PayPal is one of the great technology stories of the past 30 years.

The payments company was founded in the dot-com bubble. The PayPal Mafia of founders and employees who struck it rich when the company was sold to eBay in 2002 includes Peter Thiel, Elon Musk, Reid Hoffman, Max Levchin and more.

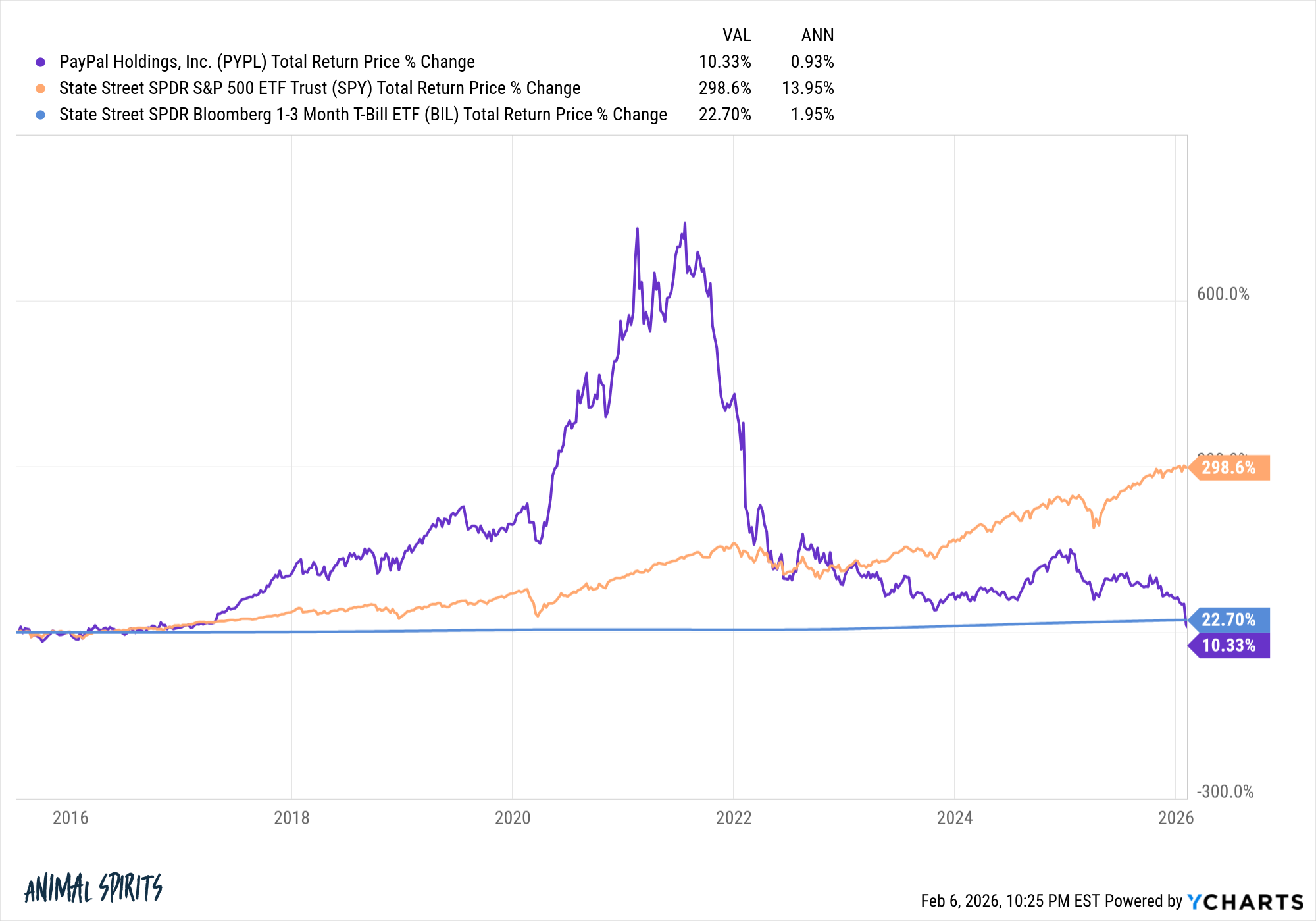

EBay spun out PayPal as its own public company in 2015. The seperation was a spectacular success for those who hung onto the shares of PayPal. From 2015 through the summer of 2021, PayPal stock was up nearly 750% versus a gain of 140% for the S&P 500.

And then the wheels fell off.

The stock price is now down 87% from the July 2021 peak.

Not only has the stock badly lagging the S&P 500 since the eBay spin-off, but you would also have been better off sitting in T-bills!

The tortoise beat the hare.

Hendrik Bessembinder’s research shows that something like 60% of all stocks underperform T-bills over the long haul. PayPal is a case in point.1

The run-up in PayPal shares shows how concentration can make you rich in the stock market. Hit just one grand slam and you could be set for life.

However, the other side of the mountain shows the darker side of concentration. Sometimes you strike out even after hitting a home run.

The current market environment is a good reminder that sometimes the high flyers are subject to a crash landing.

If you looked at any sort of diversified index or fund right now you would think things are going swimmingly.

The S&P 500 is just 0.66% off its all-time highs. The All-Country World Index just hit new all-time highs. So did the MSCI EAFE, the S&P 500 Equal Weight Index and the Russell 2000. The Dow hit 50,000 this week.

Some investors (not me) like to say It’s not a stock market; it’s a market of stocks.

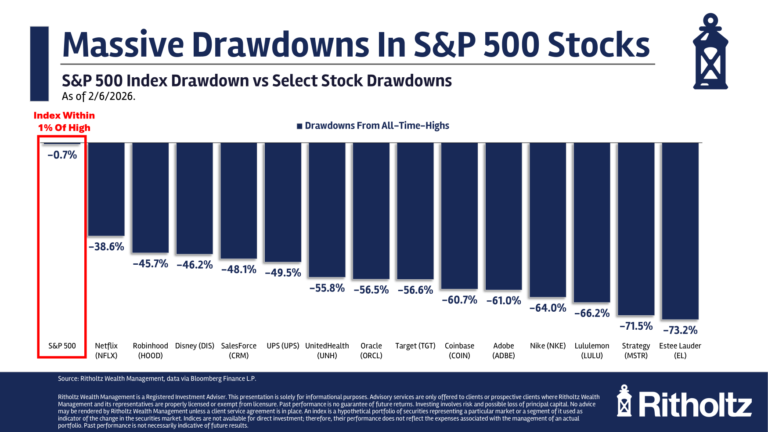

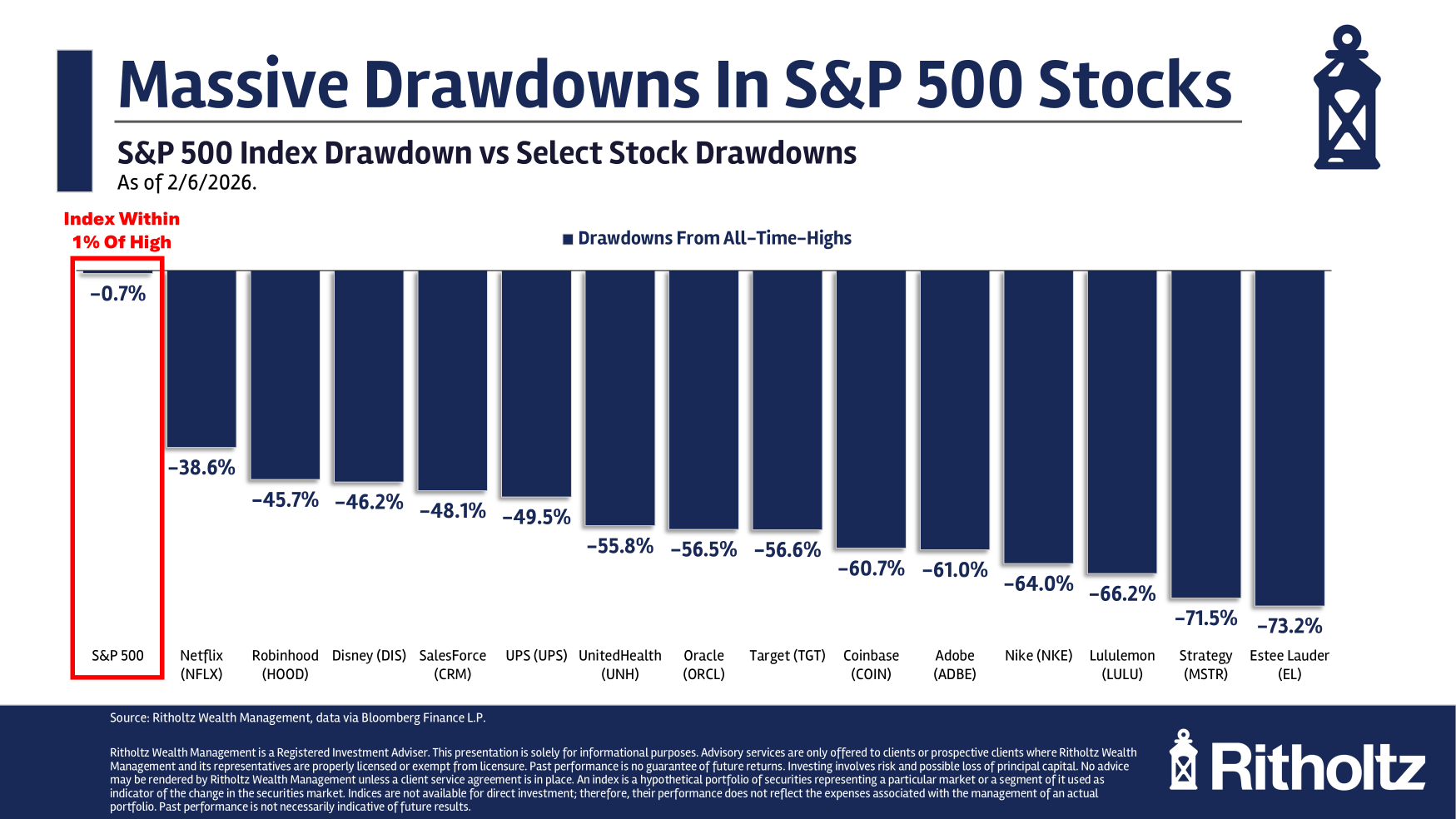

If you look under the hood a bit, there are plenty of individual names that are in outright crashes right now.

I took a look at the latest list of drawdowns in individual corporations and pulled out some household names you know:

My kids would say these stocks are crashing out.

These are name brands. You likely use many of these products or services. These aren’t simply healthy corrections. These are gigantic crashes of 40%, 50%, 60%, even 70% or worse.

All while the stock market as a whole is more or less sitting at new highs.

Maybe these stocks are a harbinger of things to come. It’s possible the volatility in certain stocks, combined with the rollercoaster ride in crypto and precious metals is foreshadowing pain ahead in the stock market.

Either way, the action in these names offers a warning to investors with concentrated positions in individual stocks.

The stock market has experienced one 20% crash in a single day on Black Monday in 1987. That happens to individual stocks a handful of times per year.

You might get 2-3 crashes in excess of 50% in your lifetime for the overall stock market. That happens to individual stocks on a regular basis, regardless of what’s happening in the market.

Investing in individual stocks can make you a lot of money when you’re right.

That upside potential only exists because of the enormous downside potential.

Concentrated positions are very fun on the upside.

They can also wreck you on the downside.

Further Reading:

Is Diversification Finally Working Again?

1It’s also worth pointing out that some investors obviously made money in PayPal shares in the meantime if they took some profits and sold.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.