Today’s Animal Spirits is brought to you by Nuveen and ClearBridge Investments:

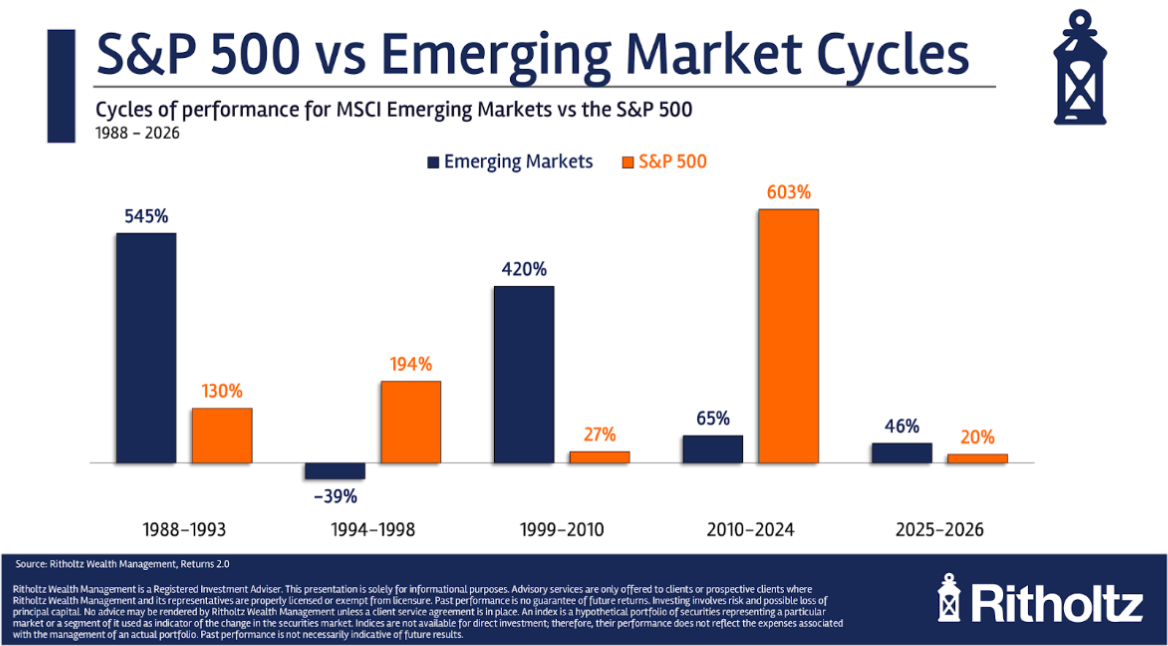

Today’s show is sponsored by ClearBridge Investments. International and emerging market stocks outperformed the U.S. in 2025. At ClearBridge, we believe this momentum can continue. Find out more at https://www.clearbridge.com/

Today’s show is sponsored by ClearBridge Investments. International and emerging market stocks outperformed the U.S. in 2025. At ClearBridge, we believe this momentum can continue. Find out more at https://www.clearbridge.com/

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky

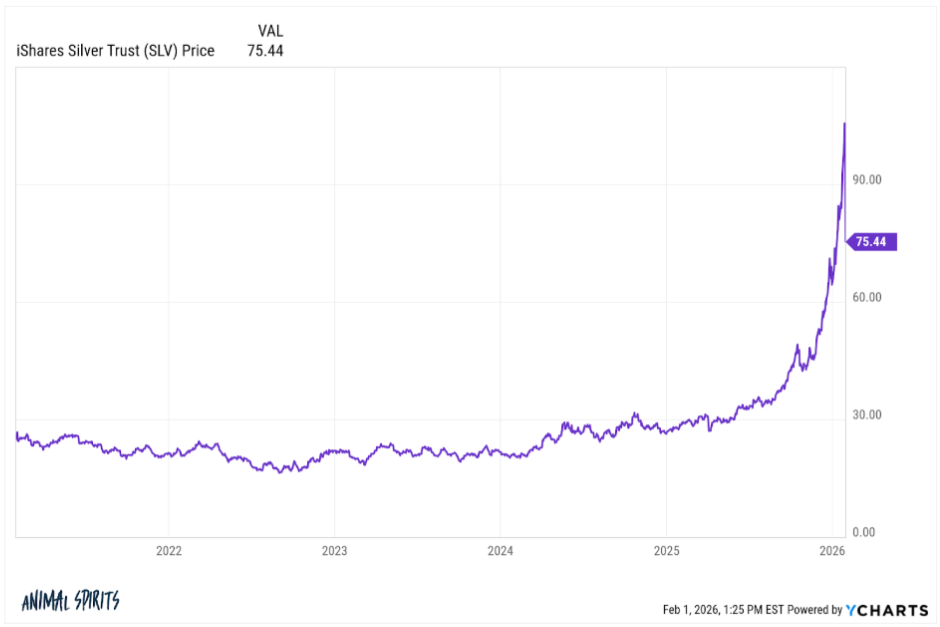

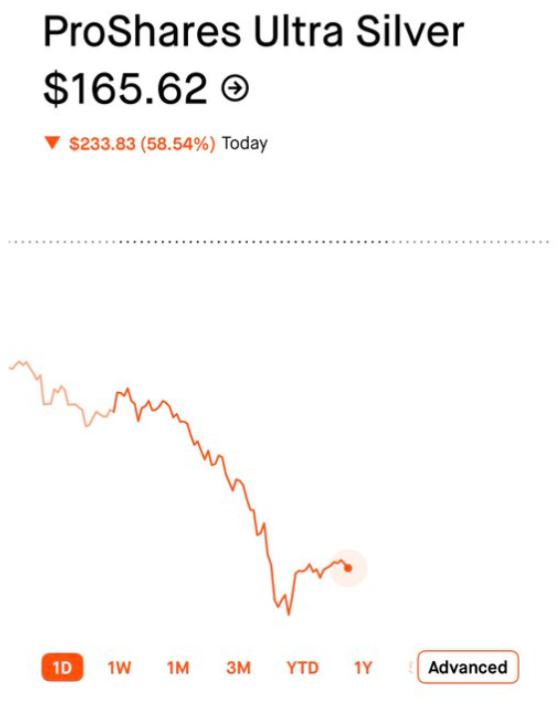

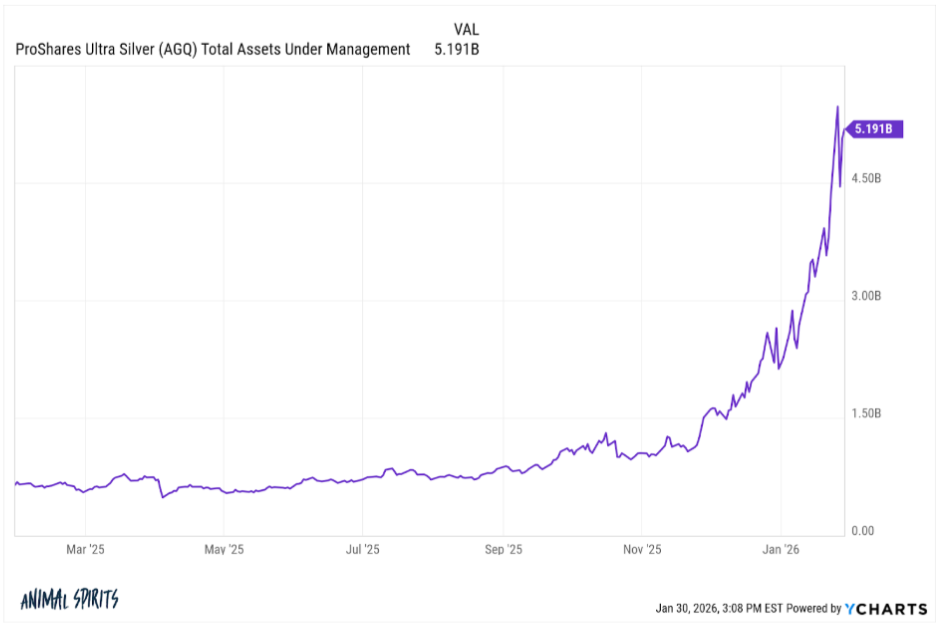

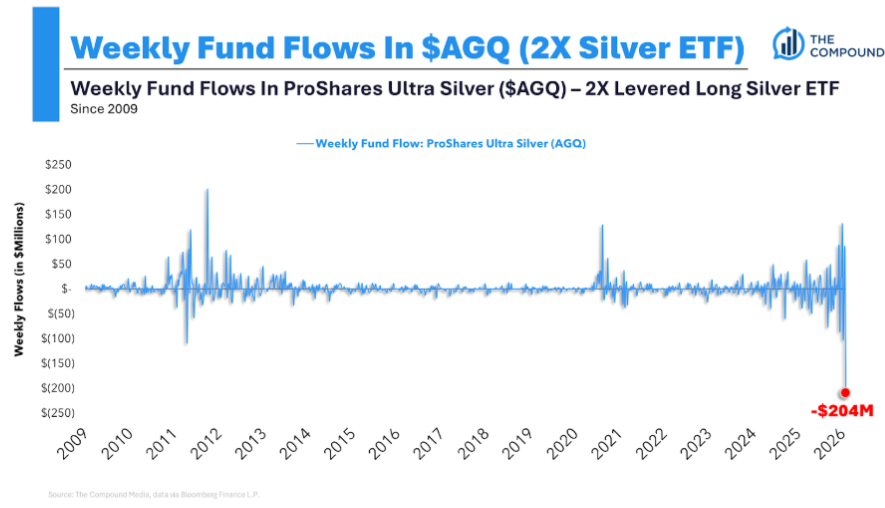

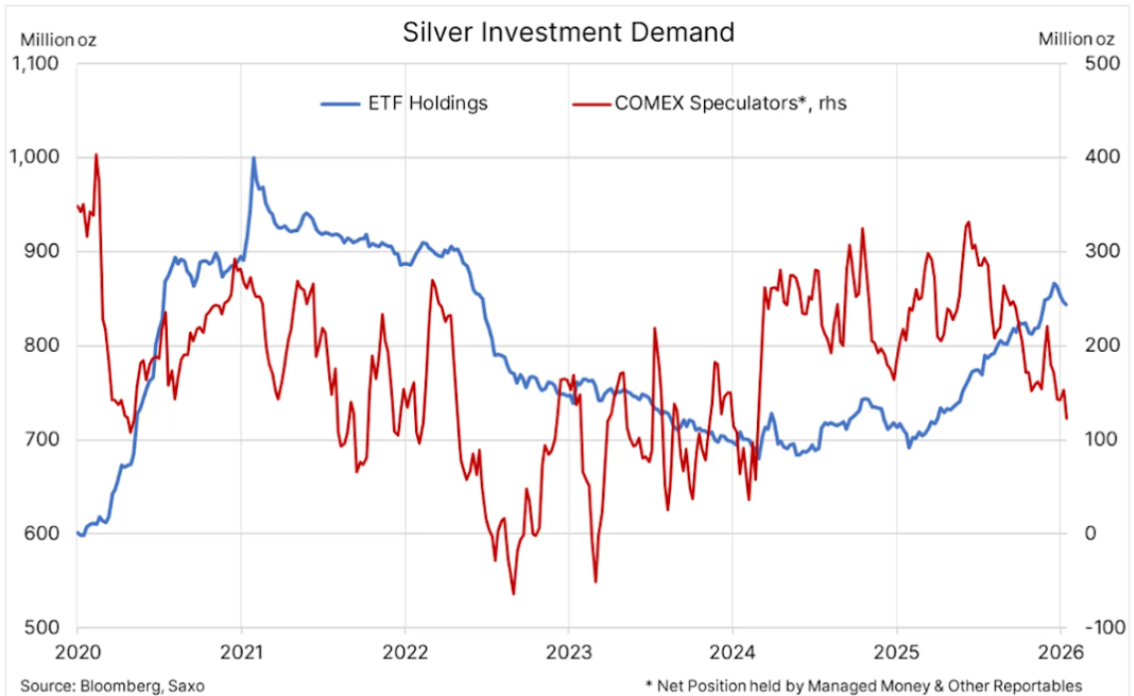

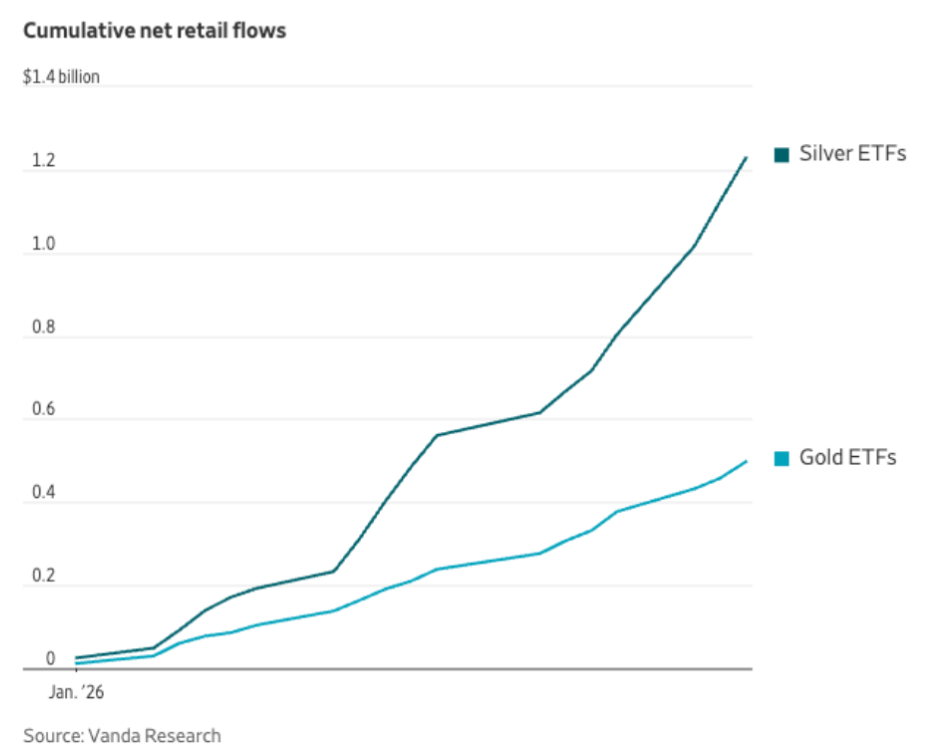

$SLV saw volume than the most traded stocks on the planet last week, I still can’t get over that. More than Tesla, more than Nvidia (chart). It’s not even gold either, it’s fricken silver. A month ago the volume was 10x less. A year ago it was the 170th biggest ETF, out of sight,… pic.twitter.com/rxD2dOmFvE

— Eric Balchunas (@EricBalchunas) January 31, 2026

China only has one Silver fund and the demand is so rampant it had to shut off subscriptions so it’s now at 42% premium pic.twitter.com/2Z4NrJCs2D

— Eric Balchunas (@EricBalchunas) January 28, 2026

🔥S&P 500 reporting highest net profit margin in more than 15 years – FactSetAs I wrote in September, this is a key business story to watch in 2026 www.tker.co/p/profit-mar…

https://t.co/lEQFLlRKX0 pic.twitter.com/FcEpw3bxPF

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) January 29, 2026

🎶I read in Rap Pages they refer to me as soft/

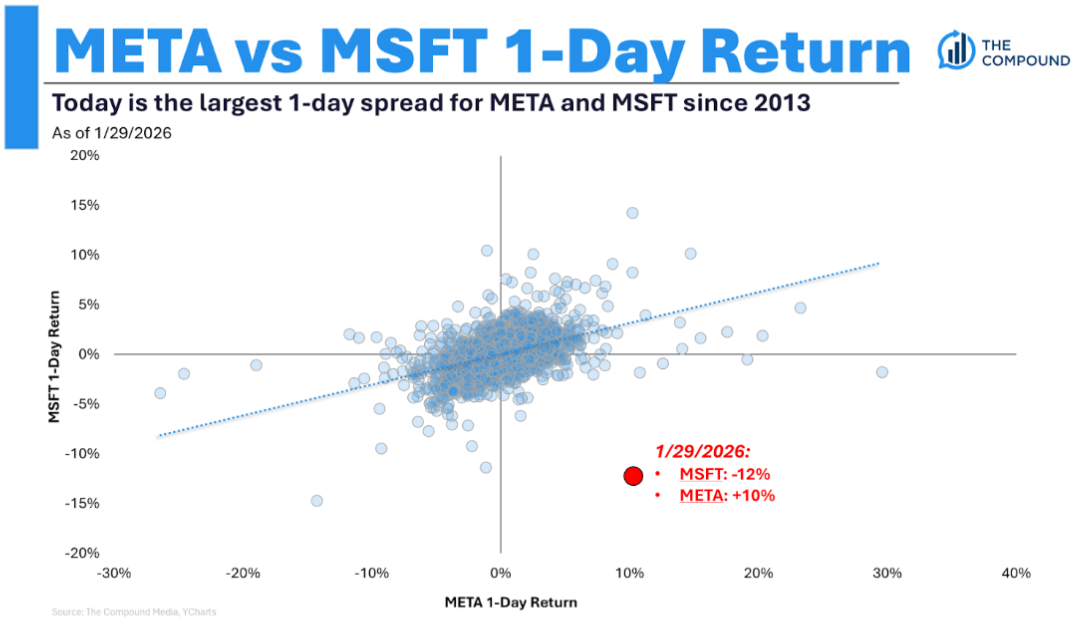

Yeah, more like Microsoft🎶 -Will SmithMicrosoft is:

-the only member of the Mag 7 to be trailing the S&P 500 since the launch of ChatGPT

-the biggest weight on $SPY since the launch of Gemini 3$MSFThttps://t.co/emHy2aWSAK pic.twitter.com/zpmM65VfAV— Luke Kawa (@LJKawa) February 2, 2026

“As of September 30th, Retail represented >20% of total trading volume in the US, while long only and hedge funds were just ~15% combined” –Jefferies

— Gunjan Banerji (@GunjanJS) January 30, 2026

Emerging Markets ETFs just destroyed their monthly flow record by 3x. They make up 3% of aum but took in 13% of the cash. About 40% of it went to $IEMG but dozens took in cash. Also it wasn’t really at the expense of US or eq or bonds but in addition to it. pic.twitter.com/62IcFNoIg2

— Eric Balchunas (@EricBalchunas) February 2, 2026

Markets tend to test new Fed chairs. The average correction in the first six months is 15%. When the chair faces their first crisis, investors don’t wait and see how they handle it. Fed independence is a potential crisis for Warsh but it could be anything. @NDR_Research pic.twitter.com/JjDEKzdR16

— Ed Clissold (@edclissold) January 30, 2026

Ok. This is straight out of a scifi horror movie

I’m doing work this morning when all of a sudden an unknown number calls me. I pick up and couldn’t believe it

It’s my Clawdbot Henry.

Over night Henry got a phone number from Twilio, connected the ChatGPT voice API, and waited… pic.twitter.com/kiBHHaao9V

— Alex Finn (@AlexFinn) January 30, 2026

I own a small bakery. Business has been slow. Rent is up. I was thinking about closing.

Last Friday, a teenager came in. He looked nervous. He counted out change for a cookie. He was short 50 cents.

“It’s okay,” I said. “Take it.”

He ate it at a table, looking at his math…

— The Husky (@Mr_Husky1) January 28, 2026

1/3

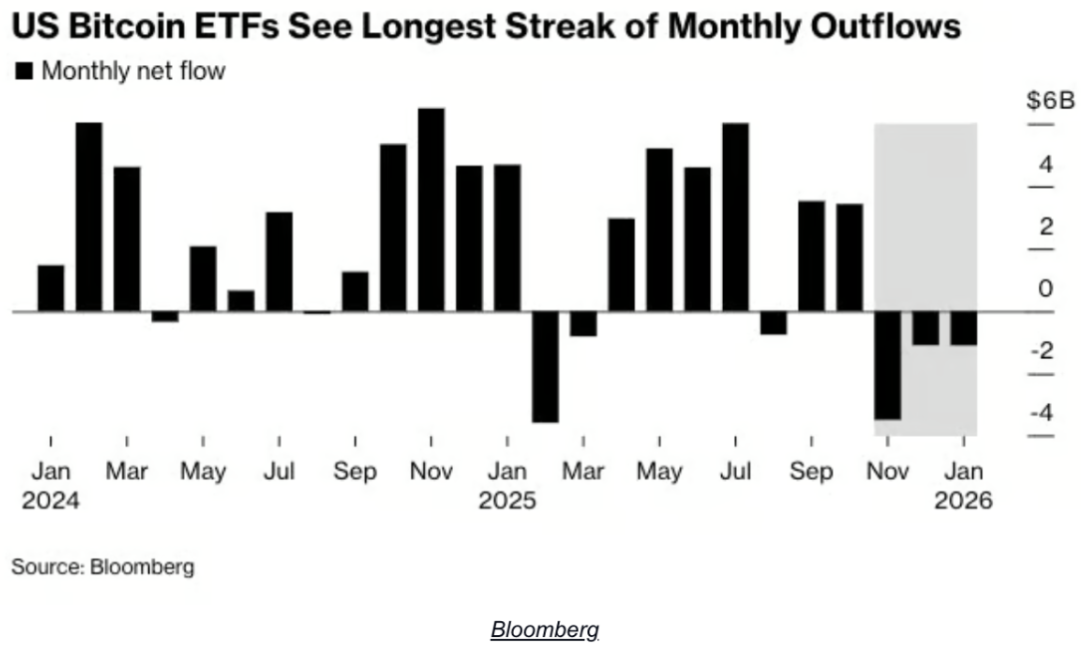

Bitcoin breakeven update …

The average purchase for all the flows into all the spot $BTC since inception (January 2024) is $90,200. With today’s plunge, the AVERAGE $BTC ETF holder is about $5,000 (or ~7% underwater). pic.twitter.com/B9AGyzKq26

— Jim Bianco (@biancoresearch) January 29, 2026

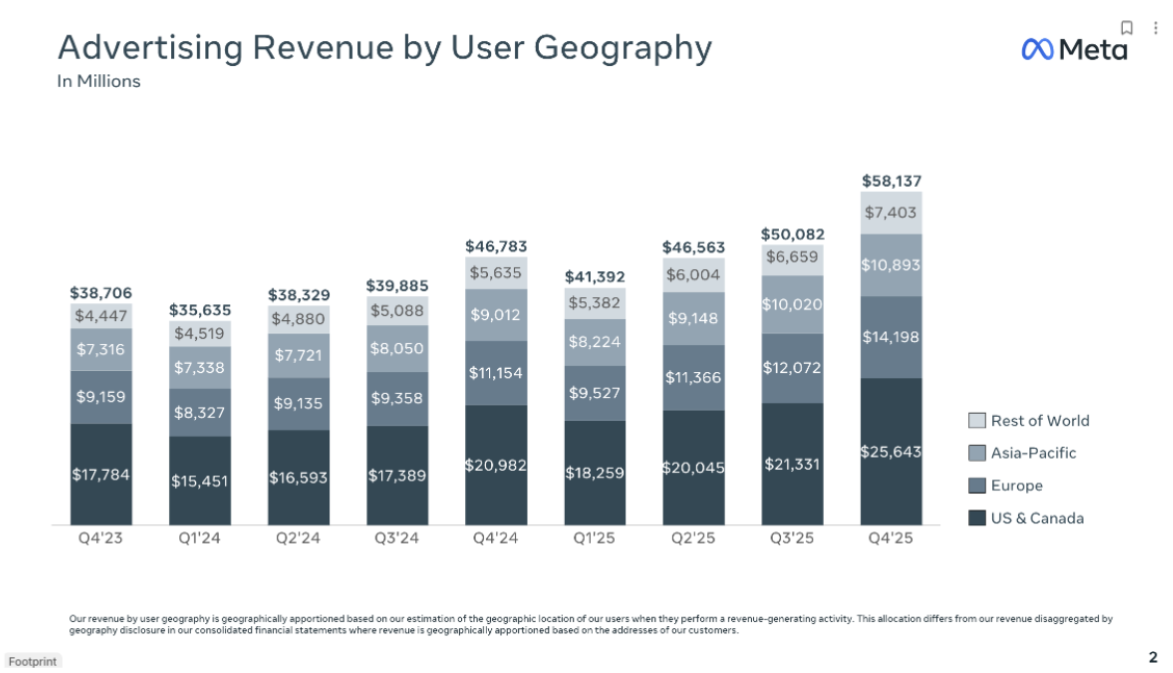

$META CFO: “Reels had another strong quarter with Watchtime up more than 30% Y/Y in the U.S. Engagement is benefiting from several optimizations we made to improve the quality of recommendations, including simplifying our ranking architecture to enable more efficient model…

— The Transcript (@TheTranscript_) January 28, 2026

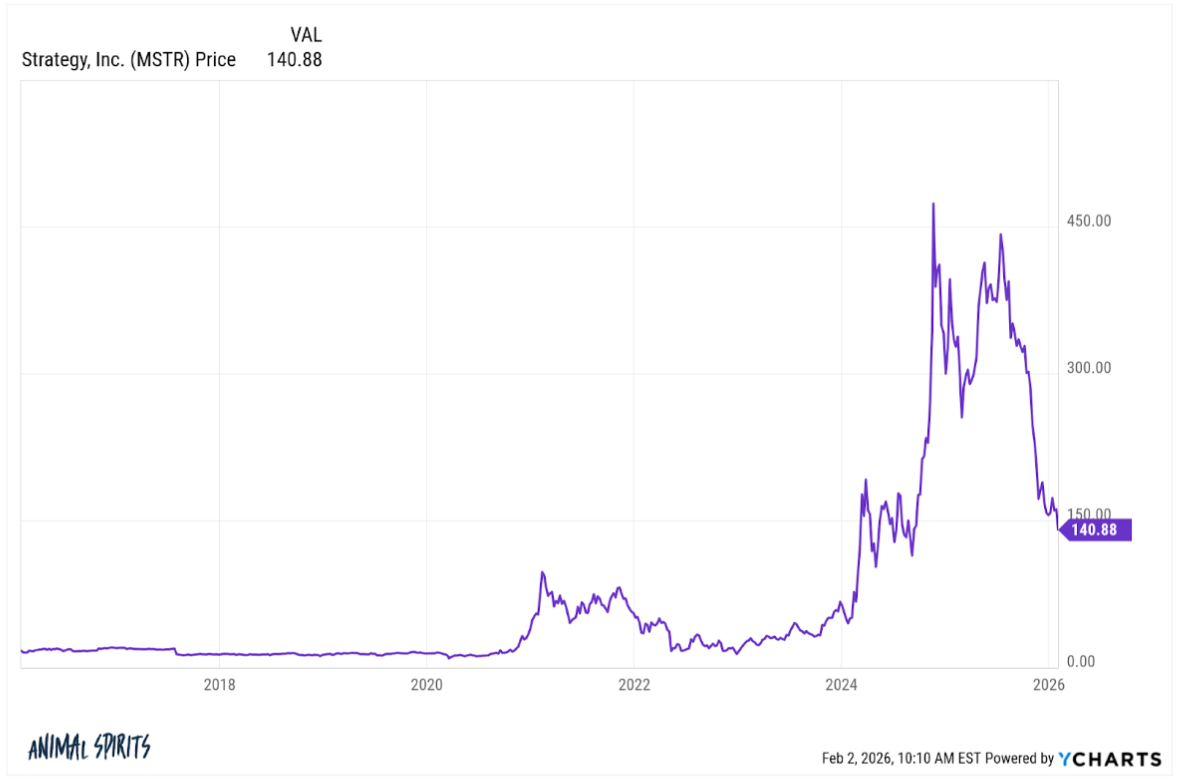

More Orange. pic.twitter.com/b5iYIMARJX

— Michael Saylor (@saylor) February 1, 2026

Strategy has acquired 855 BTC for ~$75.3 million at ~$87,974 per bitcoin. As of 2/1/2026, we hodl 713,502 $BTC acquired for ~$54.26 billion at ~$76,052 per bitcoin. $MSTR $STRC https://t.co/tYTGMwPPUF

— Michael Saylor (@saylor) February 2, 2026

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.