Markets are constantly evolving.

There are better products, services, research tools and technology. Our knowledge of the past impacts how you invest for the future.

In this sense, market cycles are always different.

But human nature doesn’t change.

People are emotional. You get stressed out, anxious, greedy, nervous, scared, excited and all of the other feelings money brings about.

In this sense, market cycles are never different.

Human nature is the one constant across all market cycles but there are ways in which innovation can amplify our emotions that can impact the markets.

All the way back in 1936, John Maynard Keynes compared the stock market to a beauty contest in his book The General Theory of Employment, Interest and Money:

Professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole; so that each competitor has to pick, not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of whom are looking at the problem from the same point of view. It is not a case of choosing those which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be.

This was true back in the 1930s and it’s still true today.

However, the information age has added an element that never existed before, which is changing the way markets function, especially in the short run.

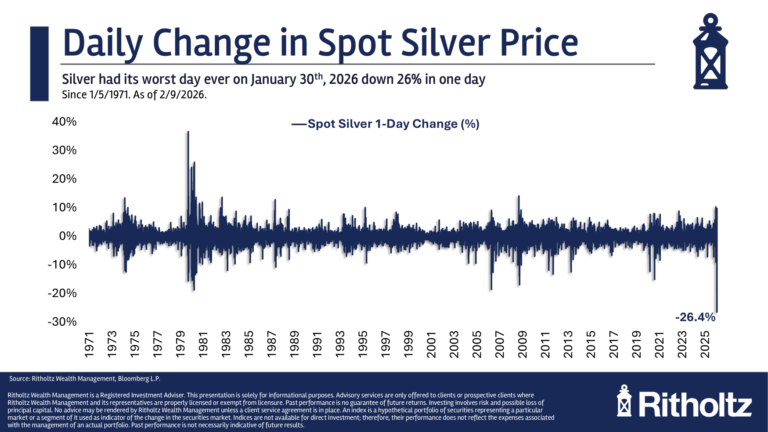

For example, the parabolic run-up and eventual crash in silver prices over the past couple of months looks breathtaking on a chart:

How do you explain a 55% return in a matter of weeks followed by a crash that wiped out a third of its value?

There are always many different reasons when markets have big up and down moves but allow me to explain the insane moves in silver this year.

Gold initially took off following the asset seizure of Russian financial assets after the Ukraine war. This caused central banks around the globe to hoard and buy more gold to own more physical assets that could not be taken away with the push of a button.

Silver is seen as a higher beta play for the gold trade.

Then we moved into a world of de-globalization because of the trade war. That caused a rethink of supply chain materials and precious metals. Silver has many industrial use cases.

We also had the AI capex boom which is going to require a lot of physical resources.

Then you have concerns about debasement from higher fiscal deficits and government debt.

It’s been a perfect storm1 for the precious metals complex.

But once everyone started to see this bull market take off the investment bots swarmed.

Leverage came into the trade. The Reddit/Robinhood/memestock crowd hopped on the bandwagon. Hedge funds saw activity spiking and decided to jump in the pool as well.

The information age took the upside and the downside volatility to another level.

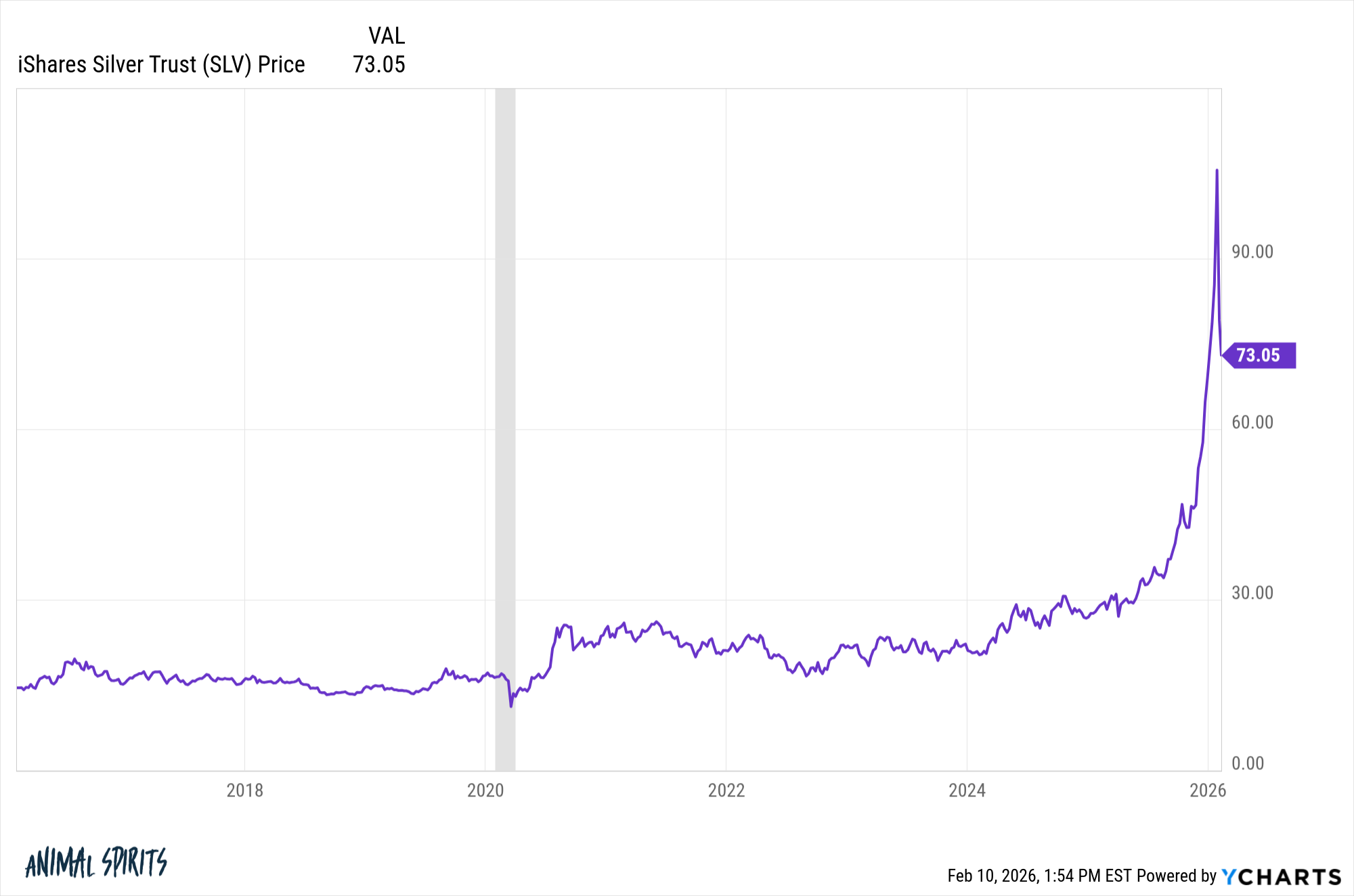

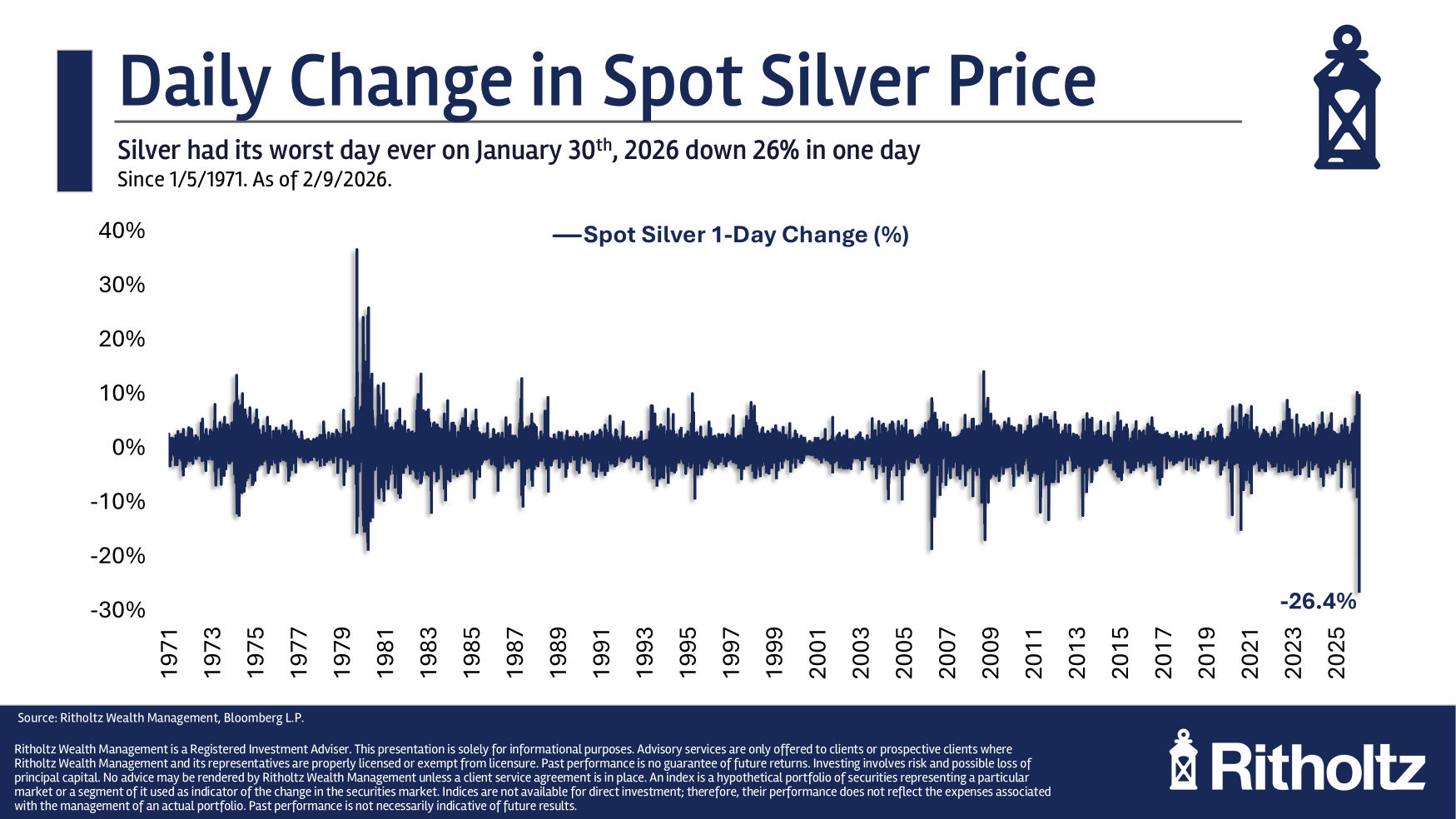

Just look at the daily swings in price compared to silver’s history:

The vol-spike in the early-1980s is when the Hunt brothers tried to corner the silver market to jack up the price. It worked until it didn’t.

In the last couple of weeks, spot silver prices have now experienced the two biggest one day drops in history. The previous record was a decline of -18.6% in March of 1980. Since the last trading day of January this year there have now been down days of -19.6% and -26.4%.

Social media has changed the markets forever. There are also more products that allow investors to easily utilize leverage.

The ProShares Ultra Silver ETF (2x leveraged)2 went from $1 billion in assets to nearly $6 billion at the peak in January:

Some of this was from price appreciation but a ton of money obviously poured in here.

The speed of information is speeding up market moves and causing manic moves in both directions.

I first wrote about how technology is speeding up markets back in 2014. Here’s what I said at the time:

Technology now allows irrational exuberance, misinformation and fear to spread around the world at a frightening pace.

This is why the glut of information is both a blessing and a curse. It’s very easy to access, which levels the playing field for people all around the world. And social media allows for instantaneous feedback on just about everything. The problem is when people make snap decisions without waiting or contemplating the ramifications. The world is now geared towards short-termism. Many default to an act-first, think-later mindset. When the implications of our decisions aren’t accompanied by enough time and deep thought, unintended consequences will occur with more frequency.

This still feels right but I definitely underestimated the meme stock nature of the market where groups of investors swarm specific securities or assets. It’s almost like a Netflix algorithm that highlights the hottest investments for people who like to chase the hot dot.

The Keyne’s beauty contest is alive and well. It just happens faster than ever now.

And it’s hard to know where the opinions will go next.

Further Reading:

Would Keynes Have Been Fired as a Money Manager Today?

1I’m typically anti-perfect storm as a finance phrase but it fits here.

2This fund was up 158% on the year through the last week of January. It’s now down 63% from the highs. Leverage works both ways.