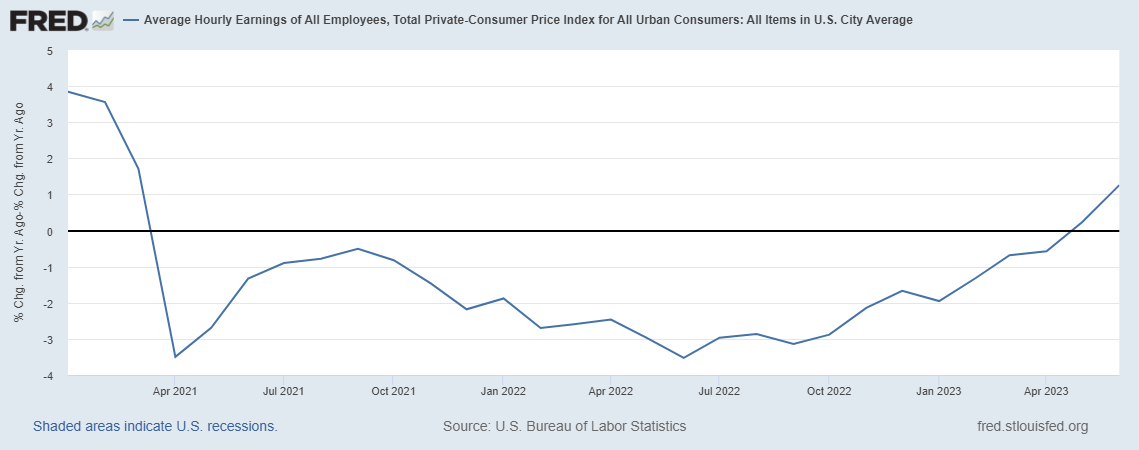

The good news is inflation is falling while the unemployment rate has remained steady:

The ever-elusive soft landing is looking like a very real possibility if this holds.

The bad news is that while the Fed has hiked aggressively, it’s possible higher rates will impact the economy on a lag. A year ago the Fed had short-term rates at 1.5%. They haven’t been at 5%+ for very long.

The downside risk here is the Fed went too hard and we just haven’t experienced the side effects yet.

The good news is the stock market has recovered nearly all of the bear market losses.

The bad news is…well there will be more bear markets in the future.

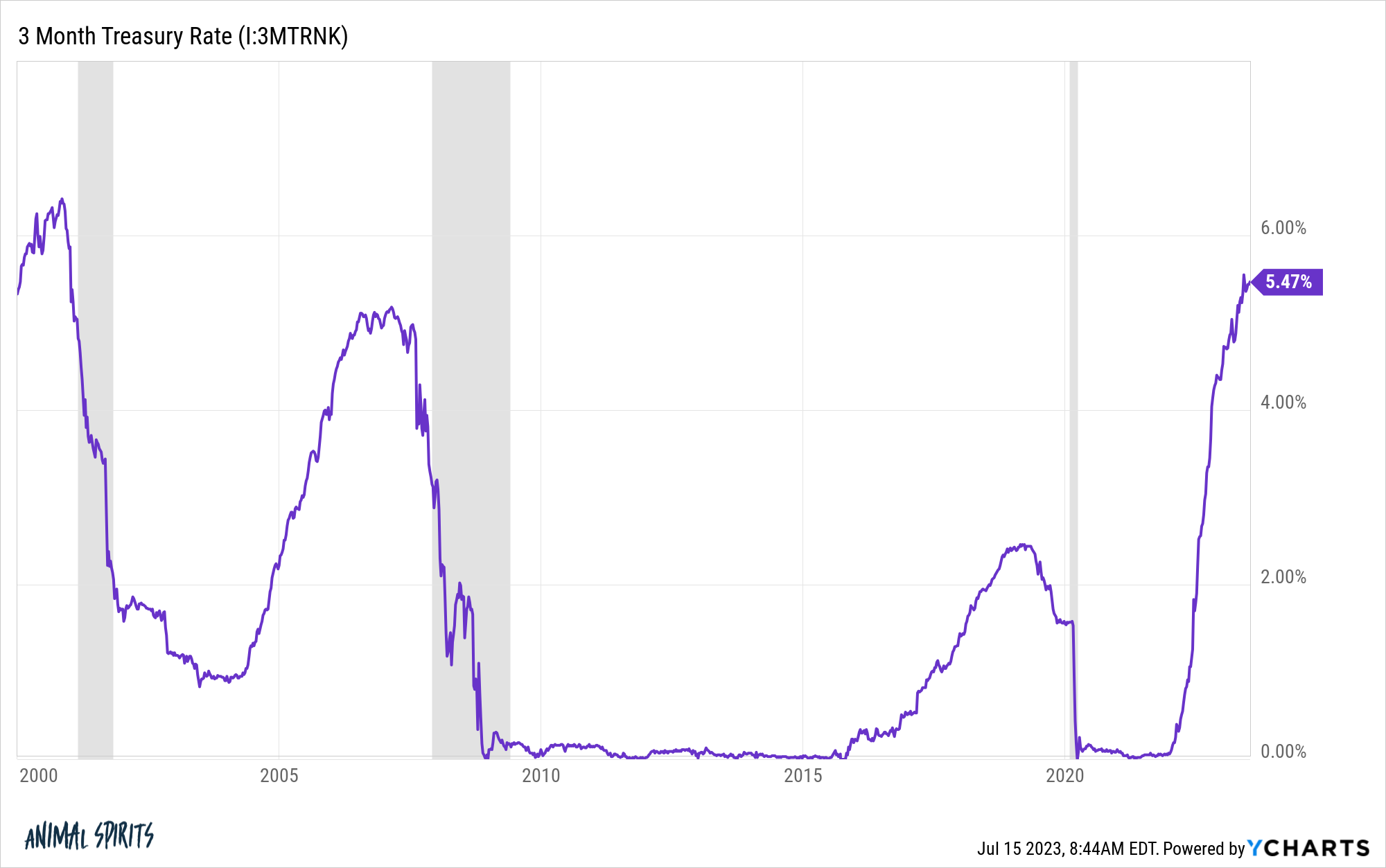

The good news is conservative investors finally are finally able to find decent yields on their savings:

Short-term interest rates are now at levels last seen in 2001 and may go higher if the Fed hikes rates again this summer.

Savers are no longer being punished by the Fed.

The bad news is inflation has eaten into these higher nominal yields, making them not as attractive on a real basis. As inflation falls, real yields are looking better but maybe not as great as they may seem at face value.

The good news nothing has broken in the economy yet (although we did have a banking crisis for like 9 days).

The bad news there is a lower margin for error now that we don’t have as much fiscal or monetary support.

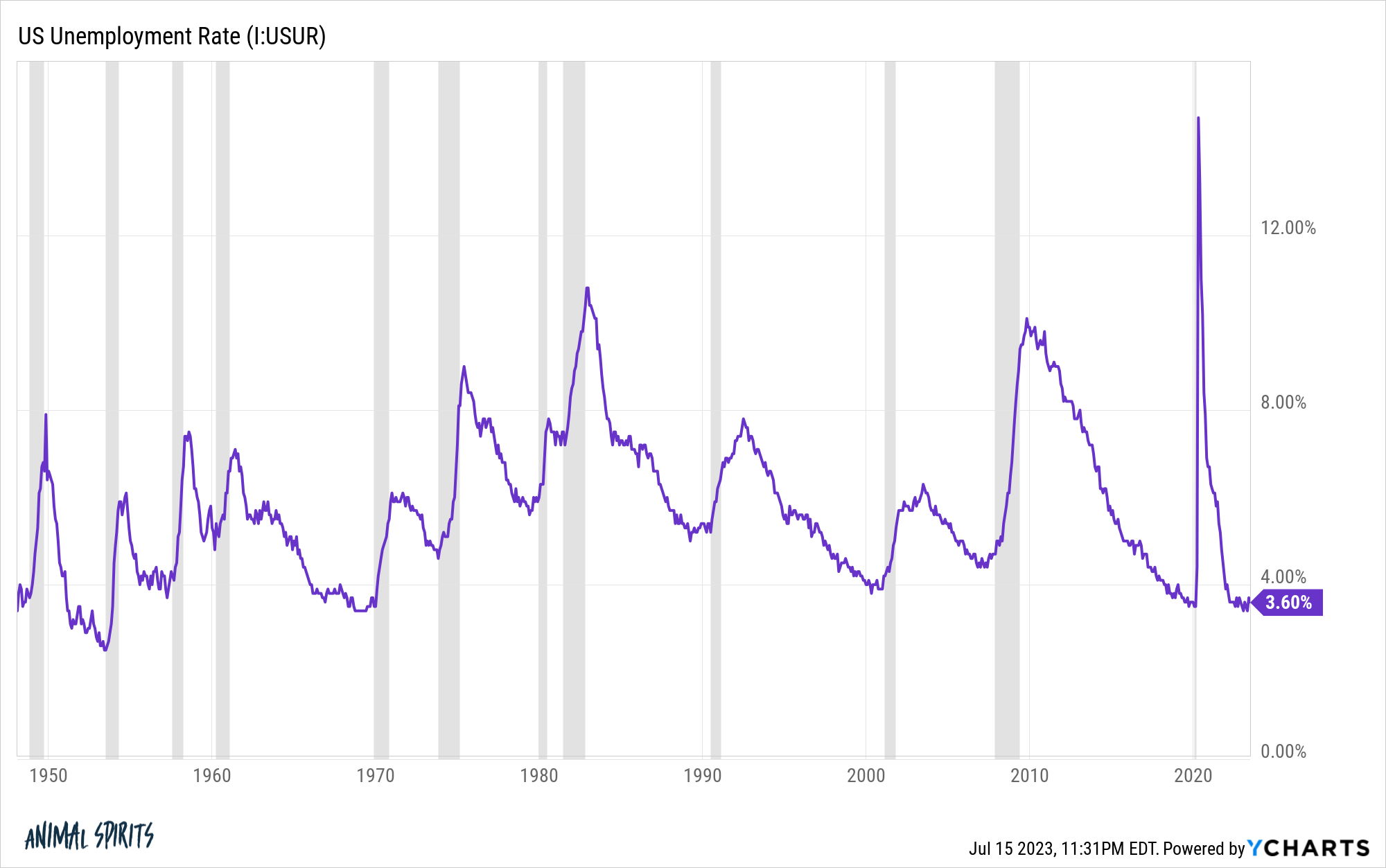

The good news we now have the lowest unemployment rate in America since 1969:

The labor market continues to impress.

The bad news is those grey bars on the chart that connotate recessions tend to inevitably follow low rates of unemployment.

Unfortunately, it’s not going to last forever.

The good news is we now have dozens of different streaming platforms with thousands of TV shows and movies to choose from.

The bad news is we might not have any new ones coming out any time soon now with the writer’s strike.

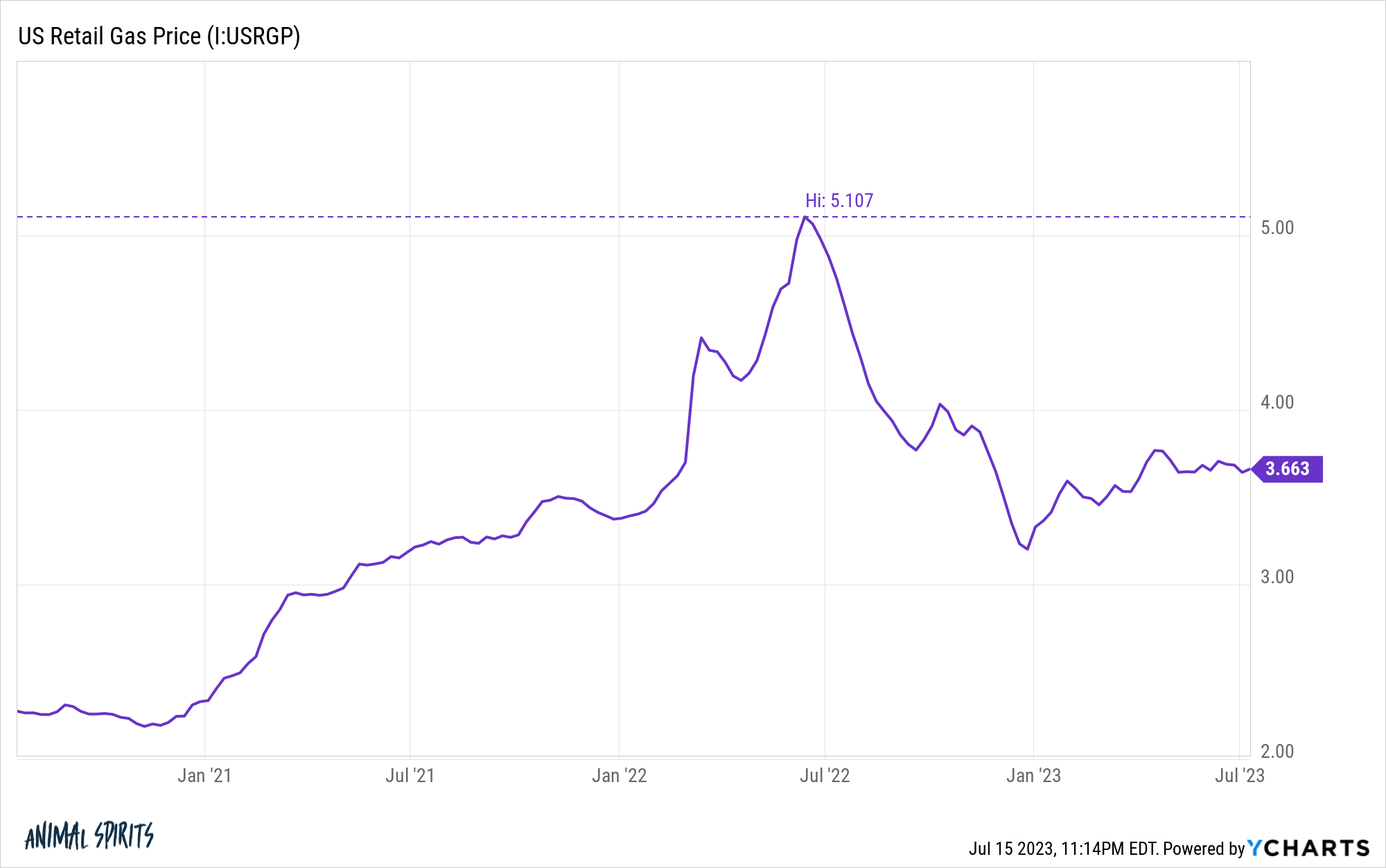

The good news is gas prices are down almost 30% from the peak of the energy crisis following the onset of the war:

I’m still surprised how much energy prices have fallen given the environment.

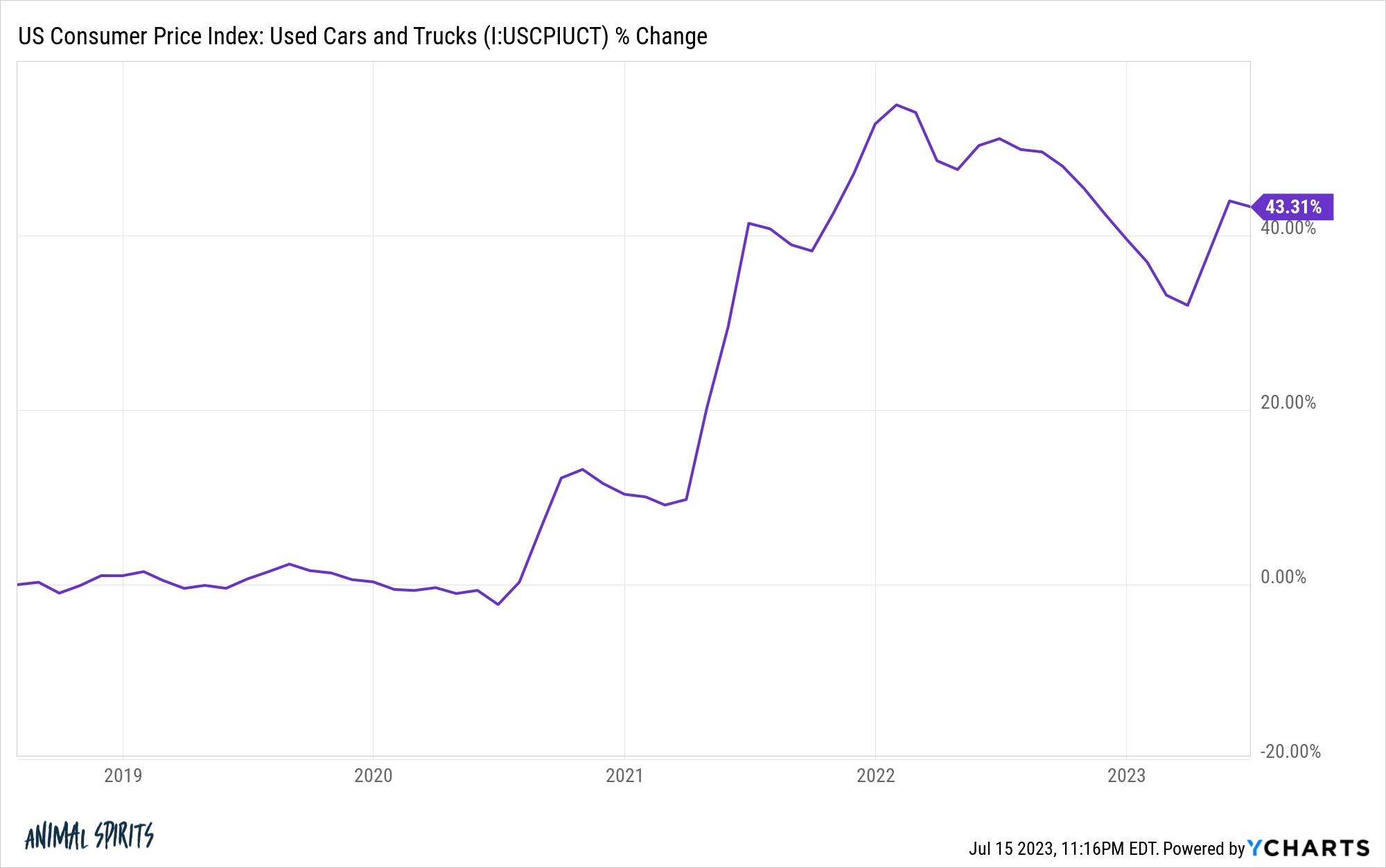

The bad news is the price of a car to put that gas in is now much higher. Just look at the inflation rate for used cars:

Used car prices are finally coming down but remain elevated from the pre-pandemic trend.

The good news is housing prices never crashed. I know many homebuyers would love to see lower prices but a housing market crash would certainly accompany an economic slowdown.

According to Redfin, home prices rose 1.5% nationwide year-over-year, the first increase in 5 months.

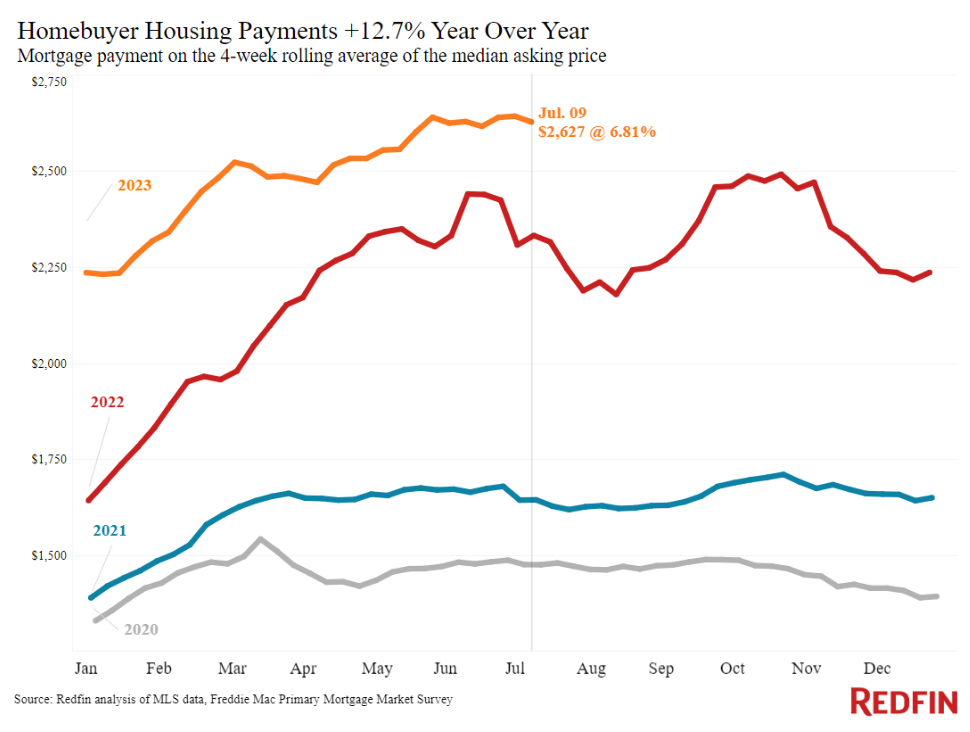

The bad news is housing remains unaffordable for a lot of buyers with higher prices and 7% mortgage rates:

The good news is if/when mortgage rates fall we are likely to see a flood of activity in the housing market.

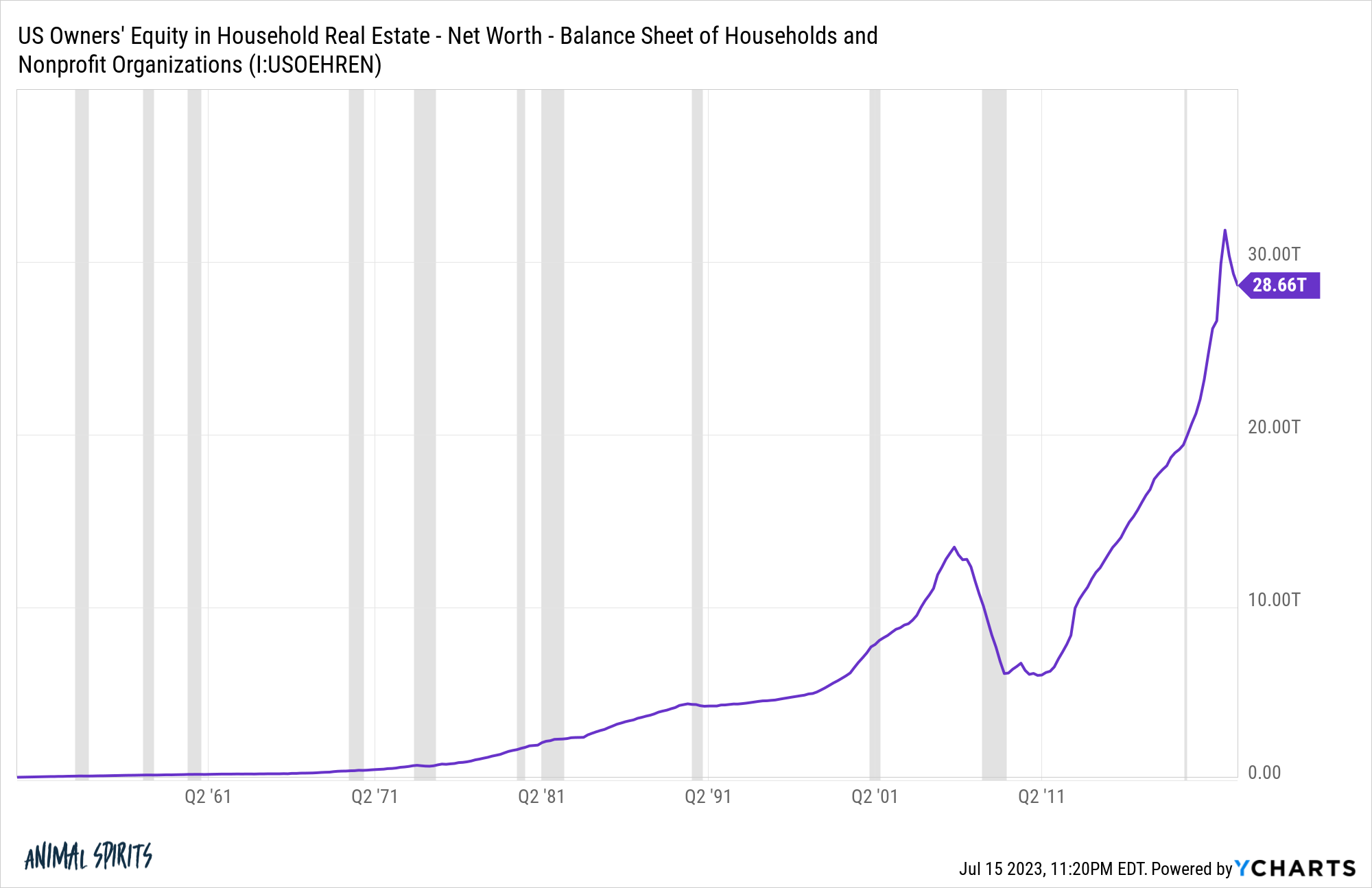

And it won’t be just more supply coming to market. Households have added almost $10 trillion in home equity since the start of the pandemic:

If mortgage rates go lower we’re going to see an insane amount of cashout refis and HELOCs.

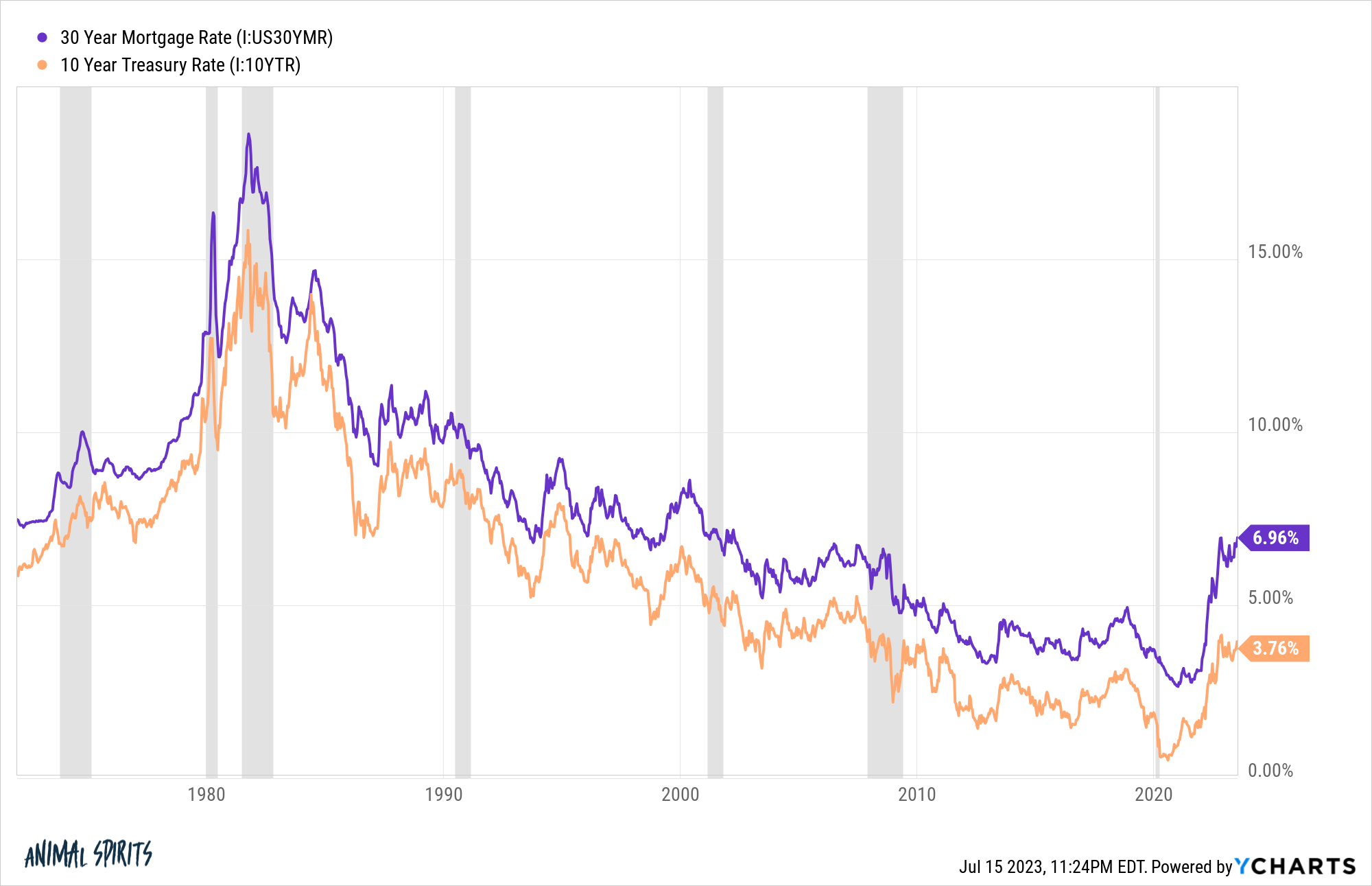

The bad news is that spreads between U.S. government bond yields and mortgage rates are much higher than historical averages from a combination of fewer Fed purchases of mortgage-backed securities and the swift change in yields:

If spreads stay high it’s possible mortgage rates don’t fall as much as borrowers hope.

The bad news borrowing rates are so much higher than they were for a decade-plus.

The good news is interest rates were high in the 90s and things were fine. Interest rates aren’t the be-all-end-all.

The bad news is excess savings are slowly but surely running out.

The good news is with inflation falling and real wages rising again we might have an immaculate economic baton hand-off in play.

The bad news is things will get worse eventually. The economy will slow. People will lose their jobs. Businesses will fail.

It won’t be fun.

The good news is we’ve had recessions before. They are a feature, not a bug, of the economic system in which we operate.

Things occasionally get worse but then they get better.

Further Reading:

Trade-Offs in the Economy, Markets & Life