There are 70+ million baby boomers.

Roughly half of them are currently retired.

Nearly 12k boomers will be retiring every day from now until the end of this decade.

This group controls more than $85 trillion of wealth.

Not all of that wealth will be spent down. A lot of it will be passed down to the next generations.

But solving the retirement spending puzzle is going to be one of the main challenges for financial advisors and investors alike in the years ahead.

There is no scientific method to this process. It’s a game of expectations, estimations, guessing, planning and course corrections.

As a self-professed finance nerd I enjoy doing deep dives on your various options when it comes to spending down your portfolio.

This past summer I spoke with Bill Bengen, the father of the 4% spending rule.

Last month I shared a blog post from John Thees about his 4 year rule.

Every time I write or talk about this stuff, there are people offering comments, questions, concerns, and their own tweaks to the models. It makes sense that people are constantly tinkering with and building on top of retirement spending methods because there is no one-size-fits-all strategy. Like most financial advice, this decision is personal and circumstantial.

Stefan Sharkansky decided to throw his hat in the ring with a new research paper titled The Only Other Spending Rule Article You Will Ever Need.

I like this goal from the paper’s introduction:

Few have adequately explained how to satisfactorily avoid both the rock of outliving one’s assets and the hard place of chronic underspending.

Therein lies the problem for most retirees — how do you balance longevity risk with the risk of underspending?

Sharkansky’s model has some elements of the Four Year Rule and some variable elements of the 4% Rule.

Here’s how it works:

There are two primary allocations. The growth bucket is a stock market index fund. The spending bucket is a ladder of Treasury Inflation-Protected Secuturies (TIPS).

The TIPS provide relatively stable, inflation-protected income while the stocks provide more variability and growth. The split between stocks and bonds depends on how many years worth of spending you require or desire in fixed income.

The goal would be to set up a ladder of TIPS such that every year the maturing bond acts as your fixed income spending for the year. There is also a variable spending component that’s recalculated each year based on the amount of money you have in stocks (it’s a percentage of the total).

So there is a fixed and a variable component involved where the variable component acts something like an annuity or required minimum distribution that ensures you’re actually spending down your nest egg.

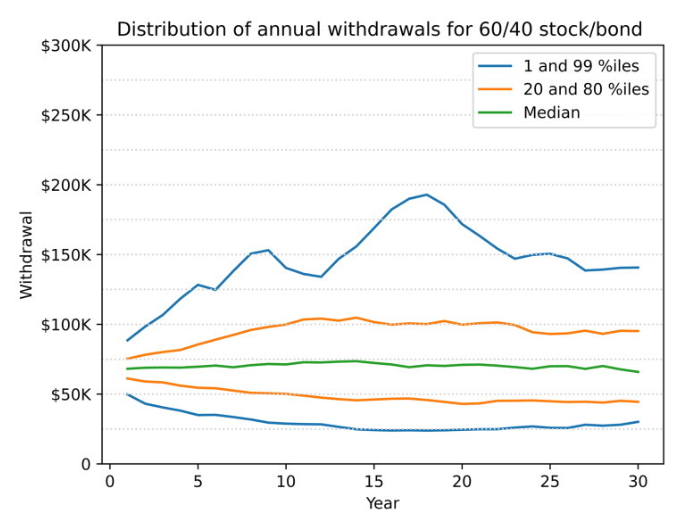

That variable component requires some flexibility though because it means higher levels of spending when the stock market is going up and lower levels of spending when the stock market is going down.

The 4% Rule was created to protect against the worst-case scenario. Most of the time the worst-cast scenario doesn’t happen so you end up under-spending based on your portfolio’s potential. That was what Sharkansky was trying to avoid with his strategy.

As with most financial decisions, there are always trade-offs involved. There are also some surprising findings in his paper like the fact that a 100% stock portfolio would have actually led to better results than a balanced portfolio.

Stefan joined me on Talking Wealth to discuss his findings, the pros and cons of each withdrawal strategy, the benefits of TIPS in retirement, how to spend more money, how to allocate your assets in retirement and more:

If you’re an advisor, subscribe to the Talking Wealth Newsletter.

Further Reading:

Does the 4% Rule Still Apply?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.