Advance Phi Delt in the Interfraternal Giving Tuesday Challenge: Smart Giving Options That Make an Impact

Why Giving Tuesday Matters

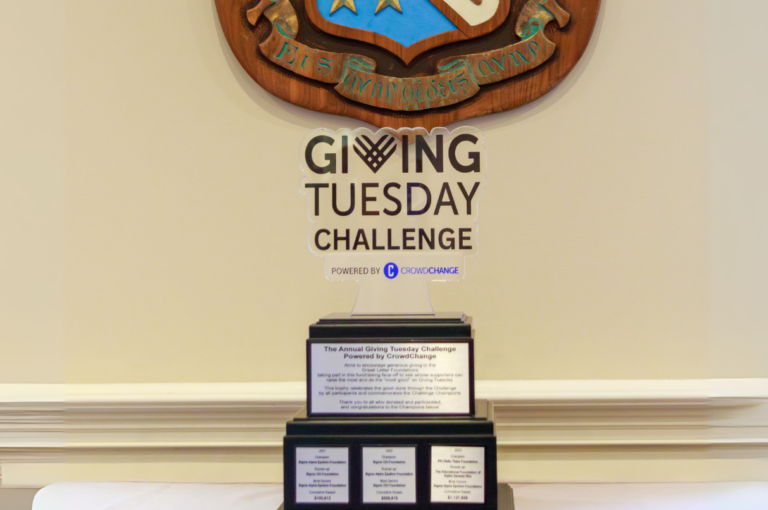

Giving Tuesday is more than a global day of generosity—it’s a chance for Phi Delta Theta to shine on the interfraternal stage. Each year, we compete against other fraternity foundations to raise the most support in a single day. In 2024, Phi Delt Nation rallied to raise $445,861, securing our second consecutive win and funding scholarships, leadership programs, and health initiatives for thousands of brothers. This year, we aim even higher—and your gift can help us keep the trophy and advance our mission.

Beyond Cash: Smarter Ways to Give

While online donations are quick and easy, there are other powerful giving strategies that can amplify your impact and maximize tax benefits:

1. Stock Giving

Donating appreciated stock is one of the most tax-efficient ways to support Phi Delta Theta. By transferring securities directly to the Foundation:

- You avoid capital gains tax.

- You receive a charitable deduction for the full fair market value.

- The Foundation receives 100% of your gift to invest in scholarships and leadership development.

Transfer Details for Stock Gifts

- Account Name: Phi Delta Theta Foundation

- Federal Tax ID: 34-6539803

- DTC Number: 0164

- Schwab Institutional Code: 40

Important: Notify Us for Challenge Credit

To ensure your gift counts toward the Interfraternal Giving Tuesday Challenge, please email Joanne McCoy after making your transfer—whether it’s stock, a DAF grant, or an IRA rollover. This step is critical for us to include your contribution in the competition totals.

2. Donor-Advised Funds (DAFs)

A DAF allows you to recommend grants to the Foundation from an account you’ve already funded. Benefits include:

- Immediate tax deduction when you contribute to your DAF.

- Flexibility to support Phi Delta Theta and other charities over time.

- Ability to donate appreciated assets without incurring capital gains tax.

Important: Notify Us for Challenge Credit

To ensure your gift counts toward the Interfraternal Giving Tuesday Challenge, please email Joanne McCoy after making your transfer—whether it’s stock, a DAF grant, or an IRA rollover. This step is critical for us to include your contribution in the competition totals.

3. IRA Charitable Rollovers

If you’re 70½ or older, you can make a Qualified Charitable Distribution (QCD) directly from your IRA:

- Satisfies your Required Minimum Distribution (RMD).

- Reduces taxable income.

- Supports Phi Delta Theta without writing a check.

Important: Notify Us for Challenge Credit

To ensure your gift counts toward the Interfraternal Giving Tuesday Challenge, please email Joanne McCoy after making your transfer—whether it’s stock, a DAF grant, or an IRA rollover. This step is critical for us to include your contribution in the competition totals.

4. Cryptocurrency Giving

Donating cryptocurrency is a fast, secure, and tax-efficient way to support Phi Delta Theta. By transferring crypto assets directly to the Foundation:

- You may avoid capital gains tax on appreciated cryptocurrency.

- You receive a charitable deduction for the fair market value of your gift.

- The Foundation converts your crypto into funds that fuel scholarships, leadership programs, and health initiatives.

How to Give Crypto

Important: Notify Us for Challenge Credit

To ensure your gift counts toward the Interfraternal Giving Tuesday Challenge, please email Joanne McCoy after making your crypto donation. This step is critical for us to include your contribution in the competition totals.

Why It Matters

Every dollar raised during Giving Tuesday fuels our vision of awarding $2 million annually in scholarships and leadership grants. These gifts empower brothers to lead with integrity, excel academically, and uphold the values of Friendship, Sound Learning, and Rectitude.

Ready to Make Your Impact?

- Stock Gifts: Contact your broker and use the transfer details above.

- DAF Grants: Recommend a grant to Phi Delta Theta Foundation through your DAF provider.

- IRA Rollovers: Ask your IRA custodian to make a direct transfer.

Then, notify Joanne McCoy so your gift helps us win the challenge!