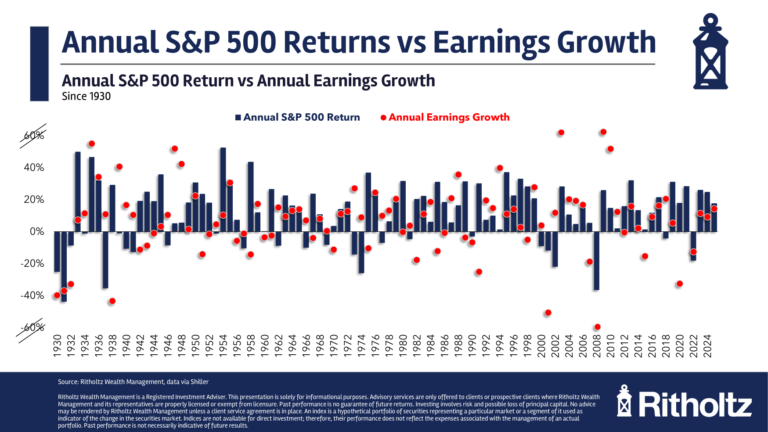

I shared this chart recently about the fundamental breakdown of S&P 500 returns in 2025:

The fact that the dividend yield plus the earnings growth more or less equalled the total return makes for a clean story.

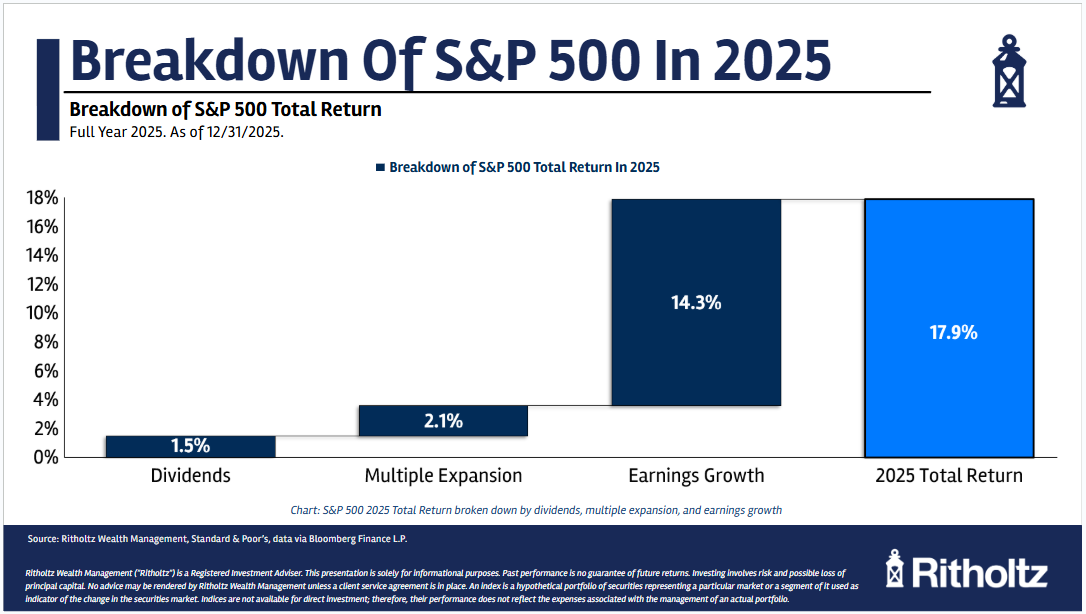

Investors tend to focus on a wide variety of variables — the Fed, geopolitics, interest rates, inflation, economic growth, etc. — but corporate earnings are the biggest driver of stock market returns over the long run:

Having said that…the relationship between earnings growth and stock market returns is not always as clear-cut as it was in 2025.

There are plenty of times when earnings and the market are not in sync with one another.

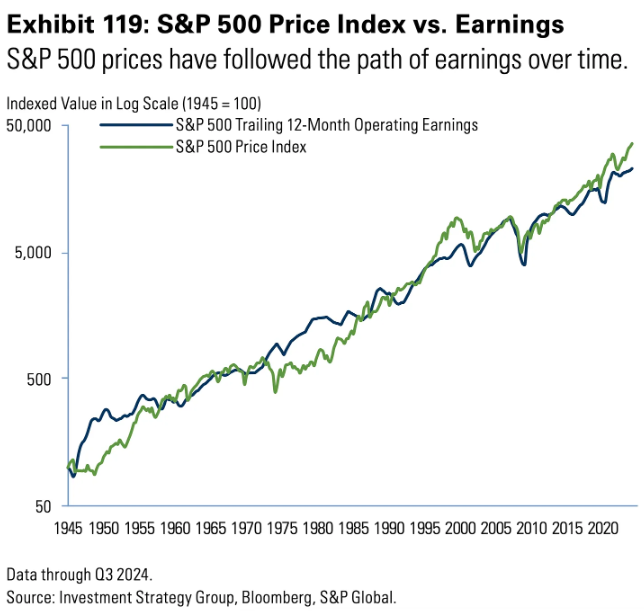

Here’s a look at the annual returns for the S&P 500 along with the year-end change in earnings going back to 1930:

You can see the relationship between the two growth rates is not exactly one-to-one in most years. In fact, there are plenty of years when returns are up, but earnings are down and vice versa.

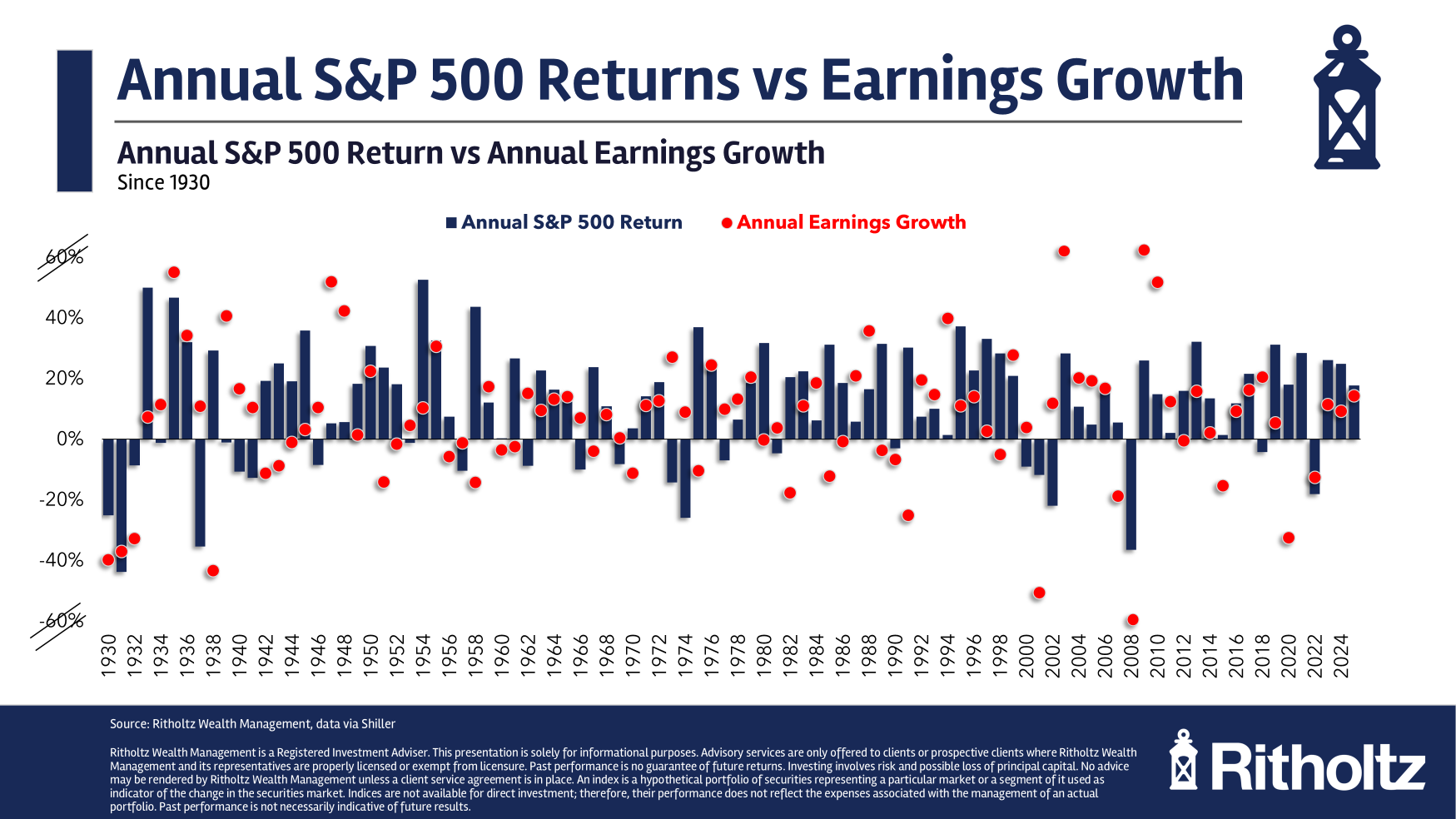

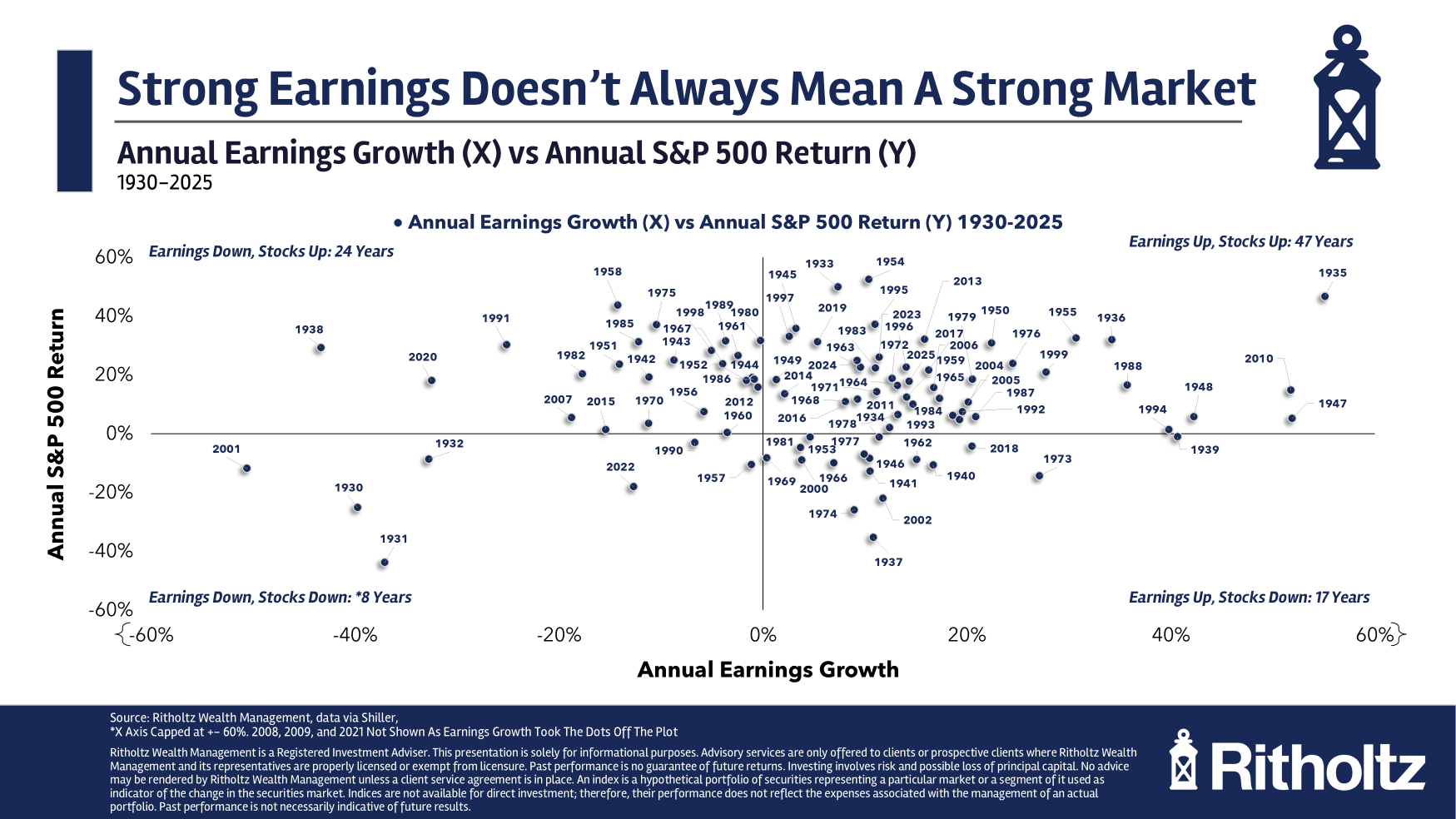

Here’s another way of visualizing this:

The quadrant with the most dots is earnings up, stocks up. That happened in 47 out of the past 96 years, roughly half the time. Then there were 8 years when stocks and earnings both fell concurrently.1 This also makes sense.

So far so good.

But there were 24 instances when earnings fell in the same year stocks finished the year up.

And there were 17 years in which the stock market was down but earnings actually rose.

That means nearly 45% of the time stocks and earnings have gone in different directions in a given year since 1930. Almost half of all years the relationship between earnings growth and price growth breaks down.

There are explanations for this of course.

Earnings are reported on a lag. The market is forward-looking. Sometimes investor expectations are caught offside.

This is a good reminder that long-term market forces can often get distrupted in the short-term. Even if you knew what earnings were going to do in a given year doesn’t necessarily mean you can predict what will happen in the stock market.

Stocks can rise during an earnings recession.

Stocks can fall when earnings are going higher.

Anything is on the table in a given year because emotions, trends and expectations often have more to do with short-term performance than fundamentals.

Plan accordingly.

Michael and I talked about corporate earnings, small caps, the stock market and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

2025 Investing Lessons

Now here’s what I’ve been reading lately:

Books:

1The reason you don’t see 2008 on this chart is because earnings fell nearly 80% that year. We had to cap the axis on the chart to make it easier to read. So 2008 is included in the total, you just can’t see the dot. Same thing with 2009 on the upside when earnings grew more than 200%.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.