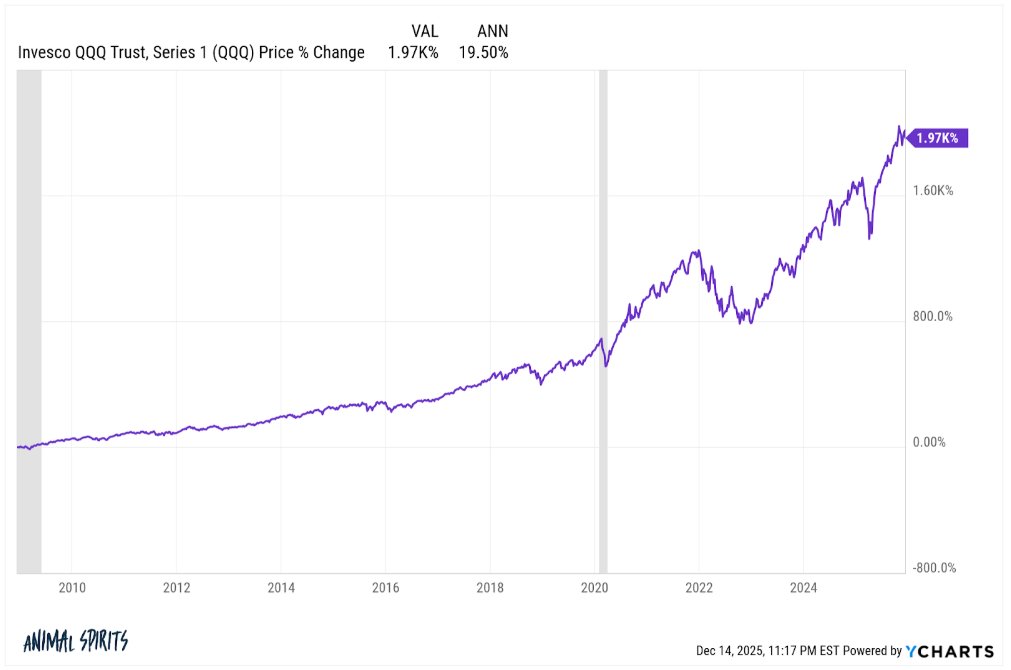

Today’s Animal Spirits is brought to you by YCharts and Vanguard:

This episode is sponsored by YCharts. download Charts That Defined 2025, here https://go.ycharts.com/charts-that-defined-2025?utm_source=Animal_Spirits&utm_medium=Original_Research&utm_campaign=Charts_that_Defined_2025&utm_content=Podcast And start your free YCharts trial through Animal Spirits (new customers only) at https://go.ycharts.com/animal-spirits

This episode is sponsored by Vanguard. Learn more at: https://www.vanguard.com/audio

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky

Cyclical sectors are leading the breakout list.

For the first time since July, financials, industrials, and technology simultaneously saw at least 10% of their stocks hit 52-week highs. pic.twitter.com/HArlcmtDlI

— Turning Point Market Research (@TPMRSignals) December 12, 2025

The U.S. unemployment rate, at 4.6% in November, is now up half a percentage point over the last five months. In 77 years of data, the number of times that’s occurred outside a recession can almost be counted on one hand—1951, 1952, 1956, 1986, 1991-92 and 2003

— Matthew B (@boes_) December 16, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product