A reader asks:

I have something of an existential question for you. I’m fast approaching retirement age with a not-to-brag level of wealth. Most experts (including my advisor) would say it’s enough money for financial independence. That means my wife and I don’t need to work anymore. We can do what we want when we want if we want to. But that sounds boring. What am I supposed to do play golf every day? I like working. It gives me a sense of purpose. I don’t want to sit on my butt all day doing nothing. I have more fun growing our nest egg than spending it down. Is there something wrong with me? Is it possible to somehow rewire my brain to enjoy our money or get off the hamster wheel?

Most personal finance experts will tell you financial independence is the only thing that matters.

You spend less than you earn. Live below your means. Create a big pile of money. And once you have that big pile of money you can do whatever you want, whenever you want with no restrictions.

The problem is no one is there to help you define what it is you want to do, especially when work and financial independence are your main priorities.

This is a first-world problem but something many retirees will be dealing with in the years ahead.

One of the reasons retirement can be such a challenge for some people is because it’s still a relatively new concept. Up until the 20th century or so the retirement plan for the majority of the population was you worked until you died.

Less than 3% of the population was 65 or older in 1850. It was just 7% in 1940. Today it’s closer to 20% of the population. By 2050 it’s projected that nearly 25% of the U.S. population will be in or entering retirement age.

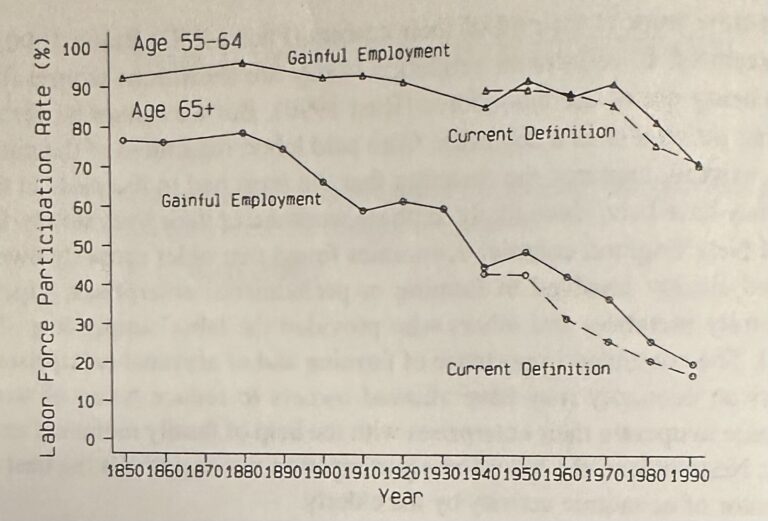

In 1880 more than three-quarters of men older than 64 were still in the labor force (and 81% of all 70 year olds).

Most people simply couldn’t afford retirement. For those who did retire, half of them lived with their children.

If you were 20 years old in 1880 you could expect to spend less than 6% of your life in retirement (2.3 years). If you were 20 in 1990, you can expect to spend up to one-third of your life in retirement.1

That much leisure time is still relatively new.

Some people spend their entire lives working in jobs they do not enjoy with the hope that one day they can retire, play golf all day and relax in the sun.

But others find purpose and satisfaction in their work. Relationships have the ability to make you happier and many people forge friendships at the office. Work can also keep you motivated.

Researchers tracked employees from Shell Oil who retired at ages 55, 60 and 65 over a 30 year period from the early-1970s through the early-2000s. They discovered the people who retired early at age 55 had double the mortality rate of those who retired at 65.

Part of the reason some people retire earlier is because their health degrades. But they also found that the lack of social and cognitive engagement played a role as well. I’ve heard plenty of stories over my years in wealth management of people who lost their way once they retired and felt like they had no purpose anymore.

Working longer can have its benefits, even when you’re financially independent.

Obviously, working too much can also be a detriment if it causes too much stress or forces you to miss out on more important stuff.

Work can be part of your financial indepence. Like other aspects of your financial plan, you just need some rules in place to guide your actions so it doesn’t become all-consuming.

Here are some work rules I would institute in this situation:

- The no assholes rule. Only work with people you like and respect.

- The no stress rule. Don’t keep working if it stresses you out all the time. You’re not wealthy if your work causes constant worry and anxiety.

- The no rule. Financial independence should make it easier to say no to invitatations, projects and events you don’t want to do. When you’re younger sometimes you have to suck it up. That shouldn’t be the case when you’re working by choice.

- The no regrets rule. Don’t keep working if it makes you miss out on family stuff. No one ever says I wish I would have worked longer hours on their deathbed.

Can you rewire your brain this late in life? Probably not.

Retirement doesn’t have to be 18 holes and sitting on the beach all day. You can still find ways to keep your brain active. The typical retirement dream is not for everyone.

But you should look for ways to introduce some more balance in your life.

Work on the stuff you enjoy and then find other ways to spend your time.

I talked about this question on this week’s Ask the Compound:

Brian Jacobs from Aptus Capital joined us on the show this week to discuss questions about options-based ETFs, buffer ETFs and more.

Further Reading:

How to be Happier at Work

1These stats are from The Evolution of Retirement by Dora Costa.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.